Overdue Invoice Template

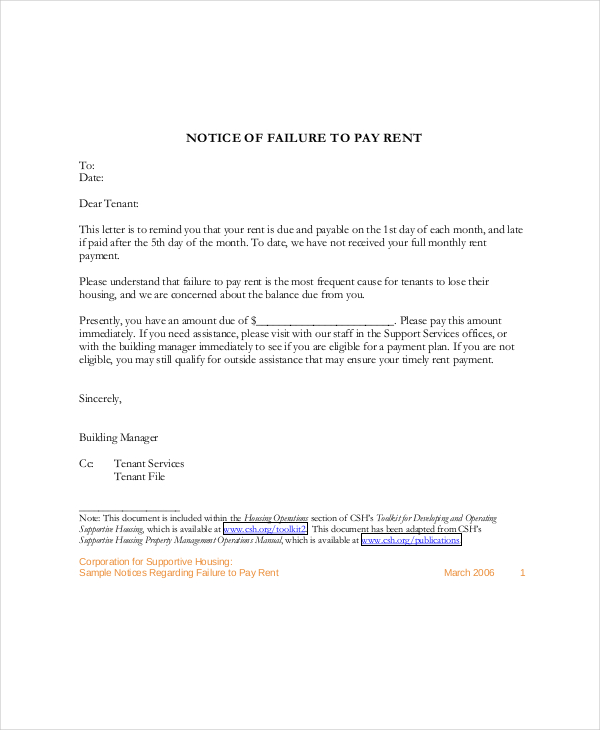

Overdue Invoice Template - If you have any queries about the invoice then please don't hesitate to get in touch. It is now well overdue and i am having trouble getting the money out of them. In the unlikely event that the invoice remains unpaid after 30 days from issue, this then becomes a delinquent account. At no stage before now has the customer disputed the invoice, i even have an email confirming that he'll sort it. I issued an invoice to a client back on 16th october with a 14 day request of payment. Hi, i have a client who has always been a slow payer. The client is based in the uk. They have recently sent out an email announcing there is no money in the company and they are intending to apply to have the company struck off at companies house. The invoice is now xxx days overdue. I'm not overly concerned about them going bust anytime soon but they are awkward about paying and inflict their 60 day eom terms on us, but. They have recently sent out an email announcing there is no money in the company and they are intending to apply to have the company struck off at companies house. If he doesn't pay this week then i intend to send him a 'notice of intended proceedings'. The client is based in the uk. It's surprising how many invoices you have to look twice at to get that basic info. It took til the 10th jan, after several emailed reminders for a cheque to arrive only for the cheque to be made out in the wrong name. I'm not overly concerned about them going bust anytime soon but they are awkward about paying and inflict their 60 day eom terms on us, but. The invoice is now two months overdue and i recently sent him a reminder in the post after weeks of emailing and calling him. If they don't then pay invoice b according to the agreed terms, you then start the credit control process running. The invoice is now xxx days overdue. It is now well overdue and i am having trouble getting the money out of them. I have a customer who owes me a fairly substantial amount (around £20k). They have recently sent out an email announcing there is no money in the company and they are intending to apply to have the company struck off at companies house. I'd appreciate it if you could make payment straight away and let me know when you have. They have recently sent out an email announcing there is no money in the company and they are intending to apply to have the company struck off at companies house. I issued an invoice to a client back on 16th october with a 14 day request of payment. Unless payment is made to the above address within 7 days legal. I'd appreciate it if you could make payment straight away and let me know when you have done so. I'm not overly concerned about them going bust anytime soon but they are awkward about paying and inflict their 60 day eom terms on us, but. It's surprising how many invoices you have to look twice at to get that basic. I have a customer who owes me a fairly substantial amount (around £20k). ( i also believe that this cheque was only sent because there was. At no stage before now has the customer disputed the invoice, i even have an email confirming that he'll sort it. From the pov of the recipient of the invoice, what they want to. You then issue invoice b with the current date for the correct amount. In the unlikely event that the invoice remains unpaid after 30 days from issue, this then becomes a delinquent account. Finding fault with an invoice and asking for a credit note / reinvoice is a common play for delaying payment. I issued an invoice to a client. It took til the 10th jan, after several emailed reminders for a cheque to arrive only for the cheque to be made out in the wrong name. If they don't then pay invoice b according to the agreed terms, you then start the credit control process running. I'd appreciate it if you could make payment straight away and let me. It is now well overdue and i am having trouble getting the money out of them. I have a customer who owes me a fairly substantial amount (around £20k). The invoice is now xxx days overdue. In the unlikely event that the invoice remains unpaid after 30 days from issue, this then becomes a delinquent account. If they don't then. Hi, i have a client who has always been a slow payer. I have a customer who owes me a fairly substantial amount (around £20k). ( i also believe that this cheque was only sent because there was. They have recently sent out an email announcing there is no money in the company and they are intending to apply to. I issued an invoice to a client back on 16th october with a 14 day request of payment. At no stage before now has the customer disputed the invoice, i even have an email confirming that he'll sort it. If he doesn't pay this week then i intend to send him a 'notice of intended proceedings'. Notice of non payment. I'd appreciate it if you could make payment straight away and let me know when you have done so. Notice of non payment of invoice(s) first reminder take notice that according to our records the sum of £_____ is overdue for payment for invoices xxx, yyy, and zzz. Hi, i have a client who has always been a slow payer.. I issued an invoice to a client back on 16th october with a 14 day request of payment. It is now well overdue and i am having trouble getting the money out of them. The client is based in the uk. You then issue invoice b with the current date for the correct amount. The invoice is now two months overdue and i recently sent him a reminder in the post after weeks of emailing and calling him. I'm not overly concerned about them going bust anytime soon but they are awkward about paying and inflict their 60 day eom terms on us, but. The invoice is now xxx days overdue. If they don't then pay invoice b according to the agreed terms, you then start the credit control process running. Unless payment is made to the above address within 7 days legal representation and/or legal proceedings to recover the debt, will be commenced against you without further. I have a customer who owes me a fairly substantial amount (around £20k). They have recently sent out an email announcing there is no money in the company and they are intending to apply to have the company struck off at companies house. It took til the 10th jan, after several emailed reminders for a cheque to arrive only for the cheque to be made out in the wrong name. If you have any queries about the invoice then please don't hesitate to get in touch. I'd appreciate it if you could make payment straight away and let me know when you have done so. Notice of non payment of invoice(s) first reminder take notice that according to our records the sum of £_____ is overdue for payment for invoices xxx, yyy, and zzz. A payment of [amountdue] is now overdue.Overdue Invoice Template Visme

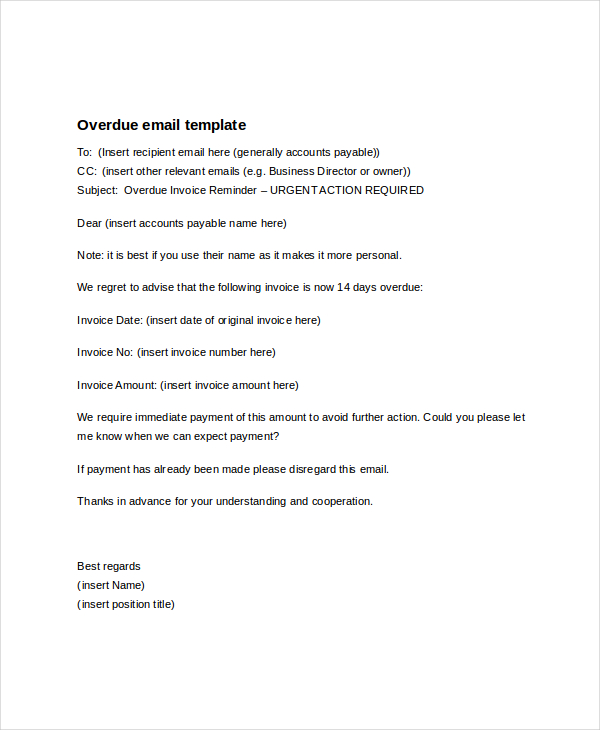

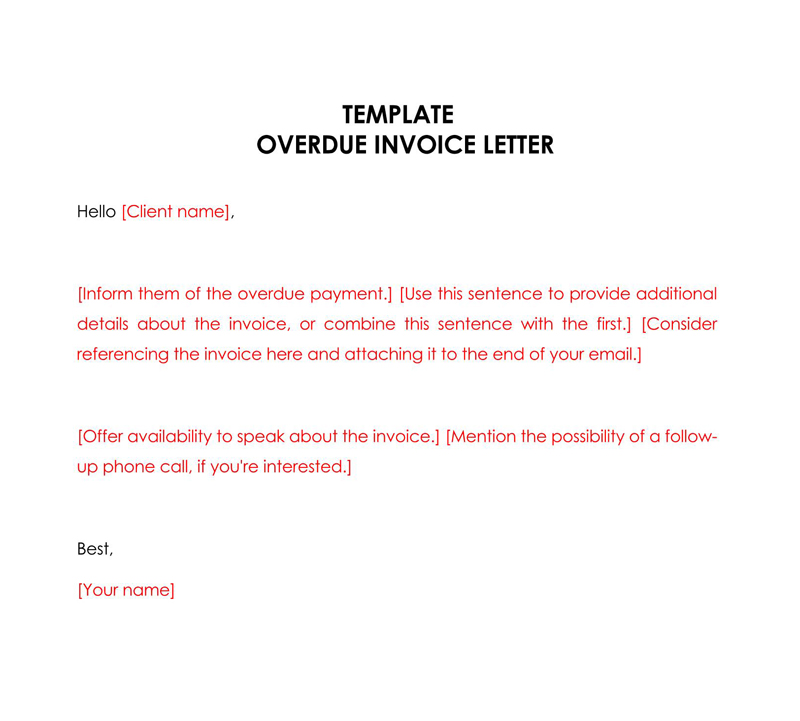

Overdue Invoice Letter 6+ Free Word, PDF Documents Download

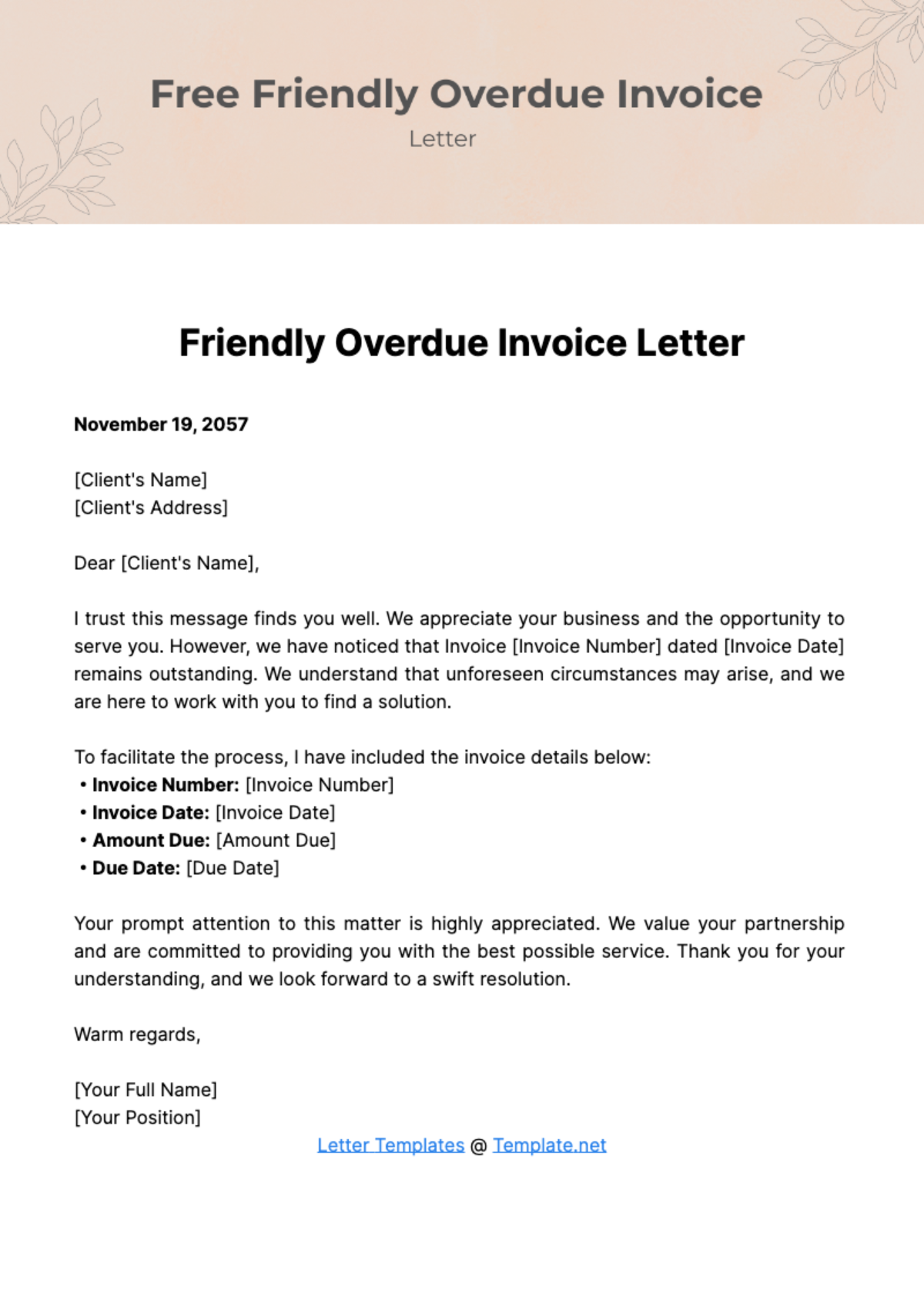

Free Friendly Overdue Invoice Letter Template Edit Online & Download

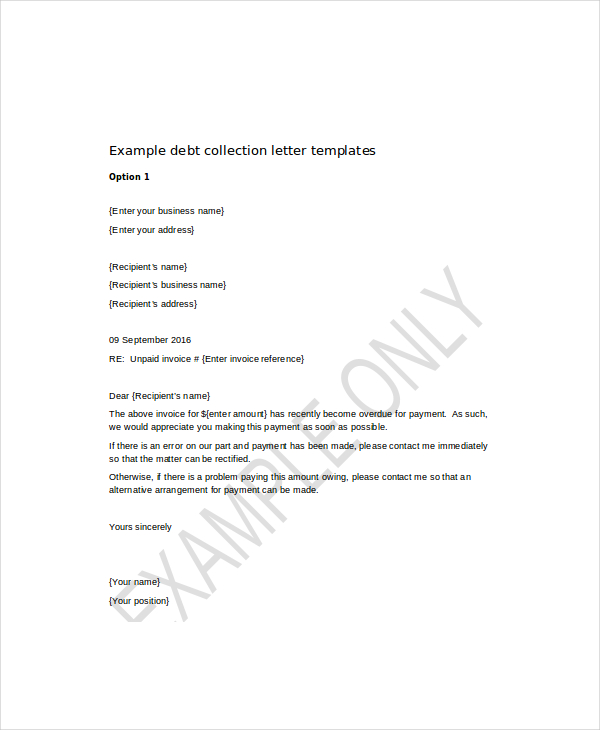

Overdue Invoice Letter 6+ Free Word, PDF Documents Download

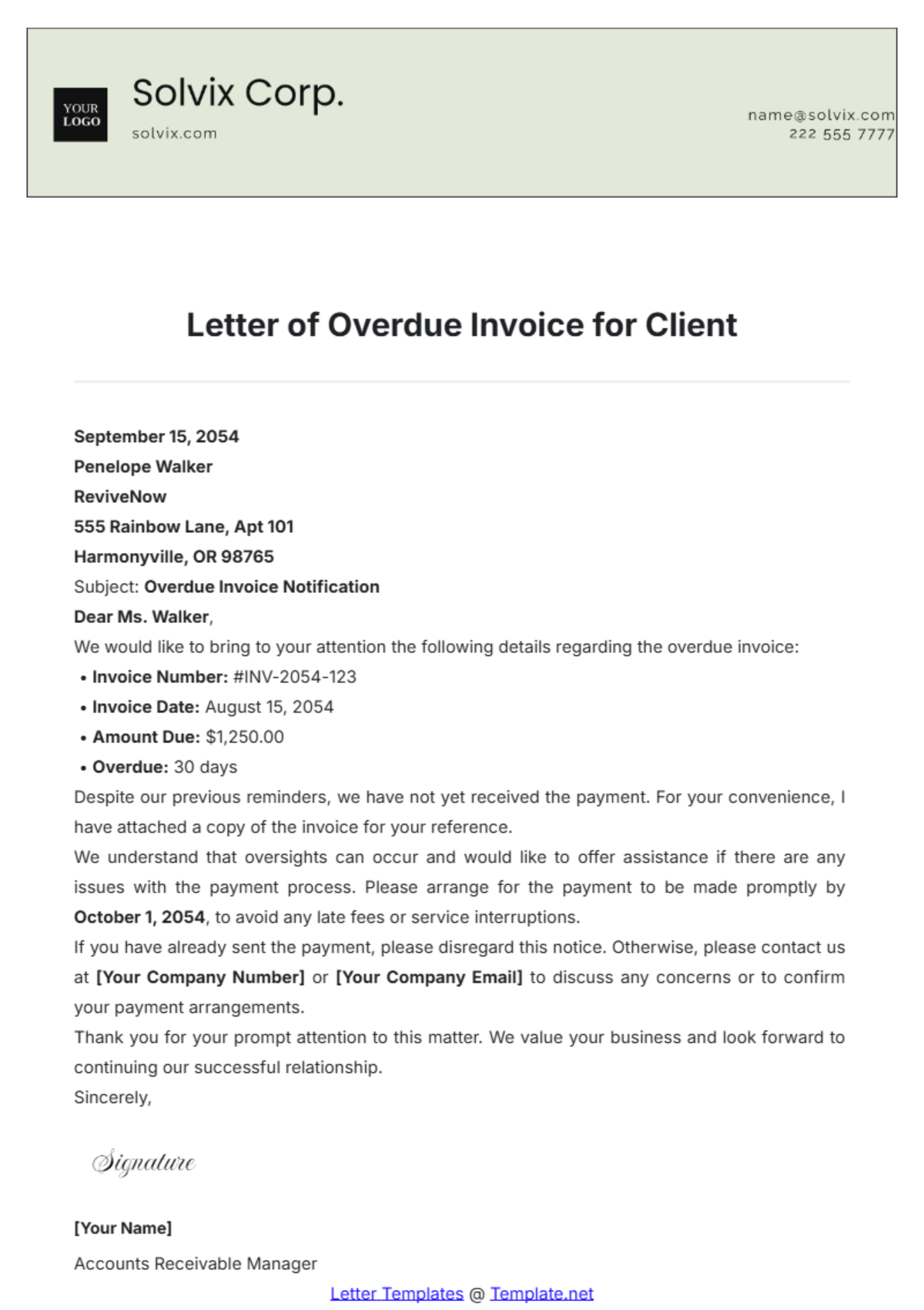

Free Letter of Overdue Invoice for Client Template Edit Online

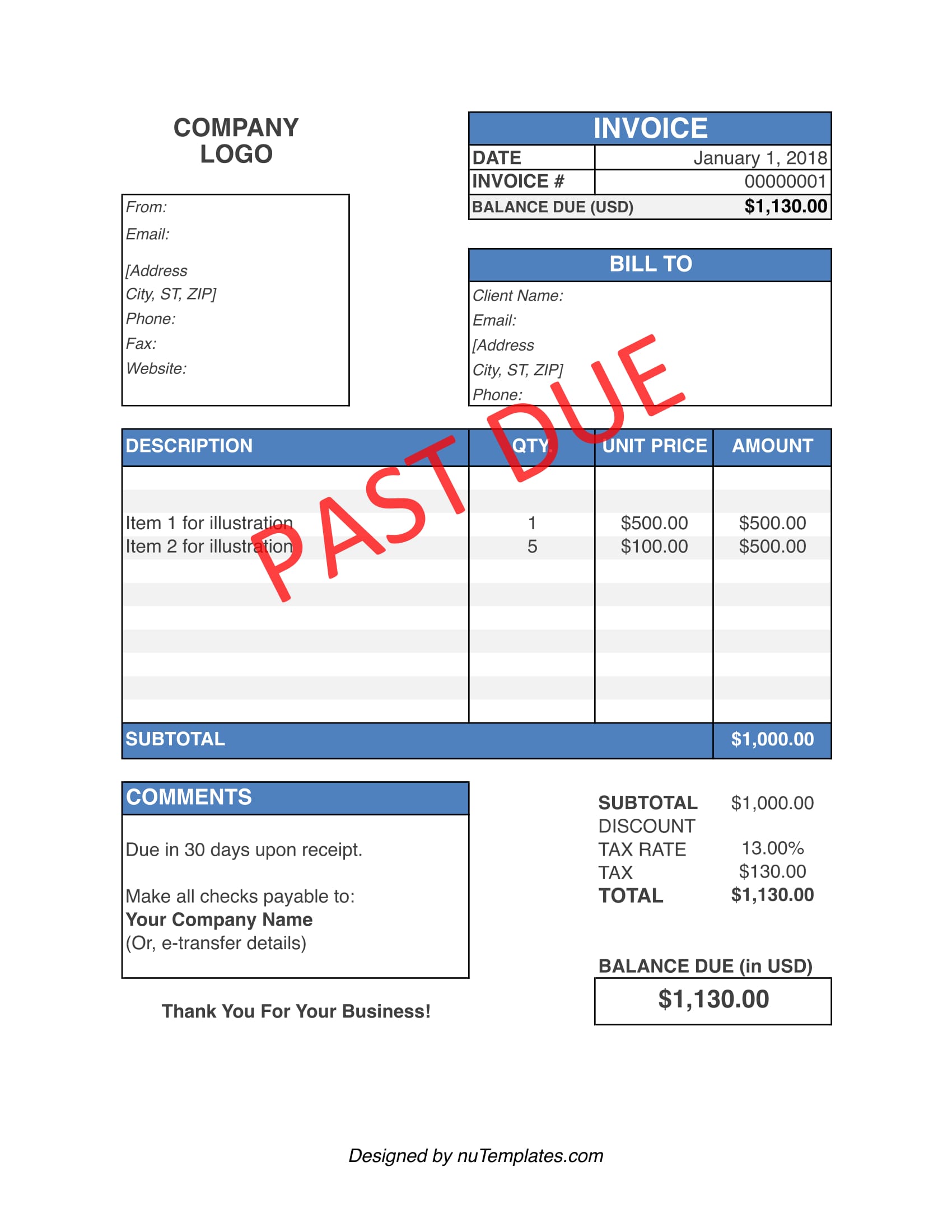

Past Due Invoice Template Overdue Invoices nuTemplates

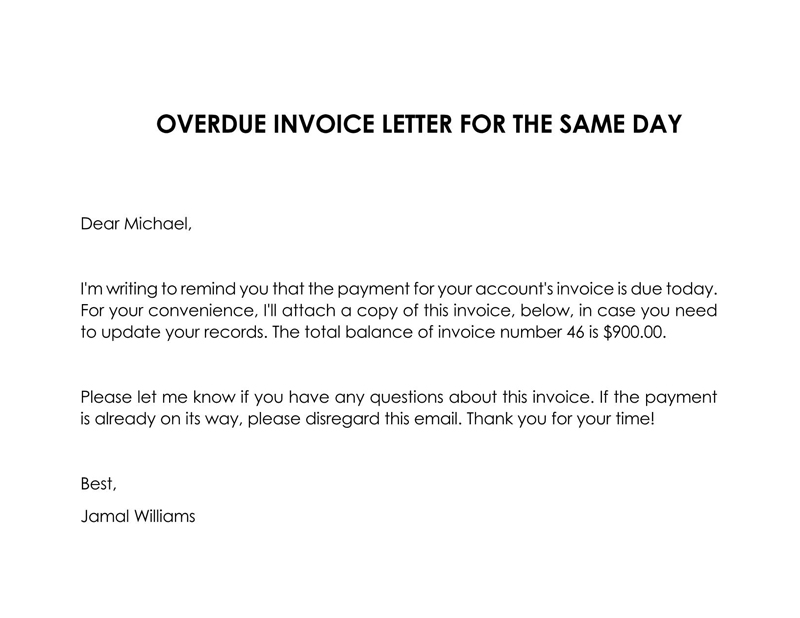

Payment Reminder Emails For Overdue Invoices Templates

Overdue Invoice Letter 6+ Free Word, PDF Documents Download

Payment Reminder Emails For Overdue Invoices Templates

Overdue Invoice Template Fill, Edit, Sign, Download & Print For Free

From The Pov Of The Recipient Of The Invoice, What They Want To See Quickly And Easily Is Name, Date, Ref Number, Description, Vat, Total, In Order To Enter Into Their System.

If He Doesn't Pay This Week Then I Intend To Send Him A 'Notice Of Intended Proceedings'.

Finding Fault With An Invoice And Asking For A Credit Note / Reinvoice Is A Common Play For Delaying Payment.

At No Stage Before Now Has The Customer Disputed The Invoice, I Even Have An Email Confirming That He'll Sort It.

Related Post: