Debt Template Google Sheets

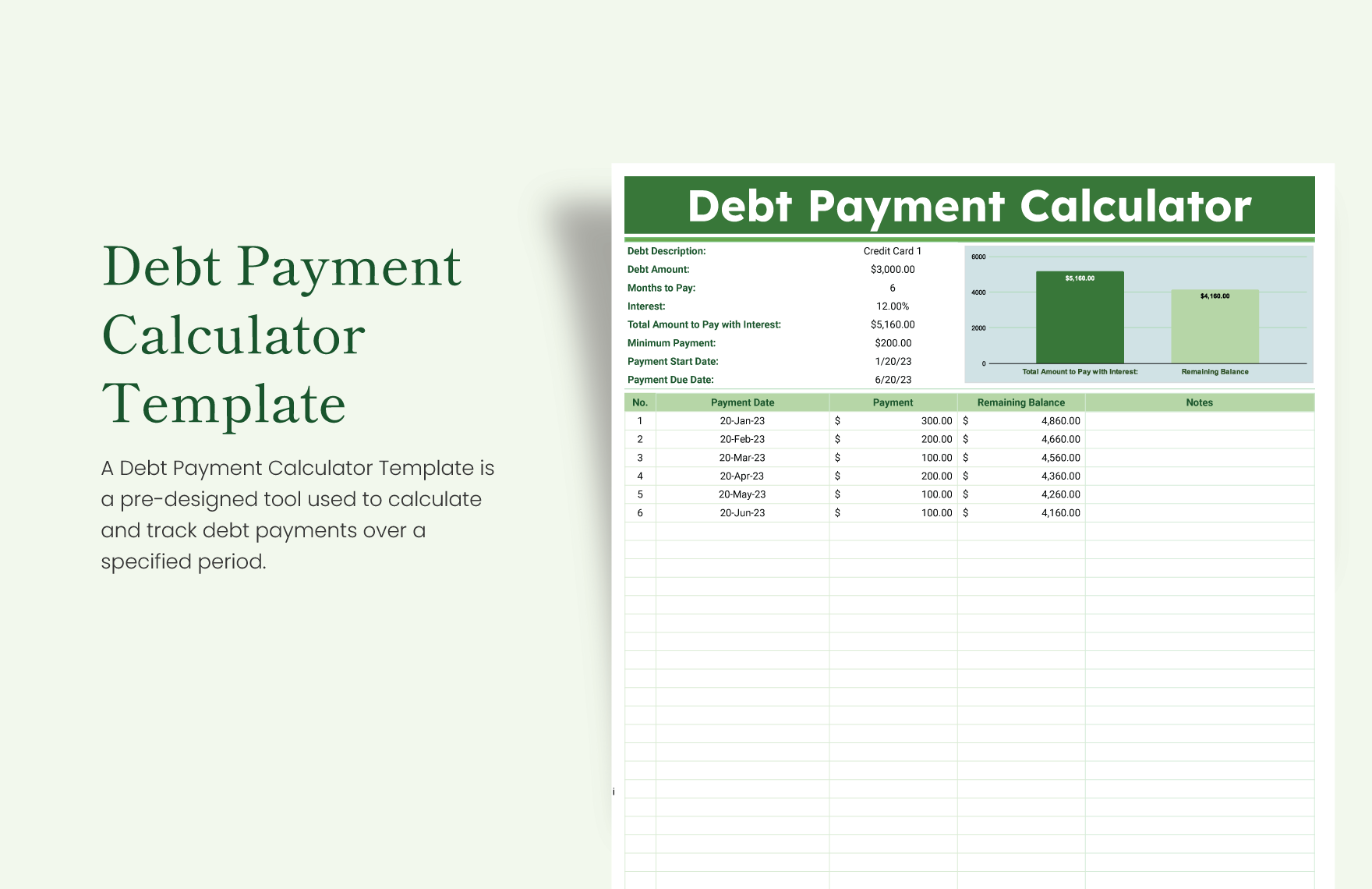

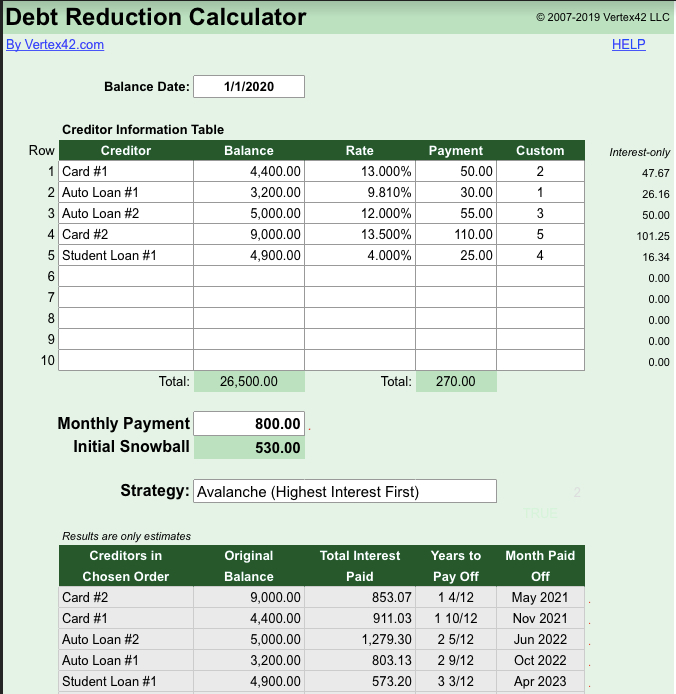

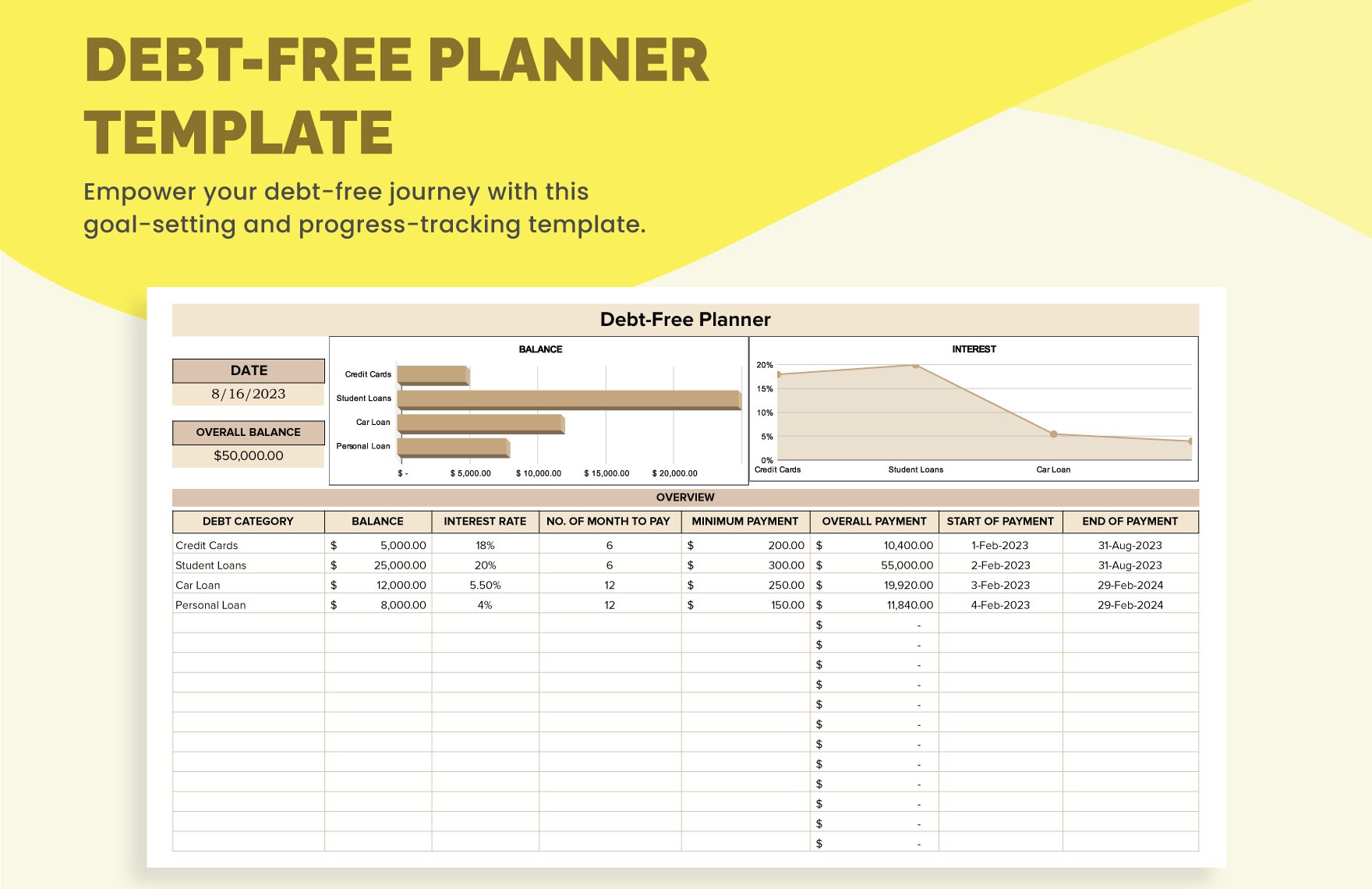

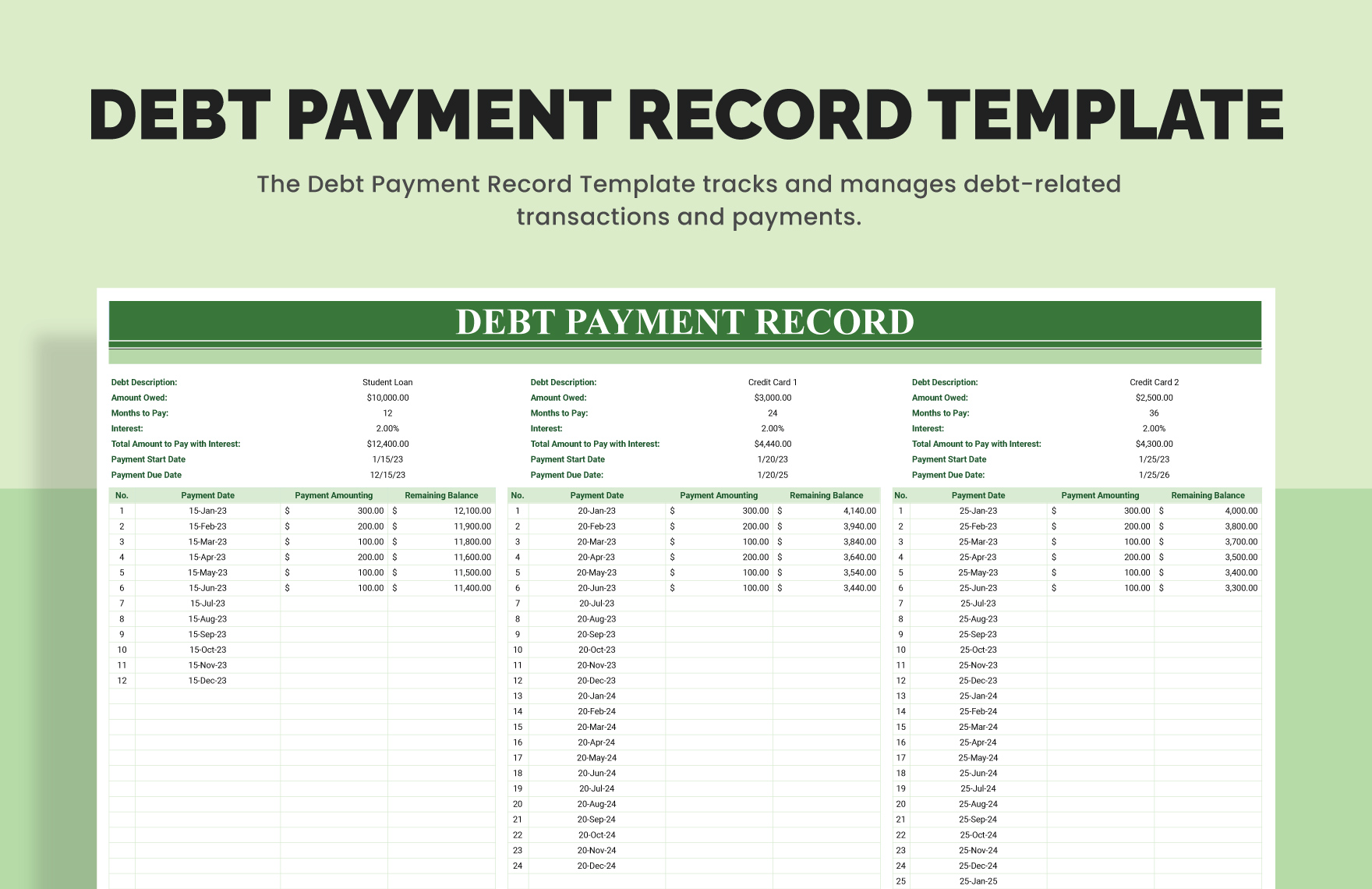

Debt Template Google Sheets - Use our spreadsheets for debt tracking and payoff to simplify your financial planning. 6.5 months *apply extra $ here to pay off faster (e.g., debt) on the balance sheet are. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. Beautifully designed, easily editable templates to get your work done faster & smarter. For beginners, we will also provide you. Before we start filling in numbers, let's get the basics in place. Anyone on the internet can find and access. Columns and rows have been professionally designed so that you only. Whether you’re dealing with student loans, credit card. This google sheets annual budget template helps businesses and individuals effectively plan and track their yearly finances. The template automatically sorts your debts, calculates your monthly payments, and rolls payments over as you eliminate each debt. Designed to help you analyze your debt and create an effective payoff plan, this template is perfect for anyone looking to get out of debt faster and save money on interest payments. Create a simple debt reduction template in google sheets to track payments, manage finances, and stay on top of your debt repayment goals easily. Simply browse, search, save & download our easy to use templates. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Setting up your google sheet. Anyone on the internet can find and access. This debt snowball template by google sheets is designed for beginners, keeping ease of use in mind. Columns and rows have been professionally designed so that you only. Get a free balance sheet template for excel & google sheets. Before we start filling in numbers, let's get the basics in place. Columns and rows have been professionally designed so that you only. This debt snowball template by google sheets is designed for beginners, keeping ease of use in mind. Use the debt payoff calculator for google sheets to. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Use snowball, avalanche, or whatever payoff strategy works best for you. Anyone can use it without. It provides a structured way to estimate. Get a free balance sheet template for excel & google sheets. Create a named range by selecting cells and entering the desired name into the text box. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. This debt snowball template by google sheets is designed for beginners, keeping ease of use in mind. 6.5 months *apply extra $ here to pay off faster Beautifully designed, easily. Designed to help you analyze your debt and create an effective payoff plan, this template is perfect for anyone looking to get out of debt faster and save money on interest payments. 6.5 months *apply extra $ here to pay off faster Accessed by screen readers for. Explore professionally designed debt spreadsheet templates that are free, customizable, and printable. This. The template automatically sorts your debts, calculates your monthly payments, and rolls payments over as you eliminate each debt. It comes with two quickly interpretable tables. This debt snowball template by google sheets is designed for beginners, keeping ease of use in mind. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you. Learn what to include and how to use it to simplify your financial reporting. Download this template today so you can get. Whether you’re dealing with student loans, credit card. Designed to help you analyze your debt and create an effective payoff plan, this template is perfect for anyone looking to get out of debt faster and save money on. Use the debt payoff calculator for google sheets to plan the best debt payment strategy for the fastest payoff based on your current financial situation. Use snowball, avalanche, or whatever payoff strategy works best for you. Get a free balance sheet template for excel & google sheets. It provides a structured way to estimate. Anyone can use it without. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. Whether you’re dealing with student loans, credit card. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. For beginners, we will also provide you. Learn what to include and how to use it. Before we start filling in numbers, let's get the basics in place. Anyone on the internet can find and access. Columns and rows have been professionally designed so that you only. Setting up your google sheet. Learn what to include and how to use it to simplify your financial reporting. Before we start filling in numbers, let's get the basics in place. Whether you’re dealing with student loans, credit card. Simply browse, search, save & download our easy to use templates. This google sheets annual budget template helps businesses and individuals effectively plan and track their yearly finances. (e.g., debt) on the balance sheet are. This debt snowball template by google sheets is designed for beginners, keeping ease of use in mind. Use the debt payoff calculator for google sheets to plan the best debt payment strategy for the fastest payoff based on your current financial situation. Designed to help you analyze your debt and create an effective payoff plan, this template is perfect for anyone looking to get out of debt faster and save money on interest payments. (e.g., debt) on the balance sheet are. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Simply browse, search, save & download our easy to use templates. Explore professionally designed debt spreadsheet templates that are free, customizable, and printable. 6.5 months *apply extra $ here to pay off faster Get free google sheets debt payoff templates and debt snowball calculators! Before we start filling in numbers, let's get the basics in place. Beautifully designed, easily editable templates to get your work done faster & smarter. It provides a structured way to estimate. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Learn what to include and how to use it to simplify your financial reporting. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. Whether you’re dealing with student loans, credit card.Debt Payment Calculator Template in Excel, Google Sheets Download

Best Free Google Sheets Budget Templates (and How to Use Them!)

Debt Payoff Tracker Template in Excel, Google Sheets Download

DebtFree Planner Template in Excel, Google Sheets Download

Debt Payment Record Template in Excel, Google Sheets Download

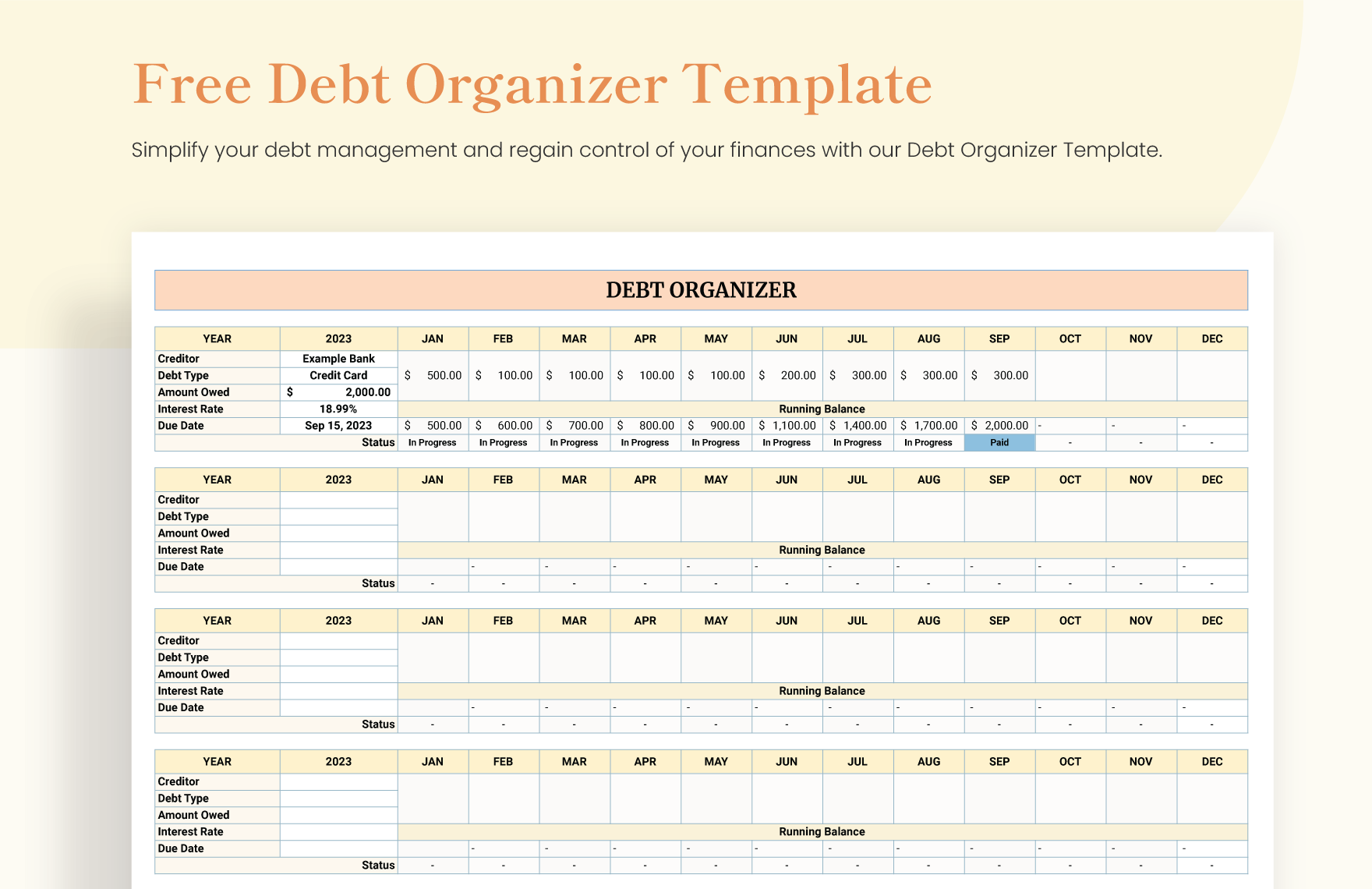

Free Debt Spreadsheet Templates, Editable and Printable

Simple Debt Schedule Template in Excel, Google Sheets Download

Google Sheets Debt Payoff Template

Debt Tracker Template in Excel, Google Sheets Download

Google Sheets Debt Payoff Template Debt Snowball Spreadsheet Etsy

Anyone On The Internet Can Find And Access.

Debt Repayment Plans Templates Are Useful And Practical When You Need To Deal With Data And Tables In Daily Work.

The Template Automatically Sorts Your Debts, Calculates Your Monthly Payments, And Rolls Payments Over As You Eliminate Each Debt.

Use Snowball, Avalanche, Or Whatever Payoff Strategy Works Best For You.

Related Post: