Donation Receipt Template Free

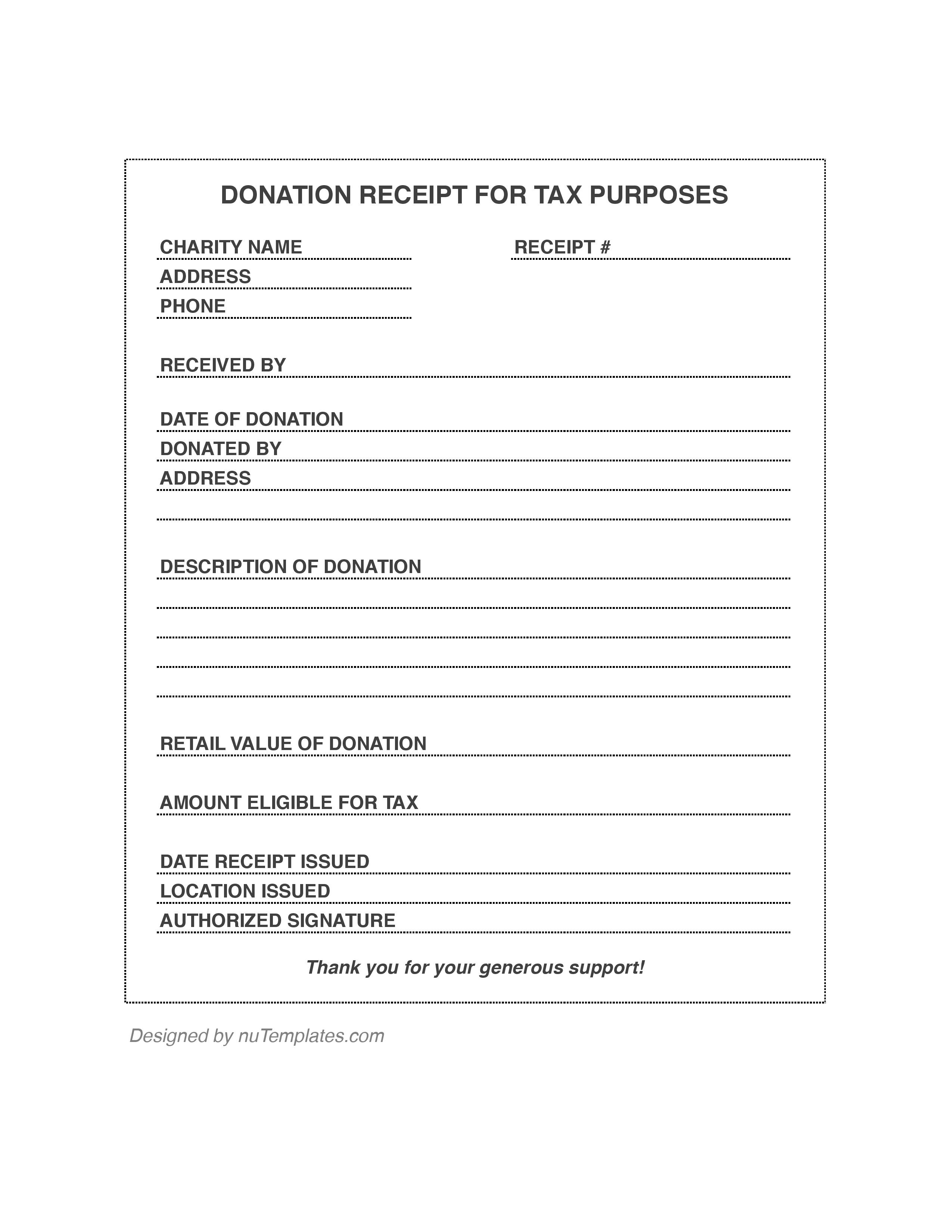

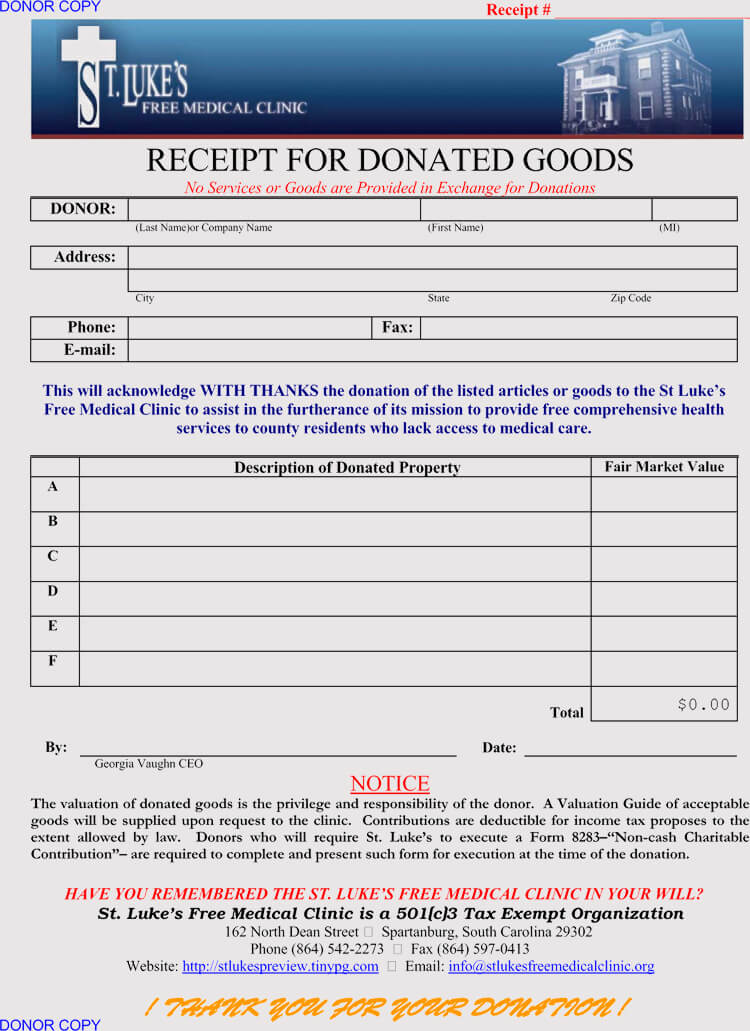

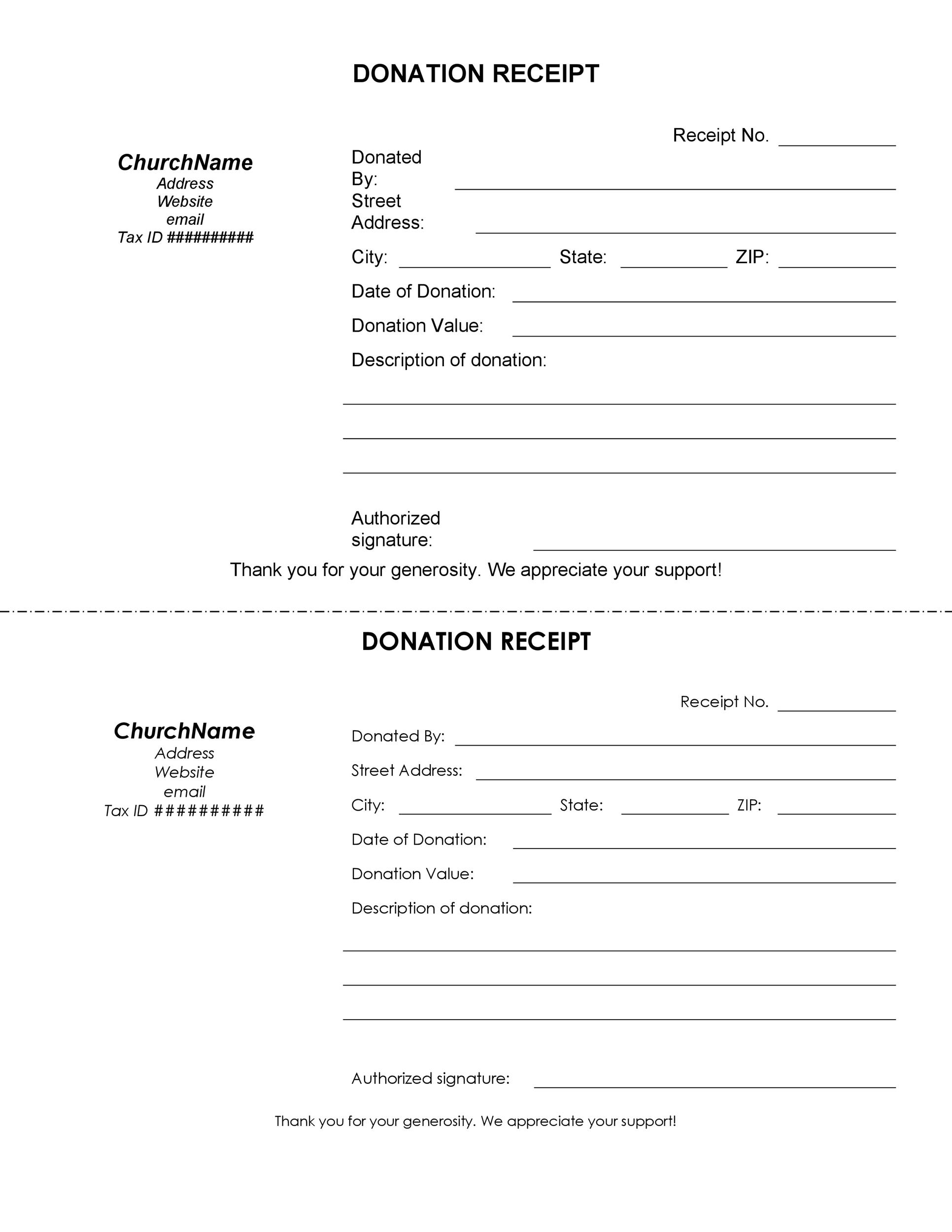

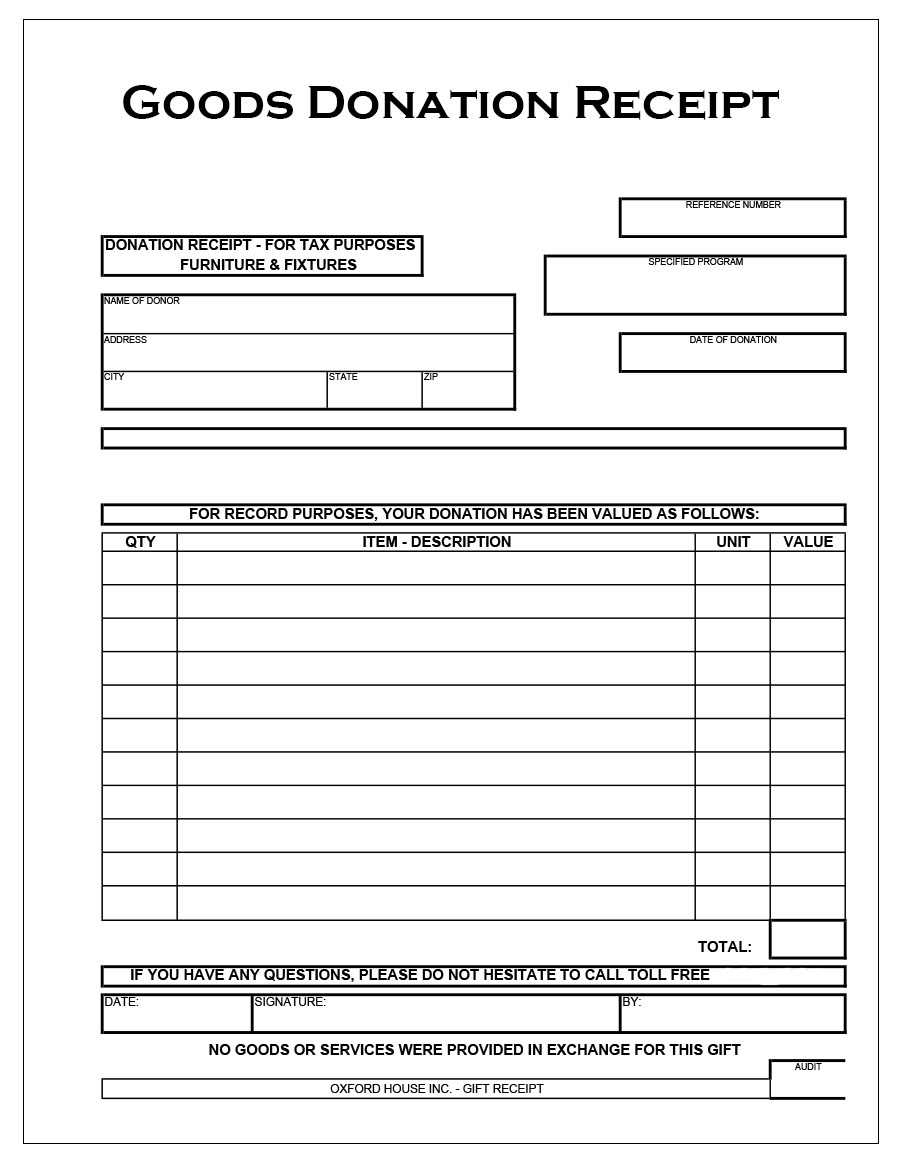

Donation Receipt Template Free - A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A donor is responsible for valuing the donated. A church donation receipt is a record of a charitable donation made to a church. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. This receipt is issued to individuals who have donated cash or. The receipt proves the transaction's authenticity to. The most common place to donate food is a local food pantry. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. A food donation receipt is an itemized list of consumable goods donated to a charity. Primarily, the receipt is used by. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. A donor is responsible for valuing the donated. The receipt proves the transaction's authenticity to. The most common place to donate food is a local food pantry. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. This receipt is issued to individuals who have donated cash or. A church donation receipt is a record of a charitable donation made to a church. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. This receipt is issued to individuals who have donated cash or. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. The receipt proves the transaction's authenticity to. A vehicle donation receipt, also known. A food donation receipt is an itemized list of consumable goods donated to a charity. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. The receipt proves. A food donation receipt is an itemized list of consumable goods donated to a charity. This receipt is issued to individuals who have donated cash or. Primarily, the receipt is used by. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. The receipt proves the transaction's authenticity to. The most common place to donate food is a local food pantry. Primarily, the receipt is used by. A church donation receipt is a record of a charitable donation made to a church. A donor is responsible for valuing the donated. A food donation receipt is an itemized list of consumable goods donated to a charity. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. Primarily, the receipt is used by. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. A cash donation receipt provides written documentation of a cash contribution from a. The receipt proves the transaction's authenticity to. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. A cash donation receipt provides written documentation of a cash contribution from. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. The most common place to donate food is a local food pantry. A church donation receipt is a. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value. A food donation receipt is an itemized list of. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. This receipt is issued to individuals who have donated cash or. The receipt proves the transaction's authenticity to. A church donation receipt is a record of a charitable donation made to a church. A food donation receipt is an itemized list. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. A donor is responsible for valuing the donated. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A food donation receipt is an itemized list. A food donation receipt is an itemized list of consumable goods donated to a charity. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A vehicle donation receipt, also known as a vehicle donation bill of sale, is a formal record that documents the charitable gift of an automobile. A church donation receipt is a record of a charitable donation made to a church. A donor is responsible for valuing the donated. The most common place to donate food is a local food pantry. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. Primarily, the receipt is used by. Donation value thank you ___________________________ [donor’s name] for your contribution of ___________________________ dollars ($__________________) in value.Non Profit Donation Receipt Letter

501c3 Donation Receipt, 501c3 Donation Receipt Template, 501c3 Donation

Free Printable Donation Receipt Template

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Goodwill Donation Receipt Template PDF eForms

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Free Sample Printable Donation Receipt Template Form

501c3 Donation Receipt Template Printable in Pdf, Word

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Printable Donation Receipt AllenZuniga Blog

A Donation Receipt Is Used By Companies And Individuals In Order To Provide Proof That Cash Or Property Was Gifted To An Individual, Business, Or Organization.

This Receipt Is Issued To Individuals Who Have Donated Cash Or.

The Receipt Proves The Transaction's Authenticity To.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)