Kentucky Tobacco Tax Excel Template

Kentucky Tobacco Tax Excel Template - The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. Keep abreast of current tax rates and regulations specific to kentucky. The kentucky tobacco tax excel template is equipped with features designed to make your tax management process seamless. Cigarette and tobacco licenses are obtained online through the. Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. Tobacco products retailers must submit a kentucky tax. Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Kentucky tobacco tax excel template helps calculate cigarette and vaping taxes, including sales tax, use tax, and wholesale tax, with formulas for easy computation and. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. Calculate kentucky tobacco tax with ease using our excel template, featuring cigarette and vaping product tax rates, revenue tracking, and smoking cessation resources,. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. Keep abreast of current tax rates and regulations specific to kentucky. Tobacco products retailers must submit a kentucky tax. Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. Here is an example of how to create a kentucky tobacco tax excel template: A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. Create a kentucky tobacco tax template now with 7 easy ways, including calculation tools, tax forms, and revenue reporting, to simplify cigarette and vaping. Here is an example of how to create a kentucky tobacco tax excel template: These templates automatically calculate tax liabilities for cigarettes ($1.10 per pack), snuff ($0.19 per. Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. A catalog of the various cigarette tax. Calculate kentucky tobacco tax with ease using our excel template, featuring cigarette and vaping product tax rates, revenue tracking, and smoking cessation resources,. A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. Kentucky. Create a kentucky tobacco tax template now with 7 easy ways, including calculation tools, tax forms, and revenue reporting, to simplify cigarette and vaping product. These templates automatically calculate tax liabilities for cigarettes ($1.10 per pack), snuff ($0.19 per. Keep abreast of current tax rates and regulations specific to kentucky. Tobacco products retailers must submit a kentucky tax. To create. Create a kentucky tobacco tax template now with 7 easy ways, including calculation tools, tax forms, and revenue reporting, to simplify cigarette and vaping product. Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. These templates automatically calculate tax liabilities for cigarettes ($1.10 per. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. An excel template helps you: Product type, quantity, wholesale price, and tax. Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. Kentucky. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. To create a functional excel template for calculating kentucky tobacco taxes, follow these steps: Keep abreast of current tax rates and regulations specific to kentucky. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking,. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. A catalog of the tobacco excise tax forms and reports for all the states along with a link to the form. An excel template. The kentucky tobacco tax excel template is equipped with features designed to make your tax management process seamless. Cigarettes are also subject to kentucky sales tax of approximately $0.32. Tobacco returns are filed, and cigarette stamp orders are made online through tap. Create a table with the following columns: An excel template helps you: This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. An excel template helps you: Product type, quantity, wholesale price, and tax. Kentucky tobacco tax excel template helps calculate cigarette and vaping taxes, including sales tax, use tax, and wholesale tax, with formulas for easy computation and. Kentucky. Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. Calculate kentucky tobacco tax with ease using our excel template, featuring cigarette and vaping product tax rates, revenue tracking, and smoking cessation resources,. Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Generate customized templates for form 73a421, kentucky's monthly tobacco tax return. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Tax compliance is critical in the tobacco industry. Here is an example of how to create a kentucky tobacco tax excel template: A catalog of the tobacco excise tax forms and reports for all the states along with a link to the form. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. Keep abreast of current tax rates and regulations specific to kentucky. Cigarette and tobacco licenses are obtained online through the. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. Kentucky tobacco tax excel template helps calculate cigarette and vaping taxes, including sales tax, use tax, and wholesale tax, with formulas for easy computation and. To create a functional excel template for calculating kentucky tobacco taxes, follow these steps:Tax Excel Template/calculator Accounting Template Etsy

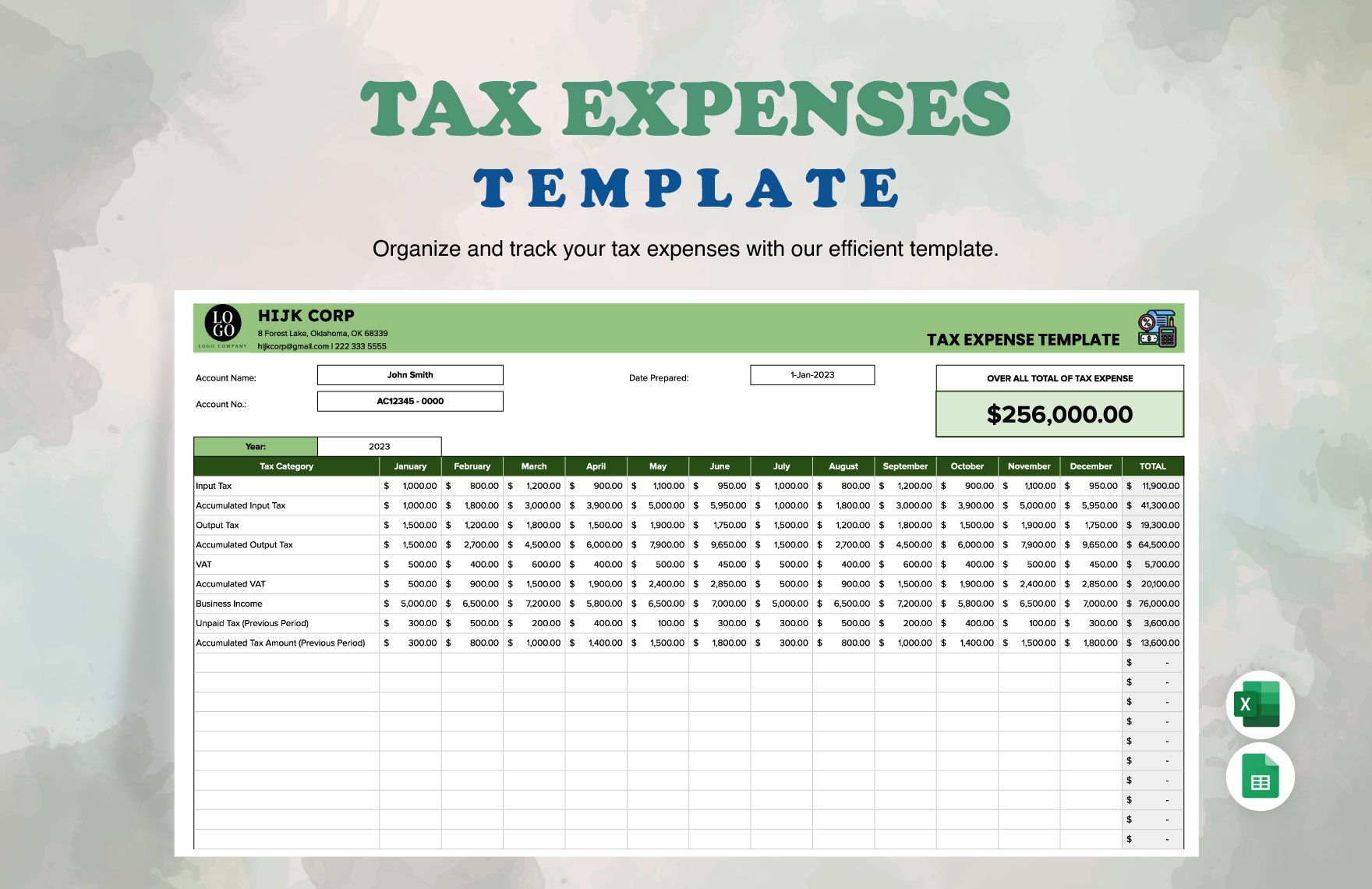

Excel Tax Template

Kentucky Tobacco Tax Excel Template Excel Web

15 Kentucky Tobacco Tax Templates Ultimate Excel Guide Excel Web

Tax Expenses Template in Excel, Google Sheets Download

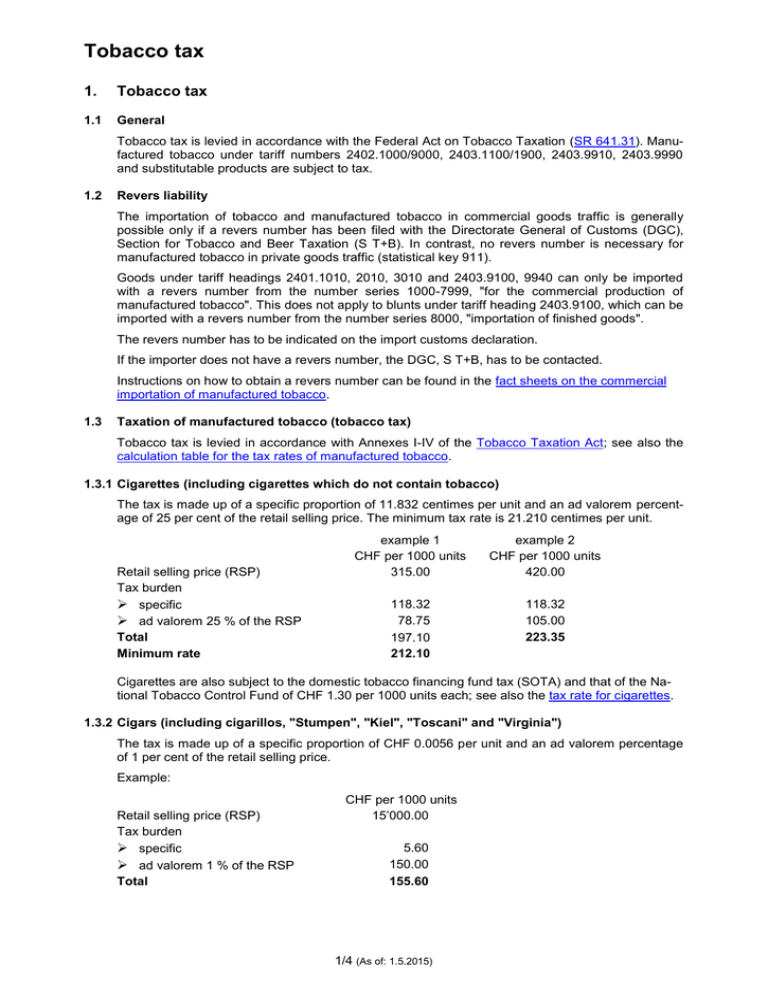

Tobacco tax

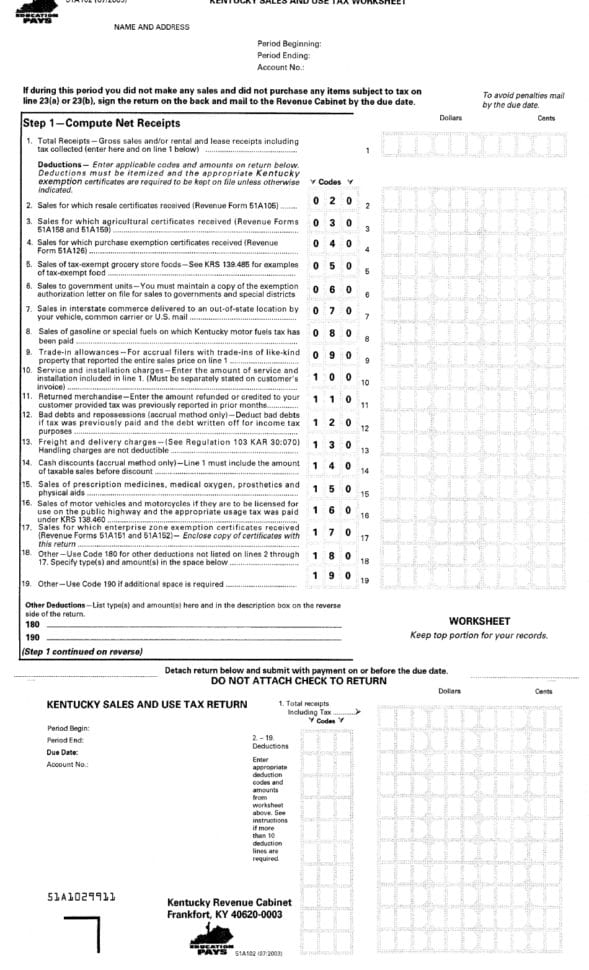

Kentucky Sales Use Tax Worksheet Printable Pdf Download —

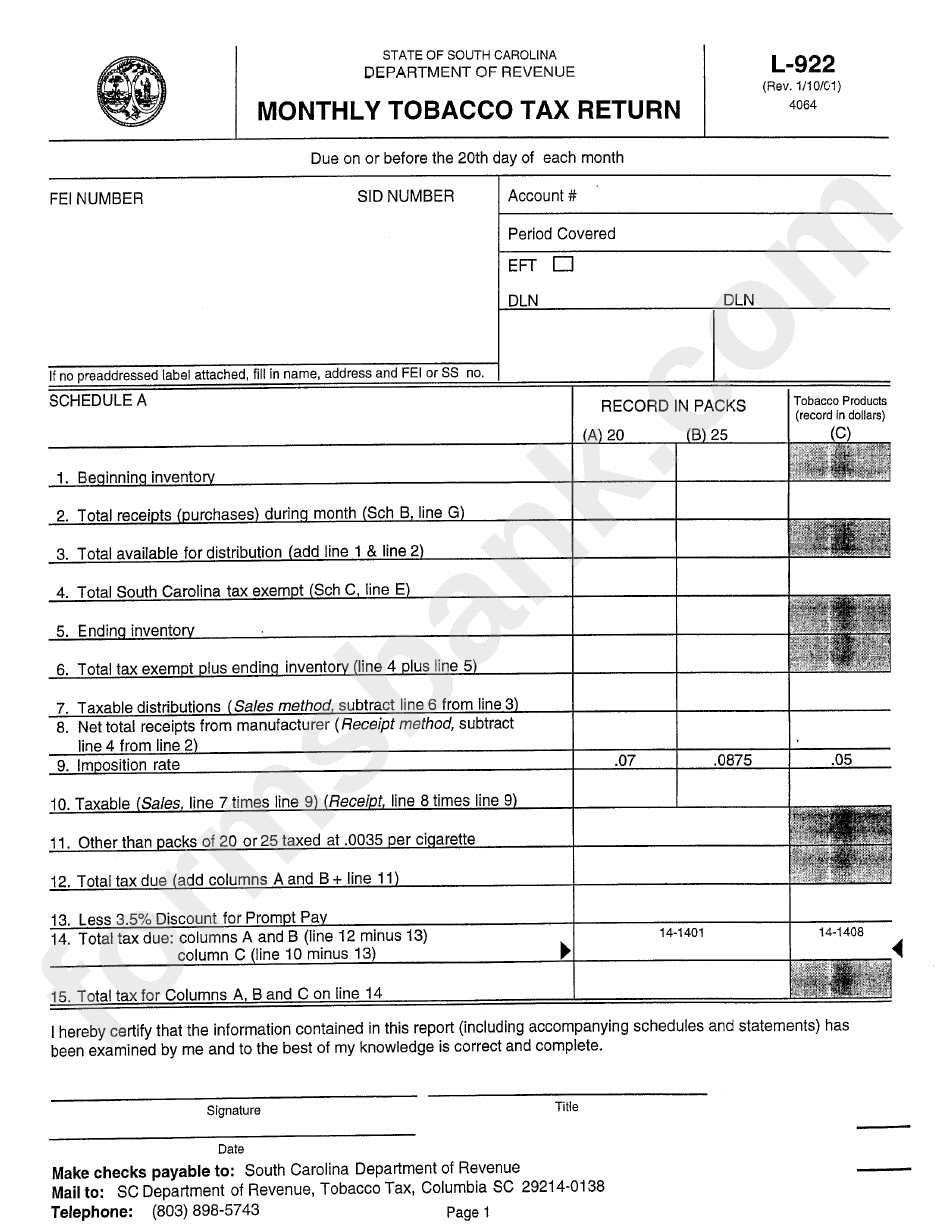

Form L022 Monthly Tobacco Tax Return Form printable pdf download

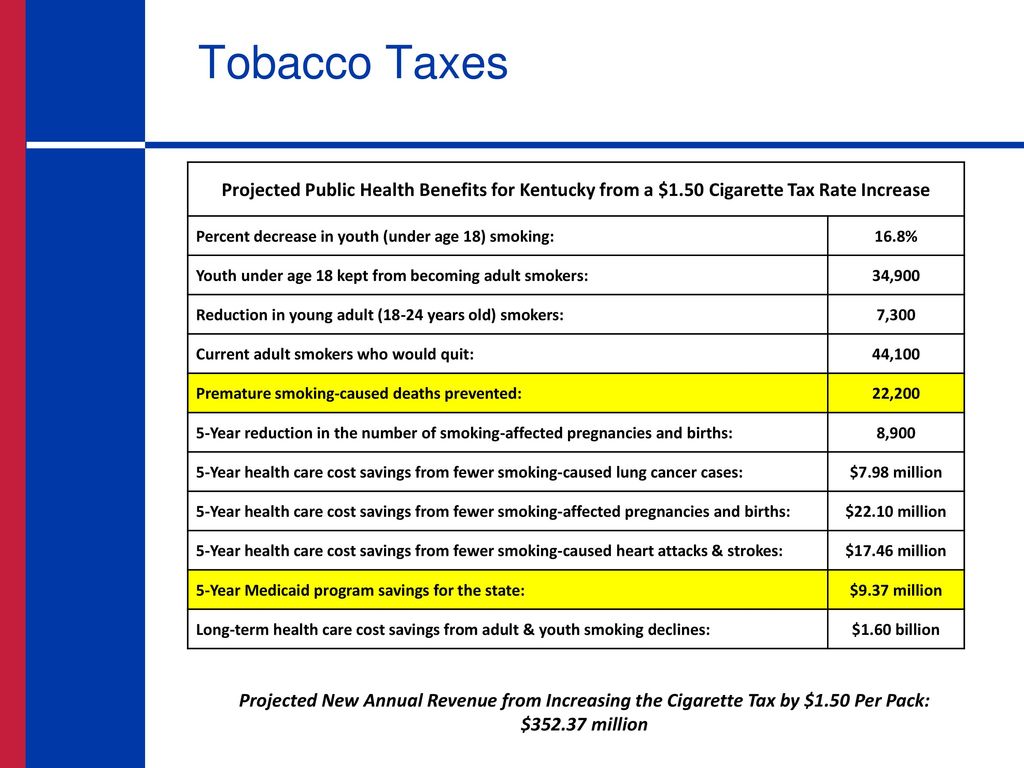

Increasing Tobacco Excise Tax ppt download

Tax Excel Template/calculator Accounting Template Etsy

The Department Of Revenue Administers Tobacco Taxes On Cigarettes, Other Tobacco Products, Snuff, And Vapor Products.

An Excel Template Helps You:

Create A Kentucky Tobacco Tax Template Now With 7 Easy Ways, Including Calculation Tools, Tax Forms, And Revenue Reporting, To Simplify Cigarette And Vaping Product.

Create A Table With The Following Columns:

Related Post: