Convertible Debt Note Template

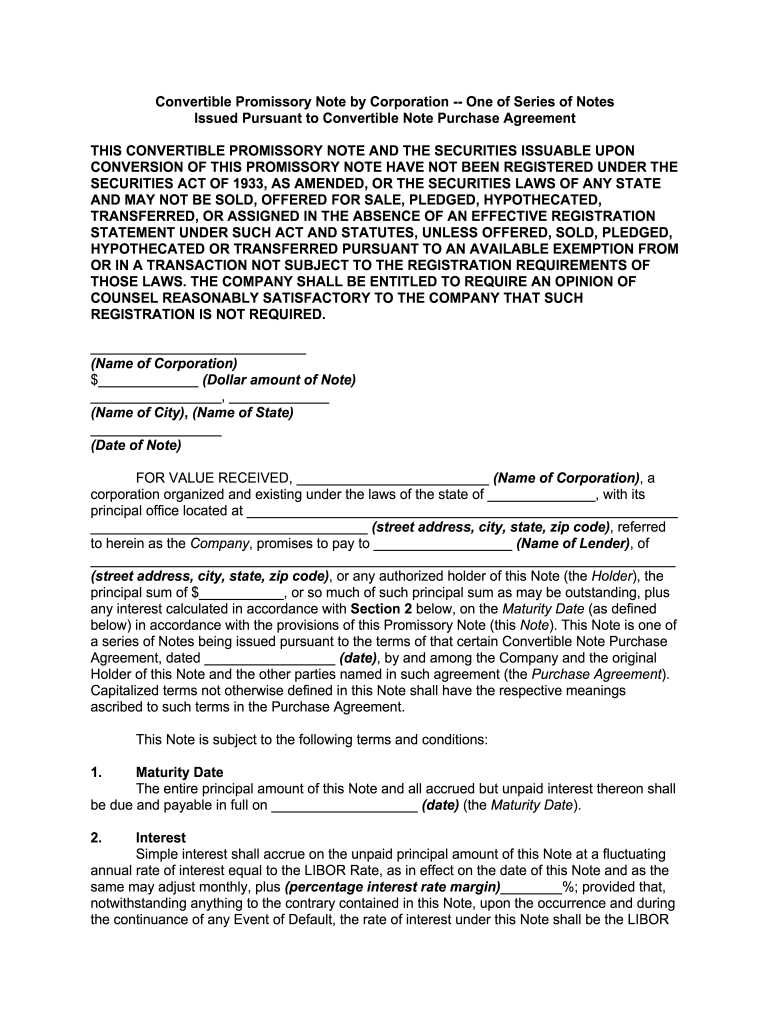

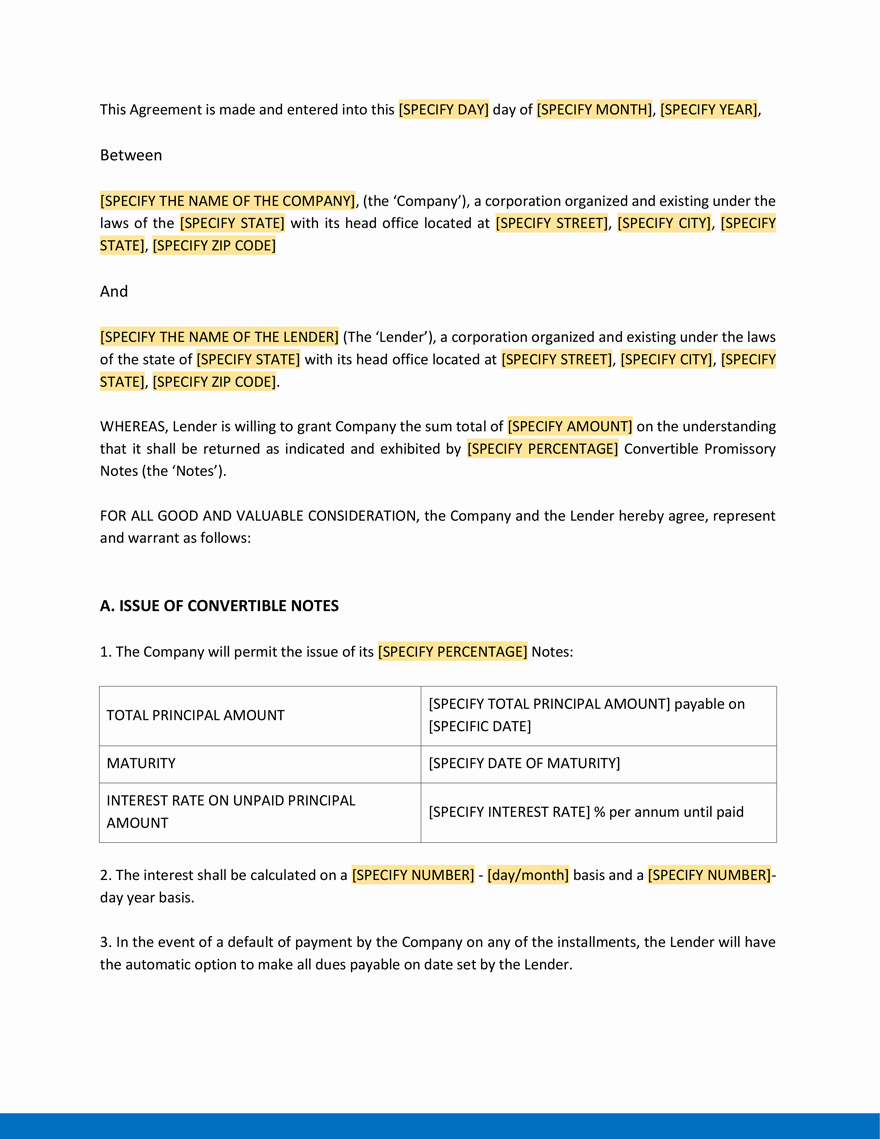

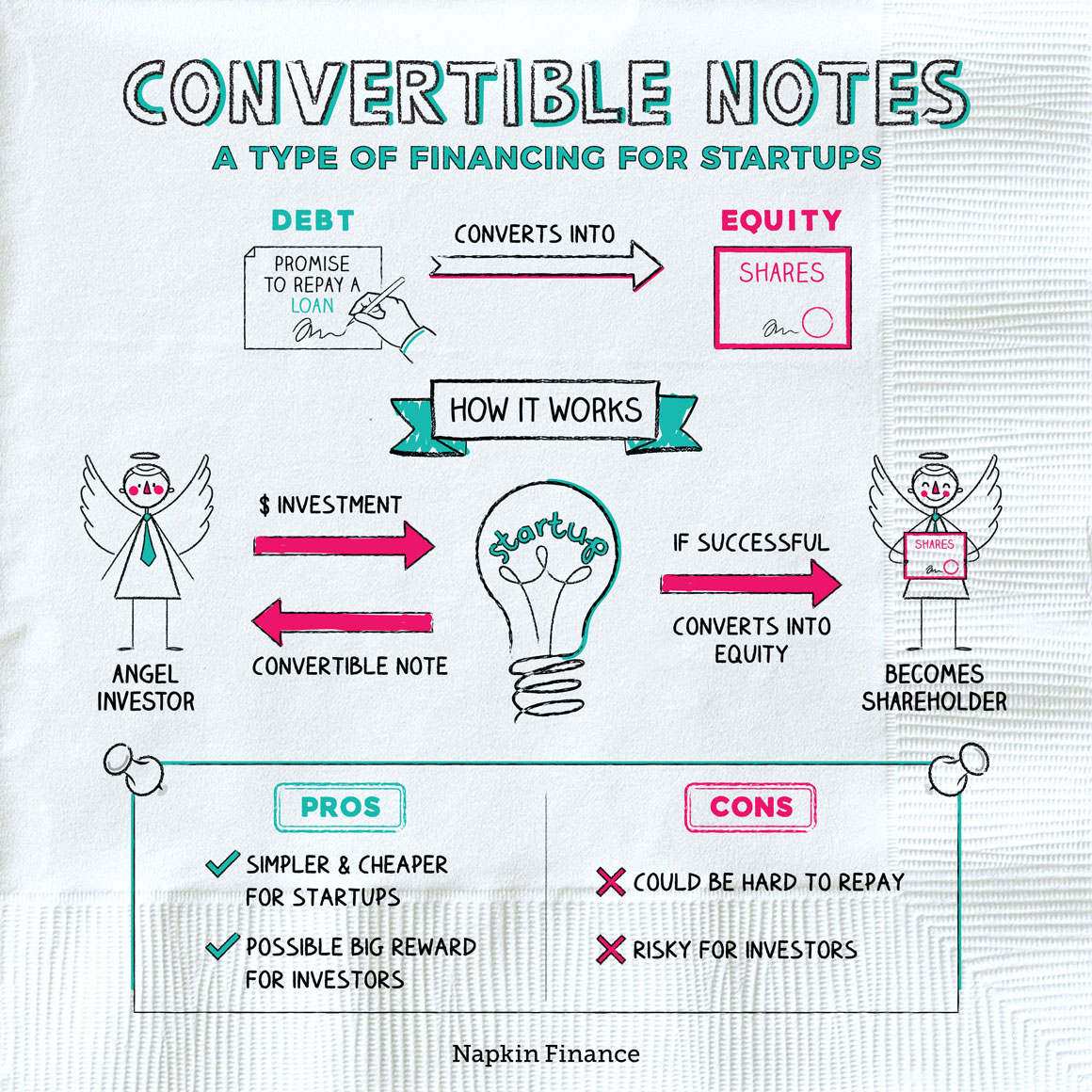

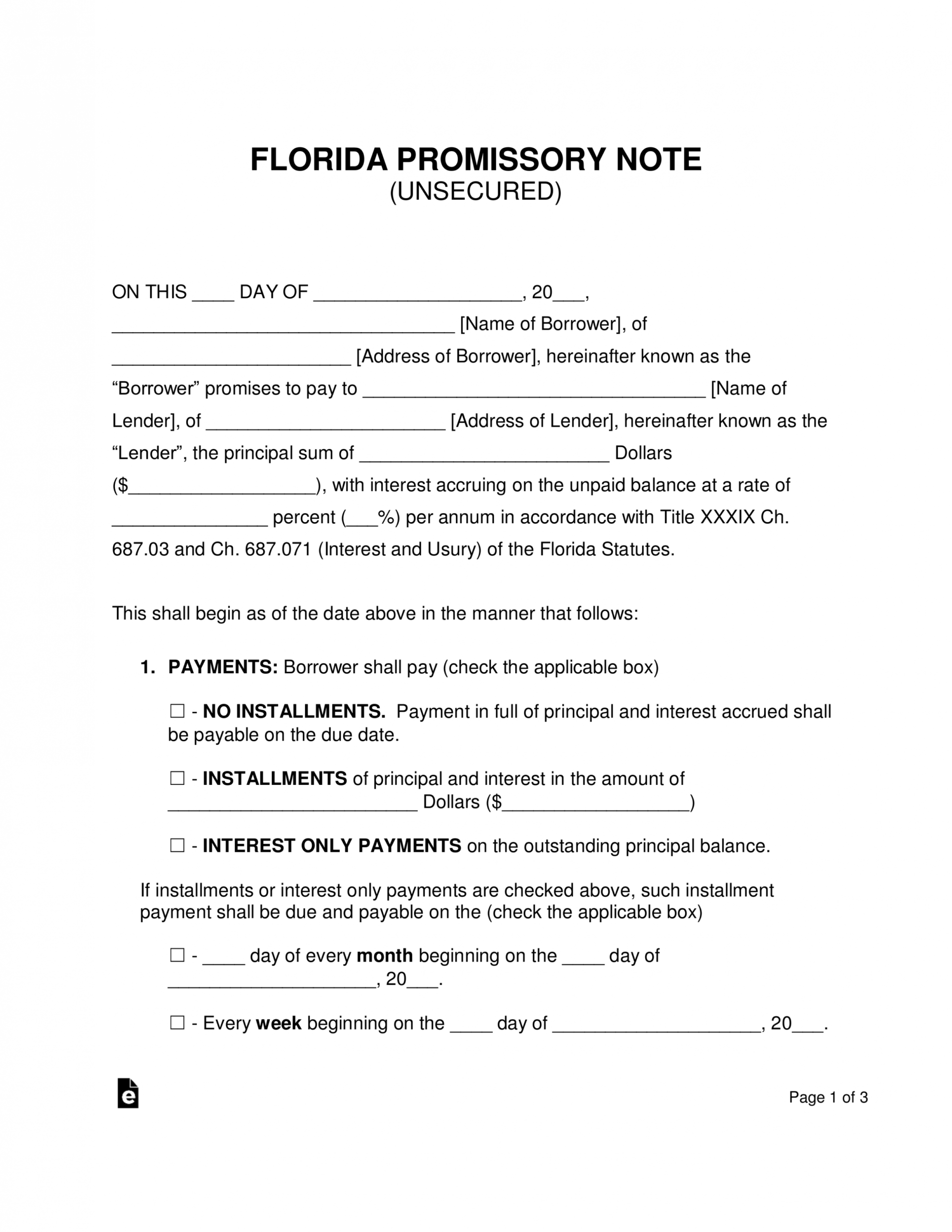

Convertible Debt Note Template - There is no need to install software, and it is easy to customize it according to your business needs. Download our free convertible note template—available in word, pdf, and google doc formats—and learn how to incorporate it into your fundraising strategy. One might make a convertible note term sheet to promote discussion and. Download convertible note purchase agreement. Download convertible promissory note template: This convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment. Instantly download convertible note agreement template, sample & example in microsoft word (doc), google docs, apple pages format. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. The debt version has both valuation cap and discount. A convertible debt note sample is a crossover of both equity and debt. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. One might make a convertible note term sheet to promote discussion and. The investor loans money for the startup but instead of. A convertible debt note sample is a crossover of both equity and debt. Instantly download convertible note agreement template, sample & example in microsoft word (doc), google docs, apple pages format. The debt version has both valuation cap and discount. The set includes a convertible debt template, a convertible equity template, and a summary of the key terms in each. This template provides a structured format for outlining the. We’ve drafted this template from the perspective of independent company counsel. Download our free convertible note template—available in word, pdf, and google doc formats—and learn how to incorporate it into your fundraising strategy. Available in a4 & us letter sizes. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. Download convertible note purchase agreement. Download convertible promissory note template: This template provides a structured format for outlining the. Available in a4 & us letter sizes. Download the free convertible note agreement template for your business. A convertible note template for seed rounds, with some useful footnotes for. This means that investors loan money to a business owner with the intention that the loan is paid. This template outlines the essential elements of a convertible note term. A convertible note template for seed rounds, with some useful footnotes for. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. Available in a4 & us letter sizes. There is no need to install software, and it is easy to. A convertible note template for seed rounds, with some useful footnotes for. The debt version has both valuation cap and discount. This template provides a structured format for outlining the. Instantly download convertible note agreement template, sample & example in microsoft word (doc), google docs, apple pages format. One might make a convertible note term sheet to promote discussion and. This template outlines the essential elements of a convertible note term. The investor loans money for the startup but instead of. This template provides a structured format for outlining the. Download the free convertible note agreement template for your business. There is no need to install software, and it is easy to customize it according to your business needs. Download convertible note purchase agreement. We’ve drafted this template from the perspective of independent company counsel. This means that investors loan money to a business owner with the intention that the loan is paid. This template provides a structured format for outlining the. The set includes a convertible debt template, a convertible equity template, and a summary of the key. This template provides a structured format for outlining the. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. The set includes a convertible debt template, a convertible equity template, and a summary of the key terms in each. Download convertible. The set includes a convertible debt template, a convertible equity template, and a summary of the key terms in each. Below are free convertible note templates used by elevate ventures. This convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment. The debt version has both valuation cap and discount.. This convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment. The set includes a convertible debt template, a convertible equity template, and a summary of the key terms in each. We’ve drafted this template from the perspective of independent company counsel. This means that investors loan money to a. Download convertible promissory note template: The debt version has both valuation cap and discount. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. This template provides a structured format for outlining the. We’ve drafted this template from the perspective of. This convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment. This template provides a structured format for outlining the. The investor loans money for the startup but instead of. Download convertible promissory note template: A convertible note template for seed rounds, with some useful footnotes for. This template outlines the essential elements of a convertible note term. Download the free convertible note agreement template for your business. The set includes a convertible debt template, a convertible equity template, and a summary of the key terms in each. There is no need to install software, and it is easy to customize it according to your business needs. This means that investors loan money to a business owner with the intention that the loan is paid. A convertible debt note sample is a crossover of both equity and debt. One might make a convertible note term sheet to promote discussion and. Below are free convertible note templates used by elevate ventures. The debt version has both valuation cap and discount. Early stage companies use convertible notes or other instruments such as simple agreements for future equity (safes) in place of equity for seed financing before their initial preferred stock. We’ve drafted this template from the perspective of independent company counsel.Convertible Note Example Template Printable Word Searches

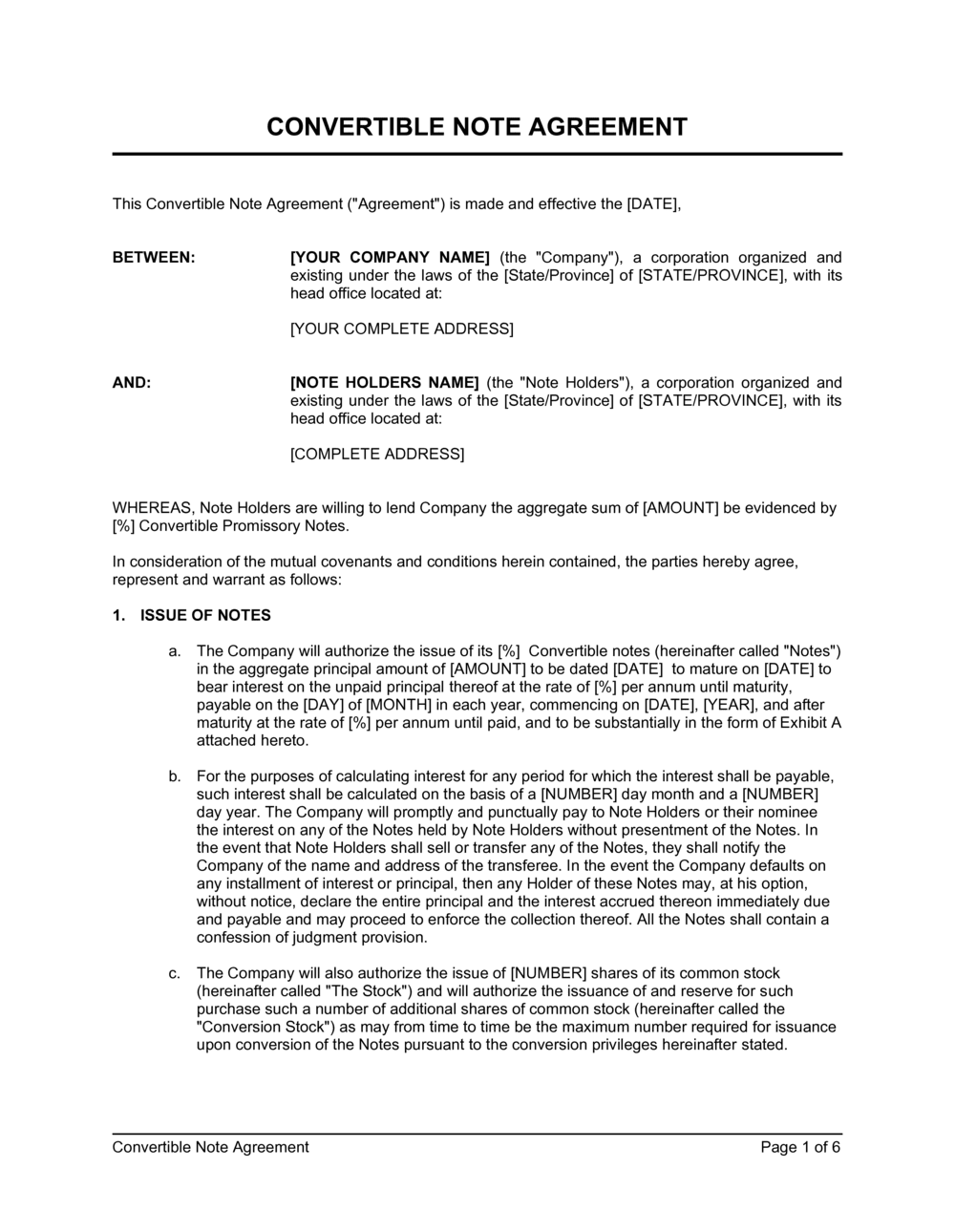

Convertible Note Template

Convertible Note Agreement Template Google Docs, Word, Apple Pages

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Convertible Note Template

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Convertible Loan Note Template

Convertible Debt Note Template

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

How Convertible Notes Convert, Template David Kircos

Download Our Free Convertible Note Template—Available In Word, Pdf, And Google Doc Formats—And Learn How To Incorporate It Into Your Fundraising Strategy.

Available In A4 & Us Letter Sizes.

Download Convertible Note Purchase Agreement.

Here Are The Steps For You To Develop Your Own Convertible Note Agreement:

Related Post: