Goodwill Receipt Template

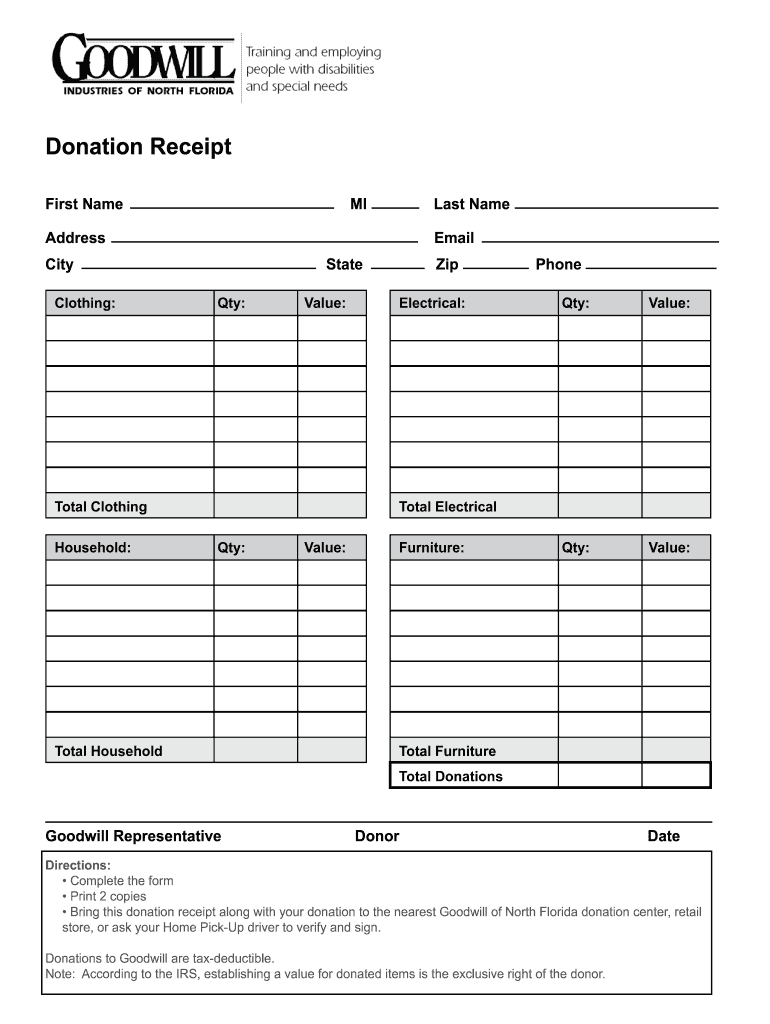

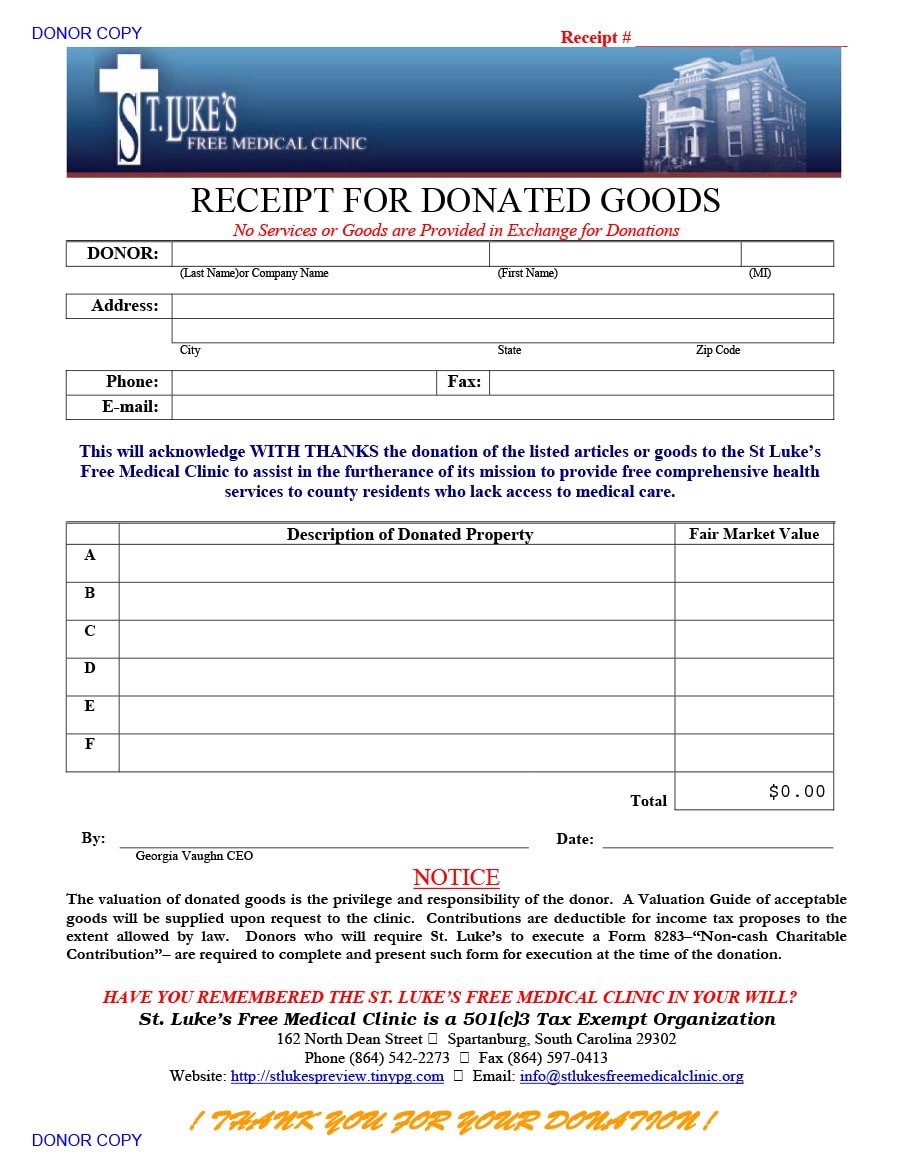

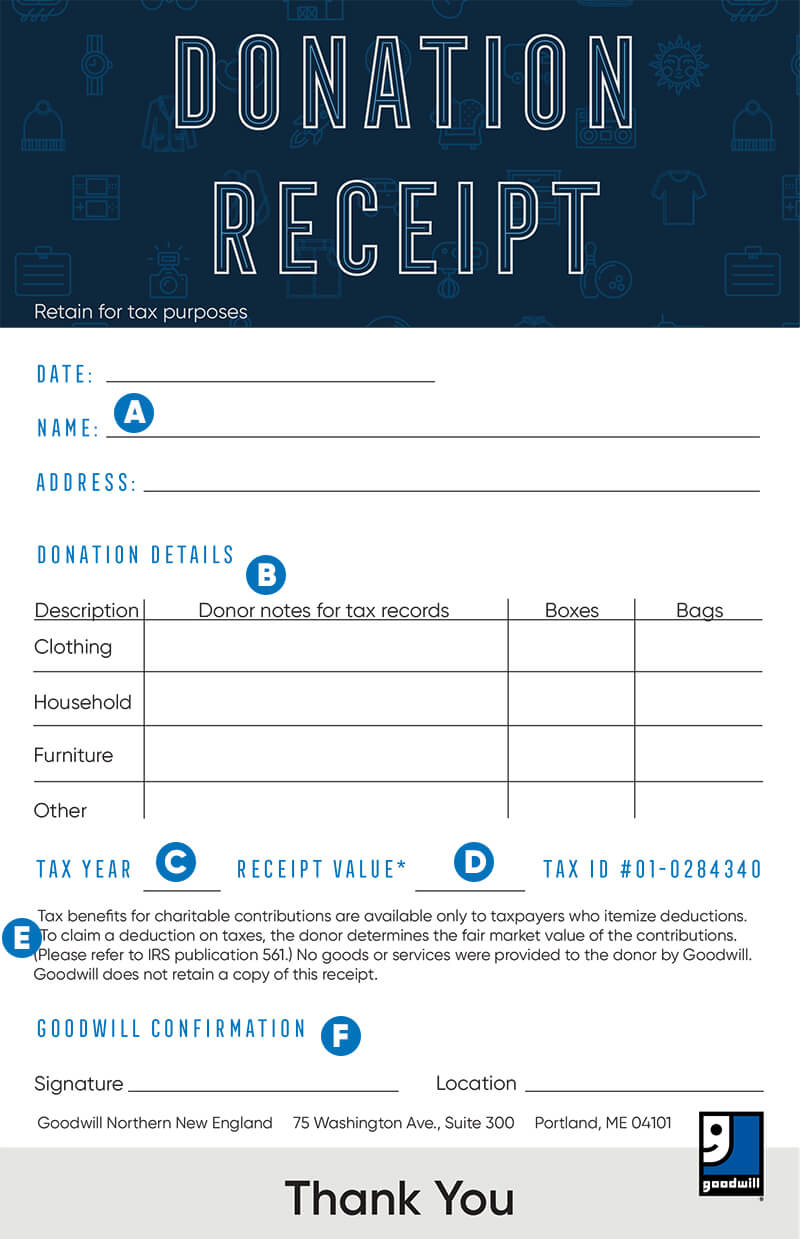

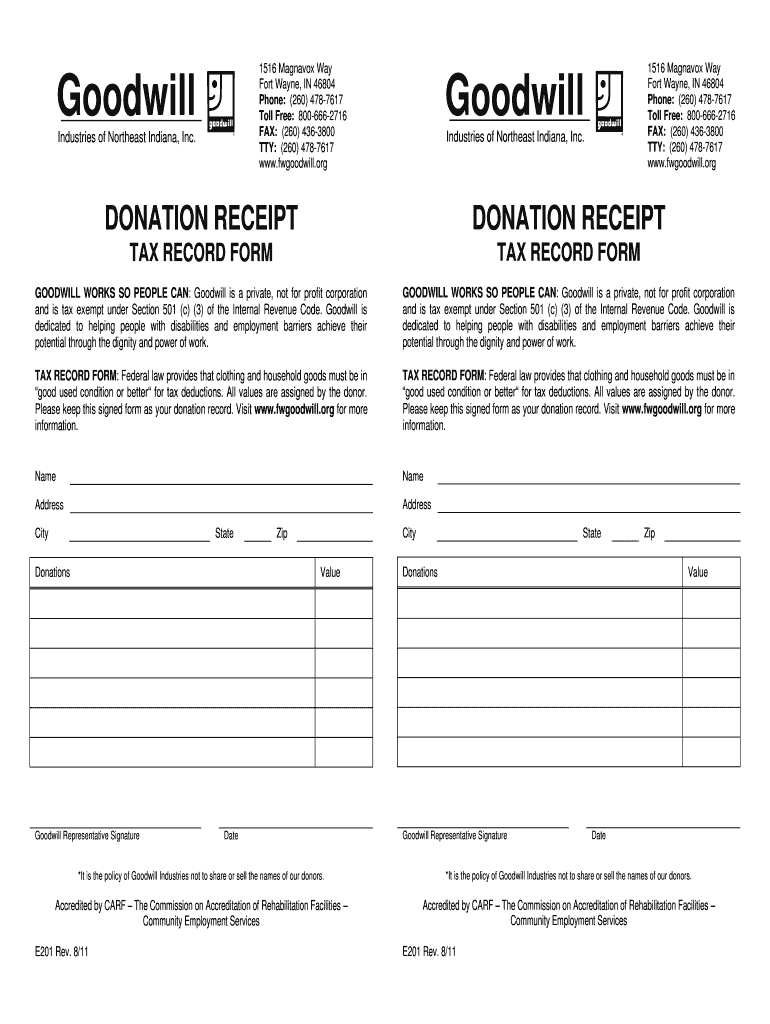

Goodwill Receipt Template - If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. To make things easier, we have built this goodwill donation receipt template for you to fill out the value of your donated clothes, books, shoes, or other used items. Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. The illustrated guide below will help you draft and fill out the donation receipt form effortlessly and quickly. If you donated to a goodwill in the following. Monetary donations receive donation receipts via email or physical mail. Easily download and fill out the goodwill donation receipt form to keep track of your charitable contributions. Download the goodwill donation receipt; If you decide to donate during working. Monetary donations receive donation receipts via email or physical mail. But if you’re already thinking of organizing a charitable activity as your own act of “goodwill,” then you can download our free printable receipts to record people’s contributions. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. Save this receipt for tax purposes. Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services. It includes essential instructions for donors on how to fill out the donation receipt for tax purposes. A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once you have supplied the needed information. Get a receipt for your donation of gently used goods to your local goodwill store. Save this receipt for tax purposes. A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once you have supplied the needed information. Use this receipt when filing your taxes. Use this receipt when filing your taxes. This file provides a detailed donation receipt for contributions to goodwill. As the donor, you are responsible for. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. Use this receipt when filing your taxes. Download the goodwill donation receipt; A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. The illustrated guide below will help you draft and fill out the donation receipt form effortlessly and quickly. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. Easily download and fill. To make things easier, we have built this goodwill donation receipt template for you to fill out the value of your donated clothes, books, shoes, or other used items. Edit on any devicepaperless workflow5 star rated24/7 tech support A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once. Use this receipt when filing your taxes. Get a receipt for your donation of gently used goods to your local goodwill store. This form serves as proof of the donor's contribution. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. A receipt table at the center of this paperwork shall display the. Edit on any devicepaperless workflow5 star rated24/7 tech support Get a receipt for your donation of gently used goods to your local goodwill store. The goodwill donation receipt form is a document that acknowledges the donation of goods to goodwill by an individual or organization. The goodwill donation receipt form serves as a vital document when you donate items to. This file provides a detailed donation receipt for contributions to goodwill. Edit on any devicepaperless workflow5 star rated24/7 tech support Easily download and fill out the goodwill donation receipt form to keep track of your charitable contributions. The illustrated guide below will help you draft and fill out the donation receipt form effortlessly and quickly. If you donated to a. This file provides a detailed donation receipt for contributions to goodwill. Goods or services were not exchanged for. A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once you have supplied the needed information. A goodwill donation receipt is used to claim a tax deduction for any donations. Save this receipt for tax purposes. Download the goodwill donation receipt; If you donated to a goodwill in the following. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services. The goodwill donation receipt form serves as a vital document when you donate items to goodwill, allowing you to keep track of your charitable contributions. But if you’re already thinking of organizing a charitable activity as your own act of “goodwill,” then you can download our free printable receipts to record people’s contributions. The illustrated guide below will help you. It includes essential instructions for donors on how to fill out the donation receipt for tax purposes. This form serves as proof of the donation and is essential for donors who wish to. To make things easier, we have built this goodwill donation receipt template for you to fill out the value of your donated clothes, books, shoes, or other used items. The illustrated guide below will help you draft and fill out the donation receipt form effortlessly and quickly. Edit on any devicepaperless workflow5 star rated24/7 tech support If you decide to donate during working. Save this receipt for tax purposes. The goodwill donation receipt form serves as a vital document when you donate items to goodwill, allowing you to keep track of your charitable contributions. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. But if you’re already thinking of organizing a charitable activity as your own act of “goodwill,” then you can download our free printable receipts to record people’s contributions. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services. Monetary donations receive donation receipts via email or physical mail. A receipt table at the center of this paperwork shall display the information regarding the goodwill donation in an organized manner once you have supplied the needed information. As the donor, you are responsible for.Goodwill Itemized Donation List Printable

Goodwill Itemized Donation List Printable

Printable Goodwill Donation Receipt Printable Templates

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Free Goodwill Donation Receipt Template PDF eForms

Goodwill Donation Receipt Fill Online Printable Fillable —

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Goods Or Services Were Not Exchanged For.

Get A Receipt For Your Donation Of Gently Used Goods To Your Local Goodwill Store.

A Goodwill Donation Receipt Is Used To Claim A Tax Deduction For Any Donations Made To Goodwill, Such As Clothing Or Household Items.

Save This Receipt For Tax Purposes.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-24.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-10.jpg)