Debt Summons Answer Template

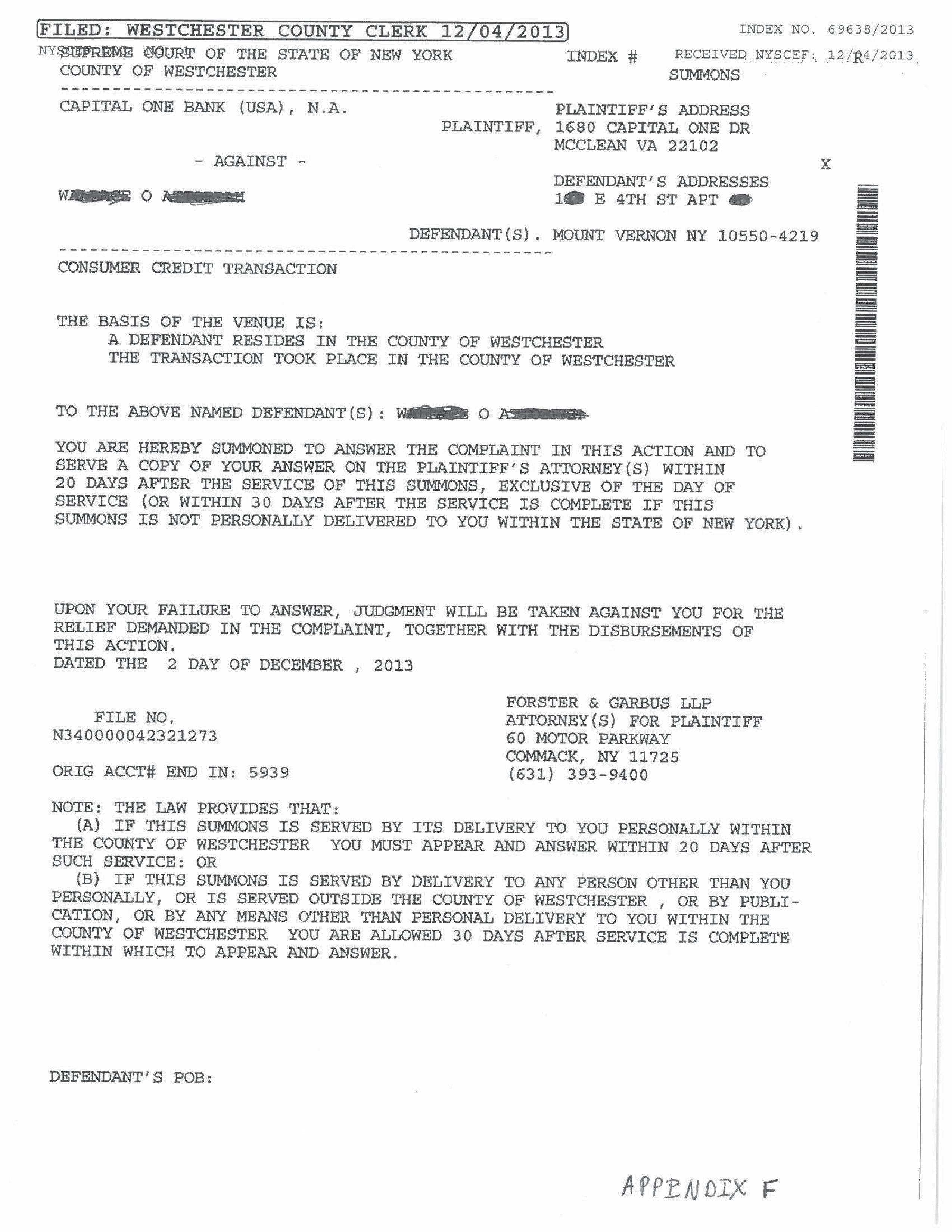

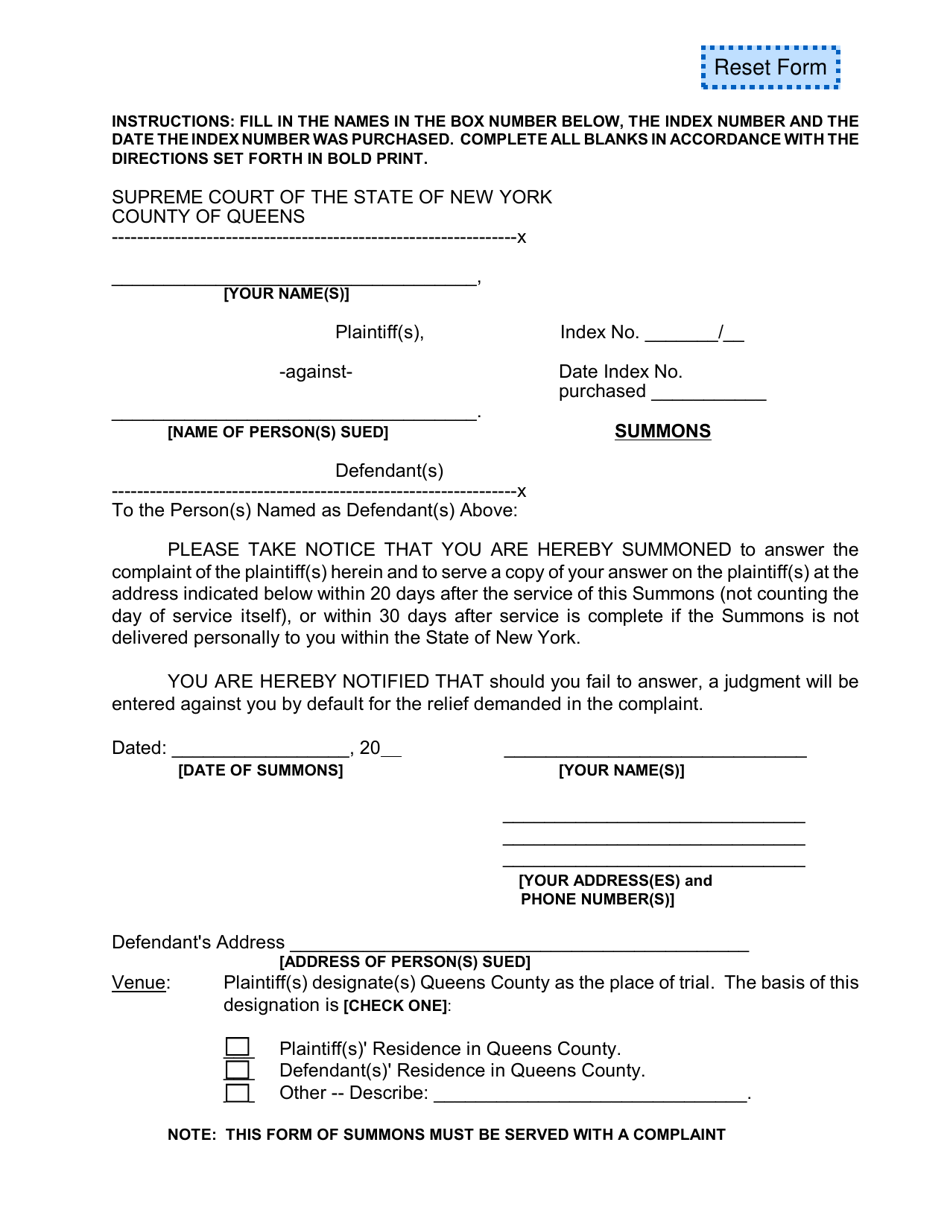

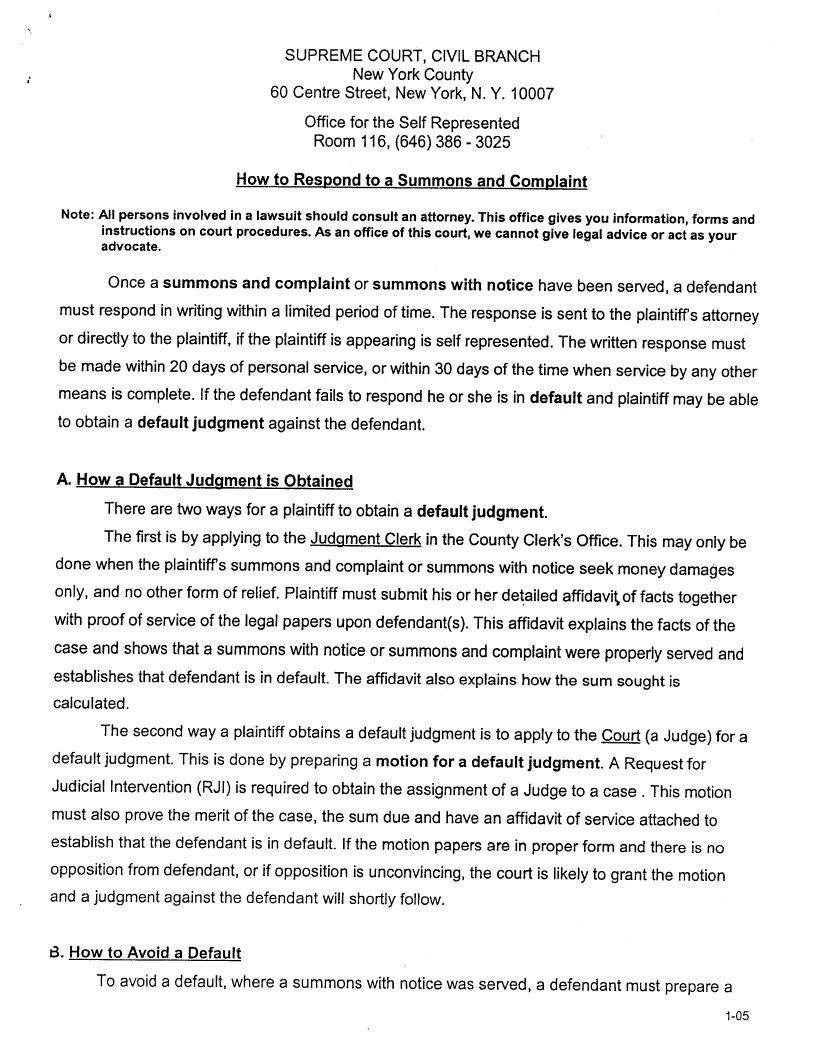

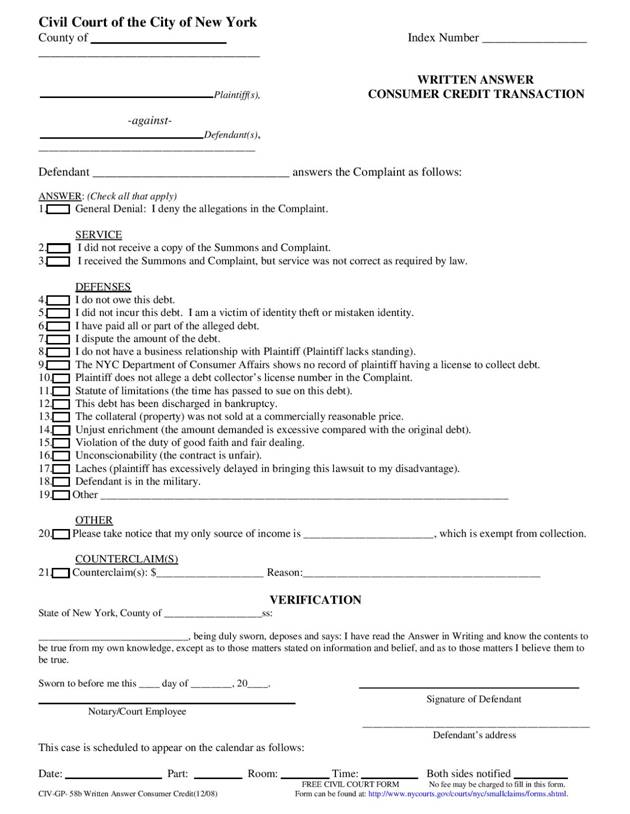

Debt Summons Answer Template - Here's a sample answer to a summons for a credit card debt lawsuit. It is the defendant’s formal response to each allegation in the complaint. The summons contains information about who is suing you, why, and for how. To fill out this form, start by providing your personal details at the beginning. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. Get the legal answers you need from licensed attorneys. I paid off $______________ more on the debt than the plaintiff says. Use the right affirmative defenses when you file your response and you can win in court. When you receive a summons, you are being sued for defaulting on the money you borrowed. One common method is to file an answer. How do i fill this out? To fill out this form, start by providing your personal details at the beginning. One common method is to file an answer. We want to help you win your debt collection lawsuit, not pay money that you don't owe, and protect your wages from garnishment. A complaint is a written statement that. It’s important to respond to (or answer) the lawsuit. In this article, we will. Up to $40 cash back sample answer to a summons for credit card is a formal legal response provided by a defendant who has been served with a summons regarding a credit card debt. Responding to a debt summons is a critical step in resolving your debts. Get the legal answers you need from licensed attorneys. A summons is an official notice that you have been sued. The summons contains information about who is suing you, why, and for how. How do i fill this out? I am being sued by debt collector and i need to write a response letter. When you receive a summons, you are being sued for defaulting on the money you. Up to $40 cash back sample answer to a summons for credit card is a formal legal response provided by a defendant who has been served with a summons regarding a credit card debt. File it with the court and attorney by the deadline. Use this file to formally submit your response in a legal proceeding. One common method is. I owe the money but cannot afford to pay. Get the legal answers you need from licensed attorneys. Up to $40 cash back as soon as the transaction is through, you can get the template sample answer to summons for credit card debt, fill it out, print it, and send or mail it to the. You have 30 days from. Responding to a debt summons is a critical step in resolving your debts. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. The summons contains information about who is suing you, why, and for how. When you receive a summons, you are being sued for defaulting on. I paid off $______________ more on the debt than the plaintiff says. The summons contains information about who is suing you, why, and for how. A complaint is a written statement that. Use the right affirmative defenses when you file your response and you can win in court. Learn how to prepare an 'answer' document as a response to a. One common method is to file an answer. I owe the money but cannot afford to pay. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. I paid off $______________ more on the debt than the plaintiff says. My bankruptcy case number is: Here's a sample answer to a summons for a credit card debt lawsuit. Use the right affirmative defenses when you file your response and you can win in court. To fill out this form, start by providing your personal details at the beginning. How do i fill this out? I owe the money but cannot afford to pay. Use the right affirmative defenses when you file your response and you can win in court. This guide provides information about filing an answer to a breach of contract case. Up to $40 cash back sample answer to a summons for credit card is a formal legal response provided by a defendant who has been served with a summons regarding. A complaint is a written statement that. I am being sued by debt collector and i need to write a response letter. A summons is an official notice that you have been sued. If you have been sued for a debt, the lawsuit typically starts with a summons and complaint. We want to help you win your debt collection lawsuit,. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. Up to $40 cash back a debt lawsuit answer template for summons serves as a helpful guide in organizing and responding to the allegations made against you. Office and the clerk will provide an answer form for you. Up to $40 cash back. That's why we put together this guide for how. Office and the clerk will provide an answer form for you. I paid off $______________ more on the debt than the plaintiff says. The summons contains information about who is suing you, why, and for how. My bankruptcy case number is: It is the defendant’s formal response to each allegation in the complaint. File it with the court and attorney by the deadline. Use this file to formally submit your response in a legal proceeding. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. One common method is to file an answer. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. Up to $40 cash back as soon as the transaction is through, you can get the template sample answer to summons for credit card debt, fill it out, print it, and send or mail it to the. I owe the money but cannot afford to pay. Most of the time you will tell the clerk which defenses you want to asser. I do not owe any money at all. An answer must follow a structured format that complies with procedural rules.Template Sample Answer To Summons For Credit Card Debt

Debt Collection Summons Response Template

Summons Answer Template

Responding To A Summons For Debt Collection

Sample Answer To Debt Summons

Summons Answer Template

Debt Summons Answer Template

Summons answer template Fill out & sign online DocHub

Sample Letter To Respond To A Summons

Summons Response Letter Template

In This Article, We Will.

We Want To Help You Win Your Debt Collection Lawsuit, Not Pay Money That You Don't Owe, And Protect Your Wages From Garnishment.

When You Receive A Summons, You Are Being Sued For Defaulting On The Money You Borrowed.

To Fill Out This Form, Start By Providing Your Personal Details At The Beginning.

Related Post: