Dependent Care Fsa Receipt Template

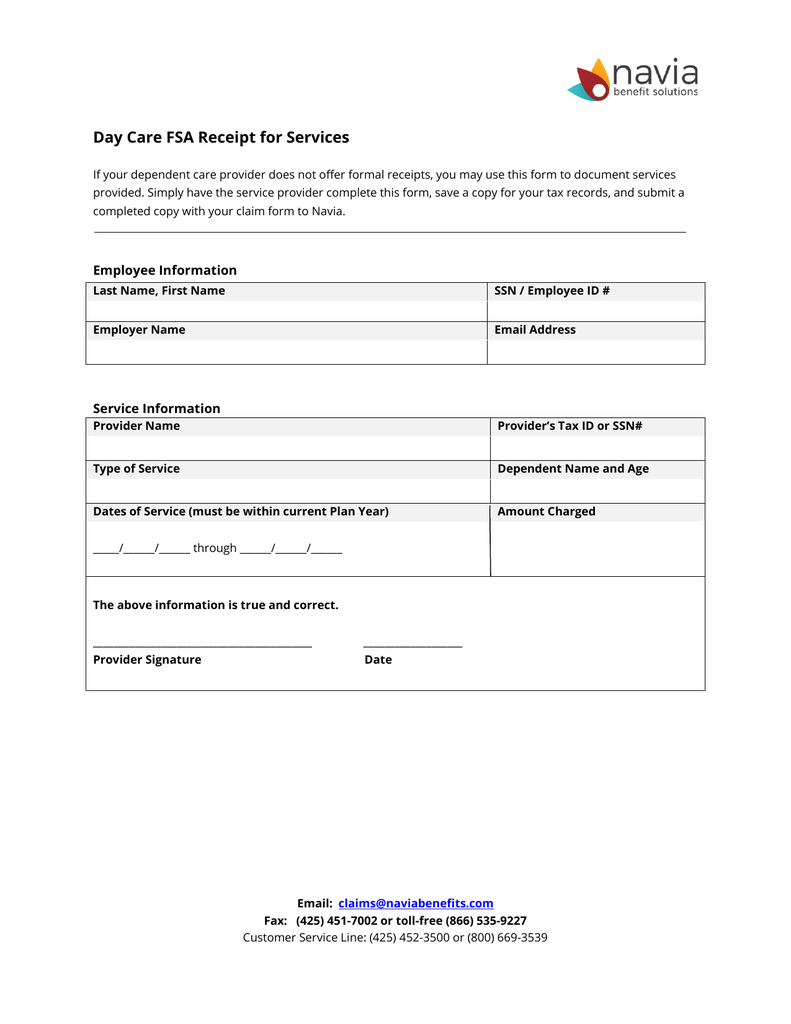

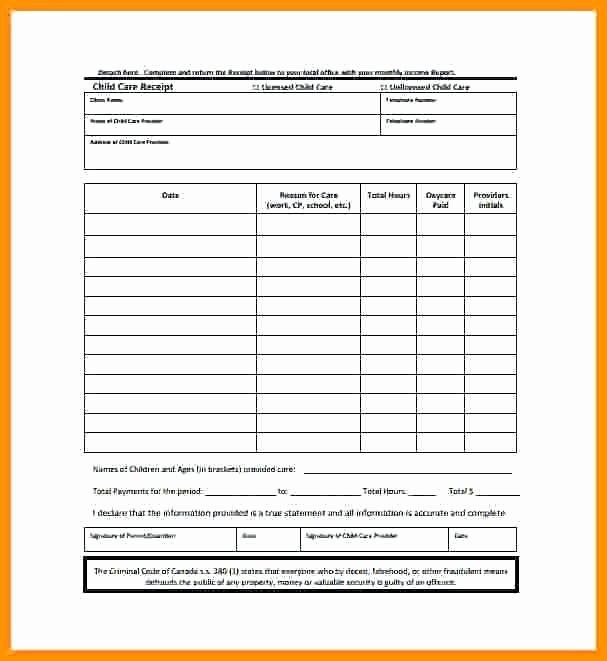

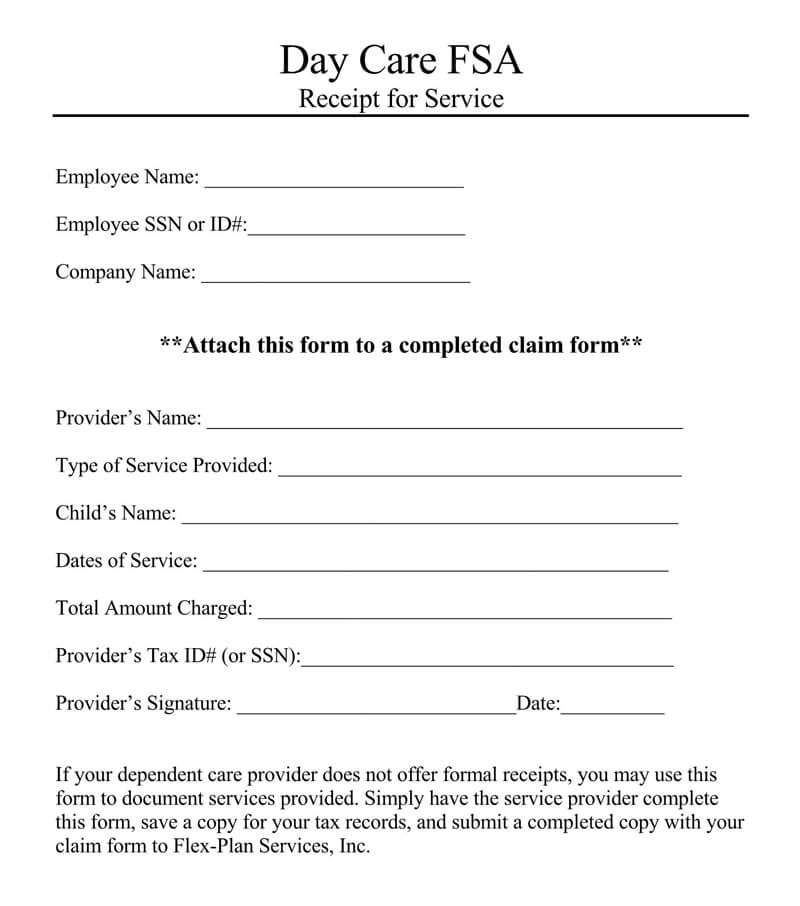

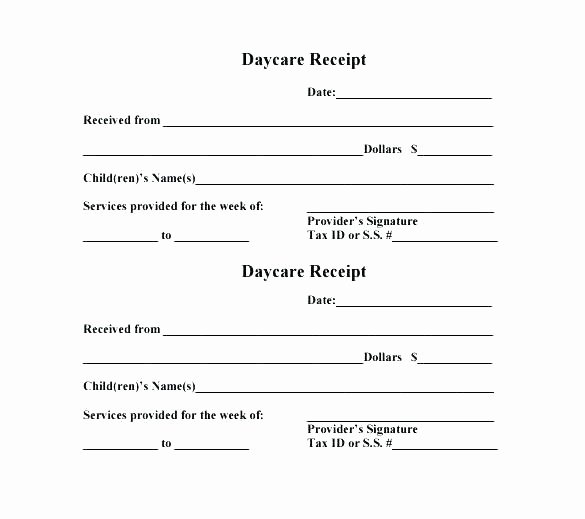

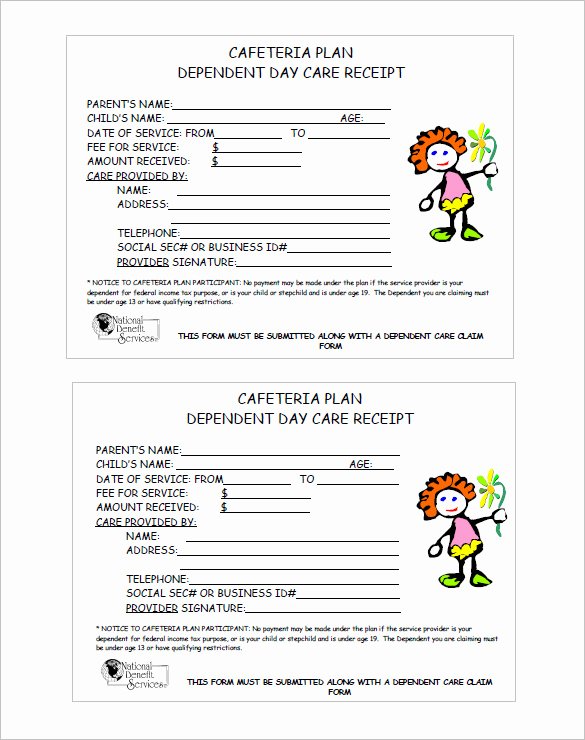

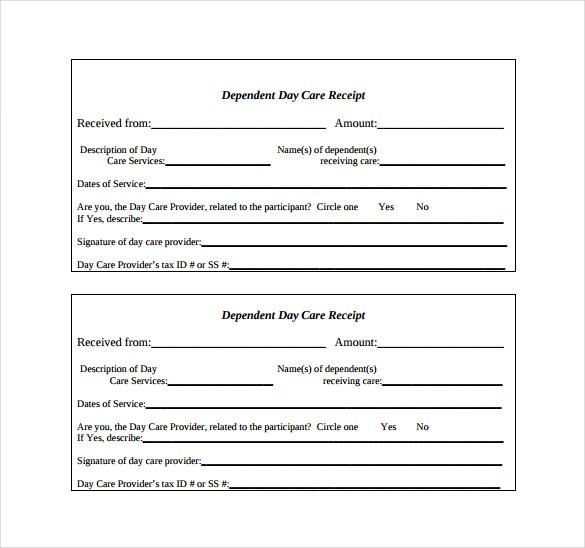

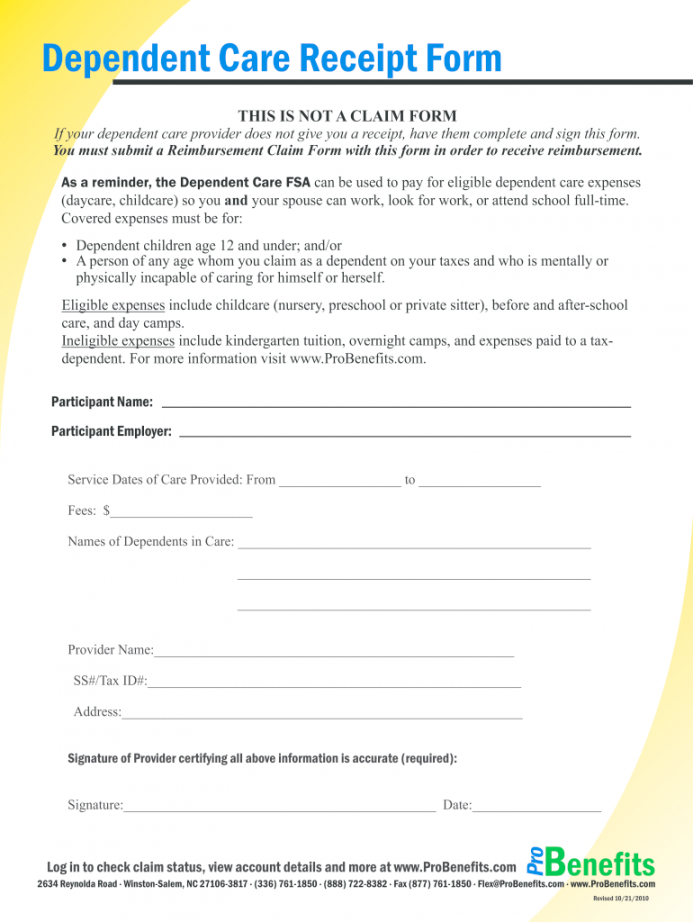

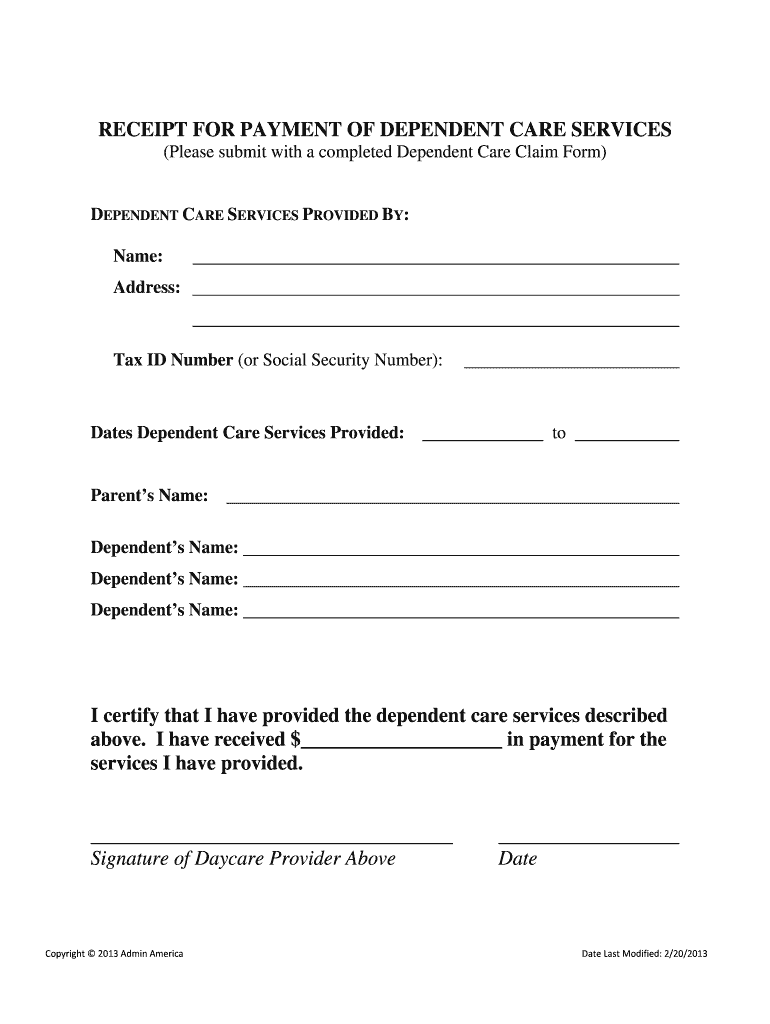

Dependent Care Fsa Receipt Template - Day care fsa receipt for services. Last name, first name ssn / employee id # employer name email address The document is a receipt for payment of dependent care services, requiring details such as the provider's name, address, tax id or social security number, dates of service, and signatures. This documentation is necessary for individuals seeking reimbursement under a. I certify that i have provided the dependent care services described above. The types of medical and dependent day care expenses which the irs allows this plan to reimburse varies. No need to install software, just go to dochub, and sign up instantly and for free. I have received $____________________ in payment for the services i have provided. It certifies that the provider has received payment for the services rendered. In order to complete a dependent care request, you are required to fill up and submit a dependent care receipt form, which are available below and you can easily find these forms from the bottom of this page. I have received $____________________ in payment for the services i have provided. In order to complete a dependent care request, you are required to fill up and submit a dependent care receipt form, which are available below and you can easily find these forms from the bottom of this page. No need to install software, just go to dochub, and sign up instantly and for free. Print the most recent paystub or include your custom payroll report. If you are one of them and don’t have time to take care of your children then a dependent care receipt template can do a lot for you. This documentation is necessary for individuals seeking reimbursement under a. Please use this form as that receipt by completing the provider information section and signing below. The irs requires that proof of service (a receipt) be provided by the care provider. I certify that i have provided the dependent care services described above. Please refer to your plan’s summary plan description (spd) for specific rules regarding eligible and ineligible expenses. I certify that i have provided the dependent care services described above. The types of medical and dependent day care expenses which the irs allows this plan to reimburse varies. Covered expenses must be for: Submit the form and payroll information to your fsa provider. The irs requires that proof of service (a receipt) be provided by the care provider. Submit the form and payroll information to your fsa provider. It certifies that the provider has received payment for the services rendered. Please refer to your plan’s summary plan description (spd) for specific rules regarding eligible and ineligible expenses. In order to complete a dependent care request, you are required to fill up and submit a dependent care receipt form,. Simply have the service provider complete this form and save a copy for your tax records. I have received $____________________ in payment for the services i have provided. This documentation is necessary for individuals seeking reimbursement under a. Day care fsa receipt for services. In order to complete a dependent care request, you are required to fill up and submit. Edit, sign, and share dependent care receipt template online. The types of medical and dependent day care expenses which the irs allows this plan to reimburse varies. The document is a receipt for payment of dependent care services, requiring details such as the provider's name, address, tax id or social security number, dates of service, and signatures. I certify that. If you are one of them and don’t have time to take care of your children then a dependent care receipt template can do a lot for you. The document is a receipt for payment of dependent care services, requiring details such as the provider's name, address, tax id or social security number, dates of service, and signatures. I certify. In order to complete a dependent care request, you are required to fill up and submit a dependent care receipt form, which are available below and you can easily find these forms from the bottom of this page. I certify that i have provided the dependent care services described above. I have received $____________________ in payment for the services i. It certifies that the provider has received payment for the services rendered. Day care fsa receipt for services. If your dependent care provider does not offer formal receipts, you may use this form to document services provided. Submit the form and payroll information to your fsa provider. Please refer to your plan’s summary plan description (spd) for specific rules regarding. Covered expenses must be for: Edit, sign, and share dependent care receipt template online. Day care fsa receipt for services. The irs requires that proof of service (a receipt) be provided by the care provider. I certify that i have provided the dependent care services described above. If your dependent care provider does not offer formal receipts, you may use this form to document services provided. Last name, first name ssn / employee id # employer name email address Covered expenses must be for: Submit the form and payroll information to your fsa provider. It certifies that the provider has received payment for the services rendered. Please refer to your plan’s summary plan description (spd) for specific rules regarding eligible and ineligible expenses. Please use this form as that receipt by completing the provider information section and signing below. The irs requires that proof of service (a receipt) be provided by the care provider. Covered expenses must be for: Last name, first name ssn / employee. I certify that i have provided the dependent care services described above. Submit the form and payroll information to your fsa provider. The document is a receipt for payment of dependent care services, requiring details such as the provider's name, address, tax id or social security number, dates of service, and signatures. The types of medical and dependent day care expenses which the irs allows this plan to reimburse varies. Last name, first name ssn / employee id # employer name email address If your dependent care provider does not offer formal receipts, you may use this form to document services provided. No need to install software, just go to dochub, and sign up instantly and for free. The irs requires that proof of service (a receipt) be provided by the care provider. Print the most recent paystub or include your custom payroll report. If you are one of them and don’t have time to take care of your children then a dependent care receipt template can do a lot for you. In order to complete a dependent care request, you are required to fill up and submit a dependent care receipt form, which are available below and you can easily find these forms from the bottom of this page. Covered expenses must be for: Please use this form as that receipt by completing the provider information section and signing below. Please refer to your plan’s summary plan description (spd) for specific rules regarding eligible and ineligible expenses. It certifies that the provider has received payment for the services rendered. Day care fsa receipt for services.Fsa Dependent Care Receipt Template

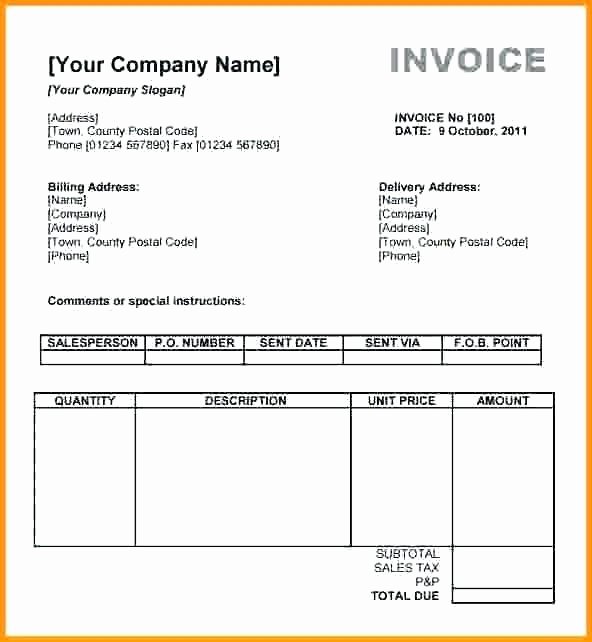

Dependent Care Fsa Receipt Template

Dependent Care Fsa Receipt Template

Dependent Care Fsa Nanny Receipt Template

Dependent Care Fsa Nanny Receipt Template

Dependent Care Fsa Receipt Template

Dependent Care Fsa Babysitter Receipt Template

Printable Dependent Care Fsa Nanny Receipt Template Fill Online

Free 9+ Daycare Receipt Examples & Samples In Pdf Doc Dependent Care

Fsa Receipt Template 2020 Fill and Sign Printable Template Online

Edit, Sign, And Share Dependent Care Receipt Template Online.

I Have Received $____________________ In Payment For The Services I Have Provided.

Simply Have The Service Provider Complete This Form And Save A Copy For Your Tax Records.

The Dependent Care Receipt Form Is Used By Individuals To Document Payments Made For Dependent Care Services.

Related Post: