Financial Model Template

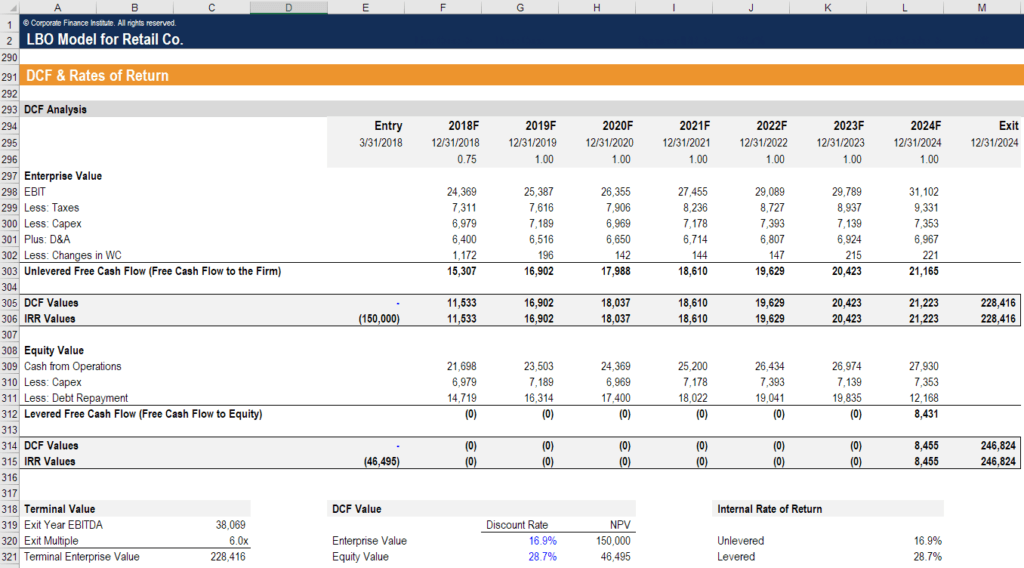

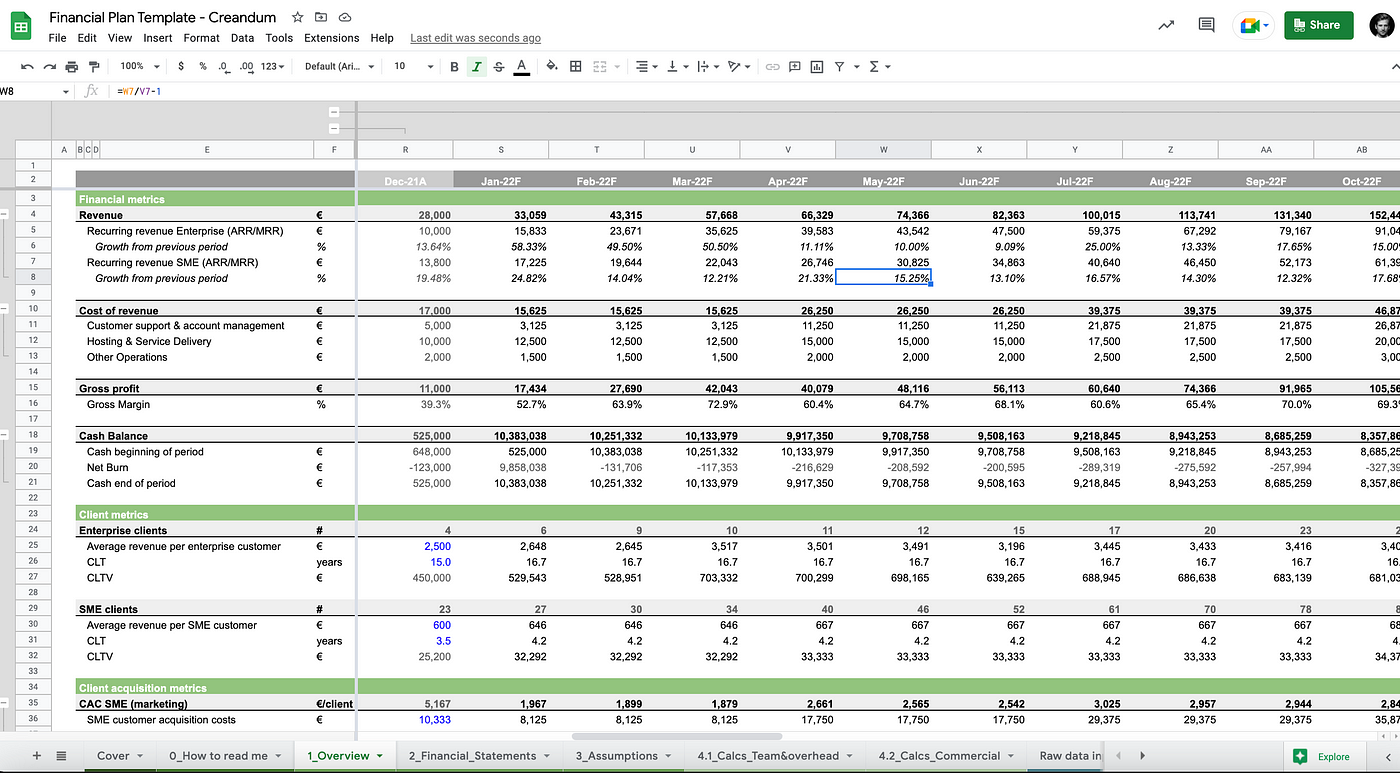

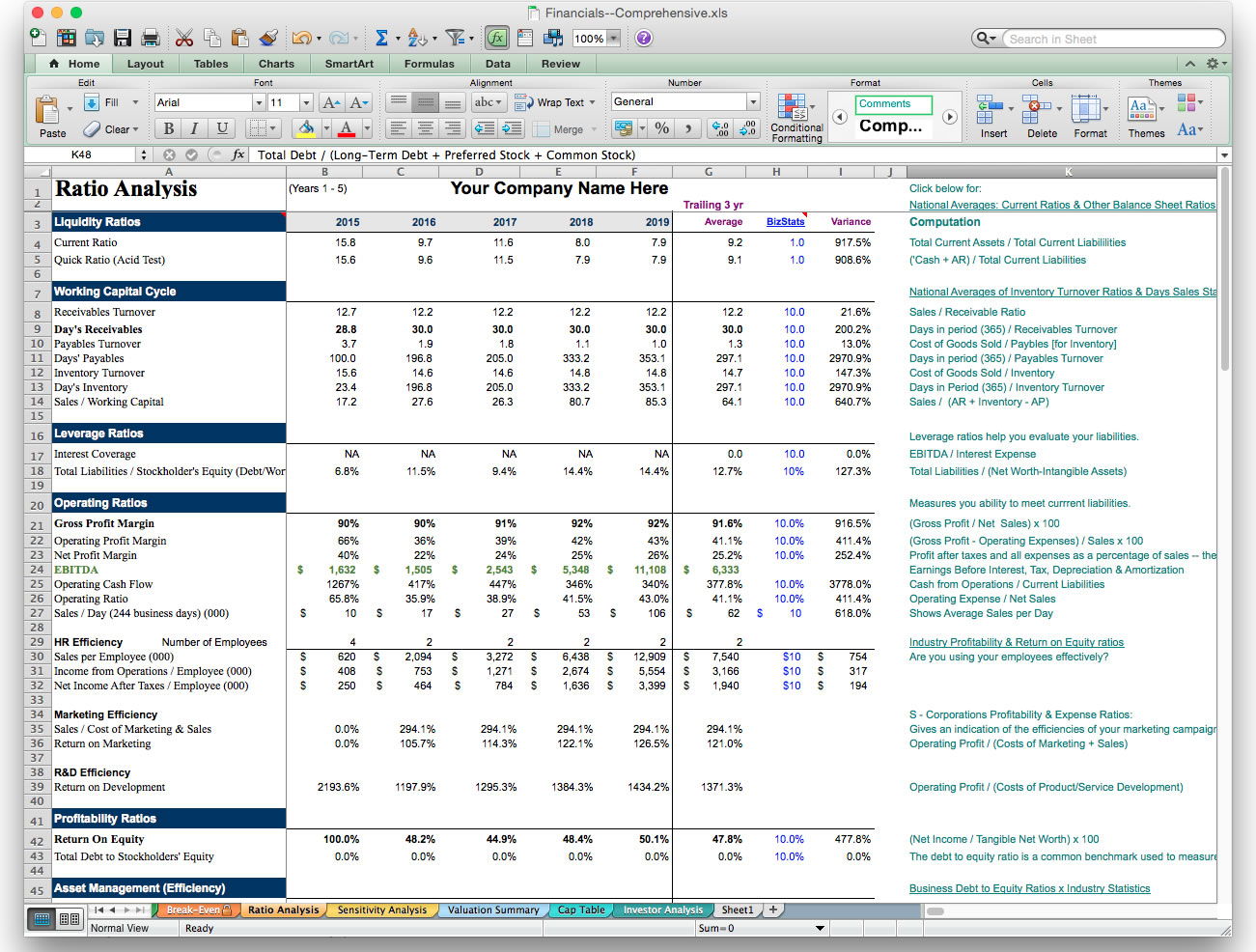

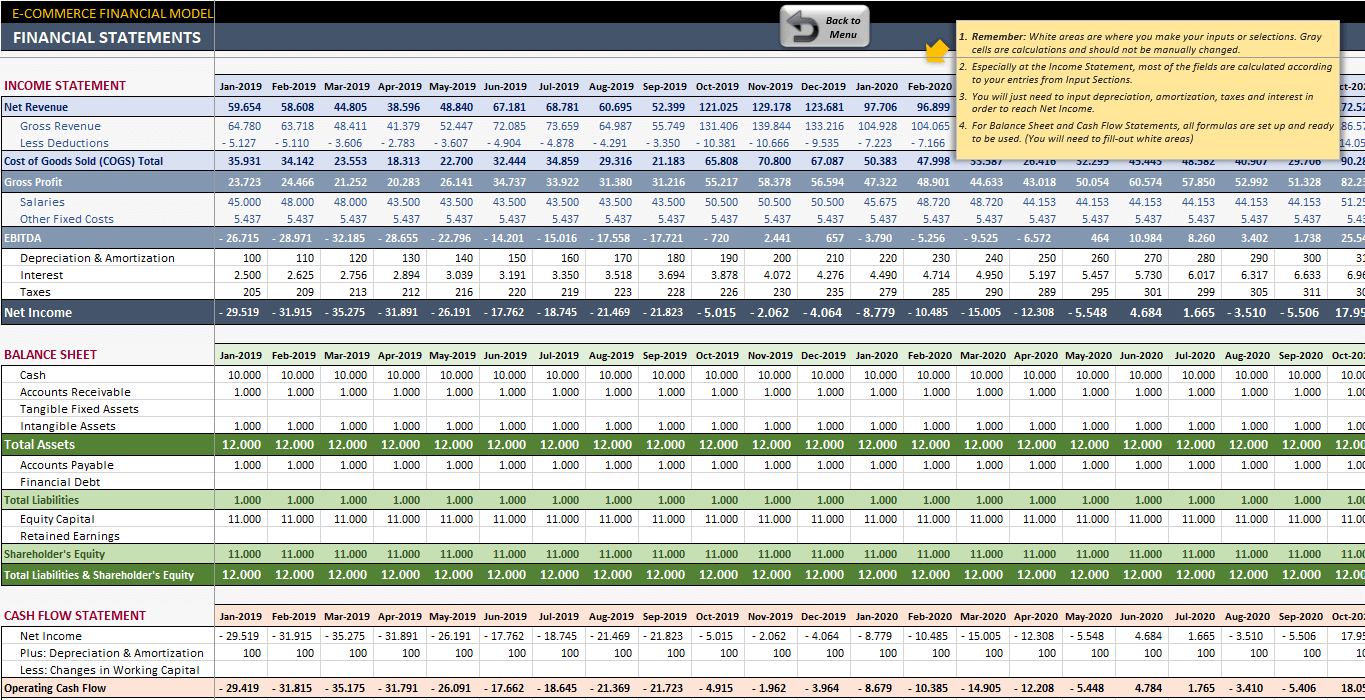

Financial Model Template - Raising capital (debt and/or equity) Below is a preview of the dcf model template: Components of a financial projection template. Nopat is used to make companies more comparable by removing This nopat template shows you how to calculate the net operating profit after tax using the income statement. Internally, businesses may use financial models to make decisions about acquisitions, raising capital, selling assets, budgeting and forecasting, capital allocation, and more. Below is a screenshot of the consolidation model template: This consolidation model template helps you summarize the financial performance of multiple business units into a consolidated model. This financial projection template contains the following sections: Enter your name and email in the form below and download the free template now! The level of complexity can vary widely. Below is a preview of the dcf model template: It’s common to use a single tab model for each company, where the consolidation of company a + company b = merged co. Enter your name and email in the form below and download the free template now! Below is a screenshot of the consolidation model template: Nopat stands for net operating profit after tax and represents a company’s theoretical income from operations of it had no debt (no interest expense). Merger model (m&a) the m&a model is a more advanced model used to evaluate the pro forma accretion/dilution of a merger or acquisition. The model helps you break down the salary, taxes. There are many types of financial models with a wide range of uses. Nopat is used to make companies more comparable by removing Components of a financial projection template. Below is a screenshot of the consolidation model template: This consolidation model template helps you summarize the financial performance of multiple business units into a consolidated model. It’s common to use a single tab model for each company, where the consolidation of company a + company b = merged co. One of the first. Download the consolidation model template. Enter your name and email in the. This nopat template shows you how to calculate the net operating profit after tax using the income statement. Nopat stands for net operating profit after tax and represents a company’s theoretical income from operations of it had no debt (no interest expense). Nopat is used to make companies. This capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net present value (npv), internal rate of return (irr), and payback period. There are many types of financial models with a wide range of uses. This financial projection template contains the following sections: Below is a preview of the template:. Below is a preview of the template: The model helps you break down the salary, taxes. This nopat template shows you how to calculate the net operating profit after tax using the income statement. It’s common to use a single tab model for each company, where the consolidation of company a + company b = merged co. Raising capital (debt. Nopat is used to make companies more comparable by removing Financial models are used to make decisions about: One of the first topics covered in the guide is the importance of thoughtful model design. Enter your name and email in the form below and download the free template now! Download the free dcf model template. Financial model designs and level of detail. Download the free dcf model template. Below is a preview of the dcf model template: Financial models are used to make decisions about: This financial projection template contains the following sections: Financial models are used to make decisions about: Below is a preview of the dcf model template: Nopat stands for net operating profit after tax and represents a company’s theoretical income from operations of it had no debt (no interest expense). What is a financial model used for? Enter your name and email in the. Merger model (m&a) the m&a model is a more advanced model used to evaluate the pro forma accretion/dilution of a merger or acquisition. It’s common to use a single tab model for each company, where the consolidation of company a + company b = merged co. Nopat is used to make companies more comparable by removing This dcf model template. It’s common to use a single tab model for each company, where the consolidation of company a + company b = merged co. Download the free dcf model template. Nopat stands for net operating profit after tax and represents a company’s theoretical income from operations of it had no debt (no interest expense). Merger model (m&a) the m&a model is. This financial projection template contains the following sections: Time invested upfront in the model design process will save considerable effort on the model build and will lead to a better financial model. Components of a financial projection template. The model helps you break down the salary, taxes. Financial model designs and level of detail. Download the dcf model template. Enter your name and email in the. There are many types of financial models with a wide range of uses. Enter your name and email in the form below and download the free template now! Financial models are used to make decisions about: Components of a financial projection template. Nopat stands for net operating profit after tax and represents a company’s theoretical income from operations of it had no debt (no interest expense). Financial model designs and level of detail. What is a financial model used for? Merger model (m&a) the m&a model is a more advanced model used to evaluate the pro forma accretion/dilution of a merger or acquisition. Internally, businesses may use financial models to make decisions about acquisitions, raising capital, selling assets, budgeting and forecasting, capital allocation, and more. One of the first topics covered in the guide is the importance of thoughtful model design. The level of complexity can vary widely. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Below is a preview of the dcf model template: Enter your name and email in the form below and download the free template now!Free Financial Modeling Excel Templates

Excel Financial Model Template

EXCEL of Financial Ratio Analysis Model.xlsx WPS Free Templates

Financial Model Templates Download Over 200 Free Excel Templates

Excel Financial Modeling Templates

Financial Modeling Templates

Financial Modeling Excel Templates

Basic Financial Modeling Template (Excel)

Full Version Financial Model Templates eFinancialModels

Excel Financial Model Template

This Nopat Template Shows You How To Calculate The Net Operating Profit After Tax Using The Income Statement.

It’s Common To Use A Single Tab Model For Each Company, Where The Consolidation Of Company A + Company B = Merged Co.

This Capital Investment Model Template Will Help You Calculate Key Valuation Metrics Of A Capital Investment Including The Cash Flows, Net Present Value (Npv), Internal Rate Of Return (Irr), And Payback Period.

Raising Capital (Debt And/Or Equity)

Related Post: