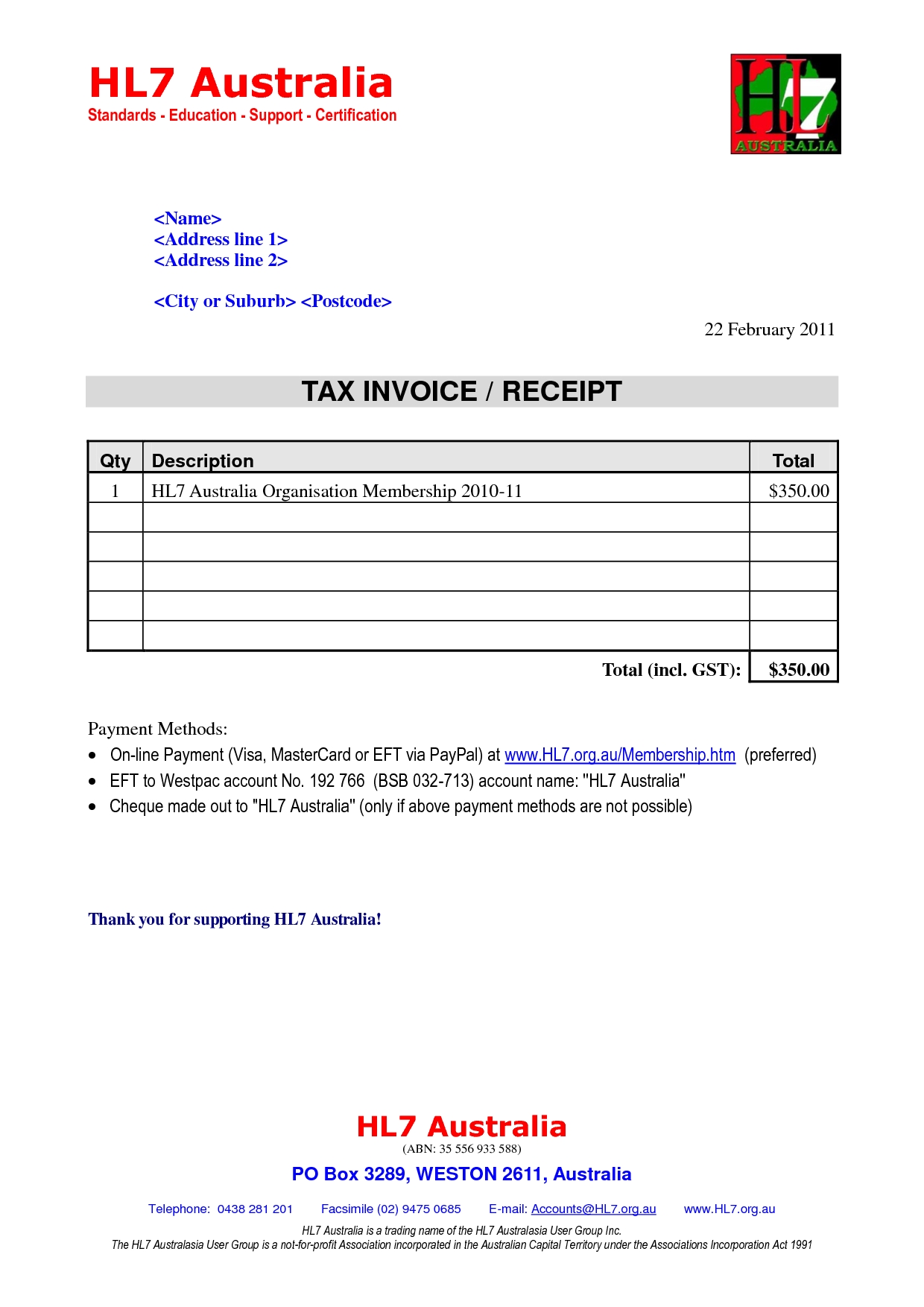

Tax Invoice Template Australia

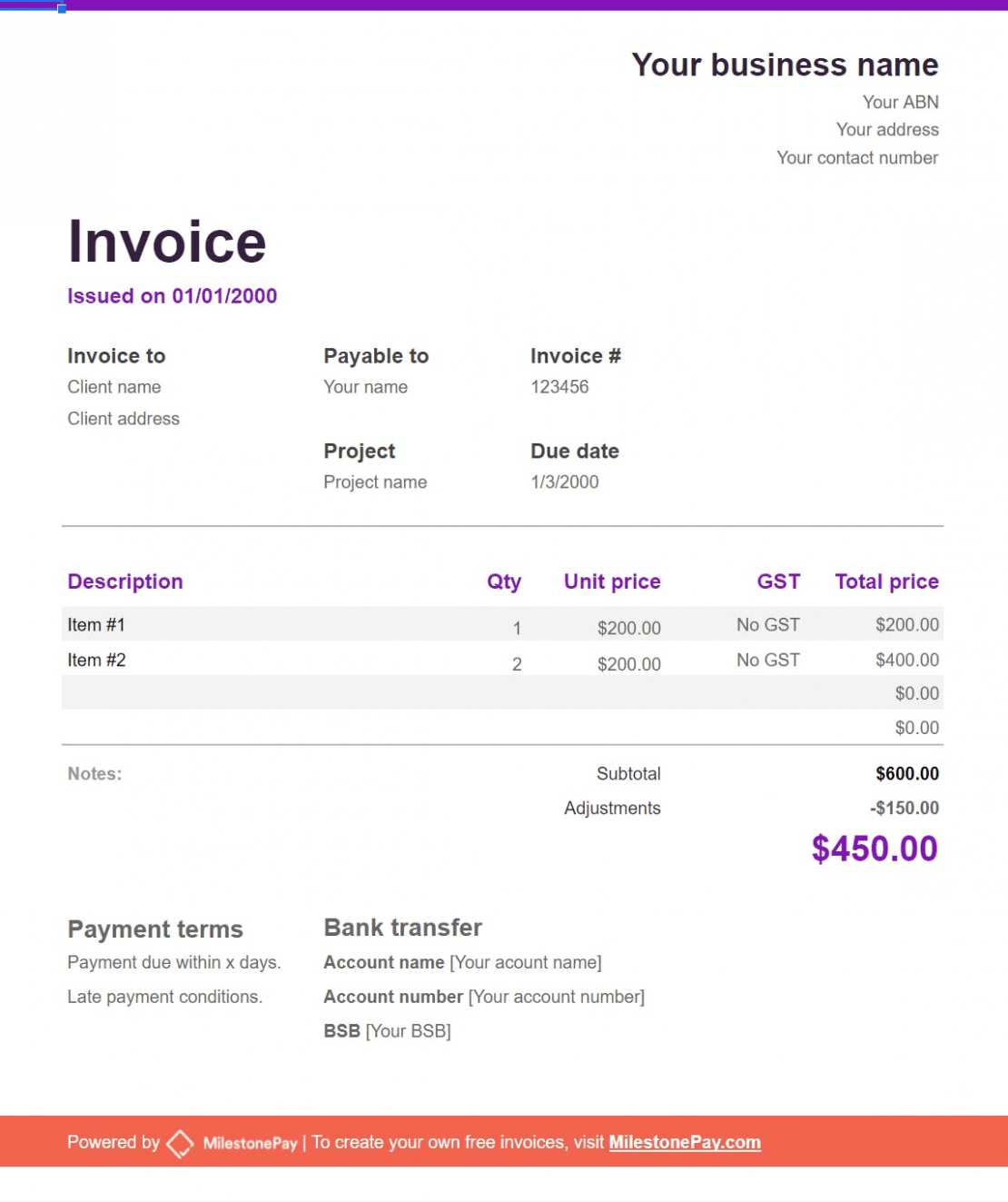

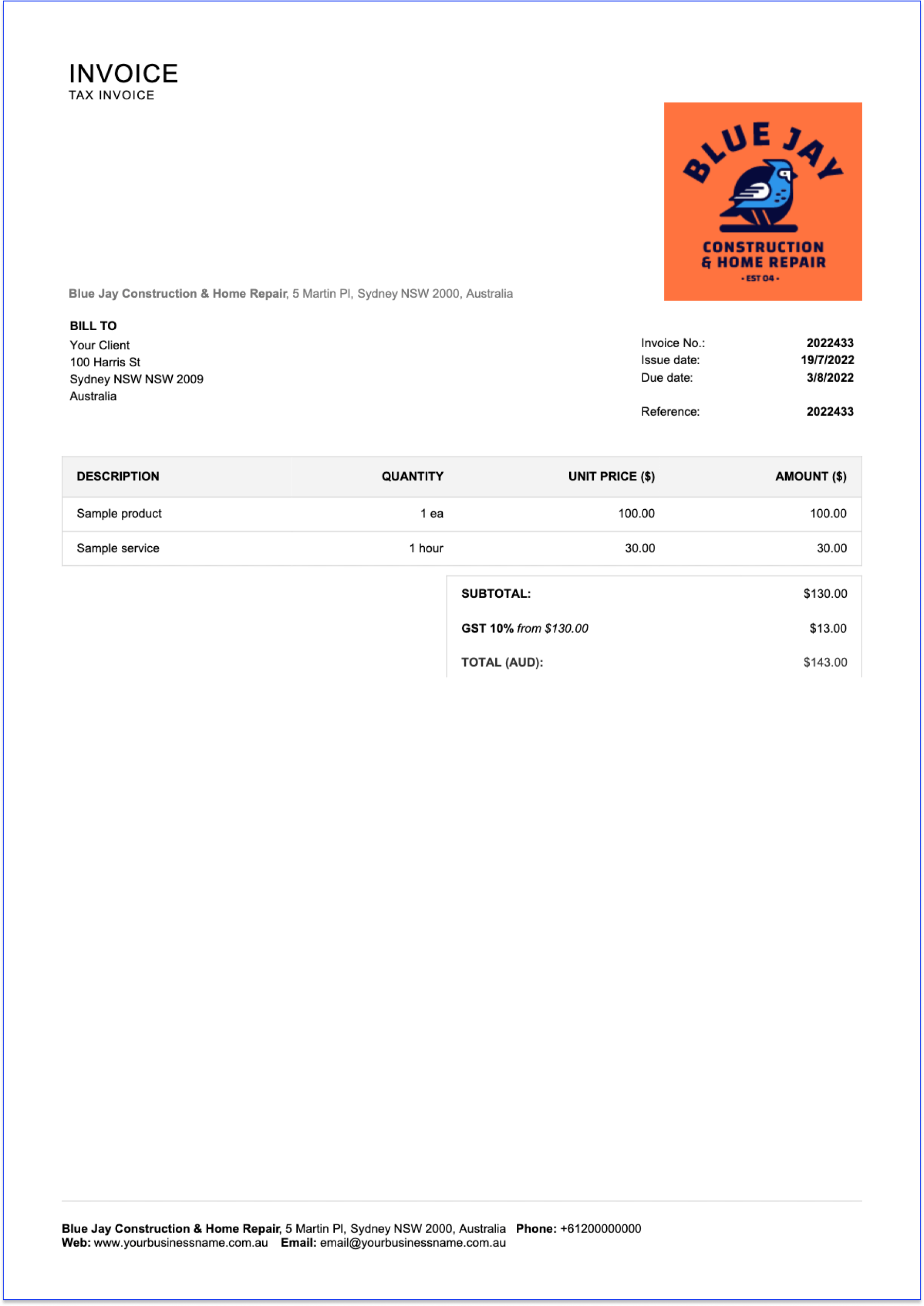

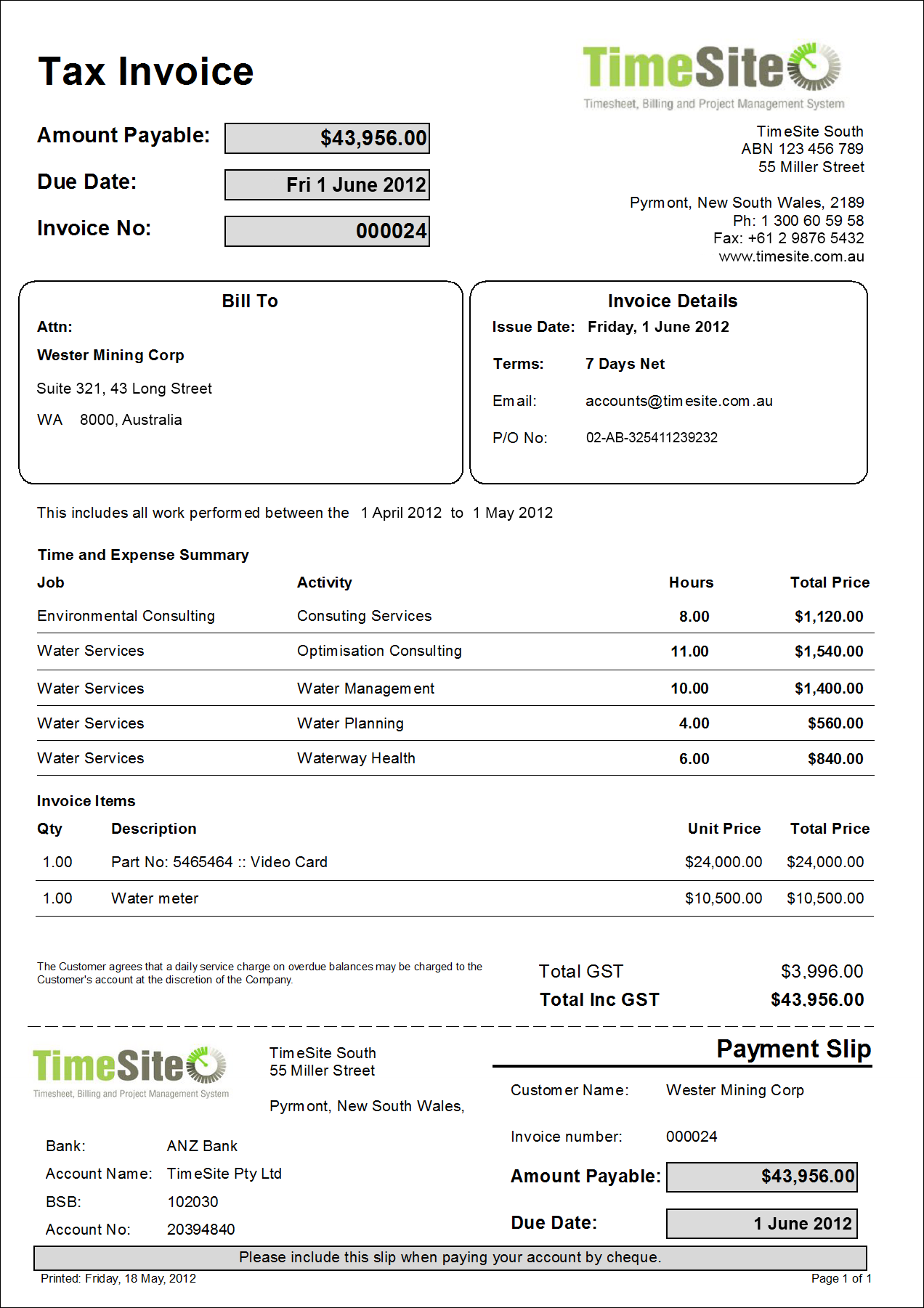

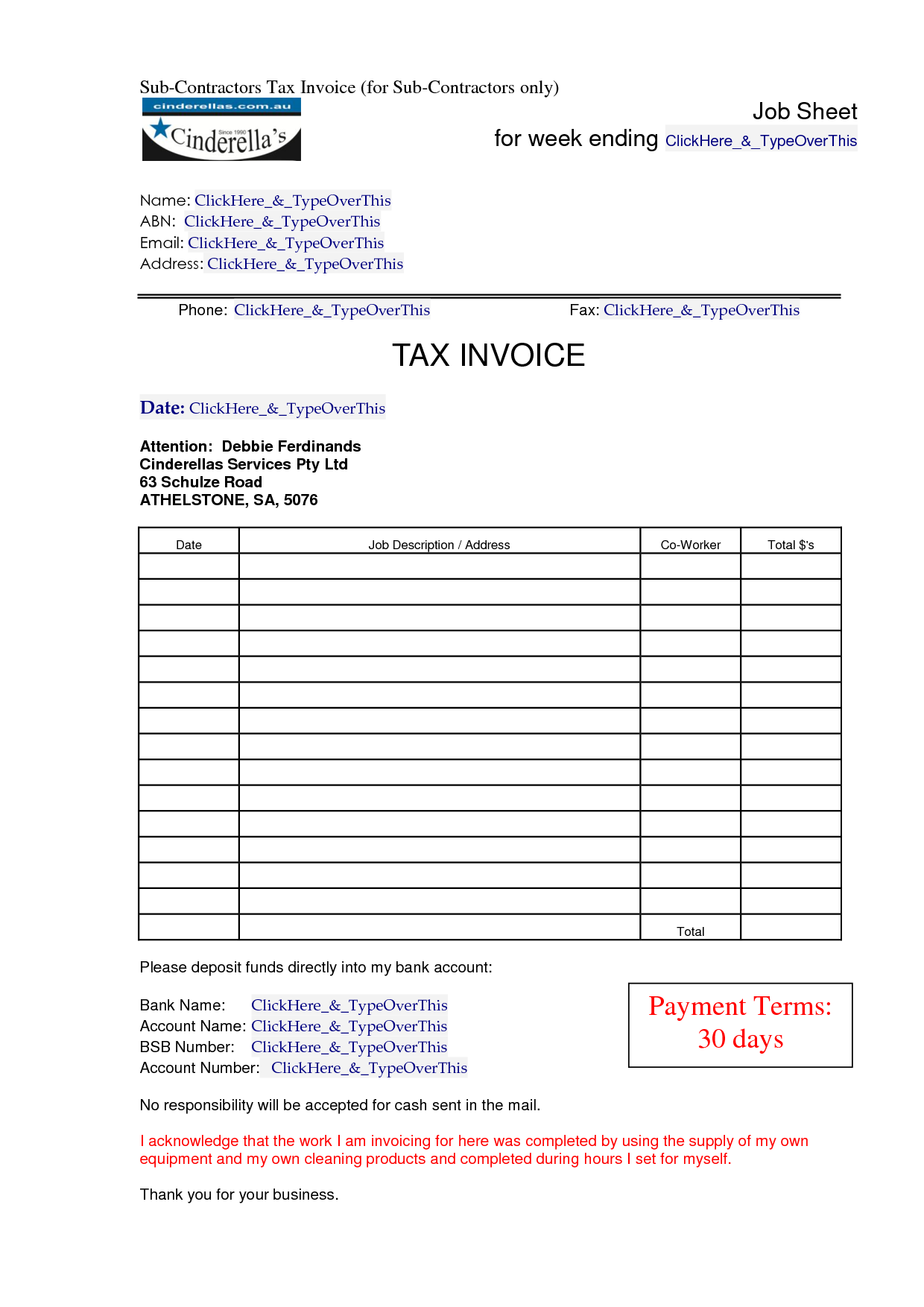

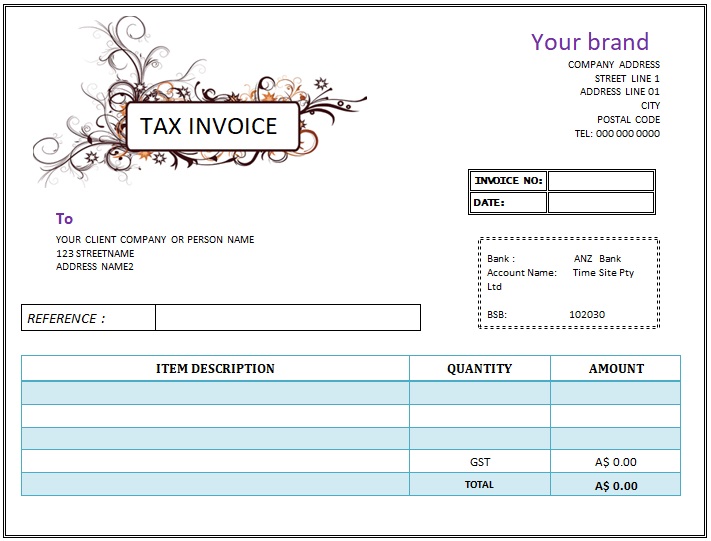

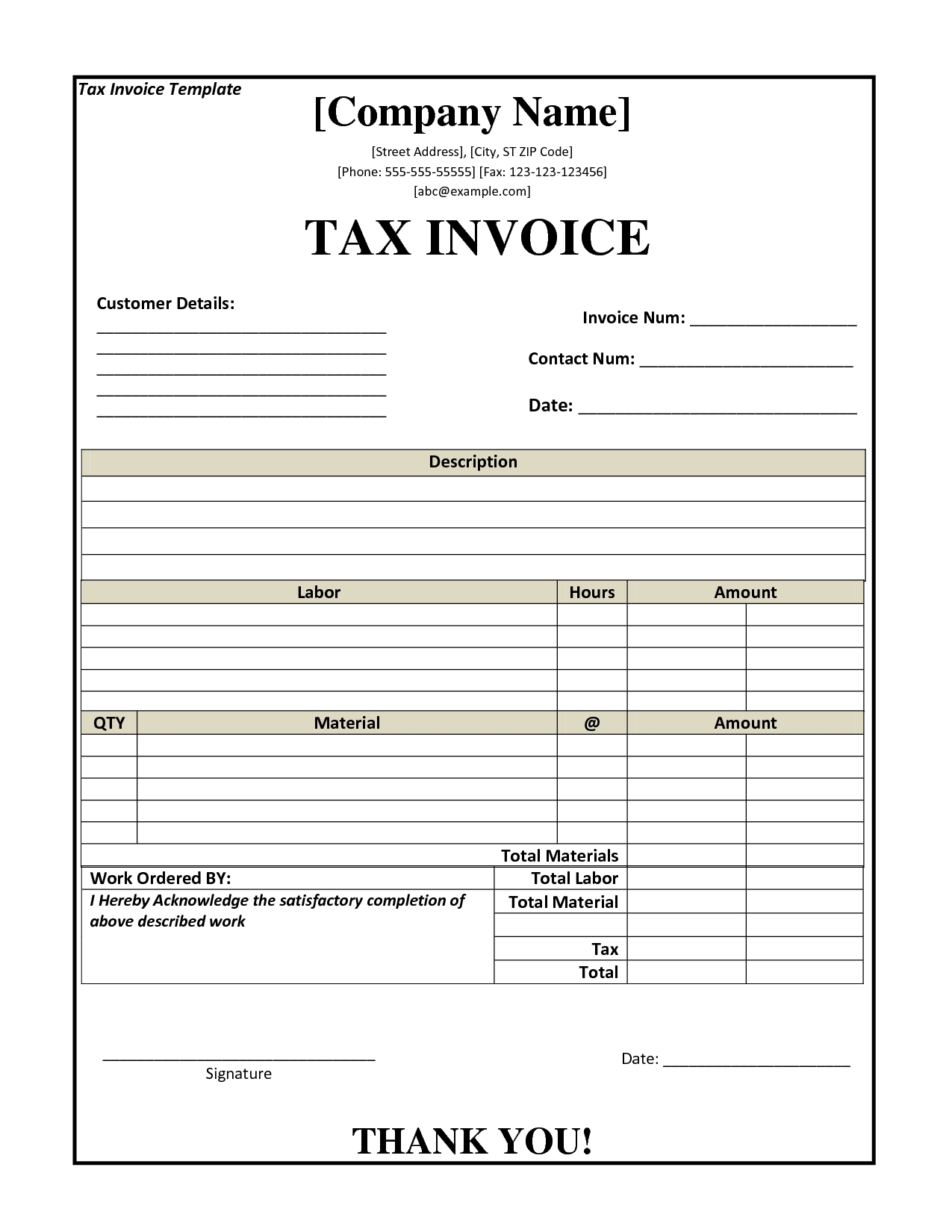

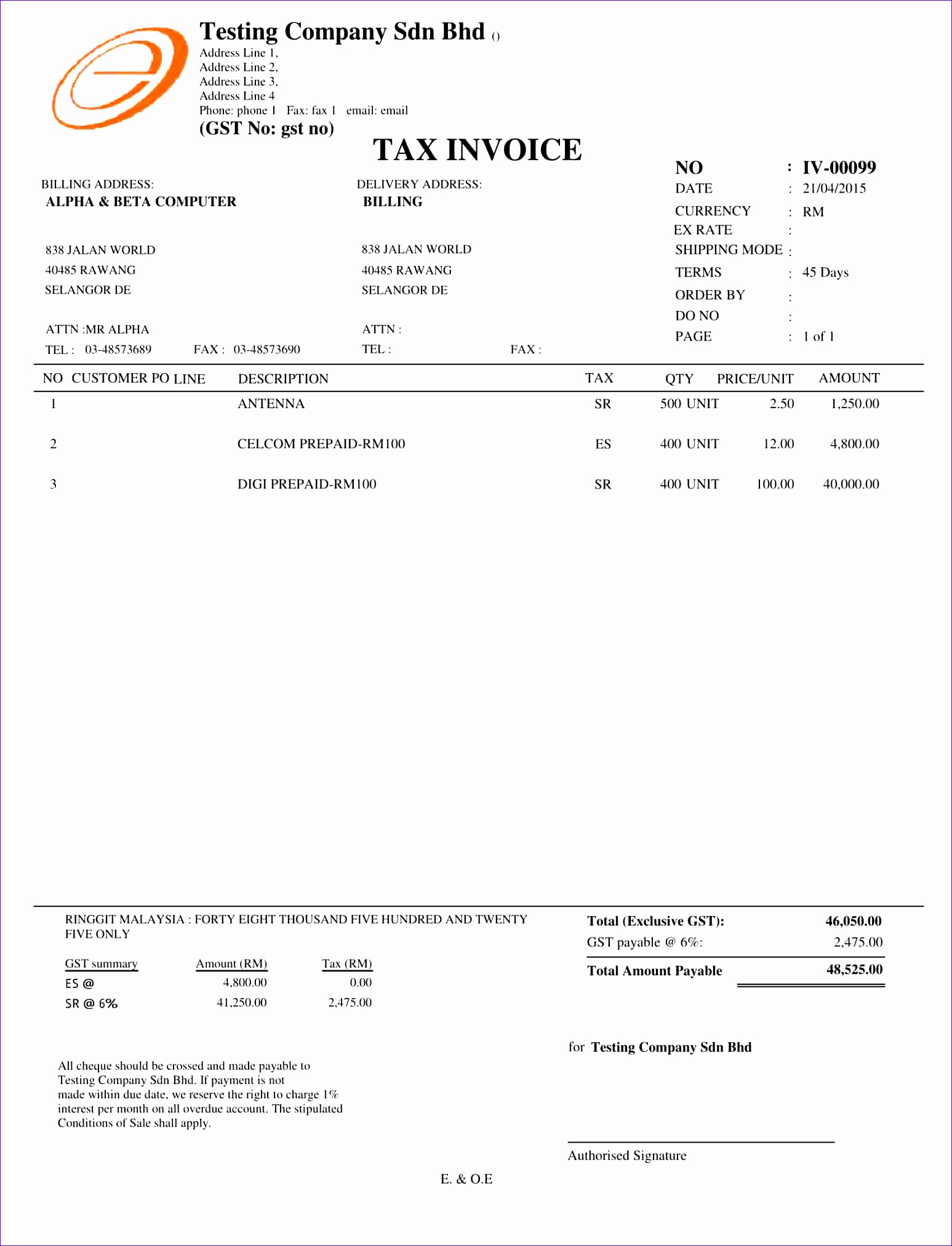

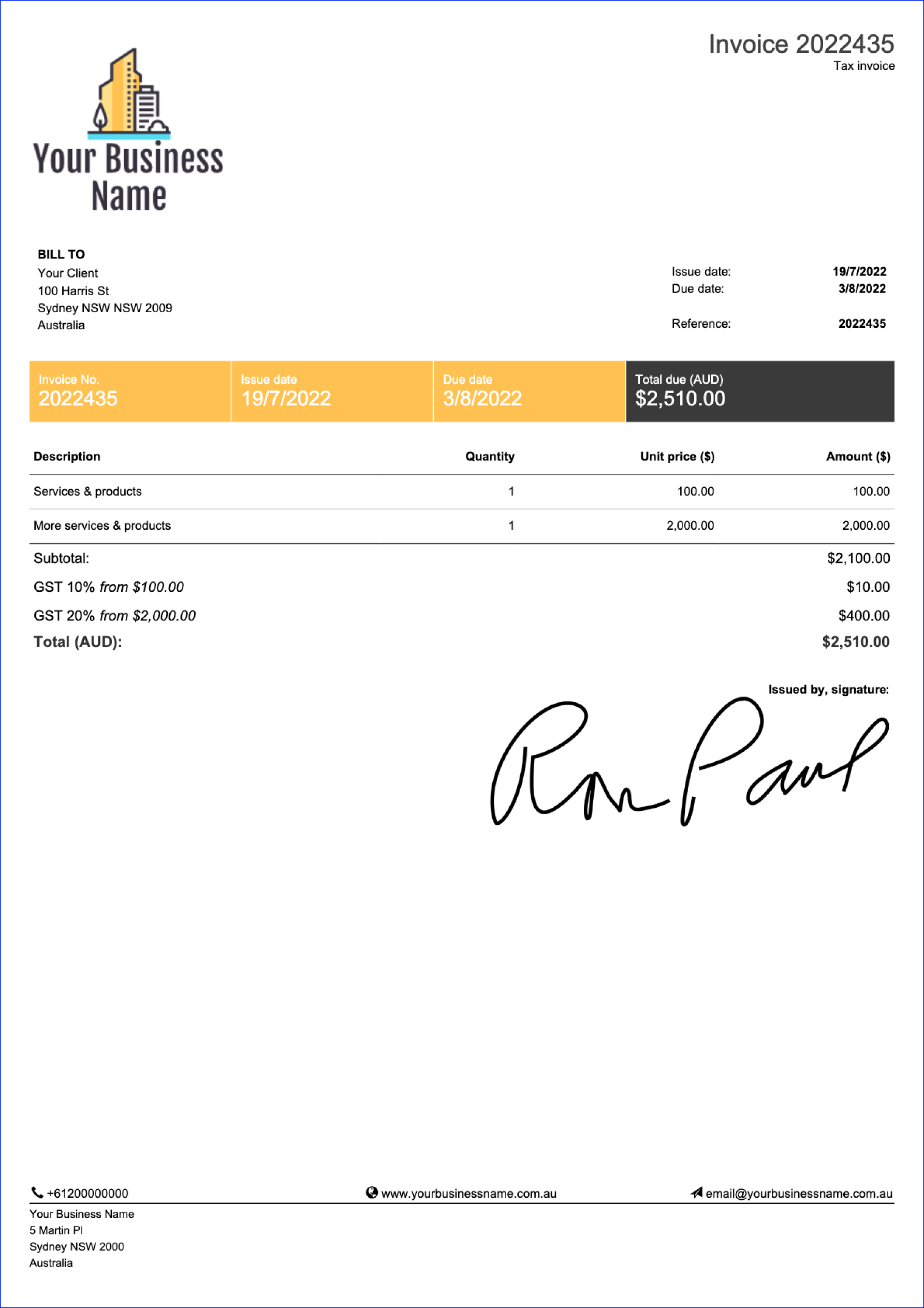

Tax Invoice Template Australia - If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community. A description of the goods or services purchased and the extent that you used the goods or services in your business Make sure you follow the digital record keeping rules for business. For record keeping purposes, an einvoice is no different to other digital records. Any fares under $82.50 (including gst) do not require a. A software provider that i’m reviewing says their product can be used in australia but refers to abn on their document templates (tax invoice etc.) as gst vat number or tax number. For example, you can issue a tax invoice to a customer by: You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. The tax invoice must contain certain information including your abn. Any fares under $82.50 (including gst) do not require a. Whether you have claimed any gst credits on the sale; You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. If you're registered for gst, your invoices should be called 'tax invoice'. The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. Make sure you follow the digital record keeping rules for business. For record keeping purposes, an einvoice is no different to other digital records. We pay our respects to them, their cultures, and elders past and. A description of the goods or services purchased and the extent that you used the goods or services in your business The tax invoice must contain certain information including your abn. Tax return for individuals 2024; Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's software; Whether you have claimed any gst credits on the sale; You can use this form as a template for creating rctis, or as a reference for information you need. Whether you have claimed any gst credits on the sale; Valuing contributions and minor benefits You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. If you choose not to issue a receipt, it may be helpful to let your donors know they can use other. If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. Tax return for individuals 2024; If you're registered for gst, your invoices should be called 'tax invoice'. A tax invoice doesn't need to be issued in paper form. We pay our respects to them, their cultures, and elders past and. If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. For more information about einvoicing for your business, see: If a customer asks for a tax invoice, you must provide one within 28 days, unless it is for a sale. Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's software; We pay our respects to them, their cultures, and elders past and. Valuing contributions and minor benefits If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. If you're registered for gst, your invoices should. We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community. If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. Tax return for individuals 2024; The information a tax invoice. A software provider that i’m reviewing says their product can be used in australia but refers to abn on their document templates (tax invoice etc.) as gst vat number or tax number. A description of the goods or services purchased and the extent that you used the goods or services in your business Tax return for individuals 2024; Using einvoicing. Is it compliant with gst legislation to issue documents that must display an. A description of the goods or services purchased and the extent that you used the goods or services in your business For example, you can issue a tax invoice to a customer by: If you're registered for gst, your invoices should be called 'tax invoice'. If you. You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: Whether you have claimed any gst credits on the sale; Tax return for individuals. For example, you can issue a tax invoice to a customer by: For record keeping purposes, an einvoice is no different to other digital records. When to provide a tax invoice. We pay our respects to them, their cultures, and elders past and. If the platform will issue tax invoices on your behalf, you should advise them of your gst. The peppol einvoicing standard can be used to issue an invoice that complies with the requirements of a tax invoice. If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. A description of the goods or services purchased and the extent that you used the goods or services in your business Make sure you follow the digital record keeping rules for business. The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: When to provide a tax invoice. A tax invoice doesn't need to be issued in paper form. If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. Is it compliant with gst legislation to issue documents that must display an. The information a tax invoice must include depends on: You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. A software provider that i’m reviewing says their product can be used in australia but refers to abn on their document templates (tax invoice etc.) as gst vat number or tax number. Tax return for individuals 2024; For record keeping purposes, an einvoice is no different to other digital records. Valuing contributions and minor benefits If you're registered for gst, your invoices should be called 'tax invoice'.Free Australian Tax Invoice Template

Master Australian Tax Invoices Your Ultimate Guide to Compliance and

Tax Invoice Template Australia A Step by Step Guide invoice example

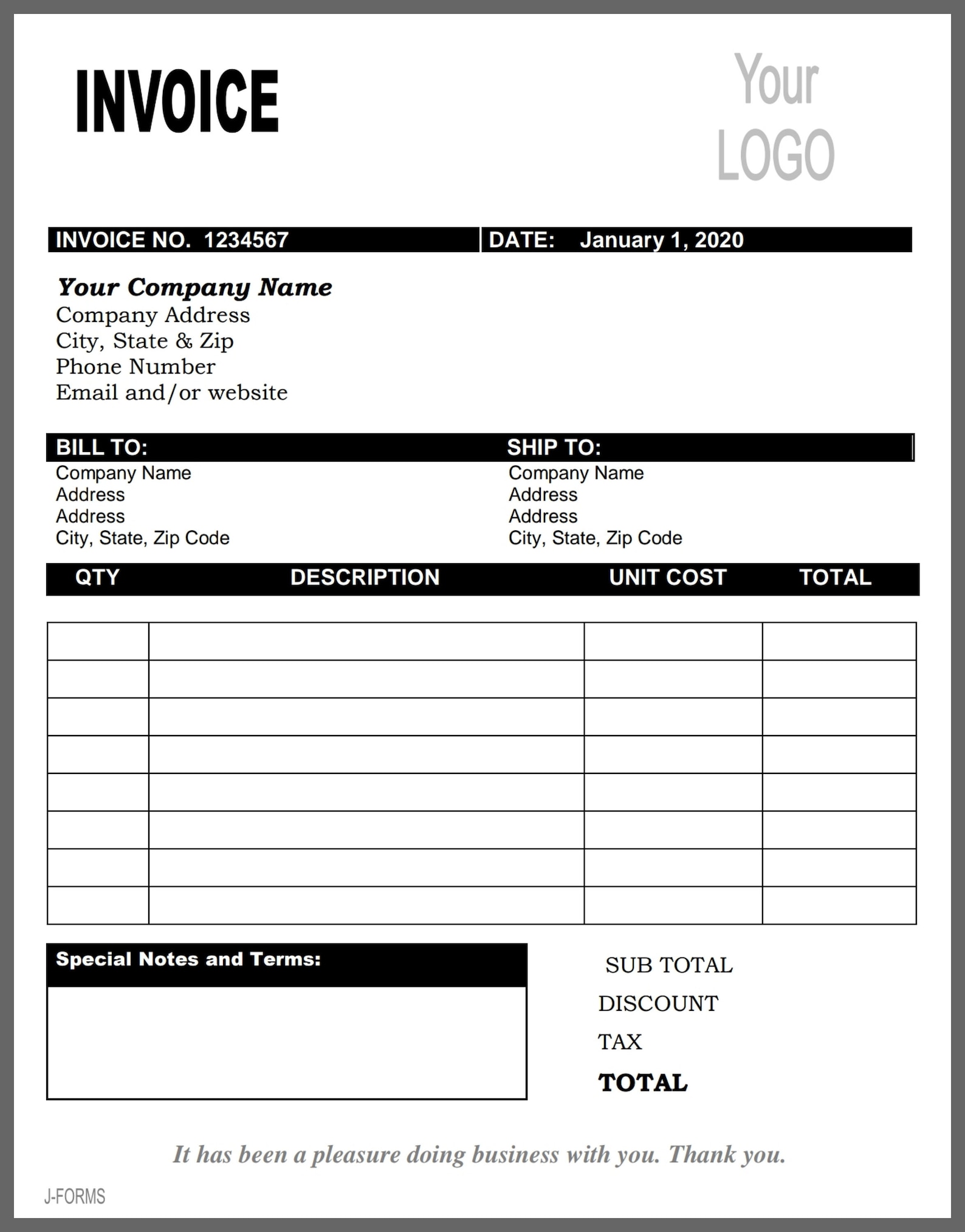

Invoice Template Australia Abn invoice example

Australia Tax Invoice Templates 25+ Free & Printable Designs All

Tax Invoice Templates Invoice Template Ideas

Sample Tax Invoice Template Australia

Change Abn From Sole Trader To Company

Australian Invoice Requirements * Invoice Template Ideas

Invoice Template Printable Invoice Business Form Editable Invoice

We Pay Our Respects To Them, Their Cultures, And Elders Past And.

Whether You Have Claimed Any Gst Credits On The Sale;

We Acknowledge The Traditional Owners And Custodians Of Country Throughout Australia And Their Continuing Connection To Land, Waters And Community.

For More Information About Einvoicing For Your Business, See:

Related Post: