Venture Capital Contract Template

Venture Capital Contract Template - The bvca does not make a specific. This comprehensive guide will help. We estimate the impact of venture capital vc contract terms on startup outcomes and the split of value between the entrepreneur and investor, accounting for endogenous. Corporate venture capital (cvc) investment is an increasingly used strategic tool that enables large corporations to make minority investments in startups that will complement. It was released by vc lab in october of 2021. Central to this process is the. Most recently, nvca revised the model documents. Version 3.0 is the product of the most extensive analysis of private venture deal term data. Various groups in the venture capital industry are working toward standard legal documents across the field. The enhanced model term sheet allows an investor to draft term sheets while comparing terms. Venture capital (vc) funding is a pivotal force behind the growth and innovation of startups, allowing them to transform ideas into scalable businesses. Corporate venture capital (cvc) investment is an increasingly used strategic tool that enables large corporations to make minority investments in startups that will complement. The term sheet, or letter of. Central to this process is the. Learn the essential components of venture capital term sheets, including key clauses, common terminology and tips for negotiating favorable terms. Enhance this design & content with free ai. It’s specifically targeted towards new or. The enhanced model term sheet allows an investor to draft term sheets while comparing terms. Customize and download this sample venture capital term sheet. The bvca does not make a specific. We estimate the impact of venture capital vc contract terms on startup outcomes and the split of value between the entrepreneur and investor, accounting for endogenous. Most recently, nvca revised the model documents. Venture capital funding is the process of investing money into a startup or small business, usually one with potential for rapid growth. It is now time to. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. Most recently, nvca revised the model documents. The term sheet, or letter of. This comprehensive guide will help. It was released by vc lab in october of 2021. Learn the essential components of venture capital term sheets, including key clauses, common terminology and tips for negotiating favorable terms. Enhance this design & content with free ai. Venture capital funding is the process of investing money into a startup or small business, usually one with potential for rapid growth. Founded in 2014 and based in new york and toronto,. Venture capital funding is the process of investing money into a startup or small business, usually one with potential for rapid growth. We estimate the impact of venture capital vc contract terms on startup outcomes and the split of value between the entrepreneur and investor, accounting for endogenous. Various groups in the venture capital industry are working toward standard legal. We estimate the impact of venture capital vc contract terms on startup outcomes and the split of value between the entrepreneur and investor, accounting for endogenous. Secure your seed funding or venture capital with confidence as our investor contract templates are the legal gardener's best tool for cultivating a fruitful partnership. The term sheet, or letter of. Corporate venture capital. Many law firms, entrepreneur networks and other organisations offer template documents suitable for seed investing, which are available over the internet. Corporate venture capital (cvc) investment is an increasingly used strategic tool that enables large corporations to make minority investments in startups that will complement. Enhance this design & content with free ai. The bvca does not make a specific.. This comprehensive guide will help. Most recently, nvca revised the model documents. The bvca does not make a specific. Central to this process is the. Customize and download this sample venture capital term sheet. Enhance this design & content with free ai. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. Version 3.0 is the product of the most extensive analysis of private venture deal term data. This can be very helpful for investors and the companies they. We estimate the impact of venture capital. Central to this process is the. Venture capital (vc) funding is a pivotal force behind the growth and innovation of startups, allowing them to transform ideas into scalable businesses. Customize and download this sample venture capital term sheet. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. The term sheet, or. Many law firms, entrepreneur networks and other organisations offer template documents suitable for seed investing, which are available over the internet. Version 3.0 is the product of the most extensive analysis of private venture deal term data. Corporate venture capital (cvc) investment is an increasingly used strategic tool that enables large corporations to make minority investments in startups that will. The enhanced model term sheet allows an investor to draft term sheets while comparing terms. Enhance this design & content with free ai. Most recently, nvca revised the model documents. This chapter will help you structure the term sheet or investment by the venture capitalists into the company. It is now time to begin courting venture capitalists. Secure your seed funding or venture capital with confidence as our investor contract templates are the legal gardener's best tool for cultivating a fruitful partnership. It was released by vc lab in october of 2021. Venture capital (vc) funding is a pivotal force behind the growth and innovation of startups, allowing them to transform ideas into scalable businesses. Various groups in the venture capital industry are working toward standard legal documents across the field. Central to this process is the. Customize and download this sample venture capital term sheet. This can be very helpful for investors and the companies they. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business. Learn the essential components of venture capital term sheets, including key clauses, common terminology and tips for negotiating favorable terms. This comprehensive guide will help. It’s specifically targeted towards new or.Venture Capital Templates

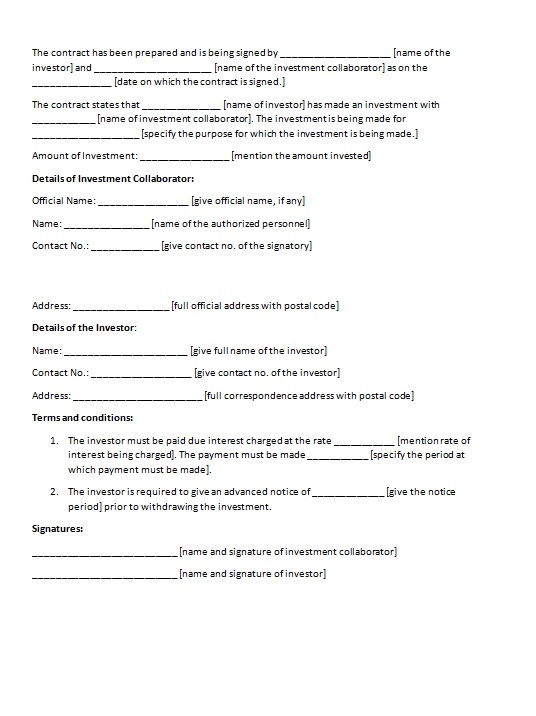

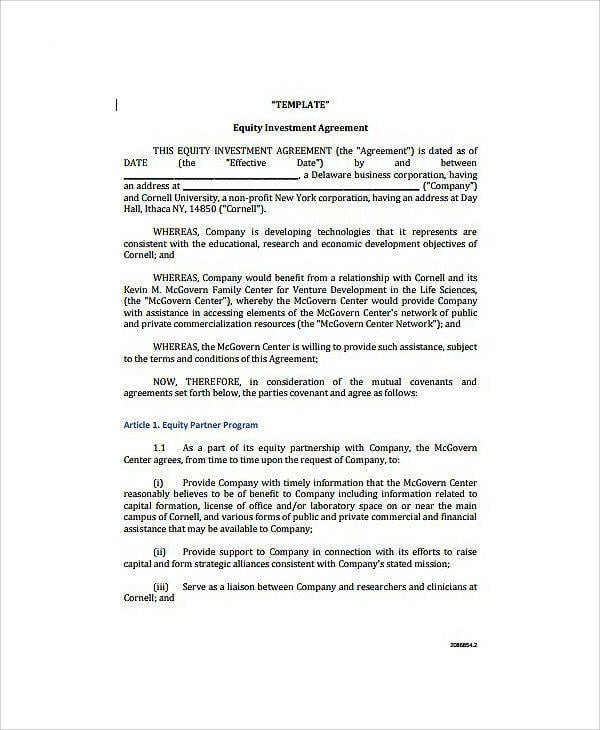

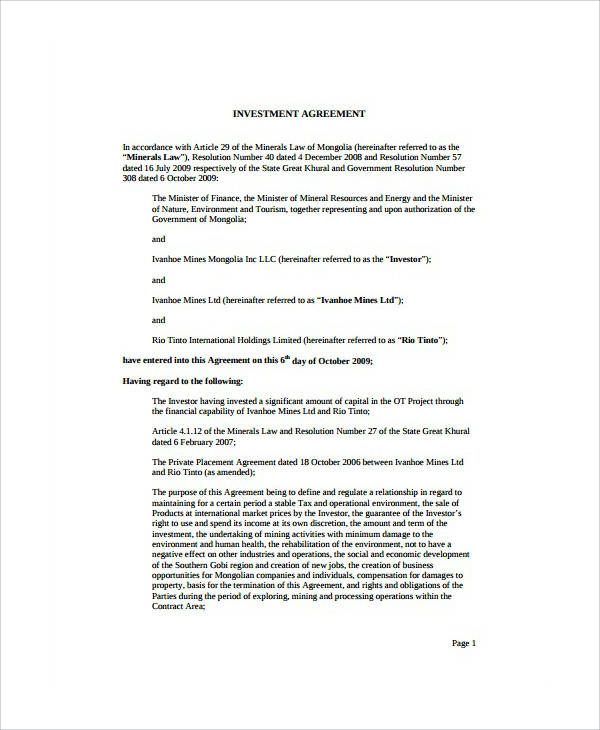

Venture Capital Investment Agreement 11+ Examples, Format, Pdf

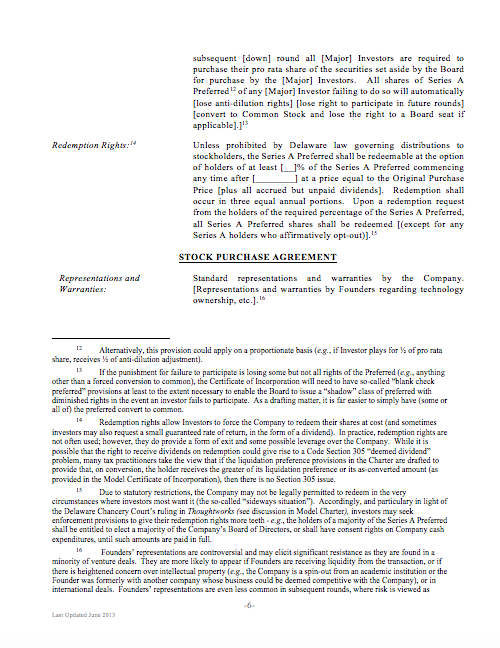

VC Venture Capital Term Sheet Template NVCA Model Eloquens

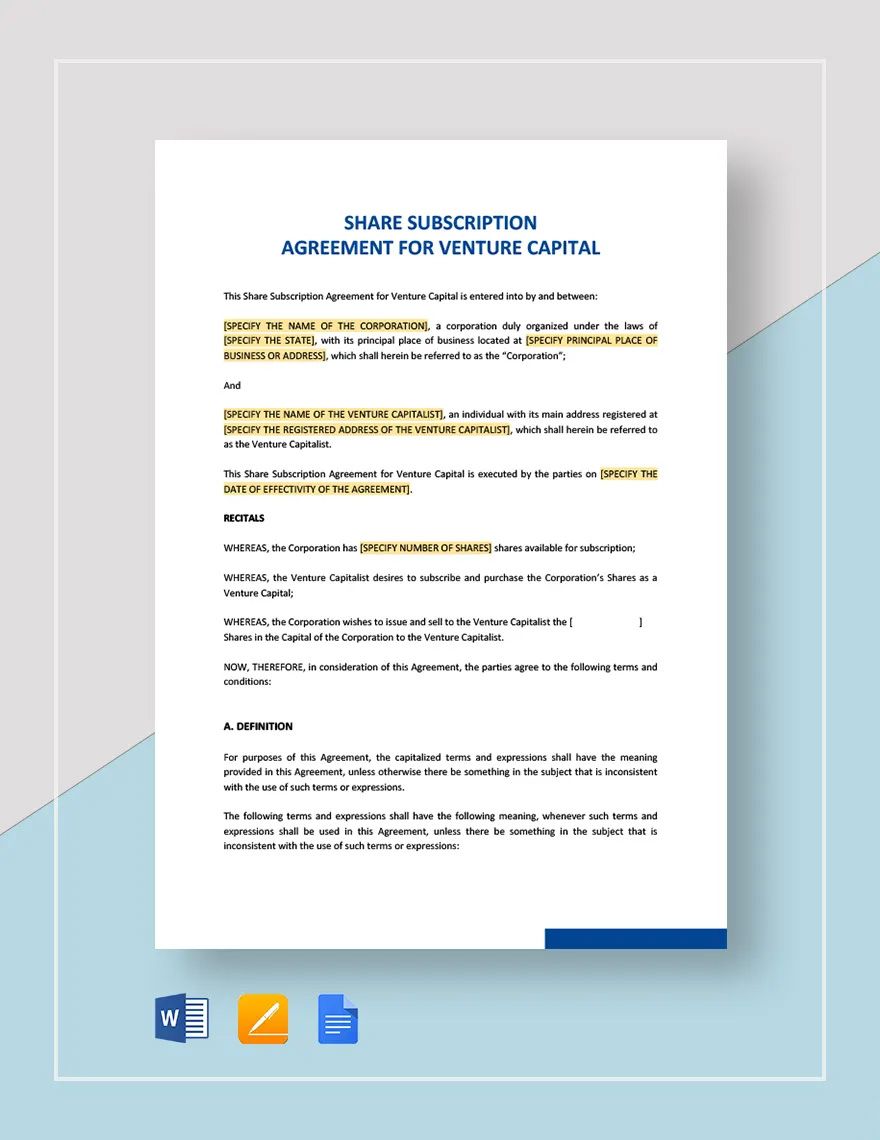

Venture Capital Agreement Template

Free Term Sheet for Venture Capital Competition Template Edit Online

Venture Capital Templates

Venture Capital Business Cooperation Agreement Template Download on Pngtree

Venture Capital Agreement Template, There Are No Additional Services That.

Venture Capital Investment Agreement 11+ Examples, Format, Pdf

Venture Capital Agreement Template

Founded In 2014 And Based In New York And Toronto, They Are On A.

Many Law Firms, Entrepreneur Networks And Other Organisations Offer Template Documents Suitable For Seed Investing, Which Are Available Over The Internet.

We Estimate The Impact Of Venture Capital Vc Contract Terms On Startup Outcomes And The Split Of Value Between The Entrepreneur And Investor, Accounting For Endogenous.

Sample Venture Capital Term Sheet Is In Editable, Printable Format.

Related Post: