Template Safe With Valuation Cap And Discount

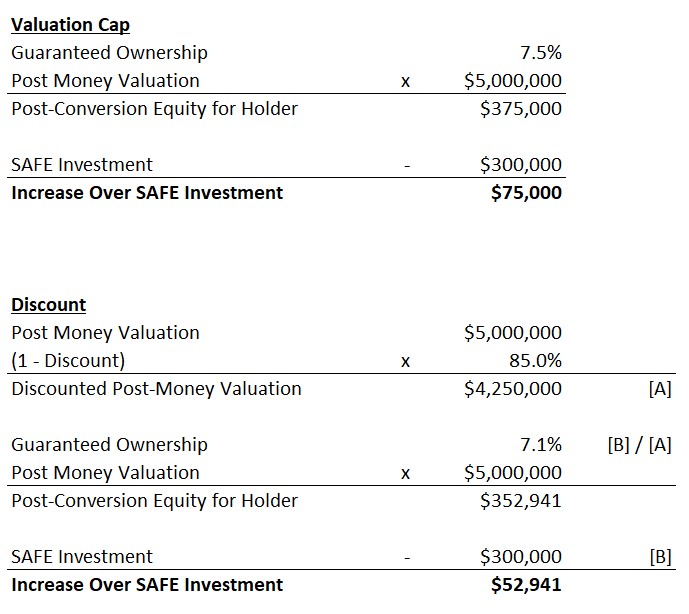

Template Safe With Valuation Cap And Discount - Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. If you don’t have a cap, then it will always be a discount and vice versa. Use a cap if you can forecast valuation. The valuation cap is a maximum valuation at which the safe can convert into equity. Offer higher discount rates to investors;. There is a little switch which says “a cap is used”. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). The valuation cap is a maximum valuation at which the safe can convert into equity. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. Link to the cap discount: If you don’t have a cap, then it will always be a discount and vice versa. Yes, i have a copy of it, but i'm. You can have a safe note with/without a cap and a discount. Use a cap if you can forecast valuation. An investor has bought a safe for $. They can help avoid fundraising gridlocks; An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. This specific template includes provisions related to the valuation. The valuation cap is a maximum valuation at which the safe can convert into equity. It can also have a valuation cap that sets the. Yes, i have a copy of it, but i'm. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). It allows the safe investor to convert to equity at a discounted price in the course. It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. For whatever reason, removed between aug 13 and aug 26. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. You can. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. Link to the cap discount: They can help avoid fundraising gridlocks; An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from. It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. The valuation cap is a maximum valuation at which the safe can convert into equity. Offer higher discount rates to investors;. Safe, or simple agreement for future equity (also referred to as safe note), is a type of. For whatever reason, removed between aug 13 and aug 26. This specific template includes provisions related to the valuation. Link to the cap discount: Yes, i have a copy of it, but i'm. They can help avoid fundraising gridlocks; If you don’t have a cap, then it will always be a discount and vice versa. Generally, safe notes have no maturity date and no interest rate. An investor has bought a safe for $. It can also have a valuation cap that sets the. In the case of a liquidation, the conversion of the safe is the same as. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. The valuation cap is a maximum valuation. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. They can help avoid fundraising gridlocks; It can also have a valuation cap that sets the. There is a little switch which says “a cap is used”. In the case of a liquidation, the conversion of. Valuation caps imply that both sides have a rough understanding of a number of factors, including when a priced round is likely to happen,. There is a little switch which says “a cap is used”. Discount rates typically range between 10% and 25%, and. It can also have a valuation cap that sets the. They can help avoid fundraising gridlocks; It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Safe notes can include a discount that is applied to a future. Safe, or simple agreement for future equity (also referred to as safe note), is a type of investment contract used by startups to raise capital from investors. For whatever reason, removed between aug 13 and aug 26. Safe notes can include a discount that is applied to a future valuation when it is time to convert. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your seed round). They can help avoid fundraising gridlocks; The valuation cap is a maximum valuation at which the safe can convert into equity. It can also have a valuation cap that sets the. The valuation cap is a maximum valuation at which the safe can convert into equity. You can have a safe note with/without a cap and a discount. Yes, i have a copy of it, but i'm. If you don’t have a cap, then it will always be a discount and vice versa. Offer higher discount rates to investors;. It allows the safe investor to convert to equity at a discounted price in the course of a subsequent round of financing. In the case of a liquidation, the conversion of the safe is the same as a standard safe with a valuation cap and no discount rate. Link to the cap discount: Generally, safe notes have no maturity date and no interest rate.The Complete Guide to SAFEs Josh Ephraim Medium

Post Money Safe Agreement Valuation Cap and Discount Doc Template

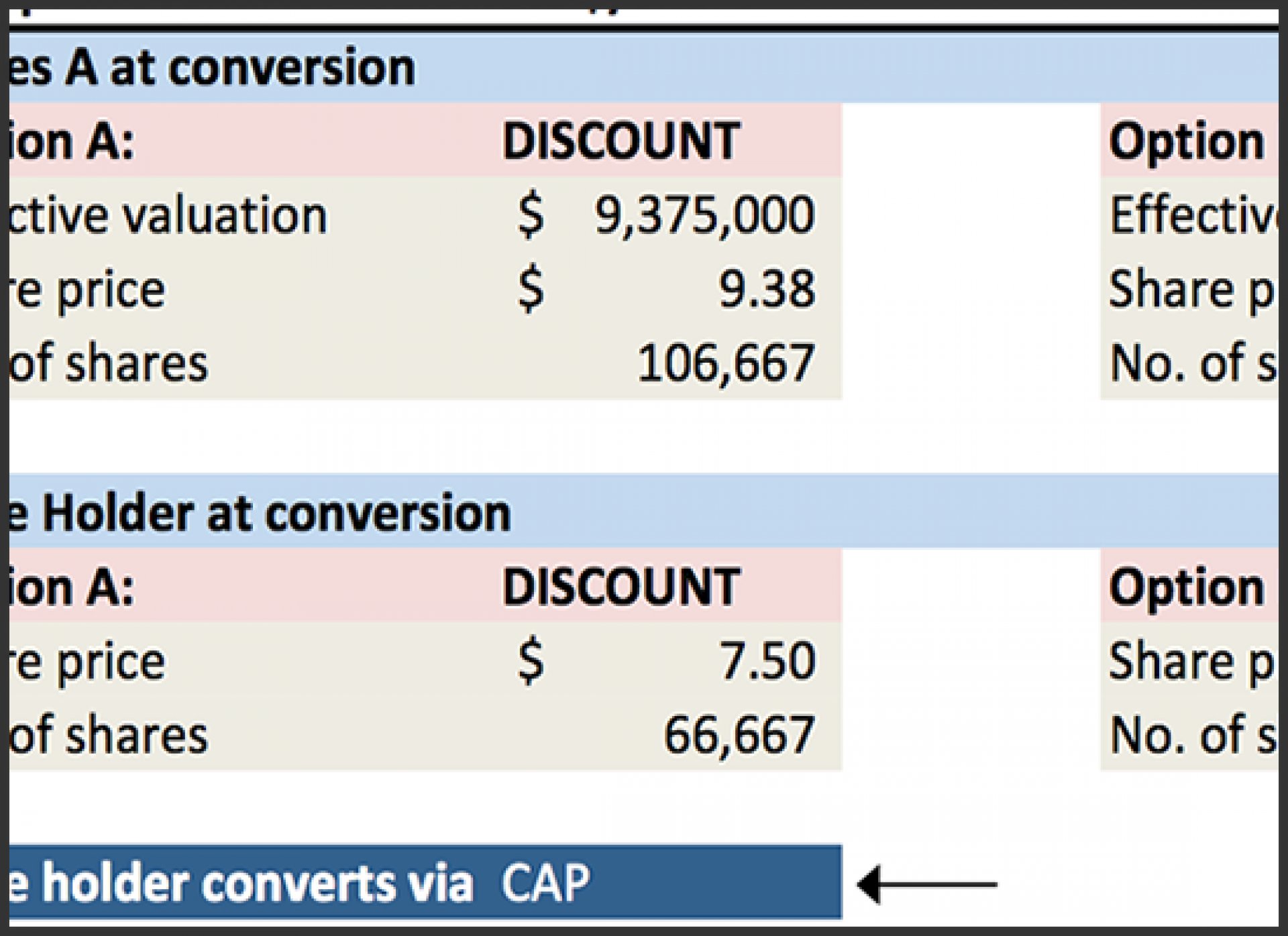

How Convertible Notes Convert, Template David Kircos

SAFE Notes Explained Video, Guide, and Excel File

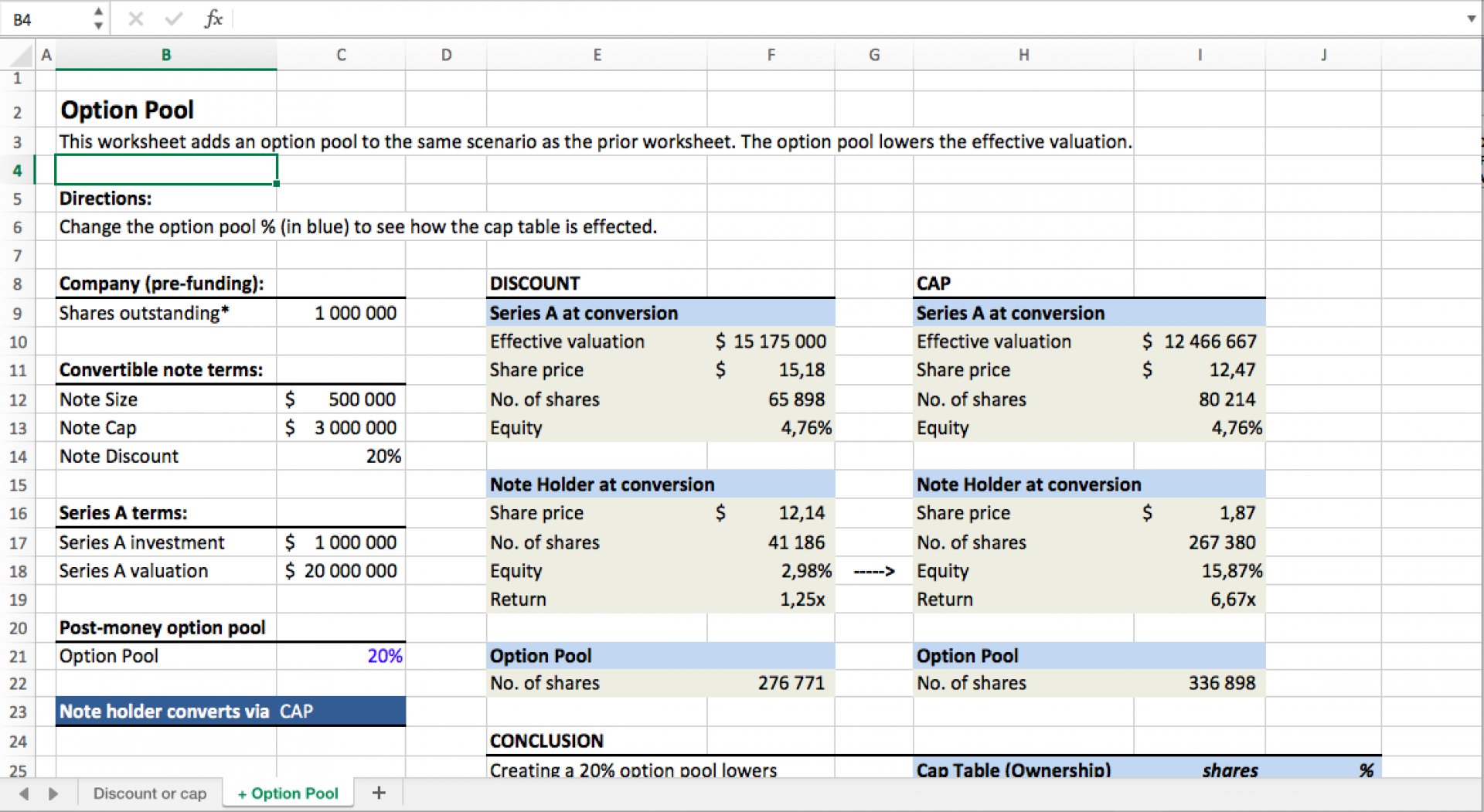

Note Discount Cap Worksheet Eloquens

Understanding SAFEs and their Impact on 409A Valuation CLA

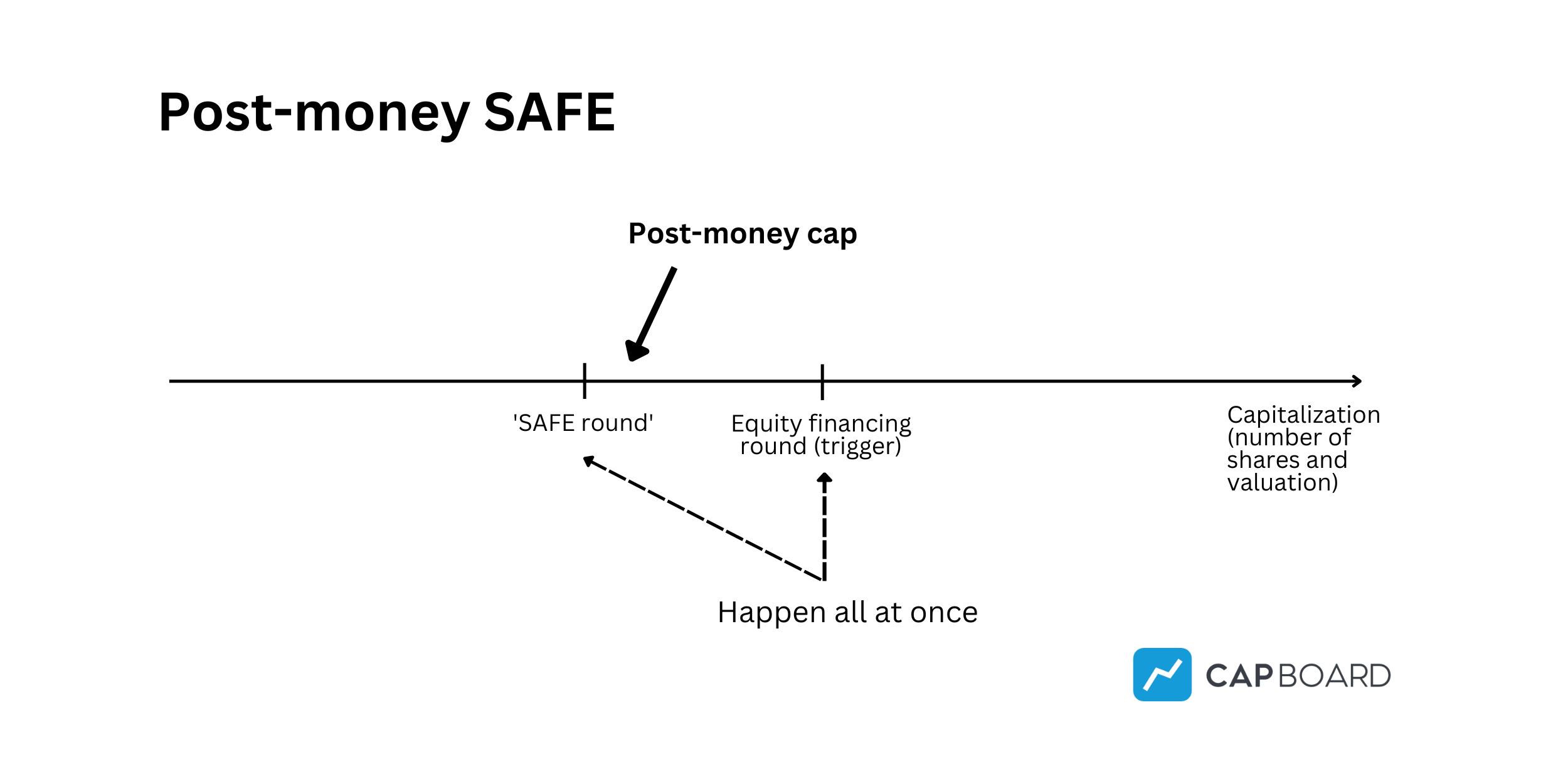

PreMoney SAFE vs PostMoney SAFE explanation and examples Capboard

Note Discount Cap Worksheet Eloquens

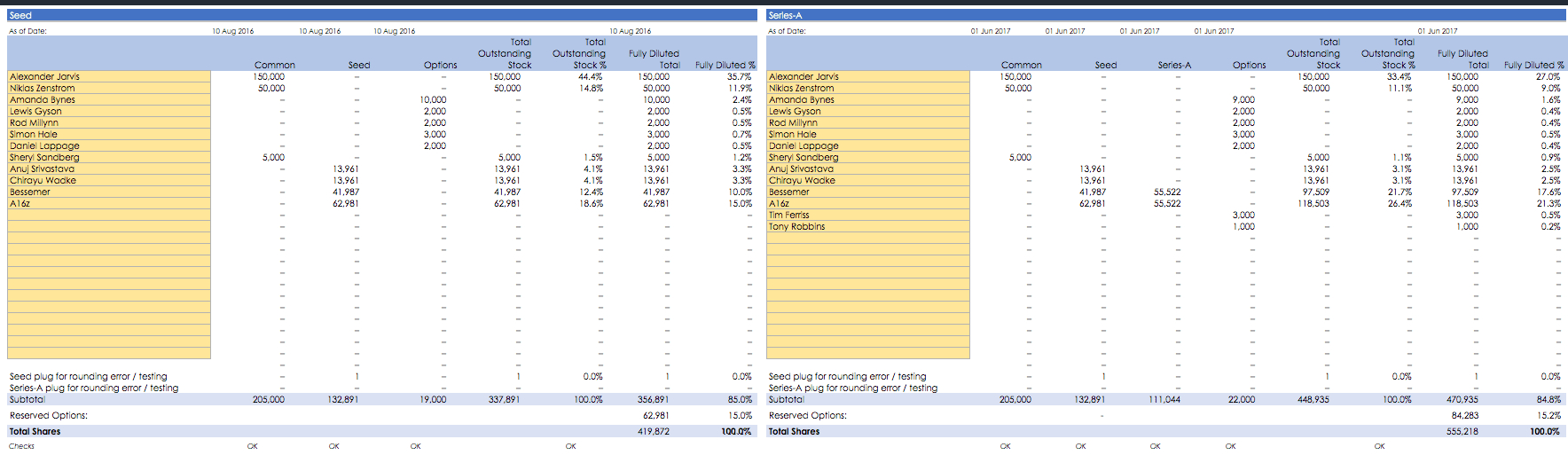

Pre And Post Money Valuation Spreadsheet inside Ultimate Free Cap Table

What is a cap table for a startup? [+ Free Google Sheets Template]

An Investor Has Bought A Safe For $.

There Is A Little Switch Which Says “A Cap Is Used”.

Valuation Caps Imply That Both Sides Have A Rough Understanding Of A Number Of Factors, Including When A Priced Round Is Likely To Happen,.

Discount Rates Typically Range Between 10% And 25%, And.

Related Post:

![What is a cap table for a startup? [+ Free Google Sheets Template]](https://global-uploads.webflow.com/5e9451ac176f31e759c9fd0c/6343daf9456e3882177ae8ec_Cap Table Shareholdings.jpg)