Loan Promissory Note Template

Loan Promissory Note Template - Typically, promissory notes include the original. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. Using a legal template allows you to document essential details to make your loan official. Up to 24% cash back what is a promissory note? Download and use this simple promissory note template for free. A promissory note is a contract completed when a party (lender) loans money to another (borrower). A promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details,. A promissory note is a written promise to pay back money owed within a specific timeframe. Clearly define the terms, conditions, and expectations on the document suitable on every scenario. Entering into a financial agreement is a significant. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address],. Enhance this design & content with free ai. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. Click the button below to start the process. Download and use this simple promissory note template for free. Also, we offer promissory note templates that are simple, easy to understand,. This includes the parties involved, when the money must be repaid, and any interest. Clearly define the terms, conditions, and expectations on the document suitable on every scenario. Typically, promissory notes include the original. The borrower receives the funds after the note is signed and agrees to make. Personal loan promissory note is in editable, printable format. Also, we offer promissory note templates that are simple, easy to understand,. The borrower receives the funds after the note is signed and agrees to make. It serves as a “written promise” from the borrower to the lender that they. A promissory note is a contract completed when a party (lender). It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. A promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details,. For those looking to create or manage a promissory note, filling out the form accurately is crucial. Unlike an iou that. Save time and ensure accuracy with a promissory note template. Typically, promissory notes include the original. Up to 10% cash back a promissory note outlines the terms of a loan agreement. This includes the parties involved, when the money must be repaid, and any interest. A promissory note is a contract completed when a party (lender) loans money to another. A promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details,. Typically, promissory notes include the original. Up to 24% cash back what is a promissory note? Using a legal template allows you to document essential details to make your loan official. Clearly define the terms, conditions, and. Save time and ensure accuracy with a promissory note template. Personal loan promissory note is in editable, printable format. This includes the parties involved, when the money must be repaid, and any interest. Clearly define the terms, conditions, and expectations on the document suitable on every scenario. Standard promissory note on the ___ day of _____, 20___, hereinafter known as. Download and use this simple promissory note template for free. Customize and download this personal loan promissory note. Typically, promissory notes include the original. It serves as a “written promise” from the borrower to the lender that they. For those looking to create or manage a promissory note, filling out the form accurately is crucial. Enhance this design & content with free ai. Up to 10% cash back a promissory note outlines the terms of a loan agreement. You can try our simple document builder to create a customized promissory note based on your specific needs. It serves as a “written promise” from the borrower to the lender that they. For those looking to create. Download and use this simple promissory note template for free. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. Customize and download this personal loan promissory note. A promissory note is a contract completed when a party (lender) loans money to another (borrower). It provides clear guidelines for. Personal loan promissory note is in editable, printable format. Entering into a financial agreement is a significant. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address],. A promissory note is a contract completed when a party (lender) loans money to another (borrower). Using a. This includes the parties involved, when the money must be repaid, and any interest. Typically, promissory notes include the original. Click the button below to start the process. Save time and ensure accuracy with a promissory note template. The borrower receives the funds after the note is signed and agrees to make. Also, we offer promissory note templates that are simple, easy to understand,. You can try our simple document builder to create a customized promissory note based on your specific needs. Clearly define the terms, conditions, and expectations on the document suitable on every scenario. Standard promissory note on the ___ day of _____, 20___, hereinafter known as the start date, _____ [borrower’s name] of _____ _____ [borrower’s mailing address],. A promissory note is a contract completed when a party (lender) loans money to another (borrower). The borrower receives the funds after the note is signed and agrees to make. Using a legal template allows you to document essential details to make your loan official. Entering into a financial agreement is a significant. Customize and download this personal loan promissory note. A promissory note is a written promise to pay back money owed within a specific timeframe. Typically, promissory notes include the original. This includes the parties involved, when the money must be repaid, and any interest. Up to 10% cash back a promissory note outlines the terms of a loan agreement. A promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details,. For those looking to create or manage a promissory note, filling out the form accurately is crucial. It serves as a “written promise” from the borrower to the lender that they.45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Free Printable Promissory Note For Personal Loan Free Printable

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

38 Free Promissory Note Templates & Forms (Word PDF)

Free Promissory Note Template in Word & PDF Signeasy

Free Printable Promissory Note For Personal Loan Free Printable

Save Time And Ensure Accuracy With A Promissory Note Template.

Up To 24% Cash Back What Is A Promissory Note?

Unlike An Iou That Only Acknowledges A Debt Amount, A Promissory Note Details The Consequences Of Failing To Repay A Loan.

It Provides Clear Guidelines For Both The Borrower And Lender, Ensuring A Fair And Transparent Transaction.

Related Post:

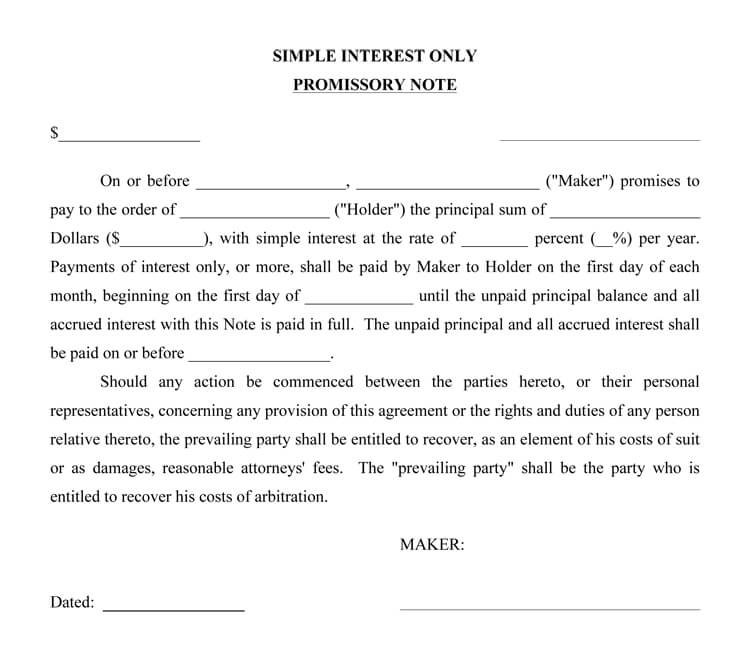

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-40.jpg?w=395)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

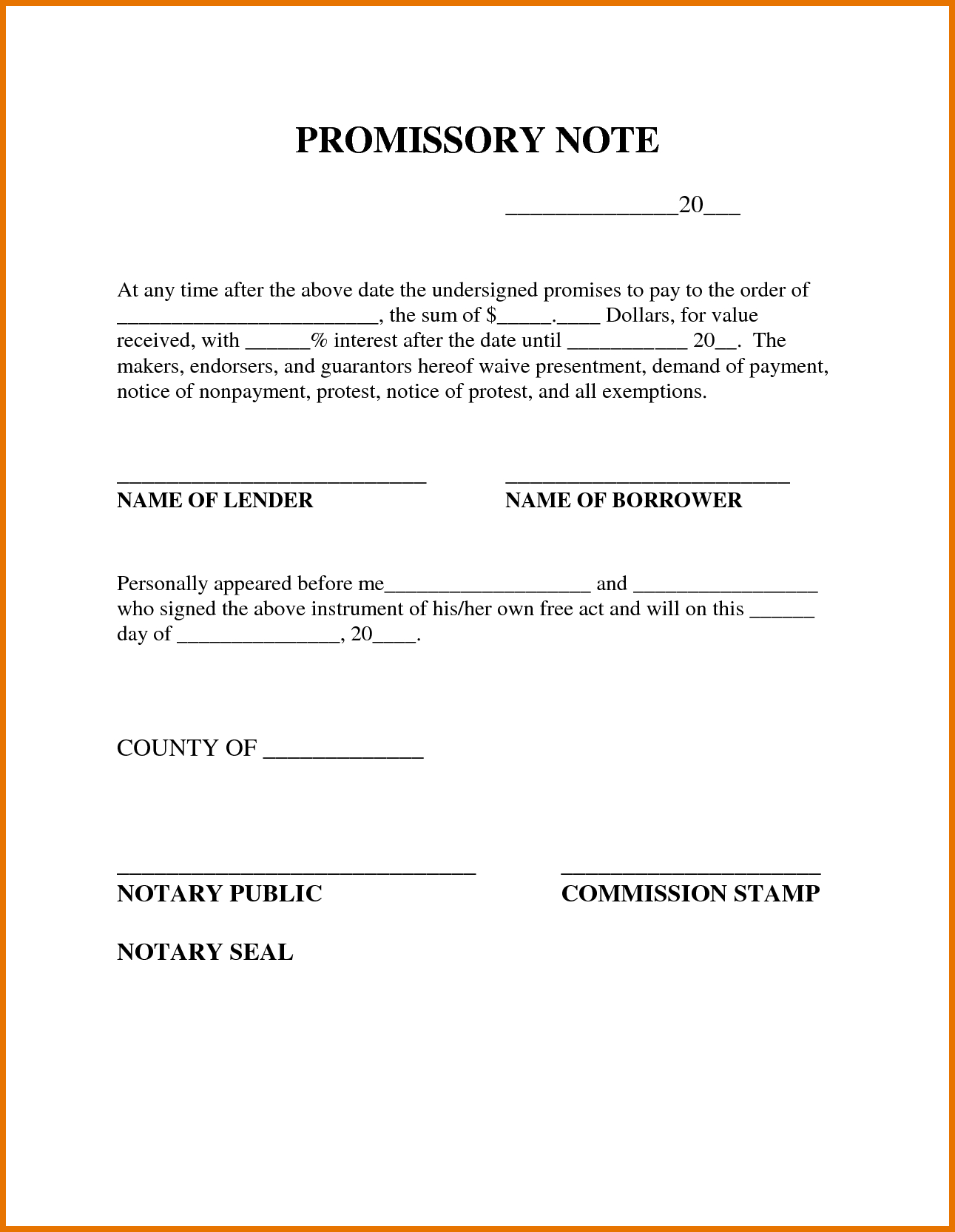

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-17.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-04.jpg)

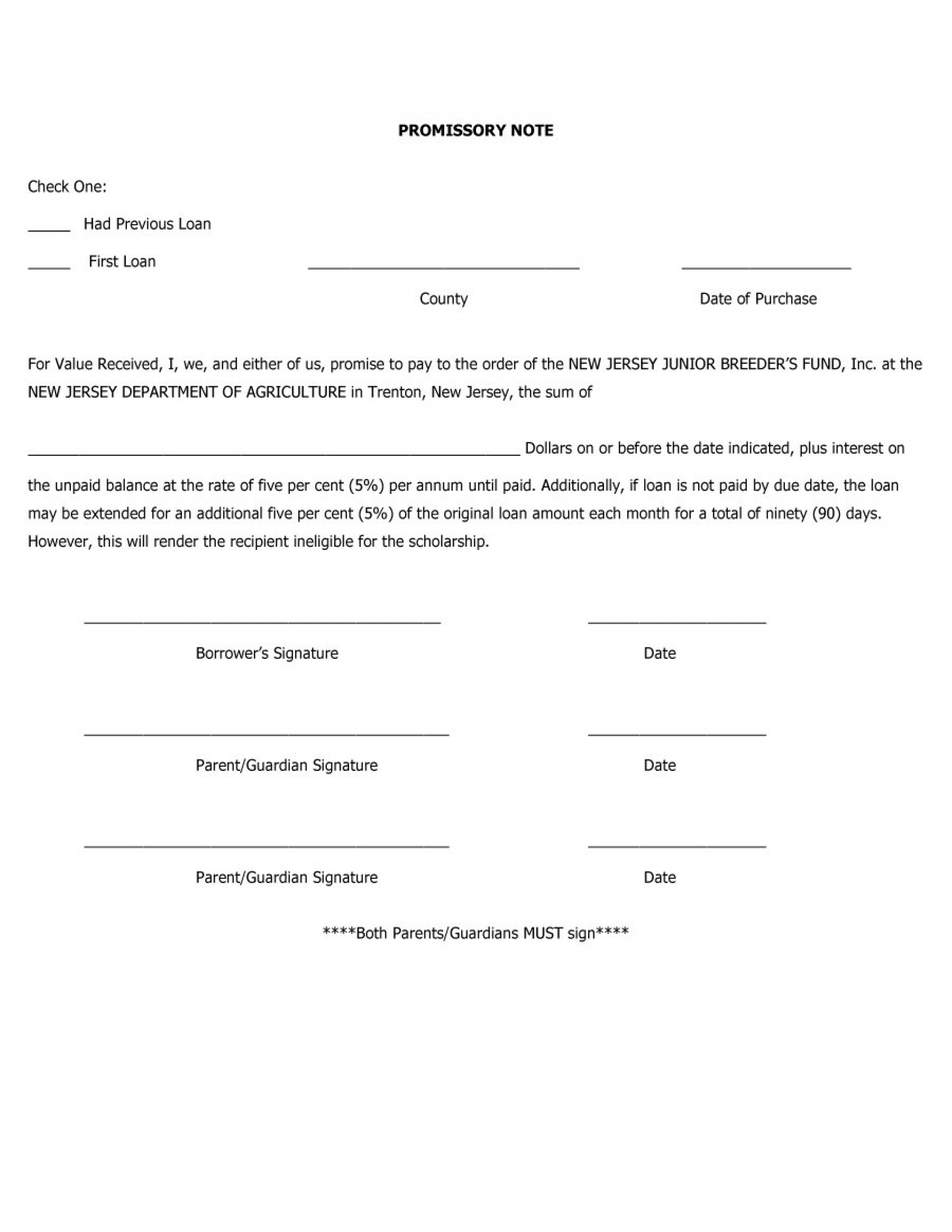

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-43.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-33.jpg)