Pay Off Credit Card Excel Template

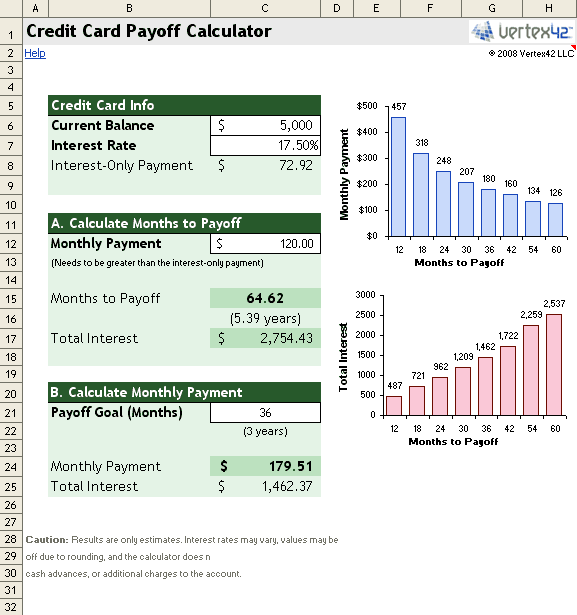

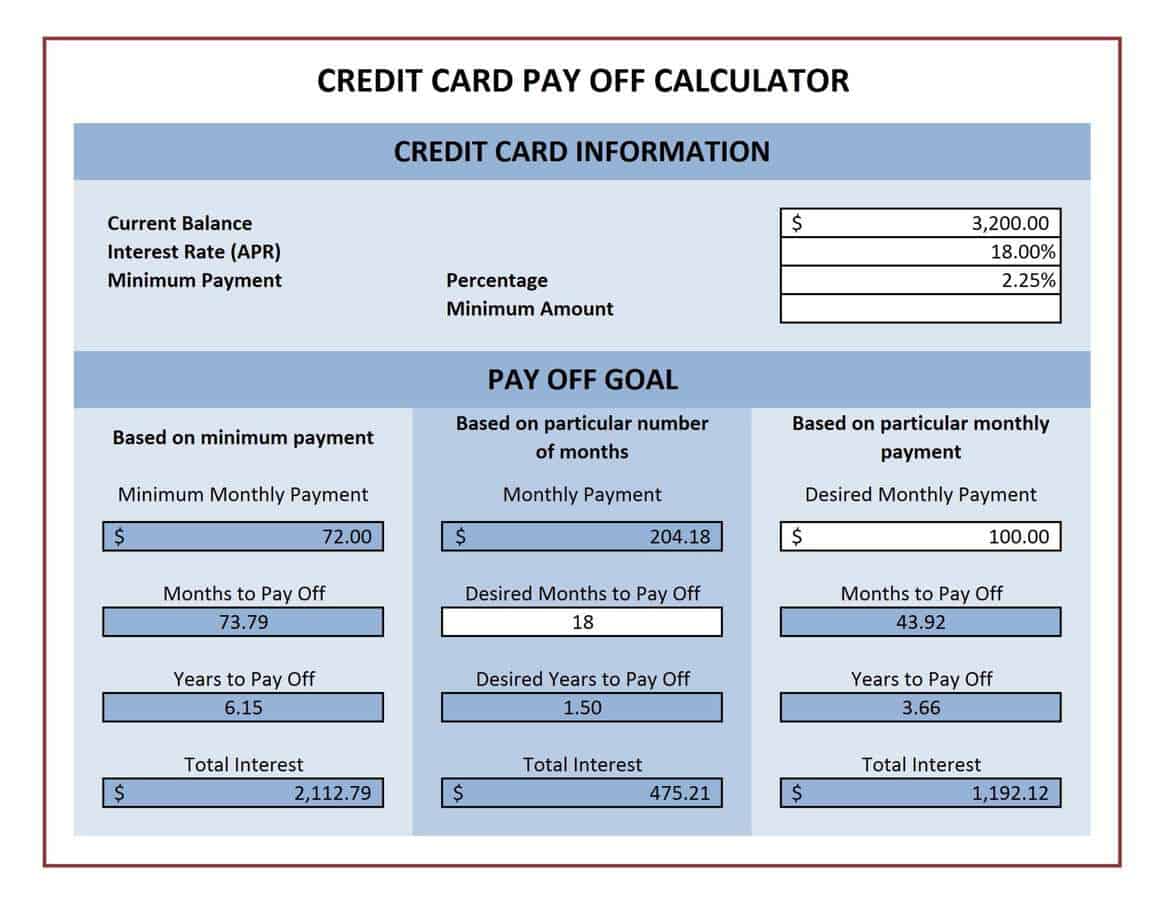

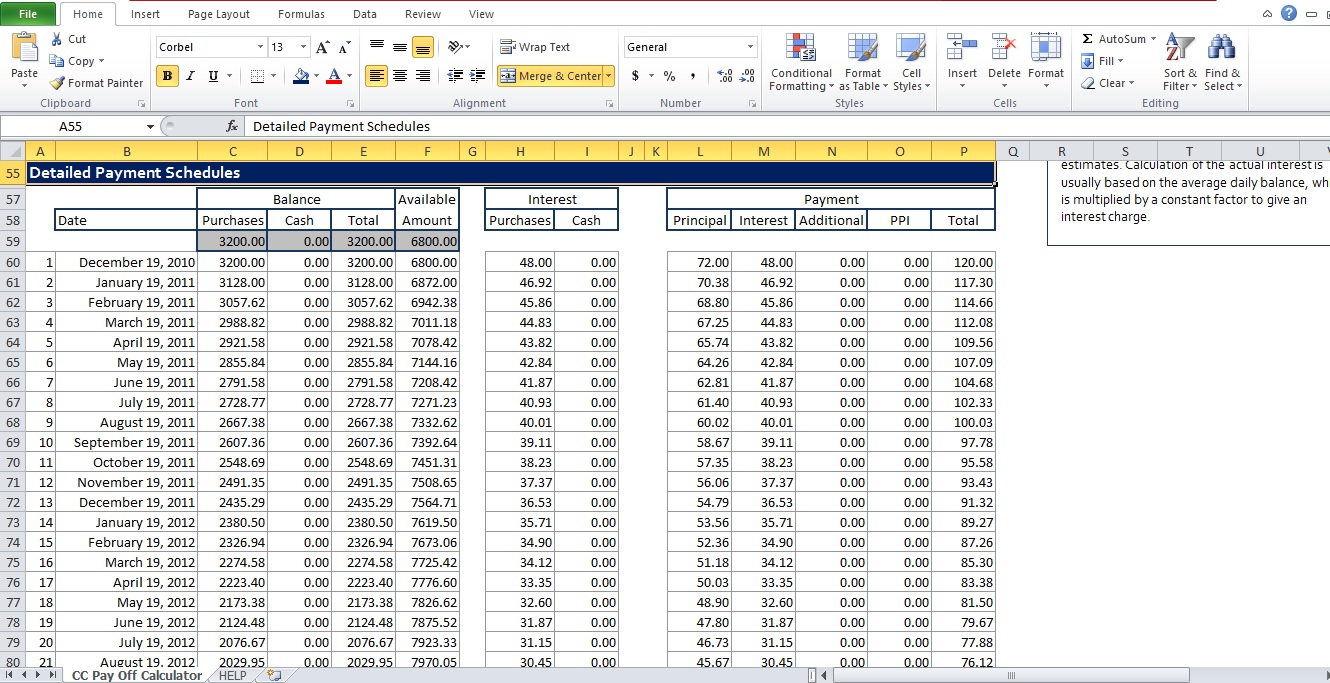

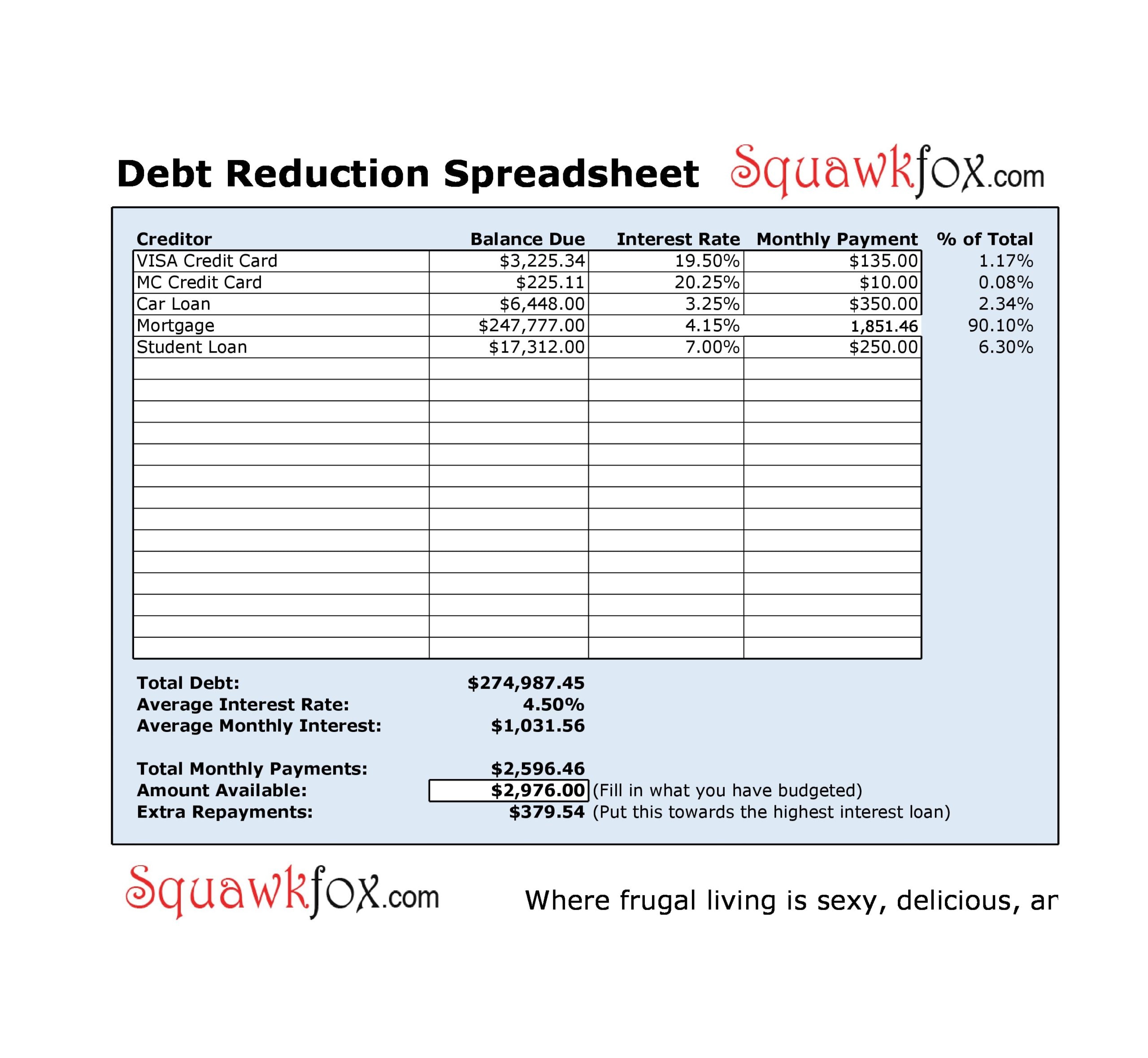

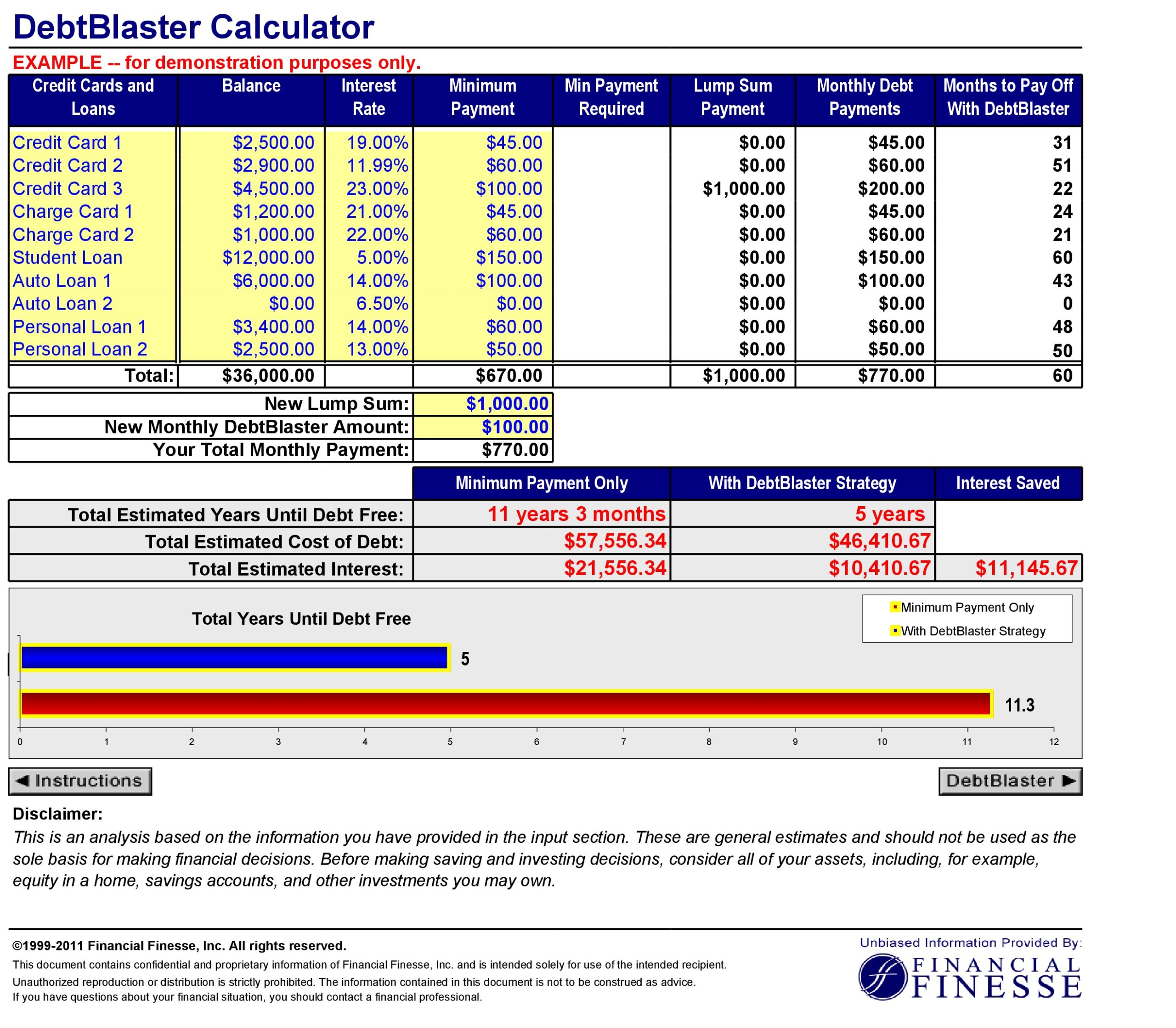

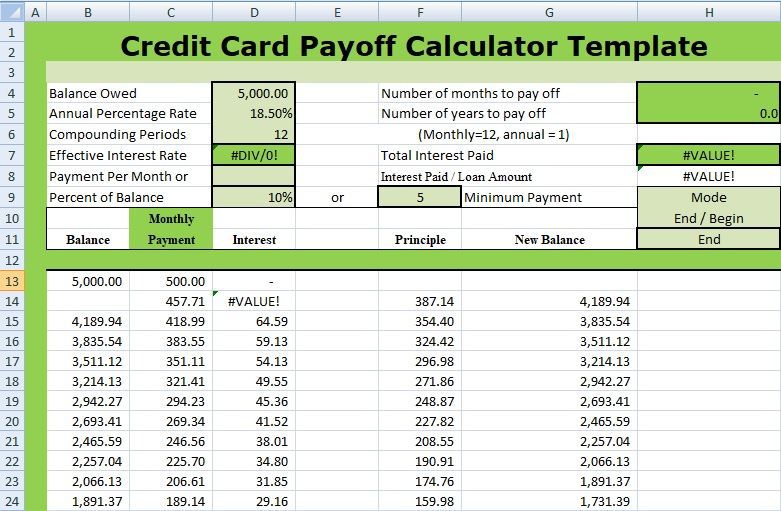

Pay Off Credit Card Excel Template - If you have the average credit card balance ($6,380, according to transunion) and you only make minimum payments at the. Create a table named credit card information. This excel template helps you keep track of your credit card payments. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. This excel template helps you easily track your credit card payments and balances. This excel template makes it easy to calculate how long it will take to pay off your credit cards. It provides a simple way to calculate and compare the cost of different payment plans. Life happens, and sometimes your payment amount might change—perhaps you. Track your credit card balances, payments, and interest charges. Download this credit card payoff calculator template you can use to follow along or input your values. Credit card payoff calculator template (excel, pdf), open office that will calculate the payment which is required to pay off your all credit card debt in the specified. It provides a simple way to calculate and compare the cost of different payment plans. This excel template helps you pay off your credit card debt faster. Life happens, and sometimes your payment amount might change—perhaps you. Easily track your payments, balance, and interest rate. If you have the average credit card balance ($6,380, according to transunion) and you only make minimum payments at the. This excel template makes it easy to calculate how long it will take to pay off your credit cards. This excel template helps you easily track your credit card payments and balances. Create a table named credit card information. Consider this minimum payment scenario: It provides a simple way to calculate and compare the cost of different payment plans. Get out of debt sooner and save money. Download this credit card payoff calculator template you can use to follow along or input your values. Consider this minimum payment scenario: Use our credit card payoff calculator to estimate your payoff timeline, monthly payments, and total. Download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate how long it. In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. This excel template helps you pay off your. Easily track your payments, balance, and interest rate. Life happens, and sometimes your payment amount might change—perhaps you. A pay off credit card excel template is a financial planning tool that helps track and manage credit card debt repayment. Download a free credit card payoff calculator for microsoft excel or google sheets that will calculate the payment required to pay. This excel template helps you keep track of your credit card payments. Credit card payoff calculator template (excel, pdf), open office that will calculate the payment which is required to pay off your all credit card debt in the specified. A pay off credit card excel template is a financial planning tool that helps track and manage credit card debt. Easily track your payments, balance, and interest rate. Consider this minimum payment scenario: Use our credit card payoff calculator to estimate your payoff timeline, monthly payments, and total interest, helping you plan a path to eliminate credit card debt efficiently. Get out of debt sooner and save money. In this article, we will demonstrate how to create a credit card. Get out of debt sooner and save money. This excel template helps you keep track of your credit card payments. This spreadsheet calculates payment schedules, interest charges,. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Create a table named credit card information. This excel template helps you keep track of your credit card payments. This excel template helps you easily track your credit card payments and balances. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. Life happens, and sometimes your payment amount might change—perhaps you. This spreadsheet calculates payment schedules, interest charges,. When a borrower has more than one debt and repays them. A pay off credit card excel template is a financial planning tool that helps track and manage credit card debt repayment. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Create a table named credit card information. Download this. Plus, it gives you a snapshot of how your efforts are paying off. Track your monthly payments, interest rate, and total balance. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. This excel template helps you easily track your credit card payments and balances. Download a free credit card payoff calculator for microsoft excel or. Get out of debt sooner and save money. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. This spreadsheet calculates payment schedules, interest charges,. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Use our credit card payoff calculator to estimate your payoff timeline, monthly. This excel template helps you easily track your credit card payments and balances. Track your monthly payments, interest rate, and total balance. Credit card payoff calculator template (excel, pdf), open office that will calculate the payment which is required to pay off your all credit card debt in the specified. Plus, it gives you a snapshot of how your efforts are paying off. This excel template helps you keep track of your credit card payments. When a borrower has more than one debt and repays them. This excel template helps you pay off your credit card debt faster. A pay off credit card excel template is a financial planning tool that helps track and manage credit card debt repayment. In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. Track your credit card balances, payments, and interest charges. Download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate how long it. Create a table named credit card information. Easily track your payments, balance, and interest rate. Use our credit card payoff calculator to estimate your payoff timeline, monthly payments, and total interest, helping you plan a path to eliminate credit card debt efficiently. It provides a simple way to calculate and compare the cost of different payment plans.3 Free Credit Card Payoff Spreadsheet Templates Word Excel Templates

4+ Credit Card Payoff Spreadsheets Word Excel Templates

Credit Card Debt Payoff Tracker Template in Excel, Google Sheets

Excel Credit Card Payoff Calculator and Timeline Easy Financial Tracker

Credit Card Payoff Calculator Excel Template Excel TMP

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

How to Create a Credit Card Payoff Spreadsheet in Excel (2 Ways)

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Credit Card Debt Payoff Spreadsheet Excel Templates

This Spreadsheet Calculates Payment Schedules, Interest Charges,.

This Excel Template Makes It Easy To Calculate How Long It Will Take To Pay Off Your Credit Cards.

If You Have The Average Credit Card Balance ($6,380, According To Transunion) And You Only Make Minimum Payments At The.

Life Happens, And Sometimes Your Payment Amount Might Change—Perhaps You.

Related Post: