Printable Free 609 Credit Dispute Letter Templates

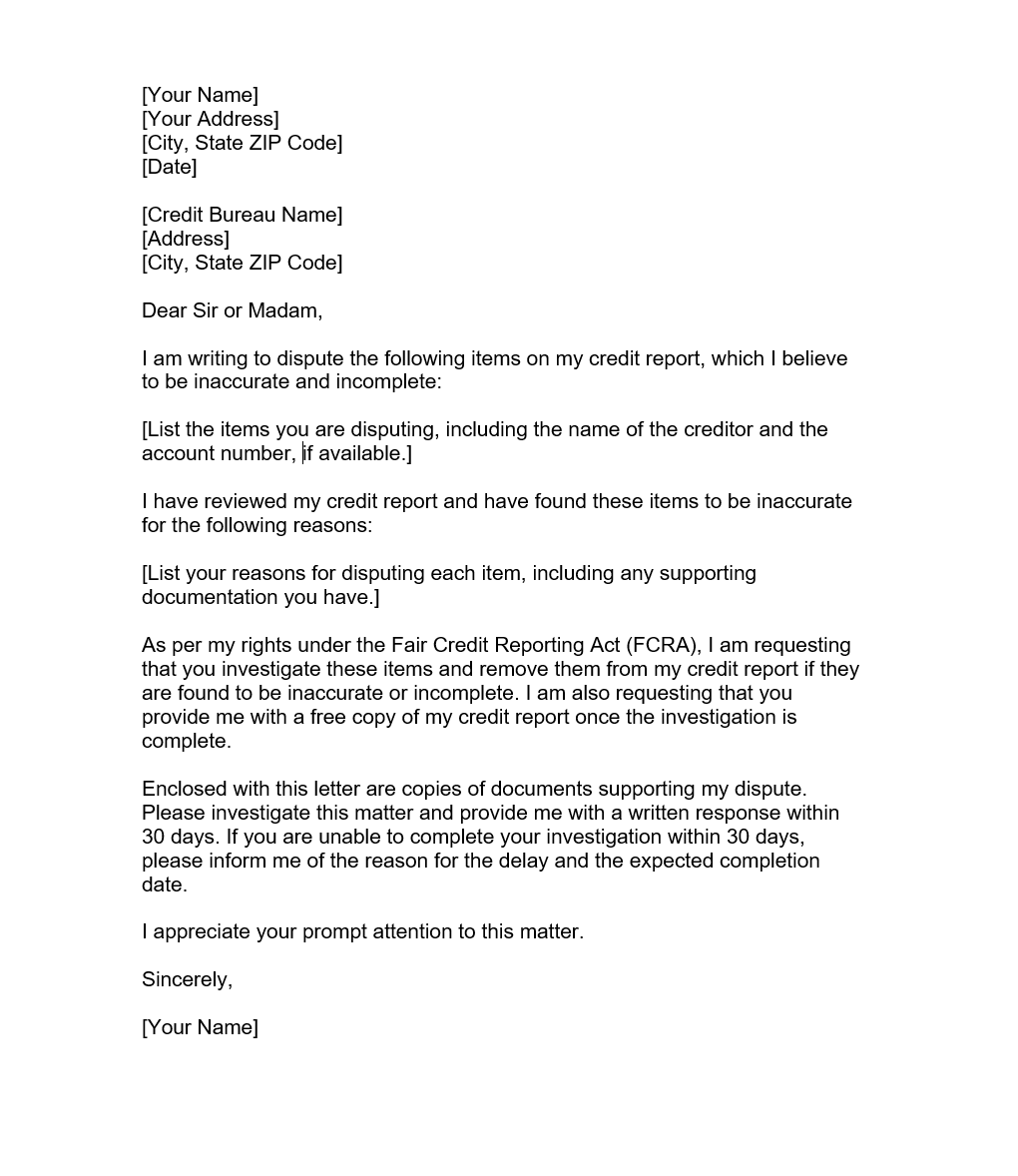

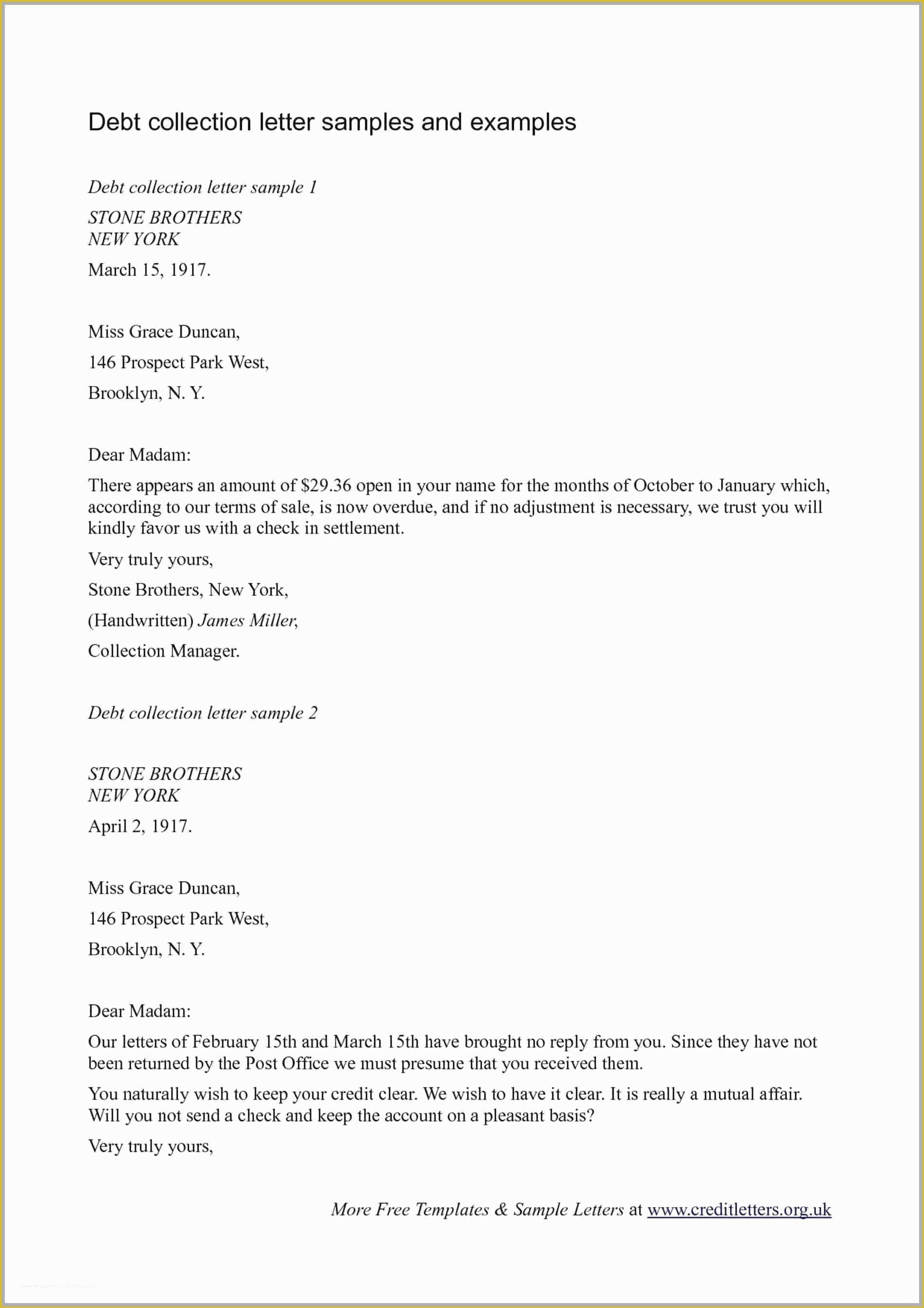

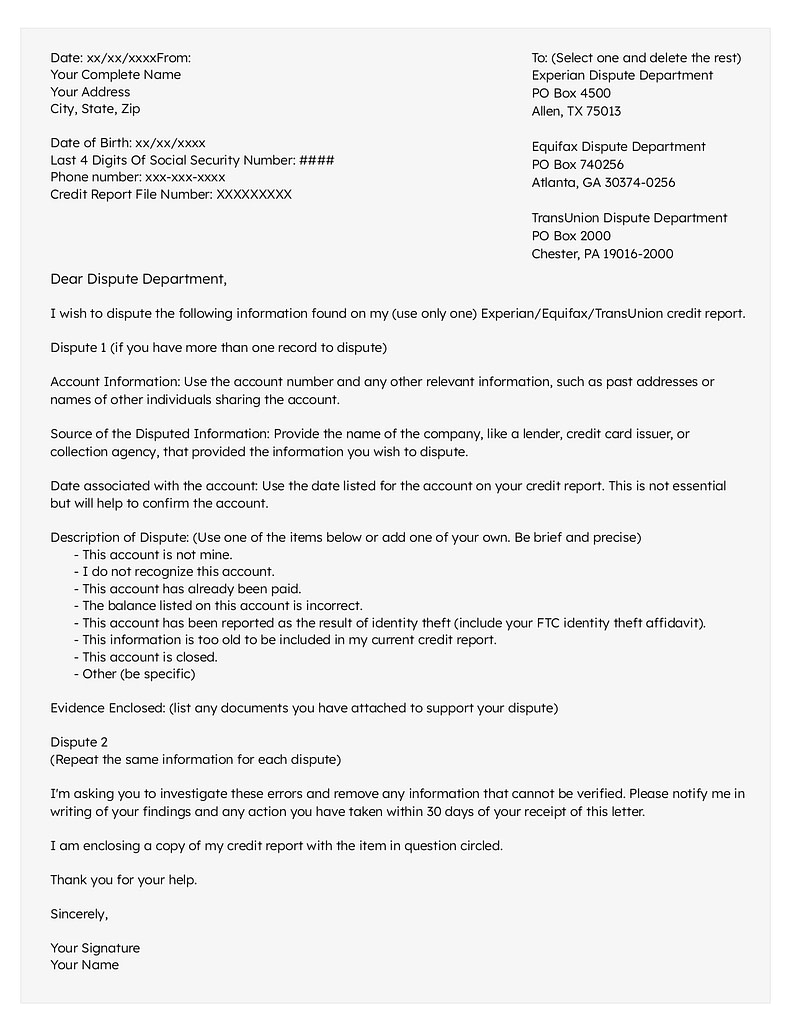

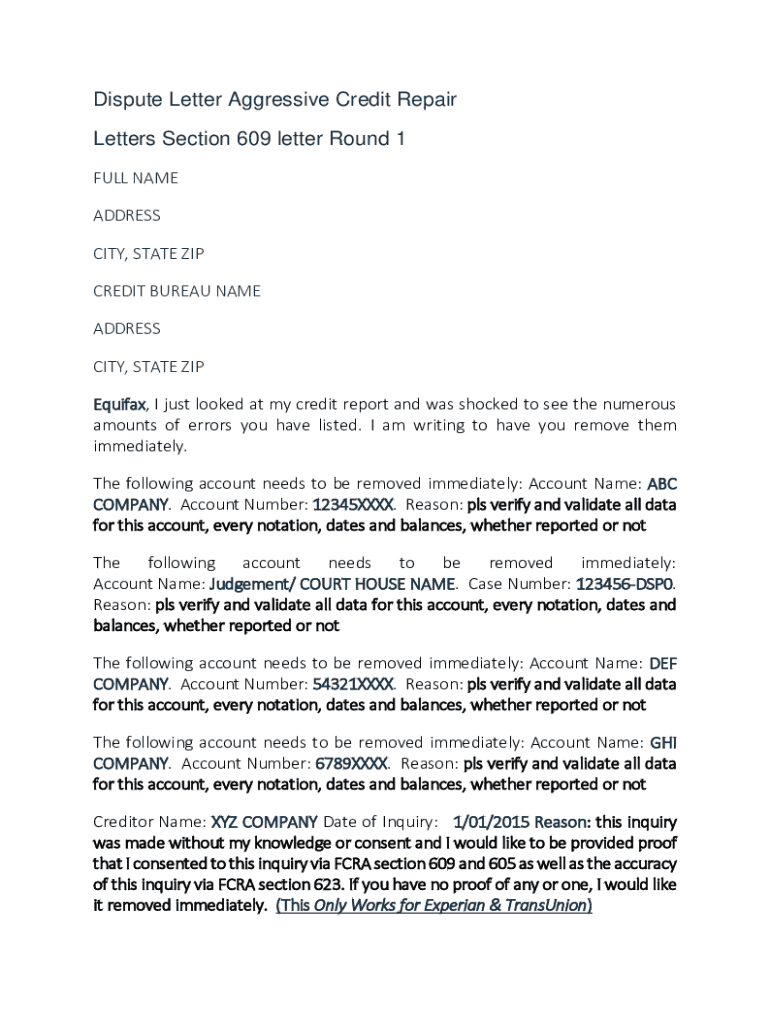

Printable Free 609 Credit Dispute Letter Templates - By law, the credit bureau must give a response within 30 days upon receiving notice. Fortunately, you can challenge inaccurate items with a 609 dispute letter. Section 609 outlines your right to receive copies of your credit report and any information appearing on it. By writing a 609 dispute letter template, you can have this fixed. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. We’ve tested over 15 dispute letters. Moreover, section 609 of the fair credit reporting act. This guide explains the process and includes a free template to help you get started! Per section 609, i am entitled to see the source of the information, which is the original contract that contains my signature. A credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Moreover, section 609 of the fair credit reporting act. Use our credit report dispute letter template to contest inaccurate items on your credit report. A “609 dispute letter” is often used to dispute inaccuracies on your credit report under the u.s. Below is a sample template for a 609 dispute letter. We’ve tested over 15 dispute letters. However, they do not always promise that your dispute will be successful. If you’ve identified inaccurate credit information, or if you want to know more about your current credit info, you need to know how to draft and send a 609 dispute letter. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. These templates provide you with a framework to draft a formal dispute letter that adheres to the legal requirements of the fair credit reporting act. Sending a 609 dispute letter may help you remove errors from your credit report. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. Fortunately, you can challenge inaccurate items with a 609 dispute letter. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with. A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific accounts or tradelines that you are disputing.. I wish to dispute the following information found on my (use only one) experian/equifax/transunion credit report. Download a printable credit dispute letter via the link below. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. Learn how. The ultimate guide to repair your credit score. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. Below is. Sending a 609 dispute letter may help you remove errors from your credit report. A credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed, or if the debt is more than seven years old. Writing this letter is an effective way of requesting that the negative information. Per section 609, i am entitled to see the source of the information, which is the original contract that contains my signature. Below is a sample template for a 609 dispute letter. Download a printable credit dispute letter via the link below. Moreover, section 609 of the fair credit reporting act. Dispute 1 (if you have more than one record. Writing this letter is an effective way of requesting that the negative information even if it’s accurate gets removed from your credit report. Dispute 1 (if you have more than one record to dispute) account information: A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. Get your free 609 dispute letter that works! The ultimate guide to repair your credit score. Writing this letter is an effective way of requesting that the negative information even if it’s accurate. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. How to. Get your free 609 dispute letter that works! Use our credit report dispute letter template to contest inaccurate items on your credit report. A credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Let’s take a closer look at what a 609 dispute letter is, how it works, and why you may. However, they do not always promise that your dispute will be successful. This guide explains the process and includes a free template to help you get started! We’ve tested over 15 dispute letters. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. Let’s take a closer look at what a 609 dispute letter is, how it works, and why you may need to write one. By law, the credit bureau must give a response within 30 days upon receiving notice. Use our credit report dispute letter template to contest inaccurate items on your credit report. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. These templates provide you with a framework to draft a formal dispute letter that adheres to the legal requirements of the fair credit reporting act. The ultimate guide to repair your credit score. If you’ve identified inaccurate credit information, or if you want to know more about your current credit info, you need to know how to draft and send a 609 dispute letter. Moreover, section 609 of the fair credit reporting act. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t meet the requirements for. These templates offer a convenient and organized way to communicate with credit bureaus and creditors to request the correction or removal of disputed items. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. You'll find countless 609 letter templates online;Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free 609 Credit Dispute Letter Templates Of Free Section 609 Credit

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Printable 609 Letter Template Fillable Form 2023

Pdf Printable Free 609 Credit Dispute Letter Templates

Free 609 Credit Dispute Letter Templates Pdf Printable Templates

Pdf Printable Free 609 Credit Dispute Letter Templates

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

609 Credit Dispute Letter Forms Docs 2023

Fair Credit Reporting Act (Fcra), Specifically Section 609.

How To Understand What Your Credit Report Says About You And What You Can Do About It!

Download Our Winning 609 Dispute Letter, Plus Free Tips To Help You Boost Your Credit.

You Can Download Each Company’s Dispute Form Or Use The Letter Included In This Guide, Which Provides The Credit Reporting Company With Enough Information To Identify You And The Specific Accounts Or Tradelines That You Are Disputing.

Related Post:

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-disputing-credit-report.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/609-credit-dispute-letter.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-10.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)