Merger Model Template

Merger Model Template - What is a merger model? An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. Merger model tutorial (m&a) how to build a merger model; This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Merger model tutorial (m&a) how to build a merger model; In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. How to interpret accretion / (dilution) analysis? Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet,. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. How to interpret accretion / (dilution) analysis? In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and. How to interpret accretion / (dilution) analysis? The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock /. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. This model runs through different scenarios and synergies. Merger model tutorial (m&a) how to build a merger model; In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. Merger model tutorial (m&a) how to build a merger model; In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Mergers and acquisitions (m&a) are among the most. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Merger model tutorial (m&a) how to build a merger model; An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. Improve your m&a analysis. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. What is. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations.. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. The. Merger model tutorial (m&a) how to build a merger model; Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. This model runs through different scenarios and synergies. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. What is a merger model? This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company.Excel Template Mergers & Acquisitions (M&A) Financial Model (Excel

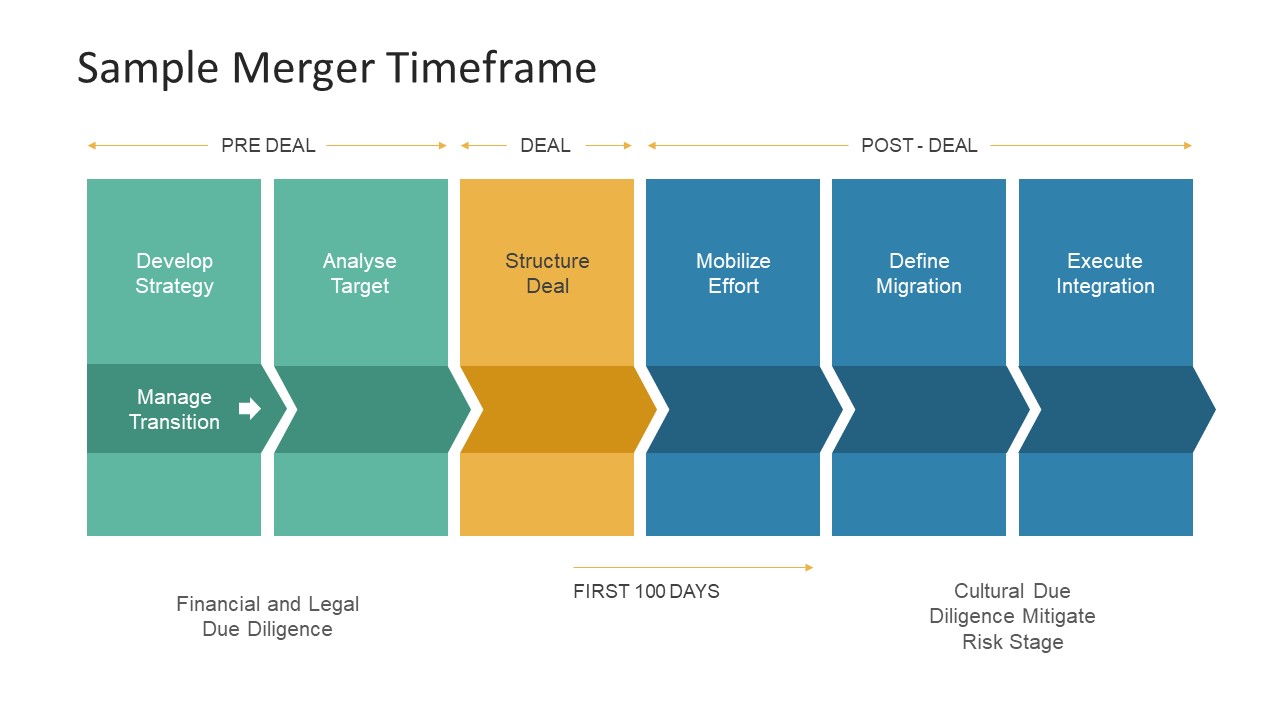

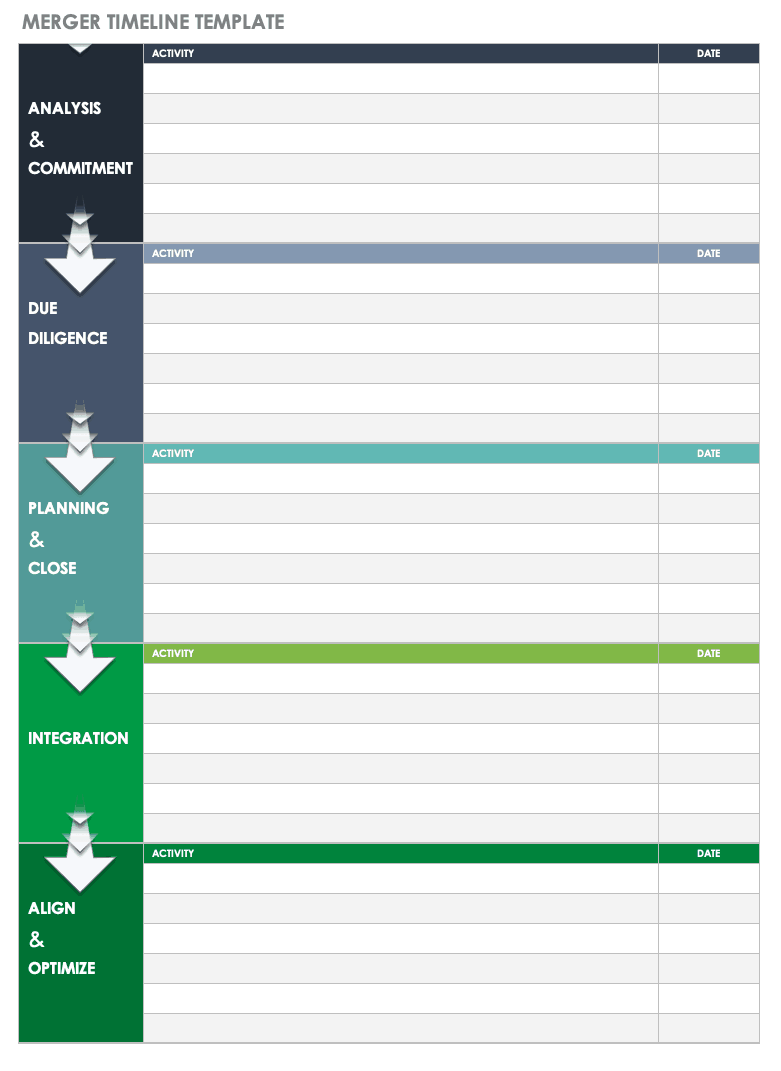

Download Free M&A Templates Smartsheet

M&A Model Excel at Josie Goodwin blog

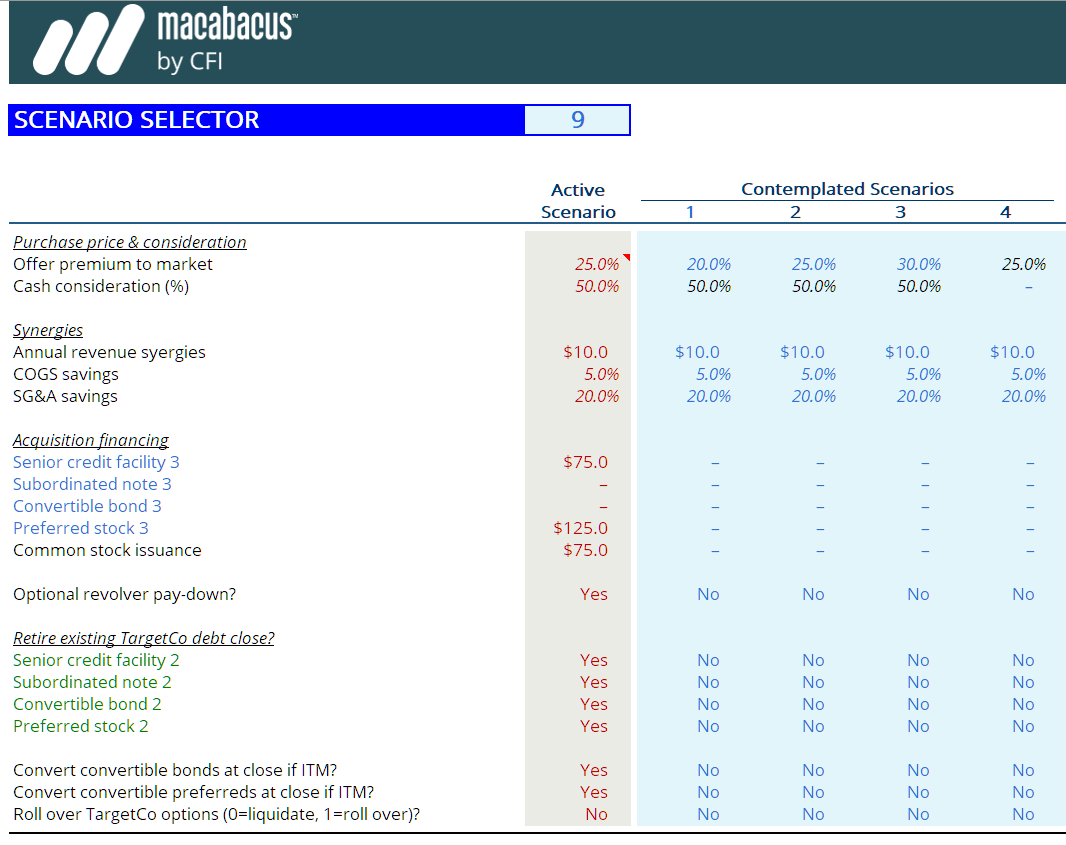

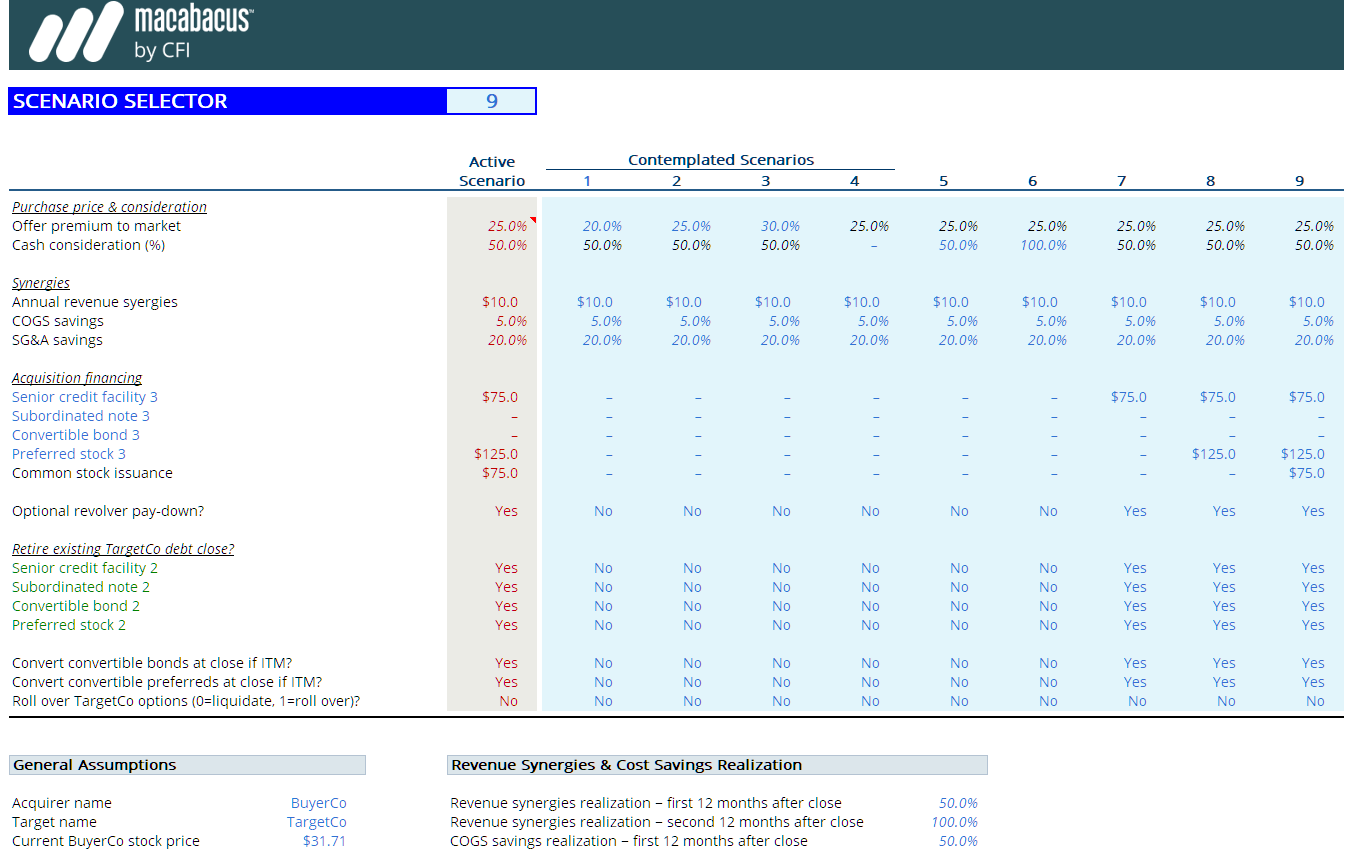

Merger Model (M&A) Free Excel Template Macabacus

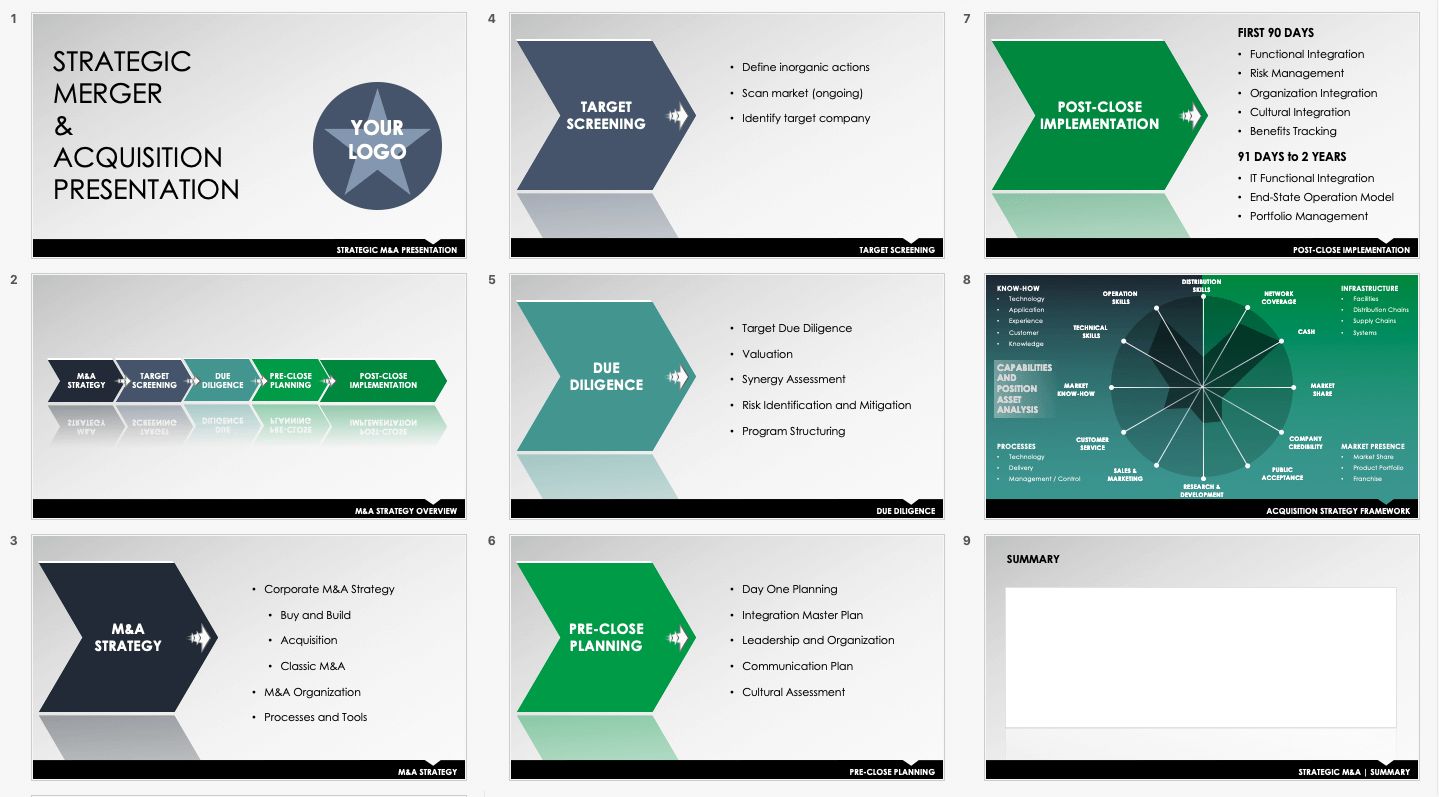

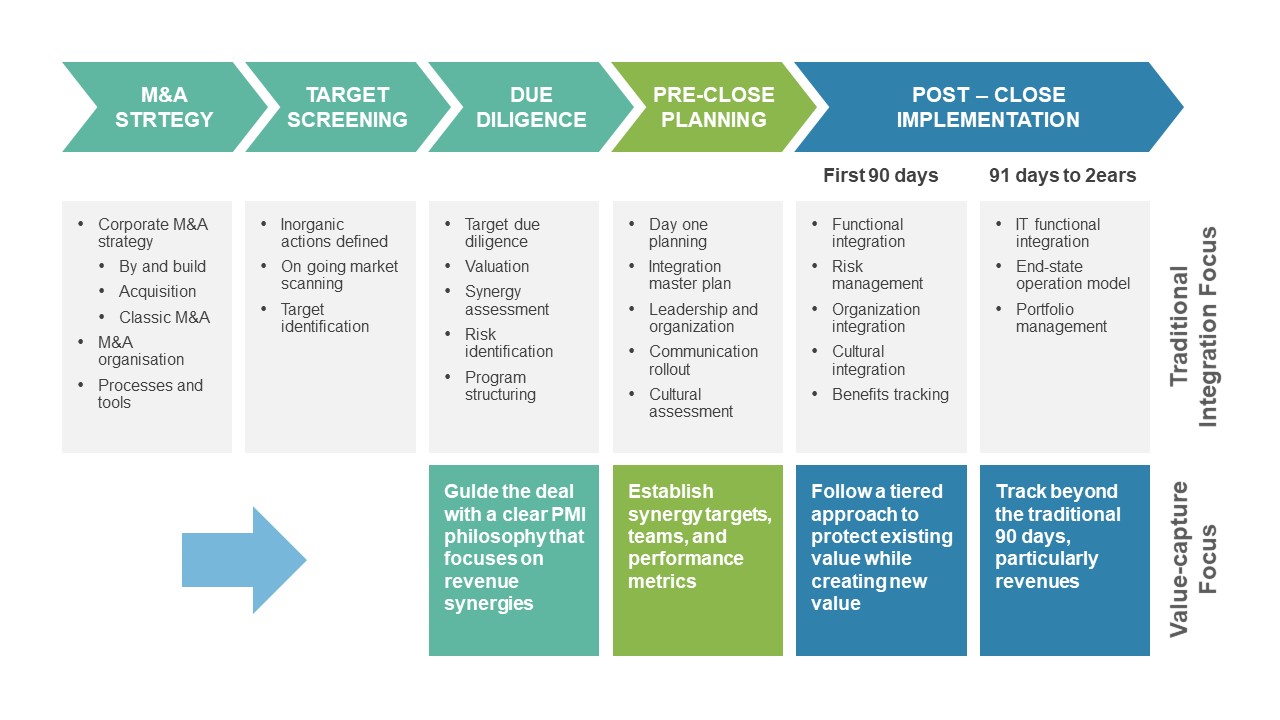

Mergers and Acquisitions PowerPoint Template SlideModel

Download Free M&A Templates Smartsheet

Mergers and Acquisitions PowerPoint Template SlideModel

Merger Model (M&A) Free Excel Template Macabacus

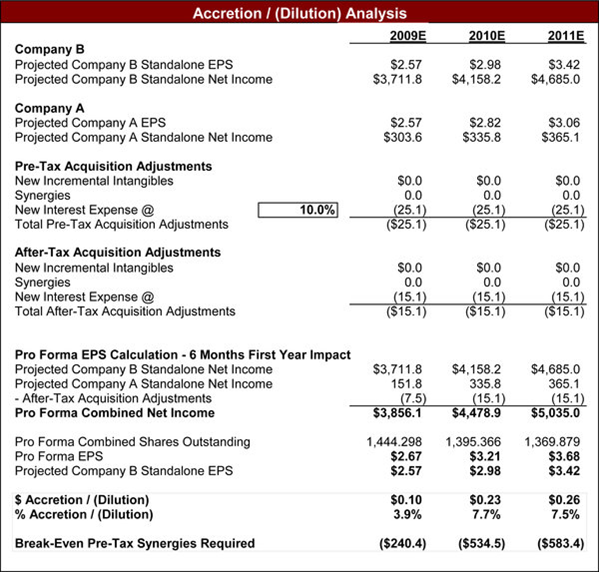

Merger Model M&A Acquisition Street Of Walls

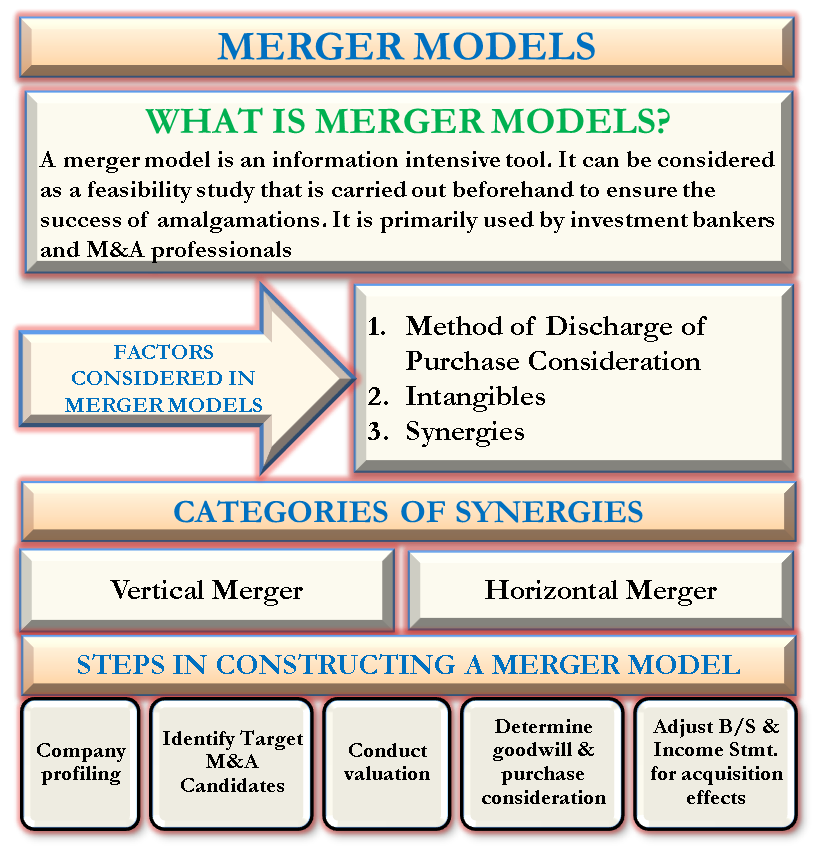

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Improve Your M&A Analysis Download The Template The Macabacus Merger Model Implements Advanced M&A, Accounting, And Tax Concepts, And Is.

An Excel Template With A Merger And Acquisition Model And Calculations Of Synergies, Levered And Unlevered Cash Flows, Headcount Projections, Balance Sheet, Return On Investment And.

How To Interpret Accretion / (Dilution) Analysis?

Related Post: