Tax Receipt For Donation Template

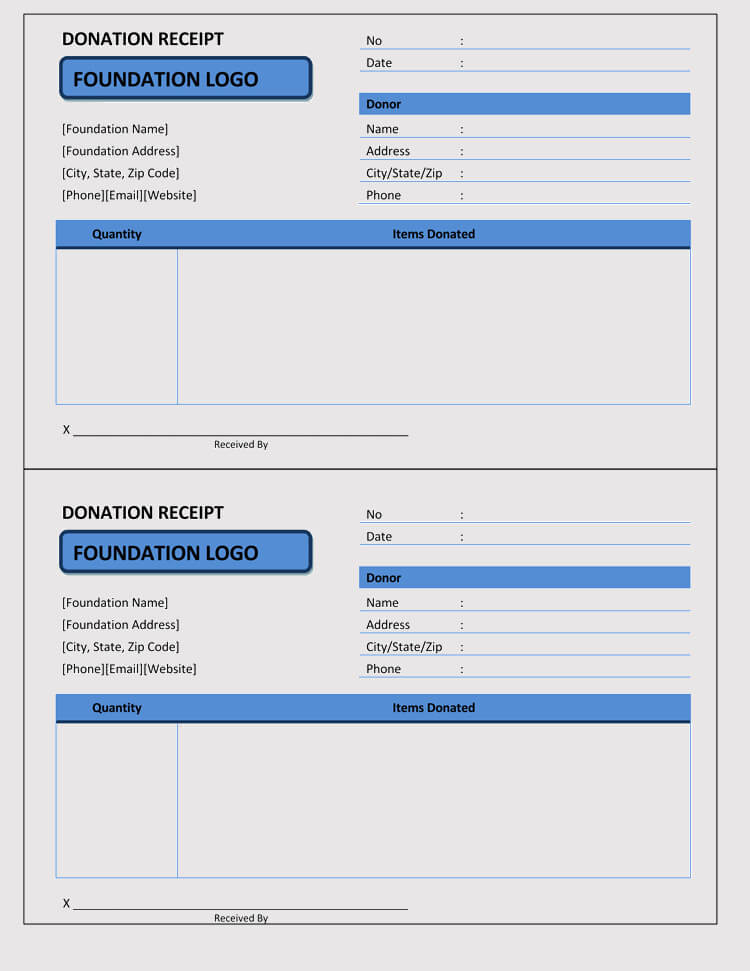

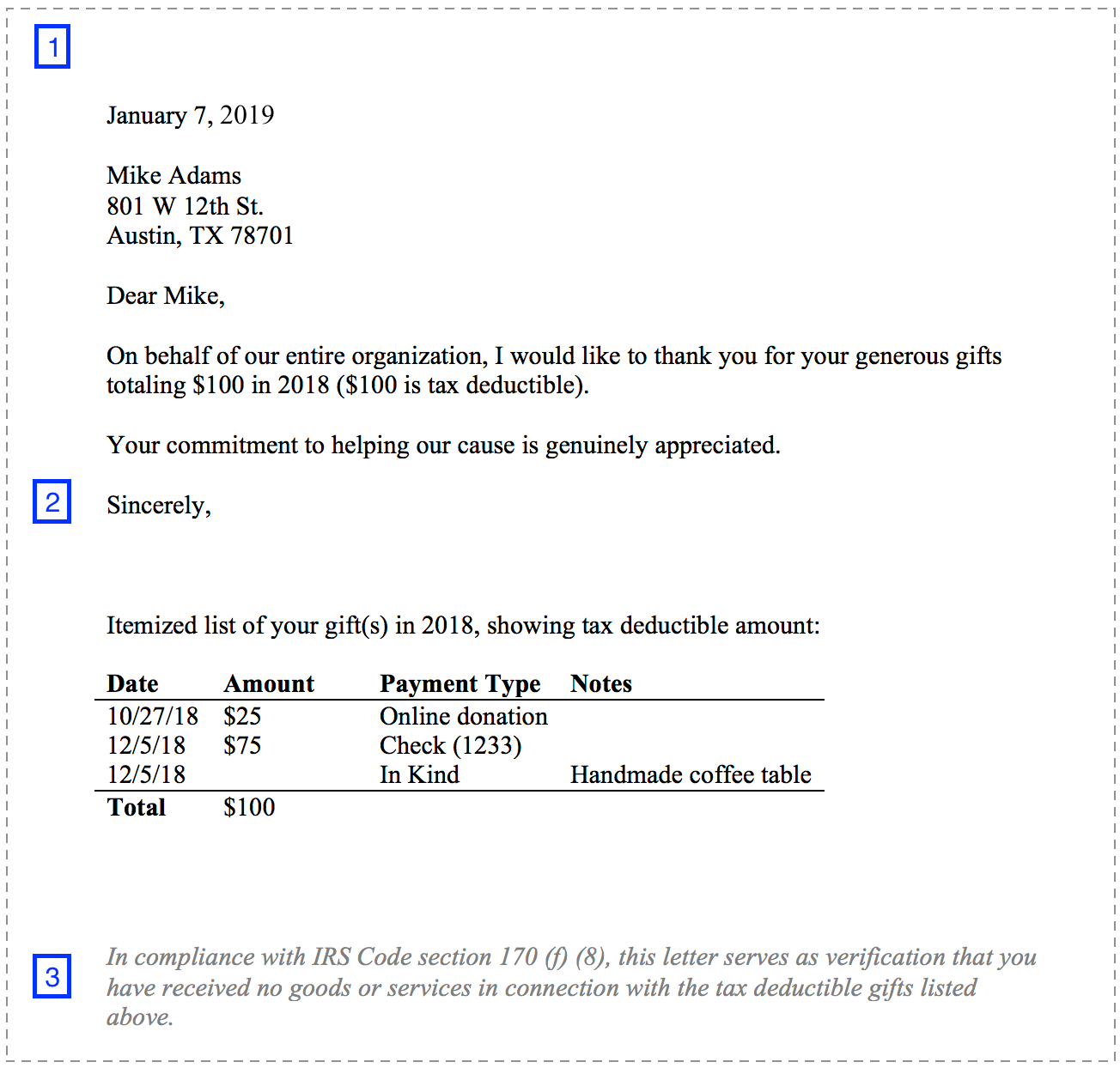

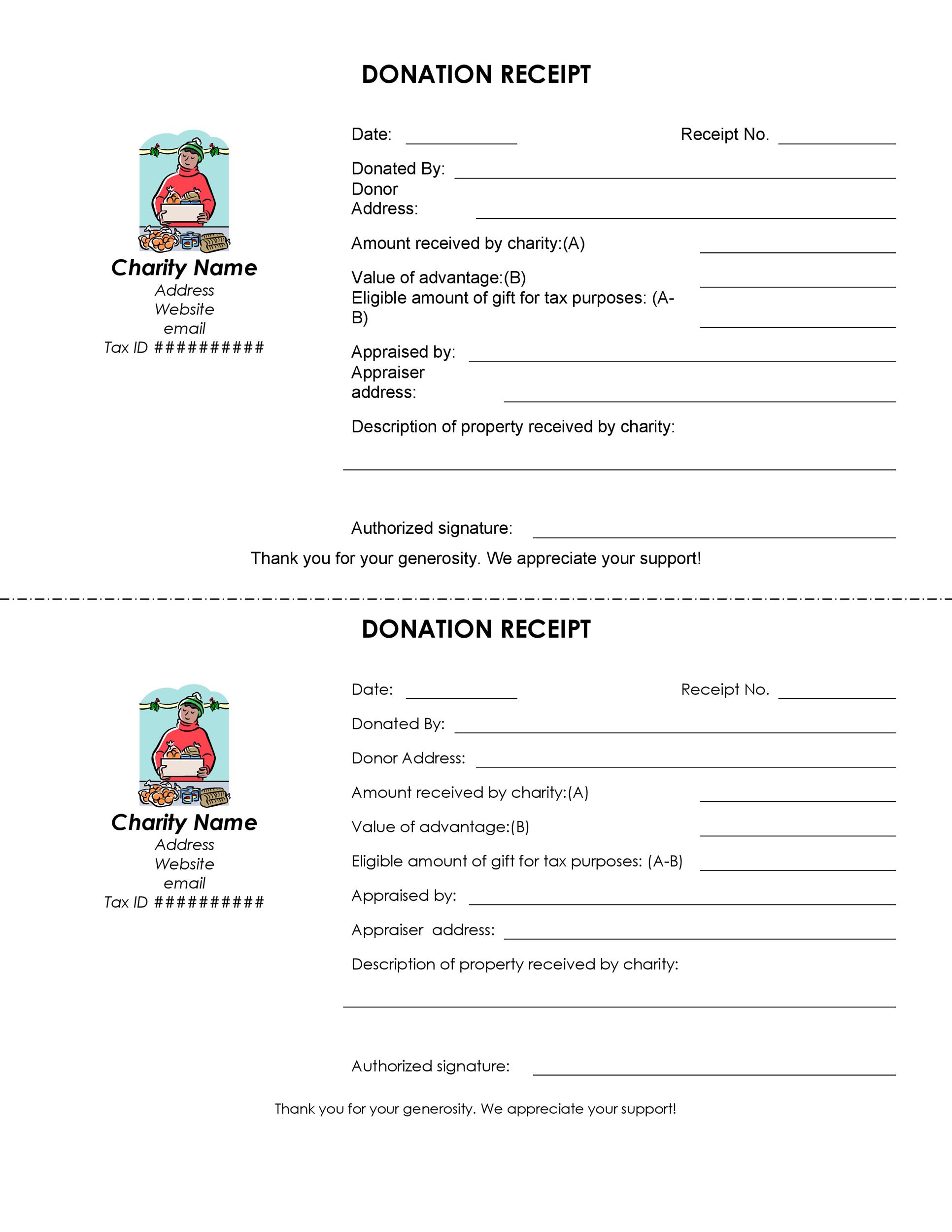

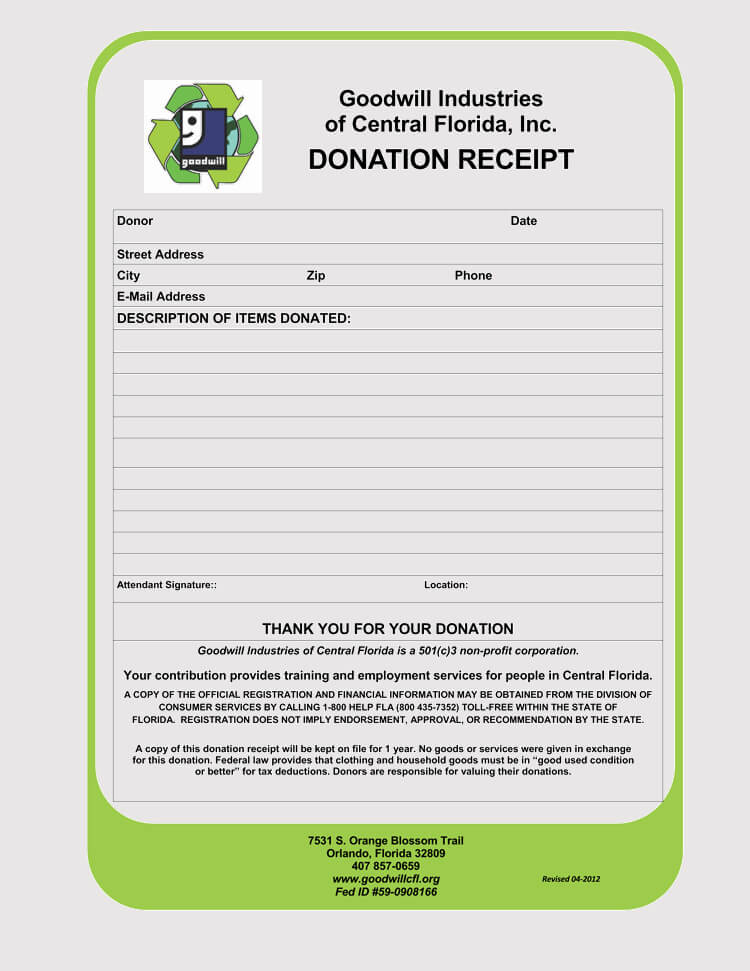

Tax Receipt For Donation Template - The name of both charity and donor, the date of the contribution, detailed description of the property donated, amount of contribution among other features. Get simple, free templates that can be used for any donation or gift here. Statement that the charity didn’t provide any goods or services in exchange for the donation. Crafting a professional donation receipt can make all the difference in maintaining. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. However, you'll need your total itemized deductions, including charitable. Write a formal yet heartfelt tax receipt for donation. Here’s an example of a donation receipt that our. Some of these essential features include; At the very least, a 501 (c) (3) donation receipt must include the following information: The name of both charity and donor, the date of the contribution, detailed description of the property donated, amount of contribution among other features. In the future, that written record can be used as proof of a donation. Donation receipt templates are a necessity when it comes to charitable donations. Write a formal yet heartfelt tax receipt for donation. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Statement that the charity didn’t provide any goods or services in exchange for the donation. Donation receipt templates are essential tools for any organization involved in charitable activities. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. There is no minimum threshold for individual charitable donations to be tax deductible donations. A printable donation receipt template can be downloaded through the link below. One of the reasons an individual might need proof of a contribution is to claim a tax deduction with the internal revenue service (irs). At the very least, a 501 (c) (3) donation receipt. With the help of this receipt, the donor claims a tax deduction on their federal tax return. However, you'll need your total itemized deductions, including charitable. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming a tax deduction. Statement that the charity didn’t. A printable donation receipt template can be downloaded through the link below. By receiving the receipt, the donors feel that their struggles have been acknowledged. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. In the future, that written record can be used as proof of a donation. At the very least, a 501 (c) (3). By receiving the receipt, the donors feel that their struggles have been acknowledged. This is generally the preferable approach since this allows the donee to impart his/her gratitude to his/her donor, while helping him/her. Here’s an example of a donation receipt that our. Donation receipt templates are essential tools for any organization involved in charitable activities. Some of these essential. Statement that the charity didn’t provide any goods or services in exchange for the donation. Write a formal yet heartfelt tax receipt for donation. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. You can download one of our free templates or samples to get a better idea of what a donation. The irs gives clear guidelines on what should be included in the receipt. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. You can download one of our free templates or samples to get a better idea of what. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Donation receipt templates are a necessity when it comes to charitable donations. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. Some of these essential features include; You can download one of our free templates or samples to get. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are essential tools for any organization involved in charitable activities. Write a formal yet heartfelt tax receipt for donation. In the future, that written record can be used as proof of a donation. By receiving the receipt, the donors feel that their struggles. Crafting a professional donation receipt can make all the difference in maintaining. By receiving the receipt, the donors feel that their struggles have been acknowledged. Here’s an example of a donation receipt that our. When a single donation is worth more than $250, the irs demands that the donor must receive a written document from the nonprofit organization for claiming. There is no minimum threshold for individual charitable donations to be tax deductible donations. Read on to learn everything you need to know about this essential paperwork and to look at our sample donor receipt template options. At the very least, a 501 (c) (3) donation receipt must include the following information: We share the top free donation receipt templates. At the very least, a 501 (c) (3) donation receipt must include the following information: Here’s an example of a donation receipt that our. Some of these essential features include; Read on to learn everything you need to know about this essential paperwork and to look at our sample donor receipt template options. The name of both charity and donor, the date of the contribution, detailed description of the property donated, amount of contribution among other features. With the help of this receipt, the donor claims a tax deduction on their federal tax return. We share the top free donation receipt templates for your nonprofit organization! There is no minimum threshold for individual charitable donations to be tax deductible donations. In the world of nonprofit organizations, tracking and acknowledging donations is an essential. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Statement that the charity didn’t provide any goods or services in exchange for the donation. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Crafting a professional donation receipt can make all the difference in maintaining. In the future, that written record can be used as proof of a donation. A printable donation receipt template can be downloaded through the link below. This is generally the preferable approach since this allows the donee to impart his/her gratitude to his/her donor, while helping him/her.46 Free Donation Receipt Templates (501c3, NonProfit)

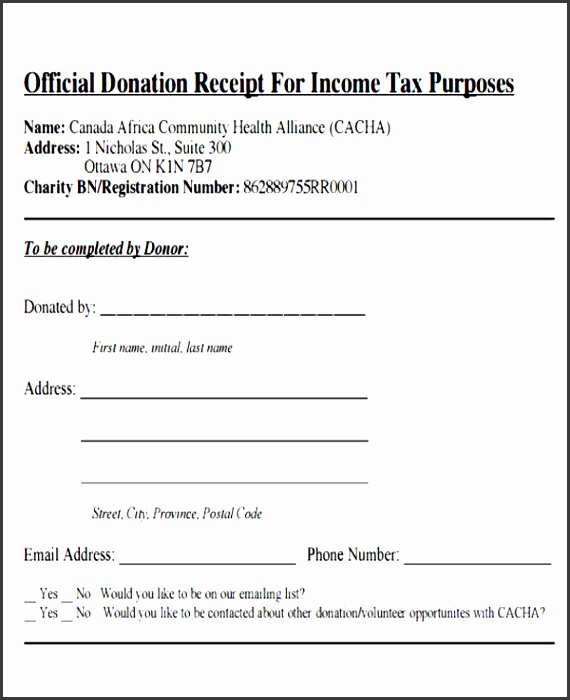

501C3 Donation Receipt Template For Your Needs

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

10 Donation Receipt Templates Free Samples, Examples & Format

FREE 7+ Tax Receipts for Donation in MS Word PDF

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

6 Tax Donation Receipt Template SampleTemplatess SampleTemplatess

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Printable Donation Receipt Template

When A Single Donation Is Worth More Than $250, The Irs Demands That The Donor Must Receive A Written Document From The Nonprofit Organization For Claiming A Tax Deduction.

By Receiving The Receipt, The Donors Feel That Their Struggles Have Been Acknowledged.

Get Simple, Free Templates That Can Be Used For Any Donation Or Gift Here.

The Irs Gives Clear Guidelines On What Should Be Included In The Receipt.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)