Donation Letter Tax Deduction Template

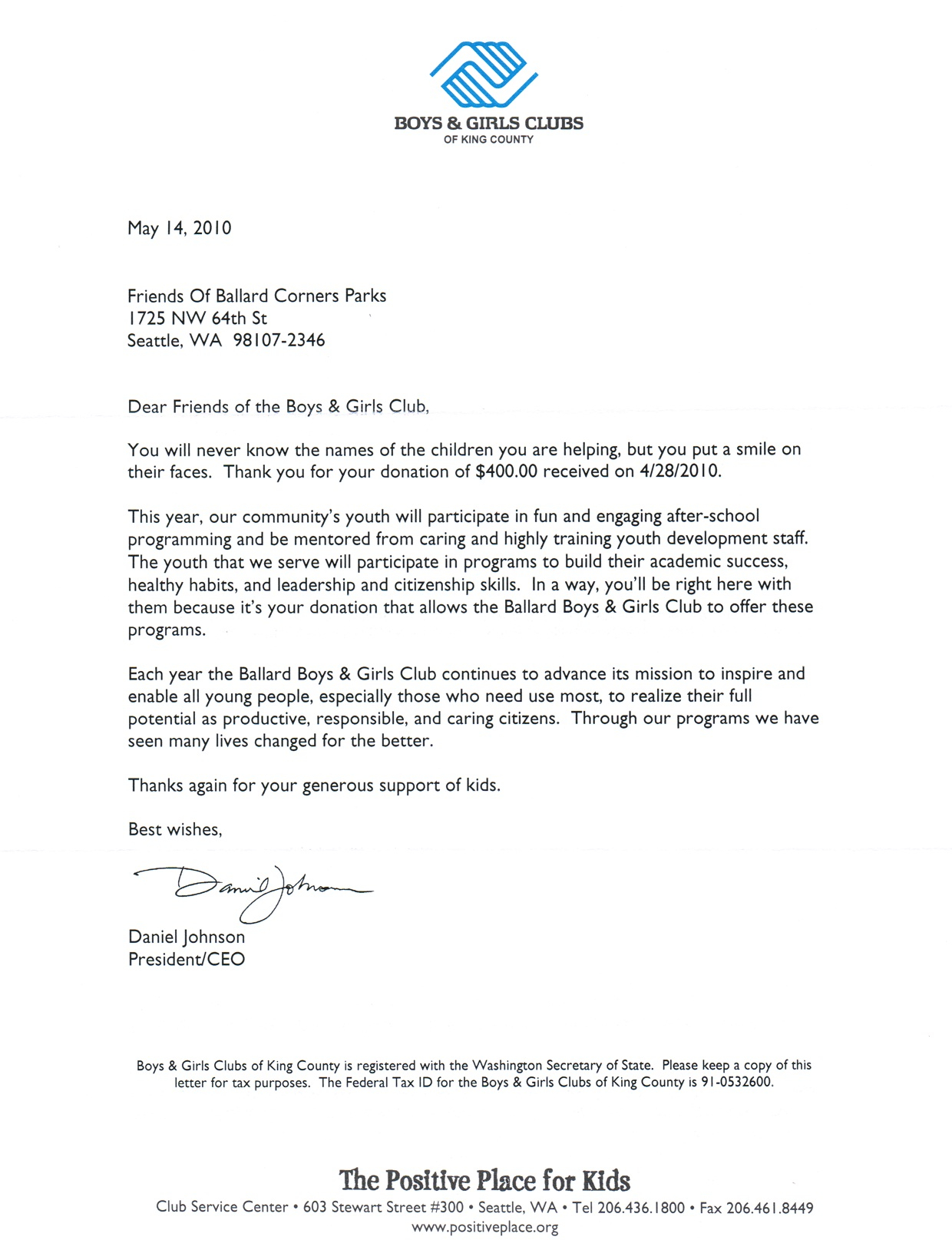

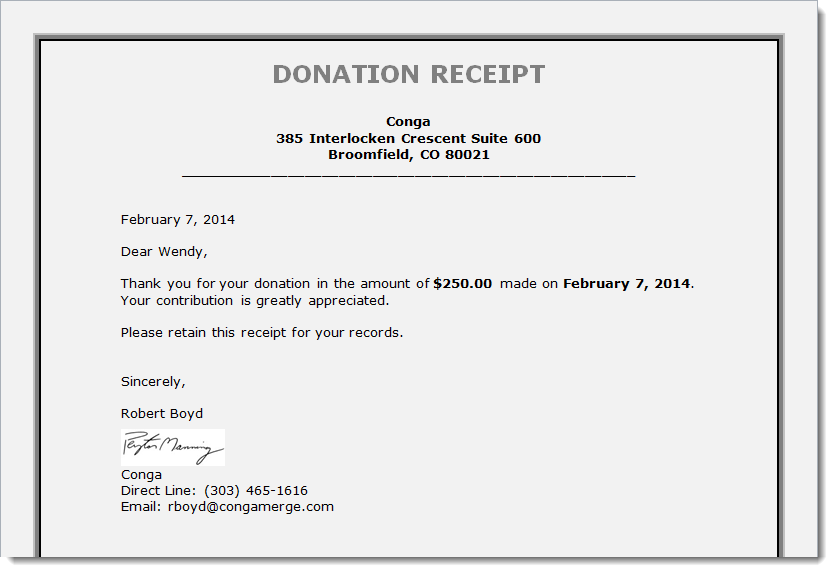

Donation Letter Tax Deduction Template - Refer to the example templates to frame a personalized and professional draft. Download or preview 2 pages of pdf version of sample tax deductible letter to donor (doc: Contents of written acknowledgment required to substantiate deduction. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. 58.7 kb ) for free. How to write a tax deductible donation letter? In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Learn to write tax deductible donation letter in a formally pleasant tone. These letters serve as official documentation for tax purposes,. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. Return to life cycle of a public charity. Refer to the example templates to frame a personalized and professional draft. Learn to write tax deductible donation letter in a formally pleasant tone. As nonprofits are faced with higher. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Contents of written acknowledgment required to substantiate deduction. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Download or preview 2 pages of pdf version of sample tax deductible letter to donor (doc: Contents of written acknowledgment required to substantiate deduction. This customizable document, available for download in ms word and google docs formats,. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. 58.7 kb ) for free. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. 58.7 kb ) for free. Return to life cycle of a public charity. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only. These letters serve as official documentation for tax purposes,. As nonprofits are faced with higher. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. Learn to write tax deductible donation letter in a formally pleasant tone. How to write a. These letters serve as official documentation for tax purposes,. Learn to write tax deductible donation letter in a formally pleasant tone. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. Download this tax deductible donation letter template. These letters serve as official documentation for tax purposes,. Return to life cycle of a public charity. How to write a tax deductible donation letter? Download this tax deductible donation letter template now! As nonprofits are faced with higher. This customizable document, available for download in ms word and google docs formats,. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Refer to the example templates to frame a personalized and professional draft. Understanding how tax deductions work for charitable contributions. Making charitable donations. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. Learn to write tax deductible donation letter in a formally pleasant tone. These letters serve as official documentation for tax purposes,. Return to life cycle of a public. These letters serve as official documentation for tax purposes,. Learn to write tax deductible donation letter in a formally pleasant tone. Contents of written acknowledgment required to substantiate deduction. Return to life cycle of a public charity. Refer to the example templates to frame a personalized and professional draft. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. Contents of written acknowledgment required to substantiate deduction. How to write a tax deductible donation letter? Understanding how tax deductions work for charitable contributions. Return to life cycle of a public charity. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. Making charitable donations. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Download this tax deductible donation letter template now! A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. Contents of written acknowledgment required to substantiate deduction. Understanding how tax deductions work for charitable contributions. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. Learn to write tax deductible donation letter in a formally pleasant tone. Download or preview 2 pages of pdf version of sample tax deductible letter to donor (doc: Refer to the example templates to frame a personalized and professional draft. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. How to write a tax deductible donation letter? This customizable document, available for download in ms word and google docs formats,. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. These letters serve as official documentation for tax purposes,.501c3 Tax Deductible Donation Letter Sample with Examples

Tax Deductible Donation Thank You Letter Template Examples Letter

Tax Deductible Donation Thank You Letter Template Resume Letter

Excellent Tax Donation Receipt Letter Template Authentic Receipt

Donation Letter for Taxes Sample and Examples [Word]

Tax Deductible Donation Thank You Letter Template Examples Letter

501c3 Tax Deductible Donation Letter Template Business

Get Our Printable Tax Deductible Donation Receipt Template Receipt

Editable Tax Deductible Donation Letter Template Pdf Sample in 2021

Donation Letter for Taxes Sample and Examples [Word]

Return To Life Cycle Of A Public Charity.

58.7 Kb ) For Free.

Making Charitable Donations Not Only Helps Worthy Causes But Can Also Provide Significant Tax Benefits.

As Nonprofits Are Faced With Higher.

Related Post:

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1)

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/donation-letter-for-tax-purpose-pdf.jpg?fit=1414%2C1999&ssl=1)