Qualified Income Trust Template

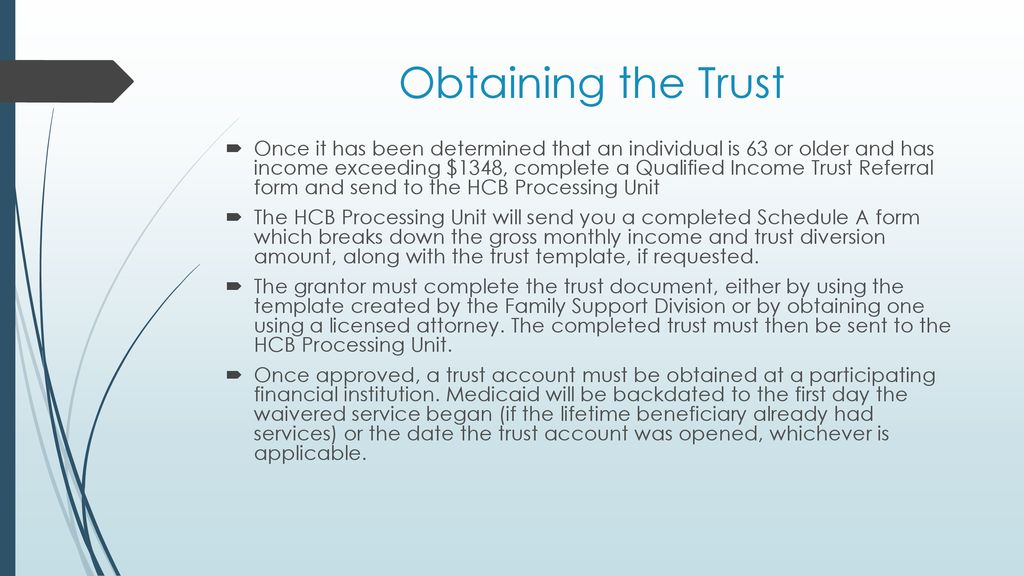

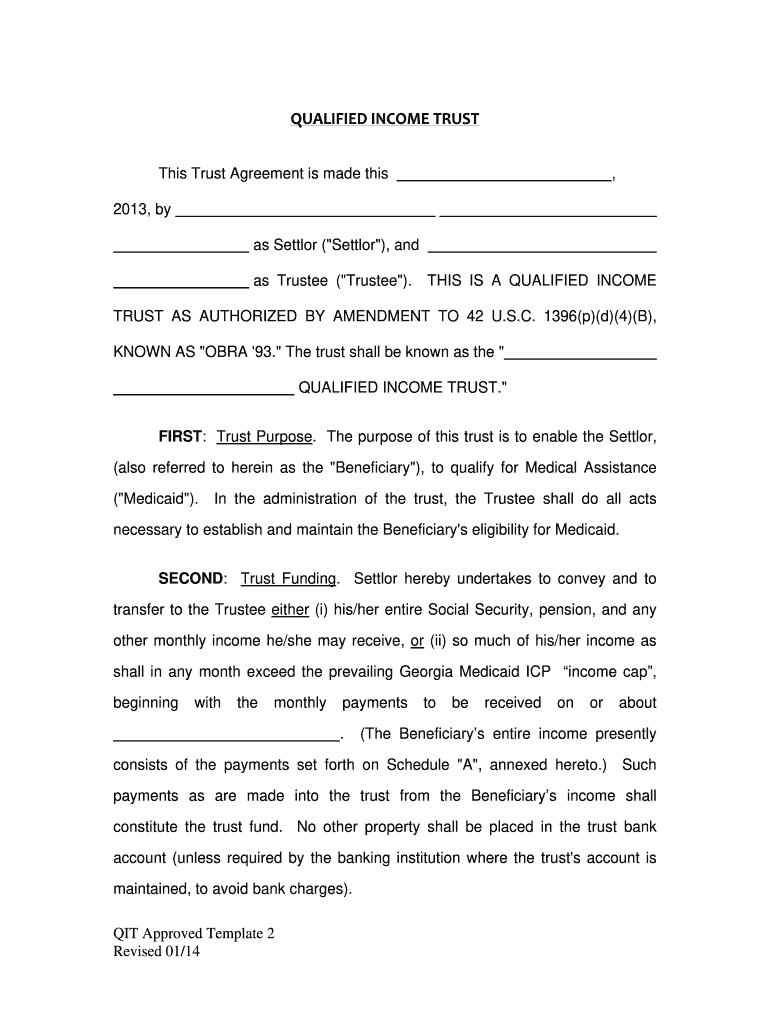

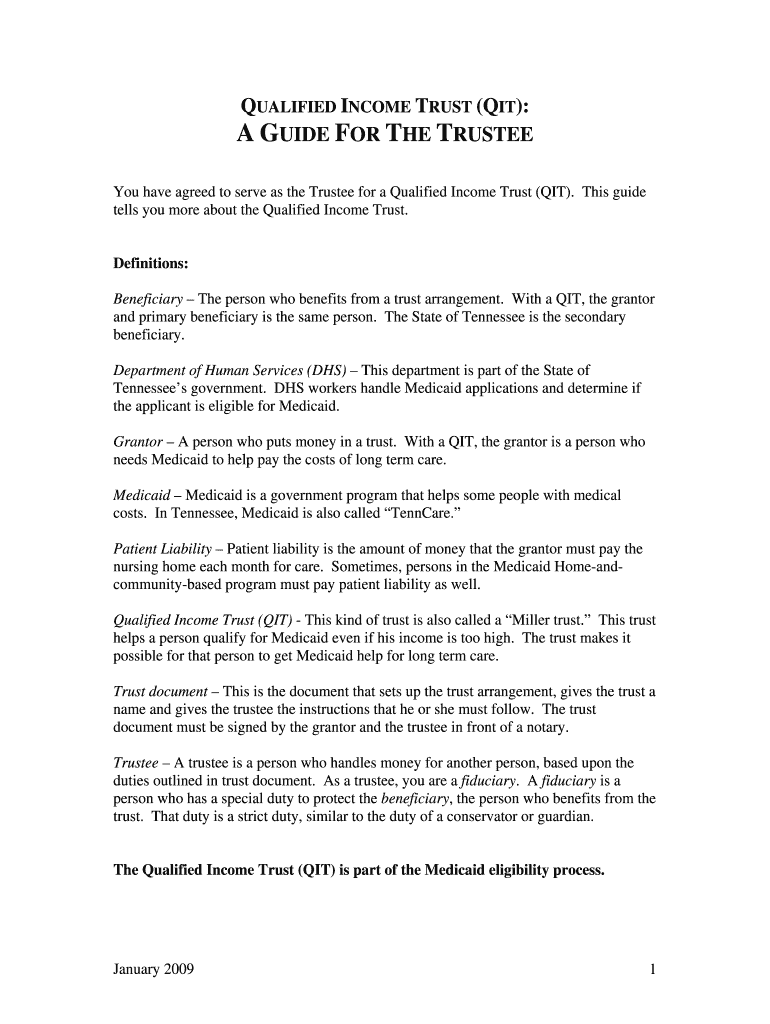

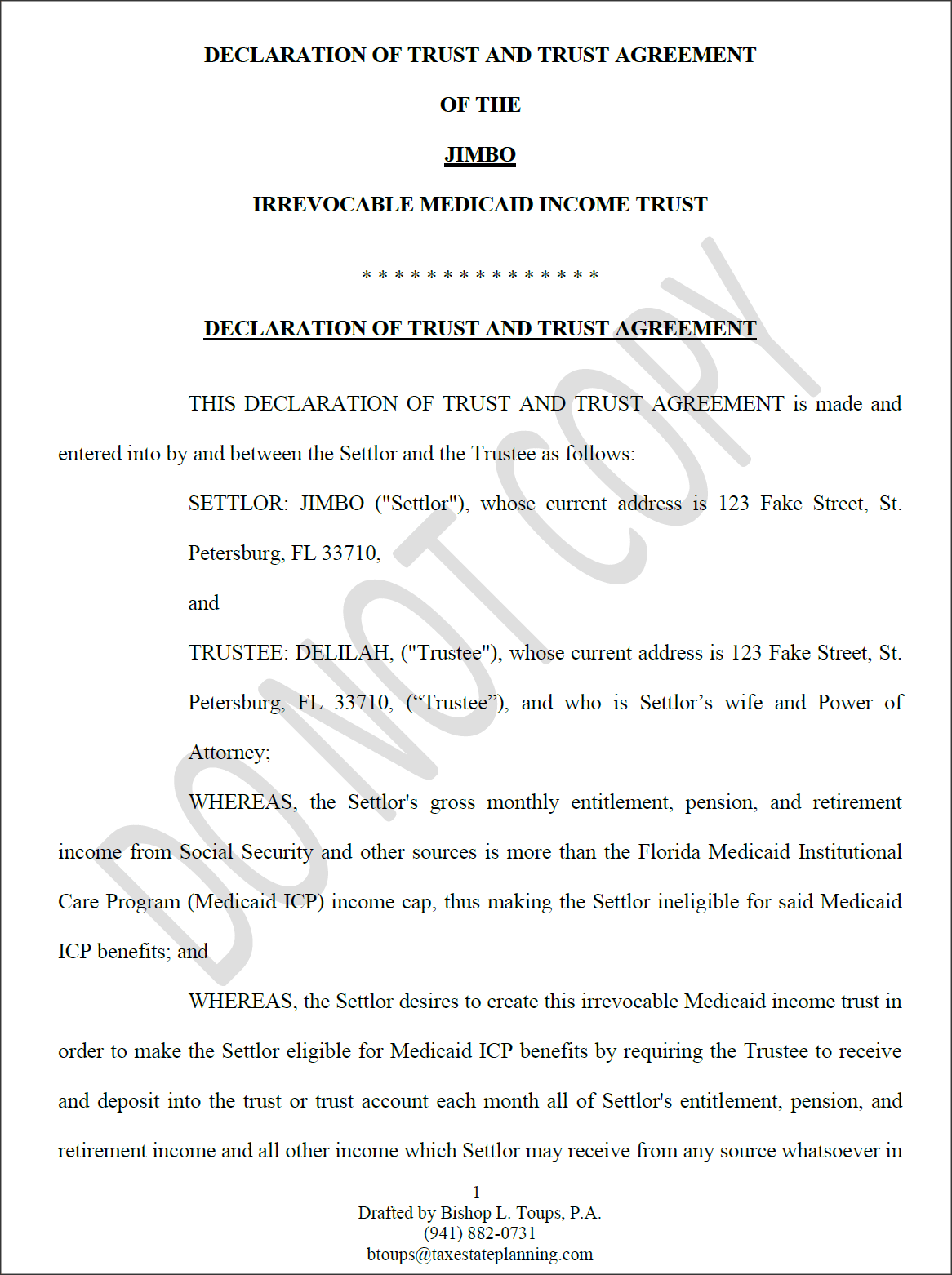

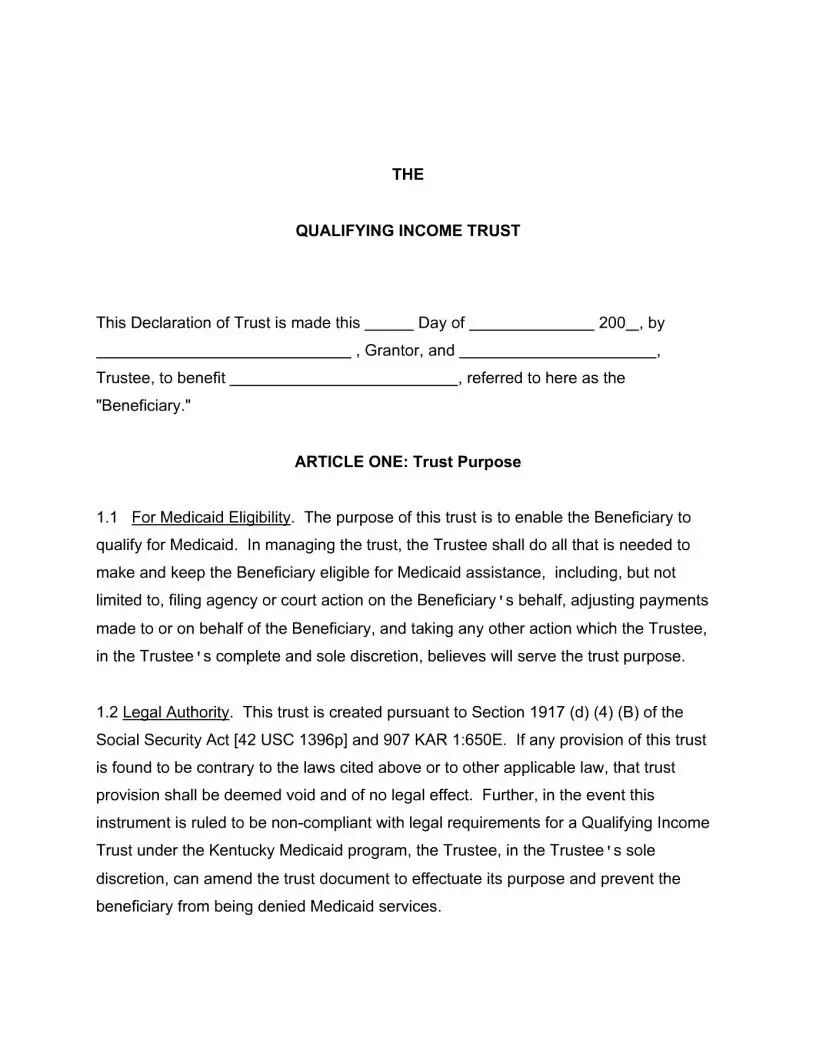

Qualified Income Trust Template - The qualified income trust (qit) deals only with income. The purpose of this trust is to assure eligibility of the primary beneficiary for medical assistance program benefits. Overview of qualified income trusts : A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. If you have income that exceeds the. The trust shall be known as the qualified income trust. first: But even if your monthly income is over that. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. The purpose of this trust is to assure eligibility of the primary beneficiary for medical assistance program benefits. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. The proper use of a qit allows a person to legally divert income into a trust, after which the income is not counted to determine medicaid eligibility for institutional or home and. Not everyone will benefit from a qualified. A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. If you have income that exceeds the. The trust makes it possible for that. Qualified income trust, certification of trust form. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. But even if your monthly income is over that. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. If you have income. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. The purpose of this trust is to assure eligibility of the primary beneficiary for medical assistance program benefits. Qualified income trust, certification of trust form. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant. The property to be placed in the trust is the income received by the primary. The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. If you have income that exceeds the. The qualified income trust (qit) deals only with income. The trust makes it possible for that. A florida qualified income trust template helps manage income to meet medicaid eligibility for those whose income exceeds the limit and require long term care in a nursing facility or under. Basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and supports.. But even if your monthly income is over that. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. The trust makes it possible for that. If you have income that exceeds the. Qualified income trust, certification of trust form. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. A florida qualified income. A florida qualified income trust template helps manage income to meet medicaid eligibility for those whose income exceeds the limit and require long term care in a nursing facility or under. The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. A miller trust (also known as a qualified income trust) is. Not everyone will benefit from a qualified. Qualified income trust, certification of trust form. If you have income that exceeds the. A qualified income trust, sometimes called a “miller trust” or a “qit,” is a trust you can establish to qualify for medicaid or to maintain your income eligibility for medicaid. What medicaid applicants need to tell a bank when. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. A qualified income trust, or qit, is a trust that medicaid requires. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. The proper use of a qit allows a person to legally divert income into a trust, after which the income is not counted to determine medicaid eligibility for institutional or home and. Qualified income trust, certification of trust form. A miller. Qualified income trust, certification of trust form. The proper use of a qit allows a person to legally divert income into a trust, after which the income is not counted to determine medicaid eligibility for institutional or home and. Miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit to become. Basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and supports. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. The trust shall be known as the qualified income trust. first: This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. A florida qualified income trust template helps manage income to meet medicaid eligibility for those whose income exceeds the limit and require long term care in a nursing facility or under. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. A qualified income trust, sometimes called a “miller trust” or a “qit,” is a trust you can establish to qualify for medicaid or to maintain your income eligibility for medicaid. Qit frequently asked questions (faqs) qualified income trust template : The property to be placed in the trust is the income received by the primary. If you have income that exceeds the. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. The qualified income trust (qit) deals only with income.Qualified Trust ppt download

Qualified Trusts (aka Miller Trusts) EZ Elder Law

Qit Approved Qualified Trust Form Fill Online, Printable

Tennessee Qualified Trust Form Complete with ease airSlate

Fillable Online dads state tx Qualified Trust QIT CoPayment

Fillable Online owsfk Qualified Trust Form. Qualified

Fillable Online afgst viewdns Qualified Trust Form. qualified

Qualified Trust Osterhout & McKinney, PA

QIT What is a Florida Medicaid Qualified Trust?

Form Trust Qualified ≡ Fill Out Printable PDF Forms Online

Not Everyone Will Benefit From A Qualified.

Overview Of Qualified Income Trusts :

But Even If Your Monthly Income Is Over That.

The Purpose Of This Trust Is To Enable The Settlor, (Also Referred To Herein As The Beneficiary), To.

Related Post: