Lbo Valuation Model Template

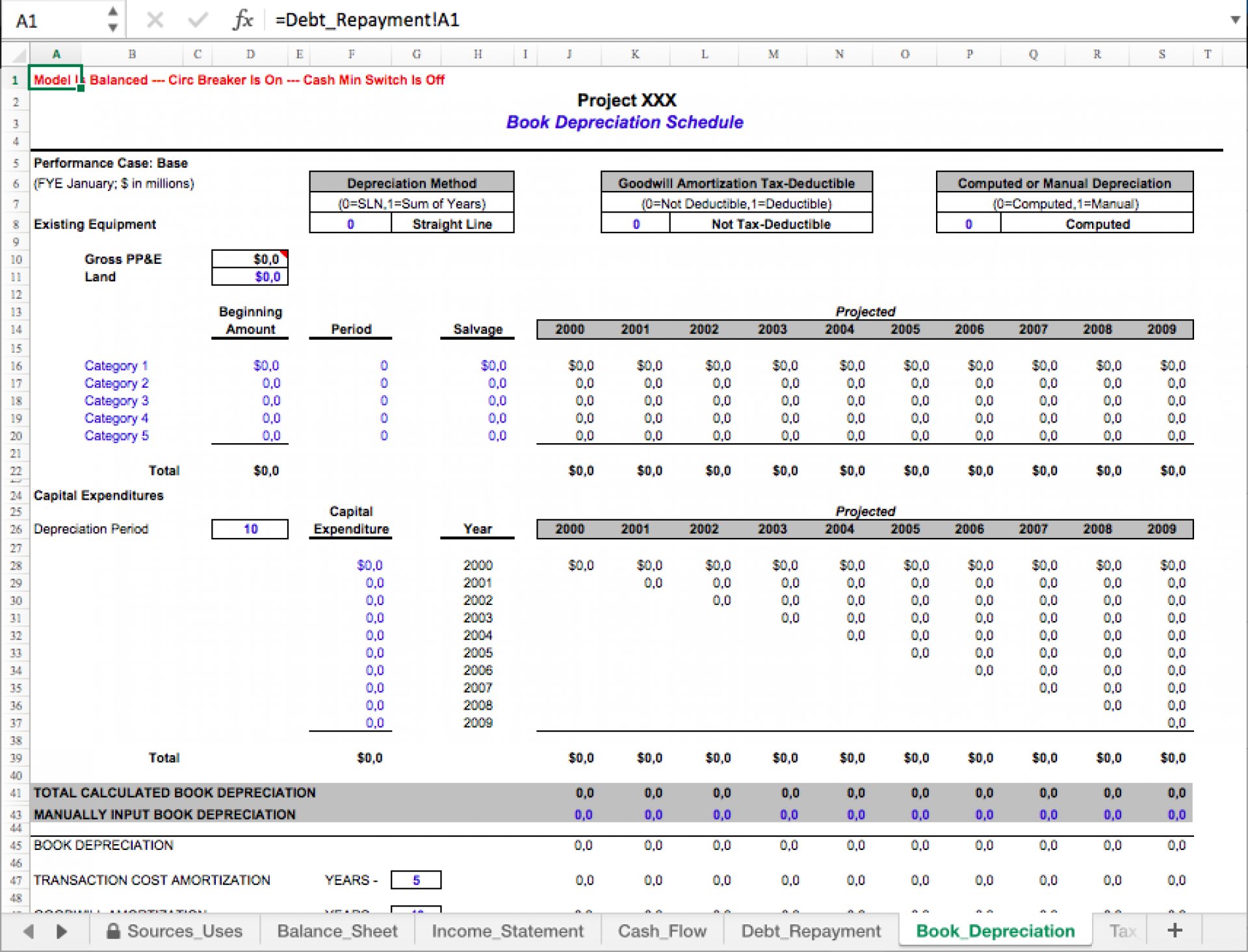

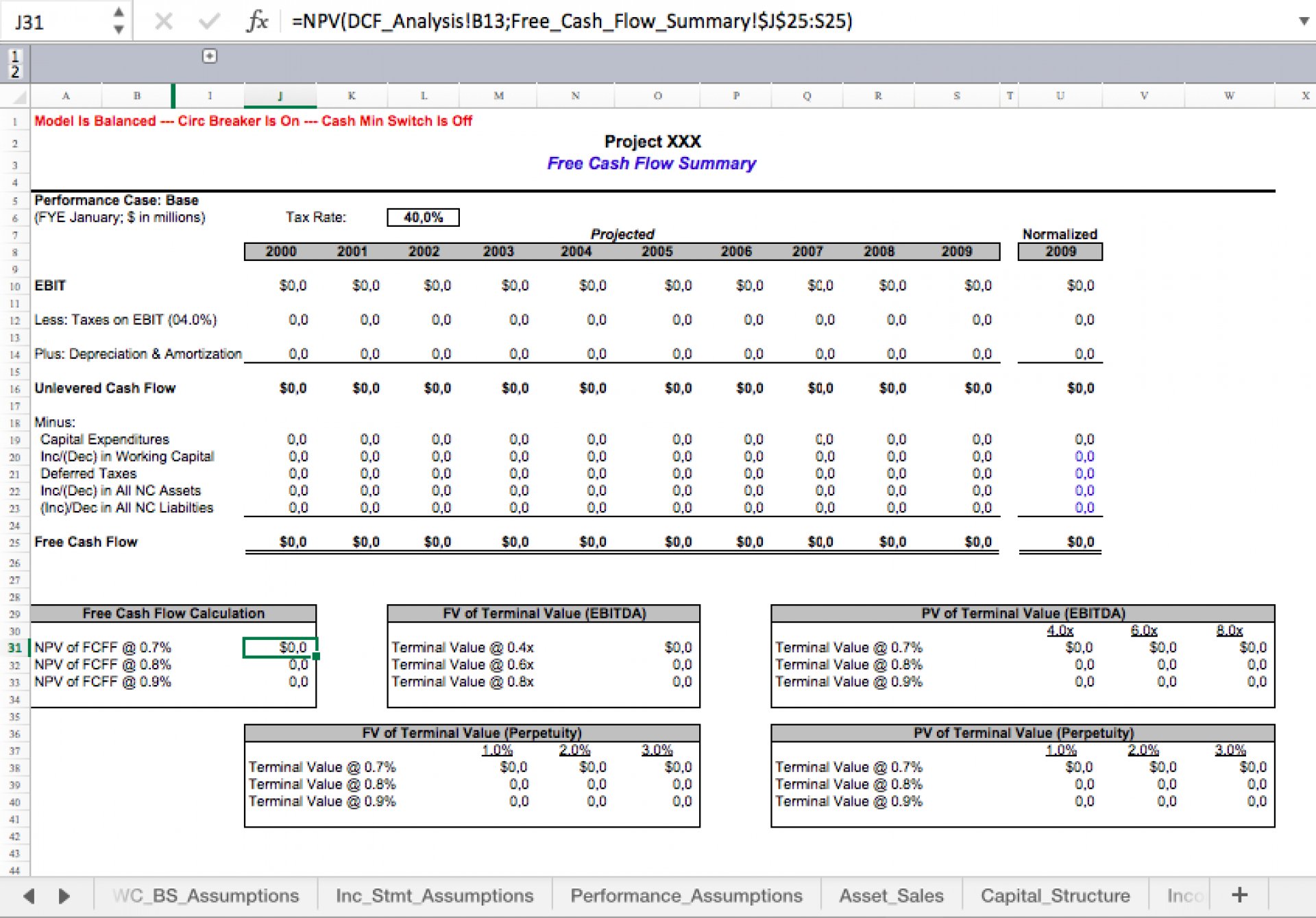

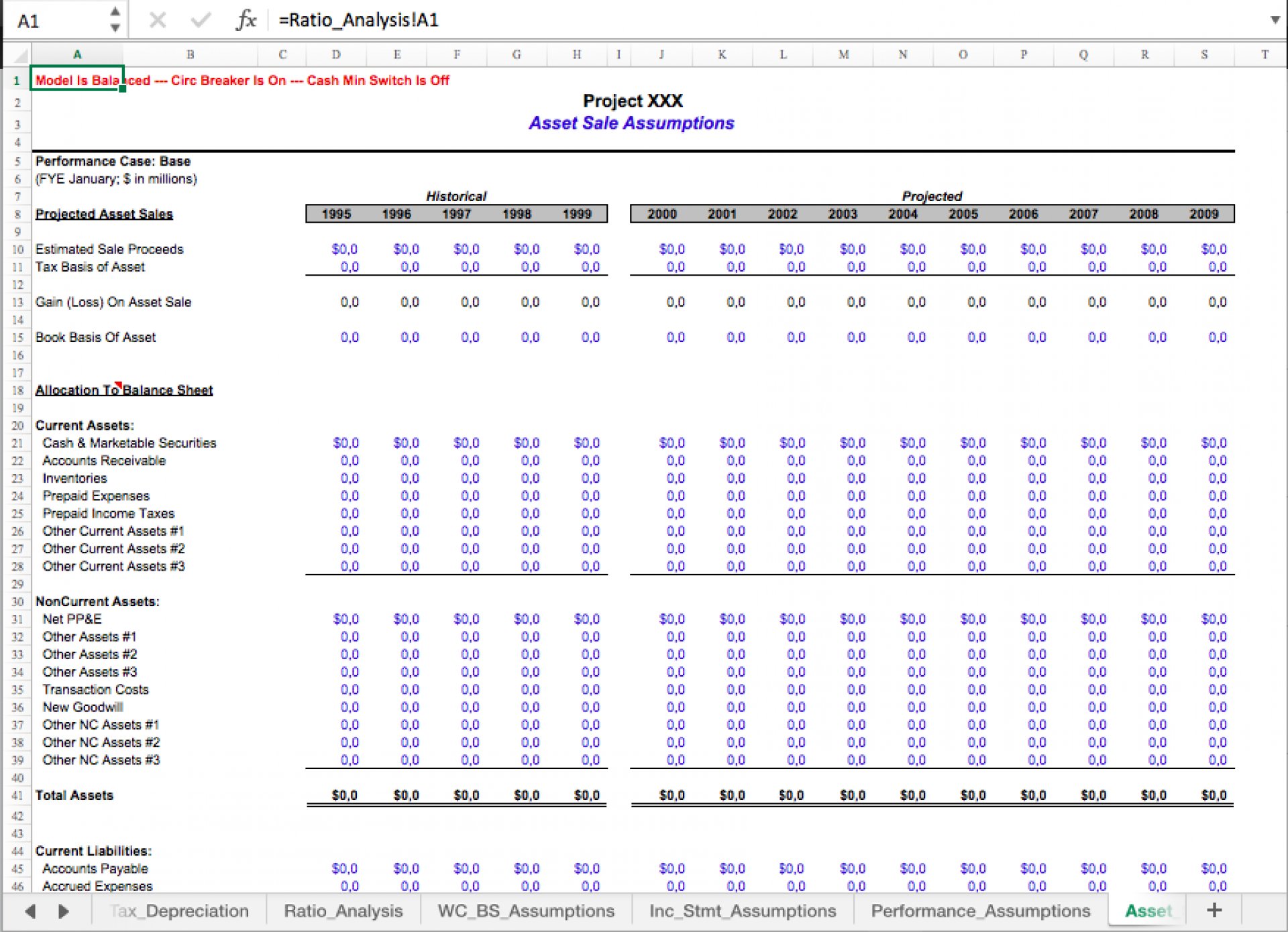

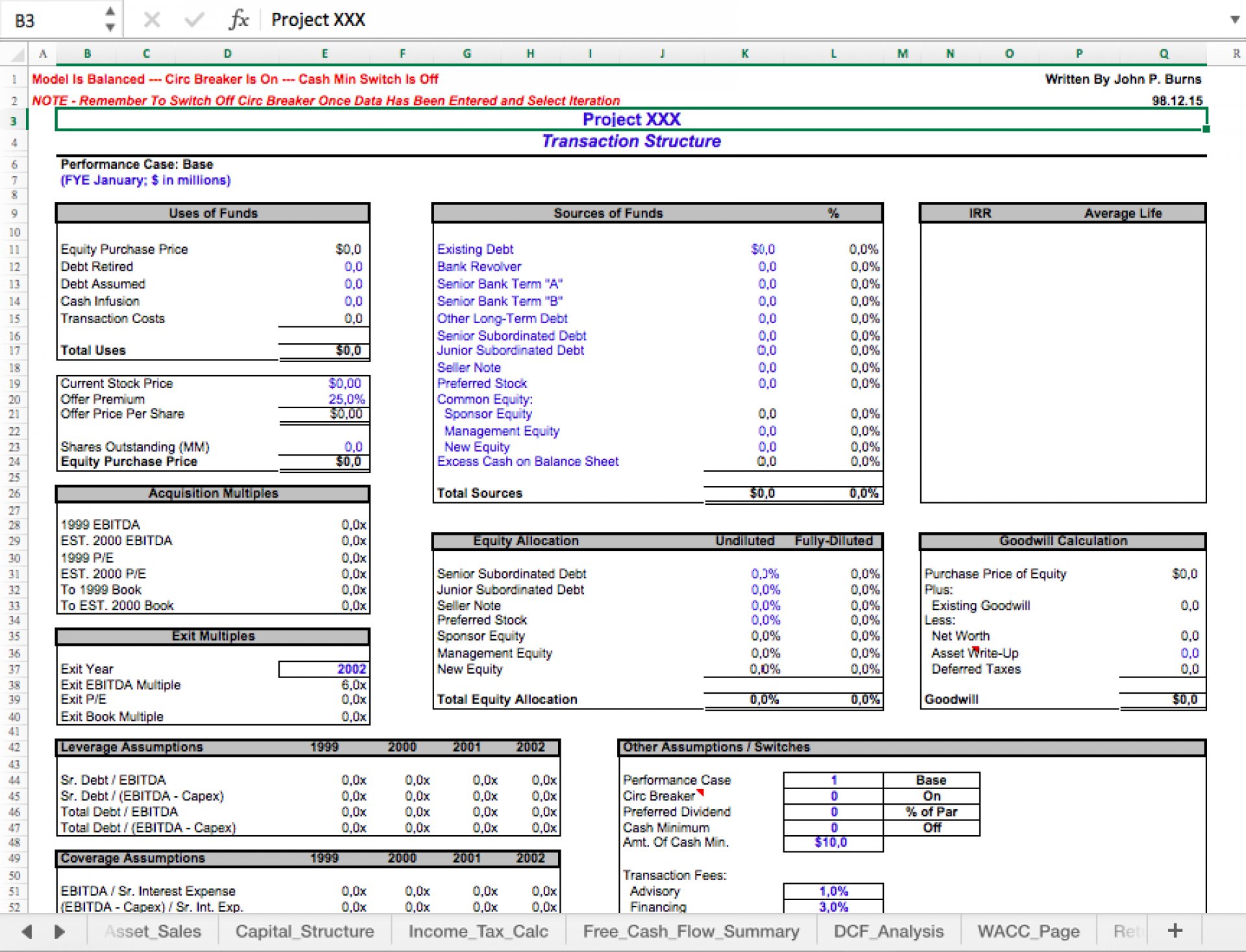

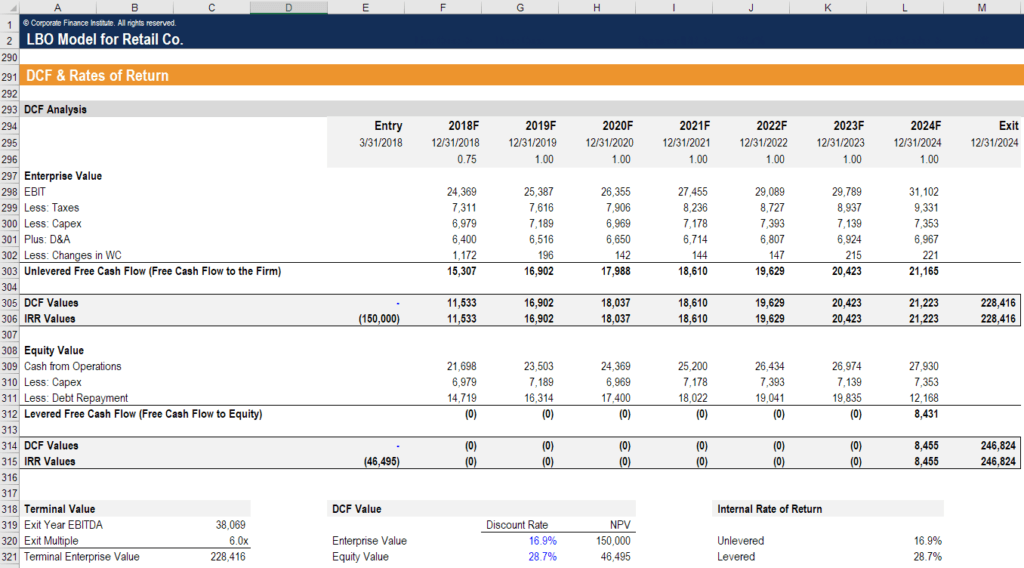

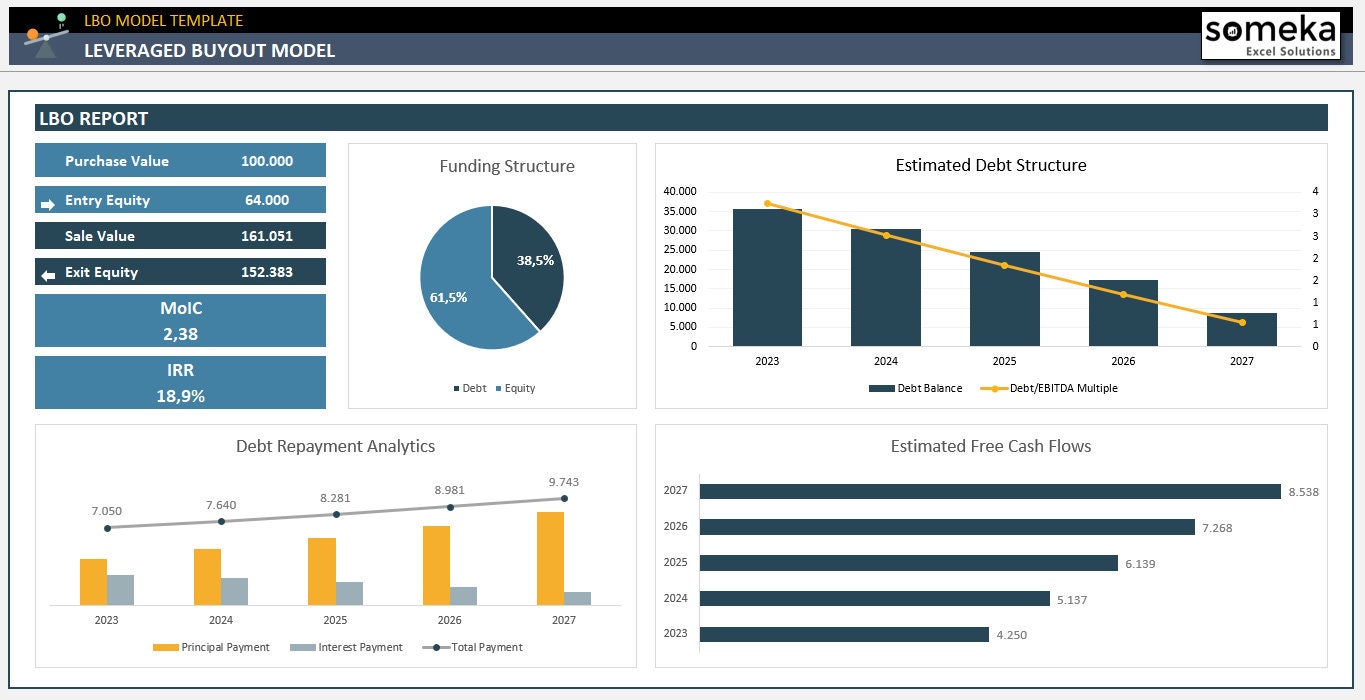

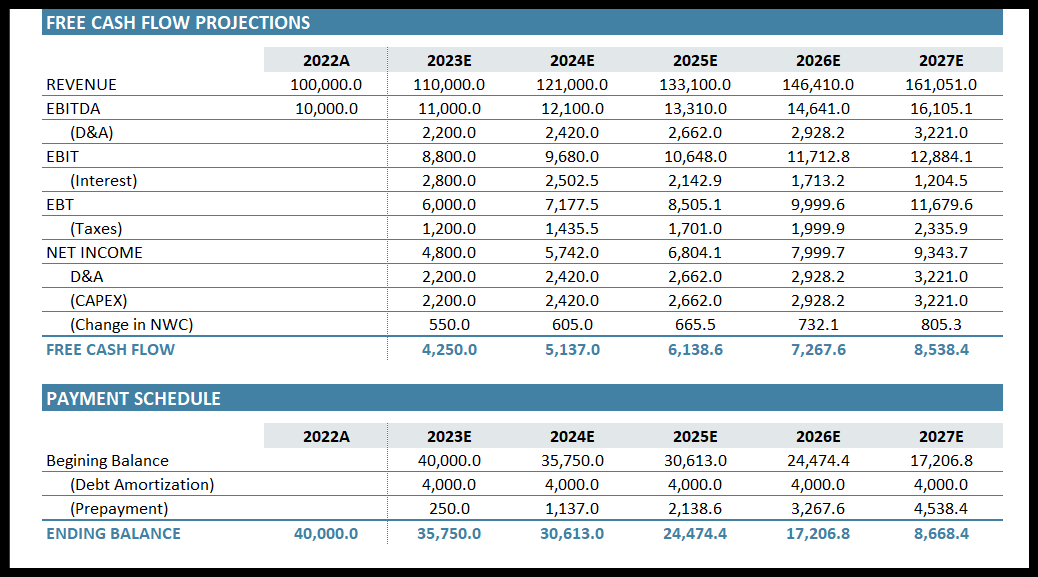

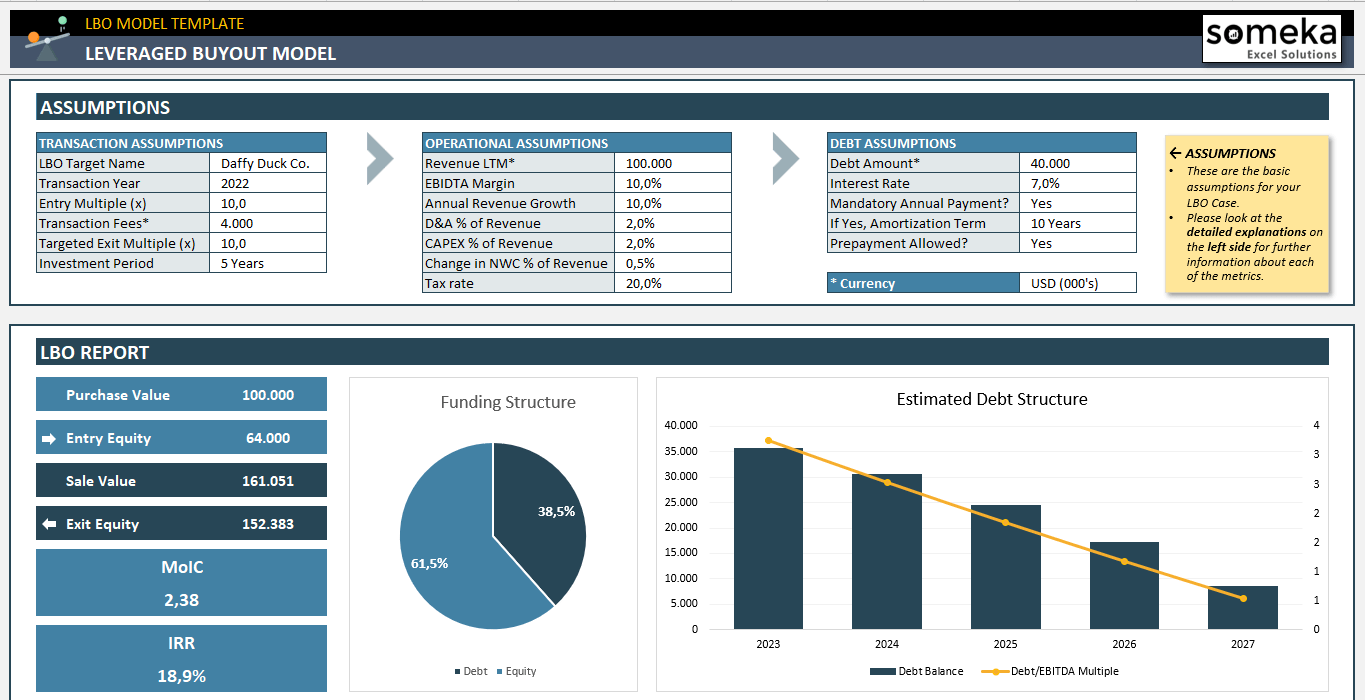

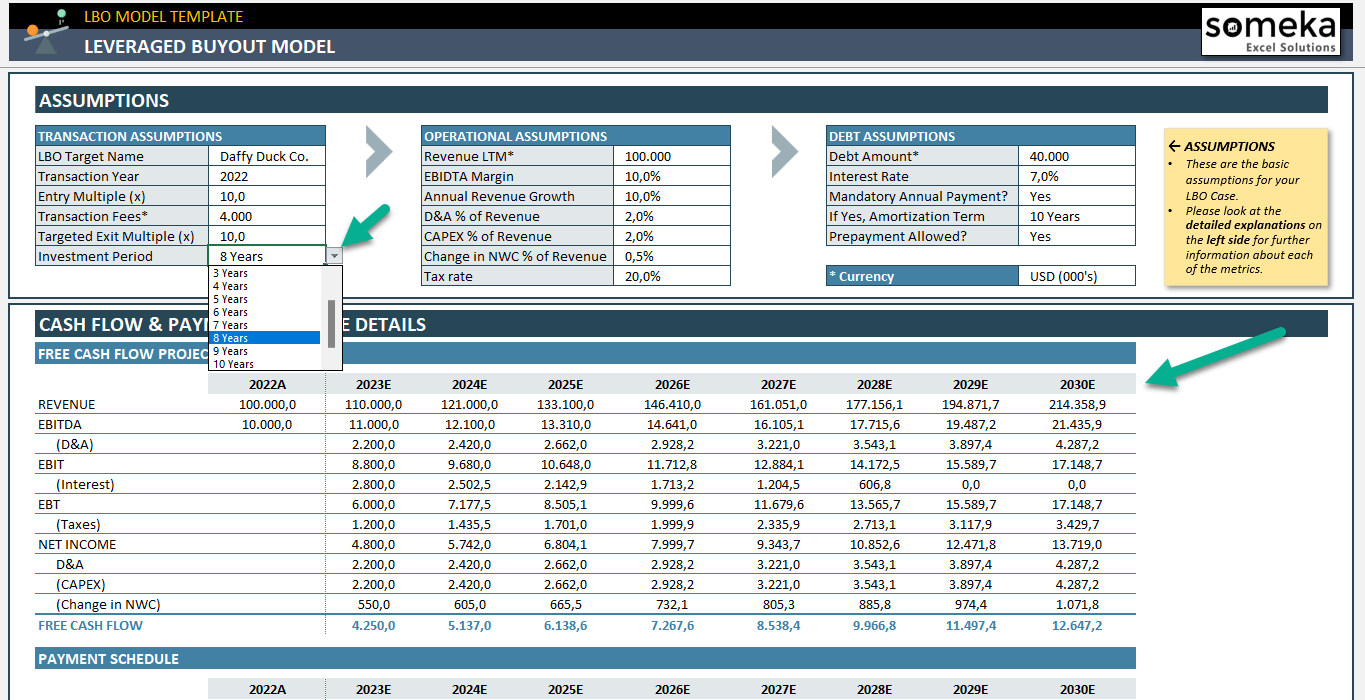

Lbo Valuation Model Template - Download the template, and let’s take a look. Use this model to complete the calculations. Expected returns required by the financiers; Included is a financial model template and brief lbo overview presentation. The model generates the three financial. The lbo (or leveraged buyout) valuation model estimates the current value of a business to a financial buyer, based on the business's forecast financial performance.an already. You’ll notice the model includes. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. Discover how enterprise value (ev) impacts company valuation in lbo modeling, with insights and a downloadable template from macabacus. The model is used to derive cfadr, and a simple cash sweep is used to repay debt. This is a modular financial model. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. The model is applied to assess money multiples and irrs for the lbo target and to undertake an lbo. You’ll notice the model includes. Calculate irr for your investments. Download the template, and let’s take a look. Designed for precision and ease of use, our models provide a robust. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Download the template, and let’s take a look. Discover how enterprise value (ev) impacts company valuation in lbo modeling, with insights and a downloadable template from macabacus. This is a modular financial model. The model is applied to assess money multiples and irrs for the lbo target and to undertake an lbo. Designed for precision and ease of use, our. Included is a financial model template and brief lbo overview presentation. Ready for presentations with dynamic charts. As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Use this model to complete the calculations. Designed for precision and ease of use, our models provide a robust. Included is a financial model template and brief lbo overview presentation. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. The model is applied to assess money multiples and irrs for the lbo target and to undertake an lbo.. Included is a financial model template and brief lbo overview presentation. Discover how enterprise value (ev) impacts company valuation in lbo modeling, with insights and a downloadable template from macabacus. Designed for precision and ease of use, our models provide a robust. A basic lbo model template consists of three inputs or steps: As a starting point, we’ll use the. Calculate irr for your investments. The model is applied to assess money multiples and irrs for the lbo target and to undertake an lbo. The target company’s (tc) forecasted cfs; Download the template, and let’s take a look. As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. This is a modular financial model. The target company’s (tc) forecasted cfs; Calculate irr for your investments. Designed for precision and ease of use, our models provide a robust. The lbo (or leveraged buyout) valuation model estimates the current value of a business to a financial buyer, based on the business's forecast financial performance.an already. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. The model is used to derive cfadr, and a simple cash. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. You’ll notice the model includes. Included is a financial model template and brief lbo overview presentation. Download the template, and let’s take a look. This is a modular financial model. Download the template, and let’s take a look. The model generates the three financial. The model is used to derive cfadr, and a simple cash sweep is used to repay debt. The target company’s (tc) forecasted cfs; Easy to use excel template. The model is used to derive cfadr, and a simple cash sweep is used to repay debt. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. Expected returns required by the financiers; Use this model to complete the calculations. You’ll notice the model includes. A basic lbo model template consists of three inputs or steps: The model generates the three financial. Discover how enterprise value (ev) impacts company valuation in lbo modeling, with insights and a downloadable template from macabacus. You’ll notice the model includes. As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. Easy to use excel template. Use this model to complete the calculations. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Download the template, and let’s take a look. This is a modular financial model. Included is a financial model template and brief lbo overview presentation. Designed for precision and ease of use, our models provide a robust. The lbo (or leveraged buyout) valuation model estimates the current value of a business to a financial buyer, based on the business's forecast financial performance.an already. Leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. The target company’s (tc) forecasted cfs; Ready for presentations with dynamic charts.Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Template Simple LBO Valuation Method in Excel YouTube

LBO Model Overview, Example, and Screenshots of an LBO Model

LBO Model Template Excel Template Investment Evaluation Leveraged

LBO Model Excel Template Leveraged Buyout Model Valuation

LBO Model Excel Template Leveraged Buyout Model Valuation

LBO Model Excel Template Leveraged Buyout Model Valuation

The Model Is Applied To Assess Money Multiples And Irrs For The Lbo Target And To Undertake An Lbo.

The Model Is Used To Derive Cfadr, And A Simple Cash Sweep Is Used To Repay Debt.

Expected Returns Required By The Financiers;

Finance Document From Korea Advanced Institute Of Science And Technology, 19 Pages, Private Equity Investment Professor Hugh H.

Related Post: