Snowball Credit Card Payoff Template

Snowball Credit Card Payoff Template - That’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. The debt snowball method focuses on paying off debts in a strategic. Available as printable pdf or google docs sheet. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. You will also learn the steps needed to create. Easily create a debt reduction schedule based on the popular debt snowball. In short— download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts. The vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Strategies to pay off credit card debt. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Easily create a debt reduction schedule based on the popular debt snowball. The debt snowball method focuses on paying off debts in a strategic. If you prefer to use a spreadsheet to track your debt payoff. In short— download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts. All pages are 100% free. That’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. If you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. The snowball method works by focusing on paying off your smallest debts first while making minimum. You will use the debt snowball calculator to set up each credit card account, and then you will list each. If you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Easily create a debt reduction schedule based on the popular debt snowball. Available as printable pdf or google docs sheet. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Why. The vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Want to see how the tool works?. In short— download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts. All pages are 100% free.. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. In this guide, you will learn what the debt snowball method and the debt snowball spreadsheet are and how they can help you pay off your debt. Easily create a debt reduction schedule based on the popular debt snowball. If you prefer to. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Just like an actual snowball rolling down a. That’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. The snowball calculator can be used to pay off your credit card. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. This is a template that you can use if you want to pay off one credit card at a time. Why do det snowballs work so. If you have multiple credit card balances, the debt snowball method helps you prioritize paying off. Want to see how the tool works?. In short— download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts. If you prefer to use a spreadsheet to track your debt payoff. The snowball method works by focusing on paying off your smallest debts first while making. The snowball calculator can be used to pay off your credit card debt, student loans, or any other type of debt, proving beneficial and effective. Want to see how the tool works?. Easily create a debt reduction schedule based on the popular debt snowball. Just like an actual snowball rolling down a. The debt snowball method focuses on paying off. The snowball method works by focusing on paying off your smallest debts first while making minimum. All pages are 100% free. The debt snowball method focuses on paying off debts in a strategic. This is a template that you can use if you want to pay off one credit card at a time. Why do det snowballs work so. Below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. All pages are 100% free. Available as printable pdf or google docs sheet. The vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Use our debt snowball calculator. You will also learn the steps needed to create. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. The snowball calculator can be used to pay off your credit card debt, student loans, or any other type of debt, proving beneficial and effective. Strategies to pay off credit card debt. If you. The snowball method works by focusing on paying off your smallest debts first while making minimum. You will use the debt snowball calculator to set up each credit card account, and then you will list each. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. That’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. These templates provide a structured framework for creating a debt repayment plan based on the debt snowball method. Easily create a debt reduction schedule based on the popular debt snowball. Available as printable pdf or google docs sheet. You will also learn the steps needed to create. Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. In short— download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts. If you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. All pages are 100% free. Why do det snowballs work so. The vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Want to see how the tool works?. This is a template that you can use if you want to pay off one credit card at a time.Snowball Bill Pay Template

Debt Snowball Tracker Digital Excel Payoff Spreadsheet Etsy

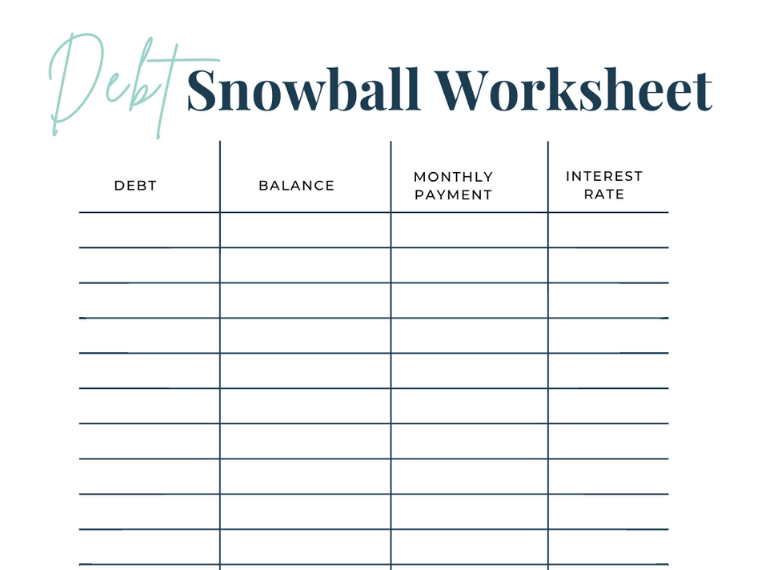

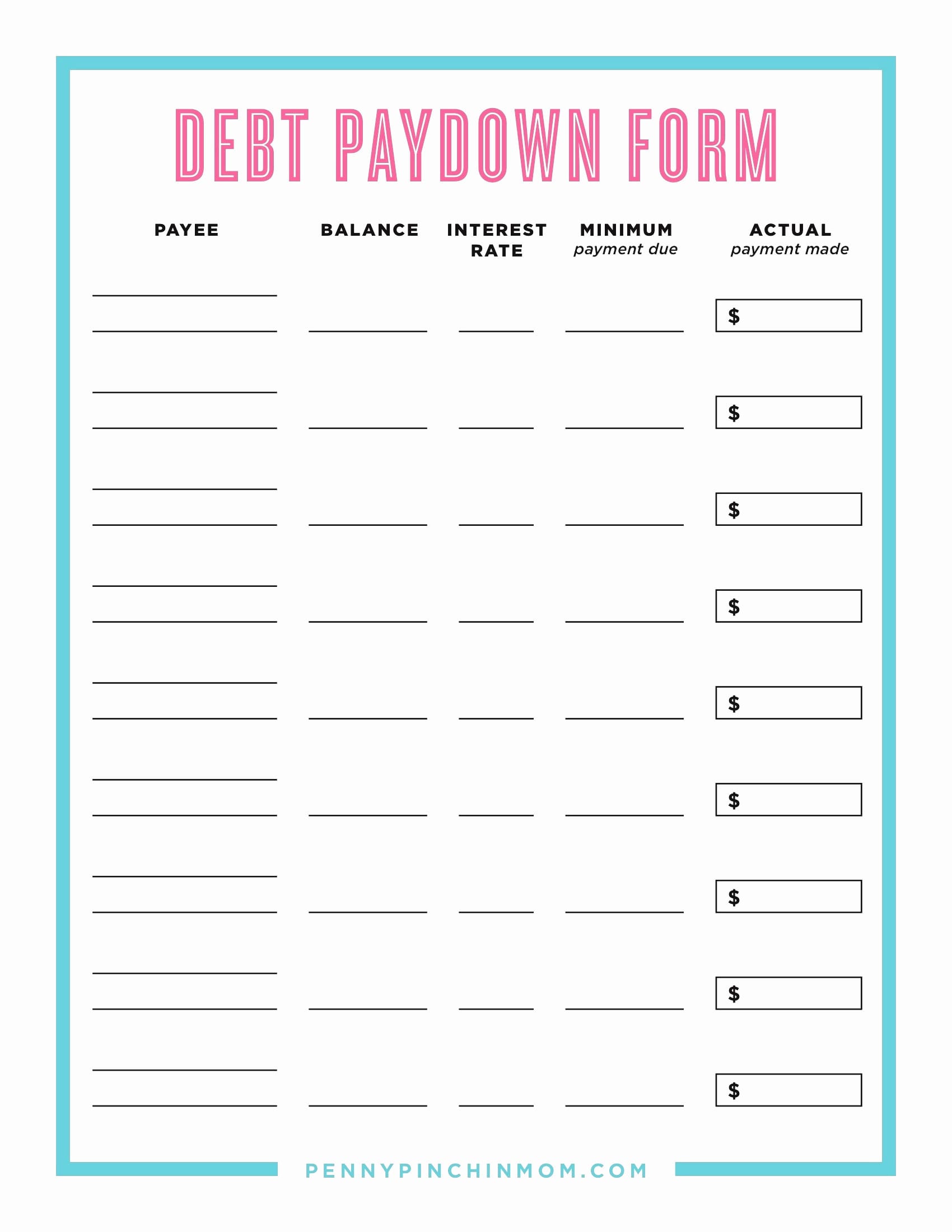

Debt Snowball Worksheet {Free Printable} Debt snowball worksheet

Credit Card Snowball Calculator Worksheet Etsy

How To Use The Debt Snowball Method To Get Out Of Debt Debt snowball

Snowball Credit Card Payoff Spreadsheet —

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Calculator Credit

How to Create Credit Card Payoff Calculator with Snowball in Excel

Free Printable Debt Snowball Worksheet To Payoff Debt In 2022

If You Prefer To Use A Spreadsheet To Track Your Debt Payoff.

Below Are 10 Debt Snowball Worksheets That You Can Download For Free To Use To Track Your Debt Payoff Process.

Choose From 35 Unique Debt Trackers That Include Debt Snowball Worksheets, Debt Payoff Planners, And More.

The Debt Snowball Method Focuses On Paying Off Debts In A Strategic.

Related Post:

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball-724x1024.jpg)