Credit Card Statement Template Word

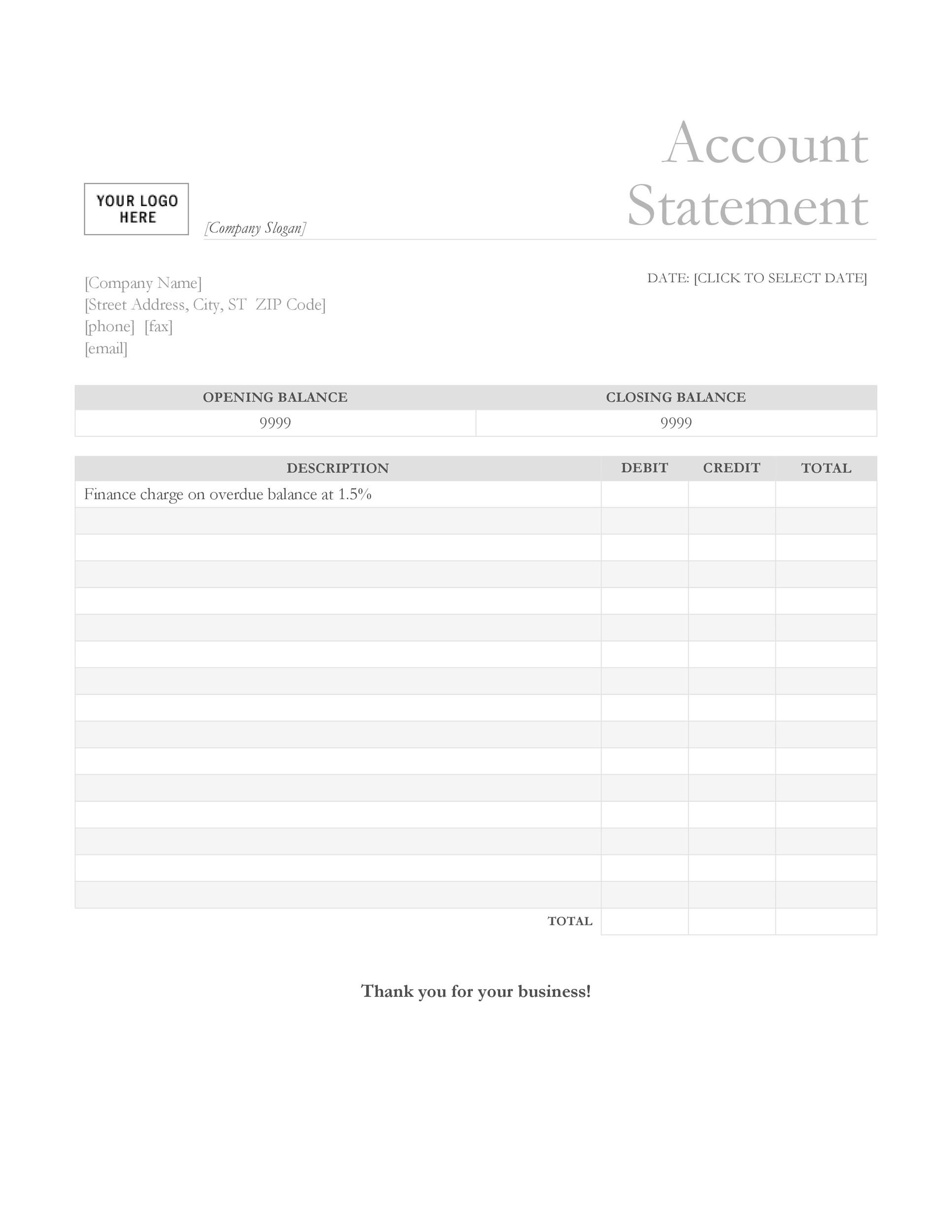

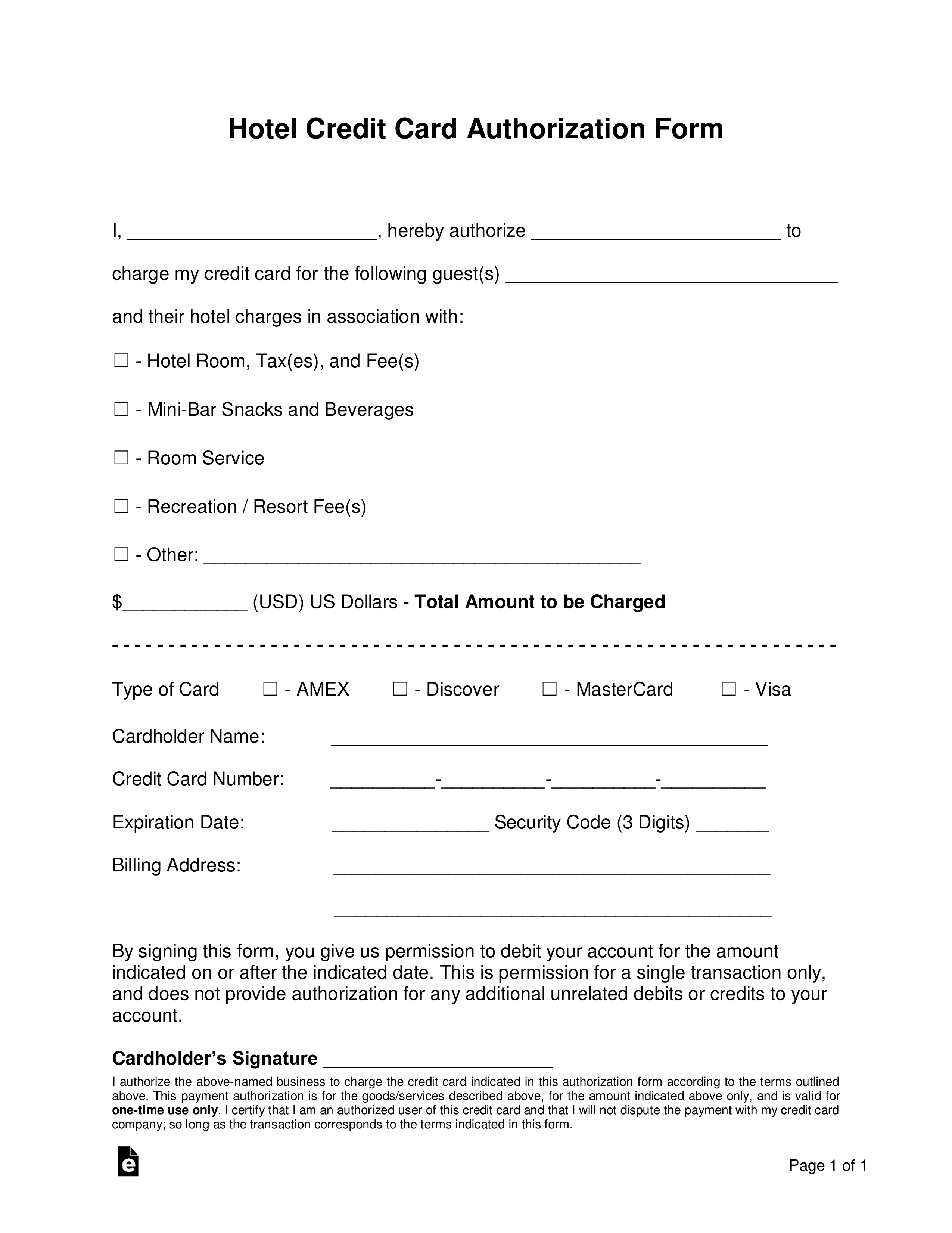

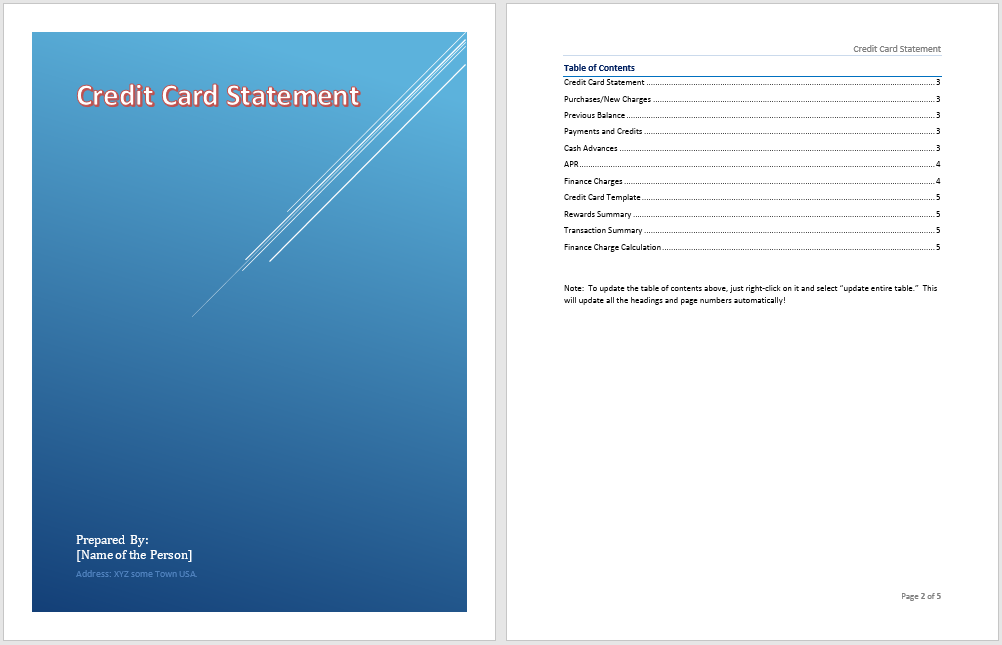

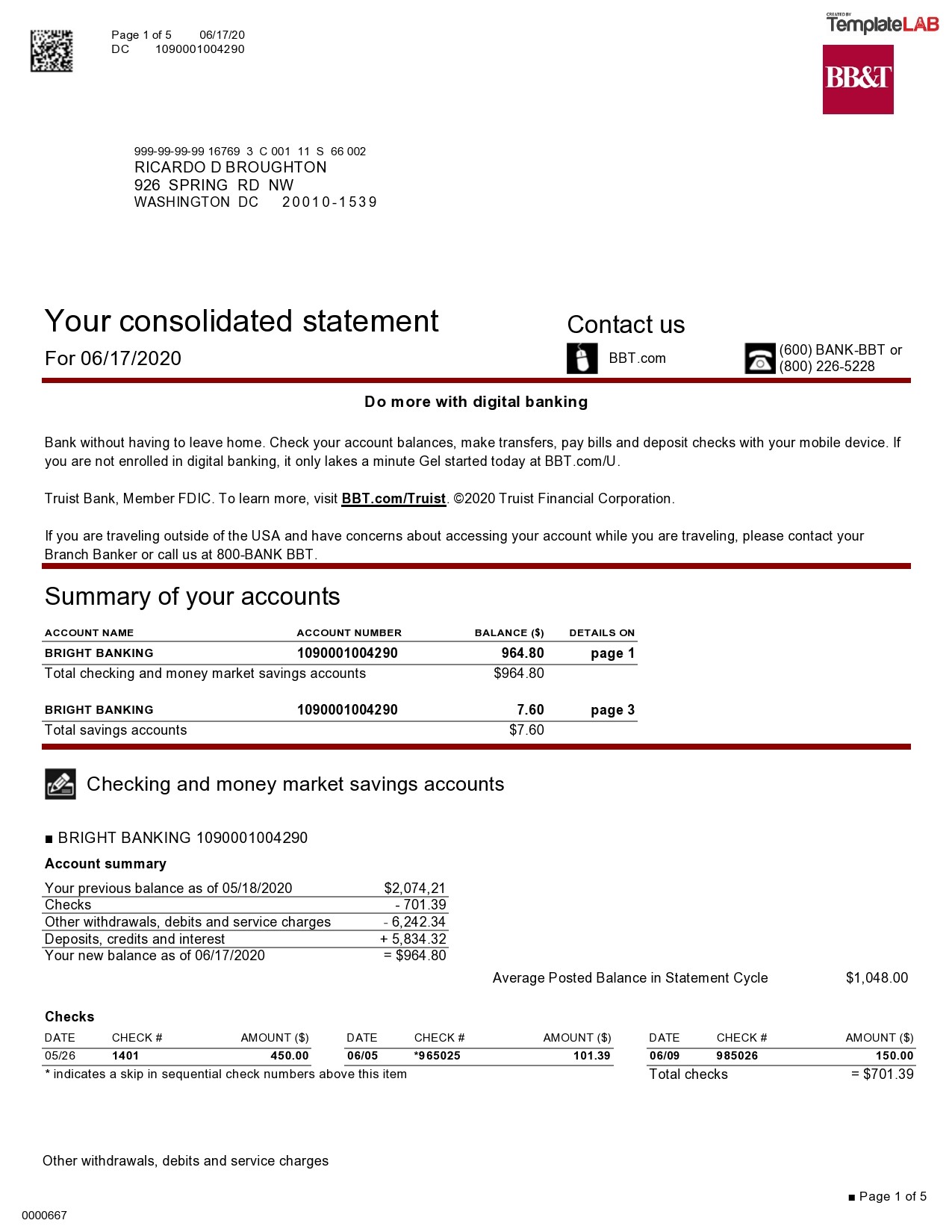

Credit Card Statement Template Word - __ i haven’t used the account for quite some time and don’t plan to use it in the future. Read the question aloud and allow students to share their responses. I understand that my information will be saved to file for future transactions on my account. The first form covers client authorizations, either to pay a current invoice or to authorize future scheduled payments. To charge my credit card or bank account below for $_____ on the (amount) _____ of each _____. Compliance with visa’s requirements does not imply compliance with any relevant state laws. You authorize regularly scheduled charges to your credit card. I am writing this letter to close my credit card account for the following reason: If all measures to obtain a required missing receipt have been exhausted, this declaration of missing receipt should. An affidavit must be completed for each missing detailed receipt. Read the question aloud and allow students to share their responses. Explains that you cannot go to court, have a jury trial or 11arbitration initiate or participate in a class action if you have a dispute with us. 1) summary of account activity. Write the correct responses on the whiteboard 3. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. I, _____, authorize_____ to charge the credit card detailed above for agreed upon payments of $_____ on a recurring basis on the _____(day) of each week/month. To do so, you can add a credit card authorization form to your intake paperwork. Credit cards may be requested for prospective cardholders by written request (credit card request form) to the treasurer. Balance over the credit access line : I acknowledge that my information will be kept on file for future transactions. I, _______________________________, authorize __________________________________ to charge my credit card above for agreed upon purchases. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Write the following question on the whiteboard: __ i got a credit card with a lower interest rate. A receipt for each payment will be. Annual percentage rate (apr) 19.80%. A receipt for each payment will be provided to you and the charge will appear on your credit card or bank statement. § 1113 or 35 u.s.c. What is a credit card statement? Of your credit card statement. The charge is in error because [explain the problem briefly. I’m not carrying a balance on this account. If all measures to obtain a required missing receipt have been exhausted, this declaration of missing receipt should. A receipt for each payment will be provided to you and the charge will appear on your credit card statement. You will be charged. If all measures to obtain a required missing receipt have been exhausted, this declaration of missing receipt should. For lost or stolen card, call: Write the following question on the whiteboard: I, _____, authorize_____ to charge the credit card detailed above for agreed upon payments of $_____ on a recurring basis on the _____(day) of each week/month. Credit card agreement. Compliance with visa’s requirements does not imply compliance with any relevant state laws. This agreement applies to the visa and/or mastercard credit card and credit devices issued to you by tib the independent bankersbank, n.a., georgia branch, although the name on your card may be that of a different financial institution. If all measures to obtain a required missing receipt. Attached are two sample authorization forms to help you get started. Credit card agreement & disclosure statement. What is a credit card statement? Detailed receipts must be retained and attached to the credit card statements. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. (day) (week, month, or year ) this payment is for _____. Credit card expense report template. An affidavit must be completed for each missing detailed receipt. I, _____, authorize_____ to charge the credit card detailed above for agreed upon payments of $_____ on a recurring basis on the _____(day) of each week/month. Balance over the credit access line : __ i haven’t used the account for quite some time and don’t plan to use it in the future. What is a credit card statement? Write the correct responses on the whiteboard 3. 1) summary of account activity. 1234 main street, anytown, usa. I’m not carrying a balance on this account. __ i got a credit card with a lower interest rate. You will be charged the amount indicated below each billing period. You will be charged the amount indicated below to your credit card each billing period. Read the question aloud and allow students to share their responses. Balance over the credit access line : A receipt for each payment will be provided to you and the charge will appear on your credit card or bank statement. You will be charged the amount indicated below each billing period. I, _______________________________, authorize __________________________________ to charge my credit card above for agreed upon purchases. Read the question aloud and allow. Original receipts are required for reimbursement of all expenses with the exception of per diems and gratuitous accommodation. __ i got a credit card with a lower interest rate. You authorize regularly scheduled charges to your credit card. I, _______________________________, authorize __________________________________ to charge my credit card above for agreed upon purchases. Attached are two sample authorization forms to help you get started. Annual percentage rate (apr) 19.80%. I, _____, authorize_____ to charge the credit card detailed above for agreed upon payments of $_____ on a recurring basis on the _____(day) of each week/month. This collection of information is required by 15 u.s.c. For lost or stolen card, call: Detailed receipts must be retained and attached to the credit card statements. What is a credit card statement? Balance over the credit access line : Explain to students a credit card statement is a summary of how the cardholder has used their credit card for a certain period of time (billing. Credit card statements show you how you’ve used your credit card for a billing period. You will be charged the amount indicated below each billing period. To charge my credit card or bank account below for $_____ on the (amount) _____ of each _____.28 Credit Card Statement Template Robertbathurst in 2020 Credit

USA Discover bank credit card statement template in Word and PDF format

USA USAA bank Credit card statement template in Word and PDF format by

USA TD bank credit card statement template in Word and PDF format katempl

Detail Credit Card Statement Template Word Koleksi Nomer 11

Philippines Rizal Commercial Banking Corporation (RCBC) credit card

Credit Card Statement Template Word

Credit Card Statement Template My Word Templates

Credit Card Statement Template Word

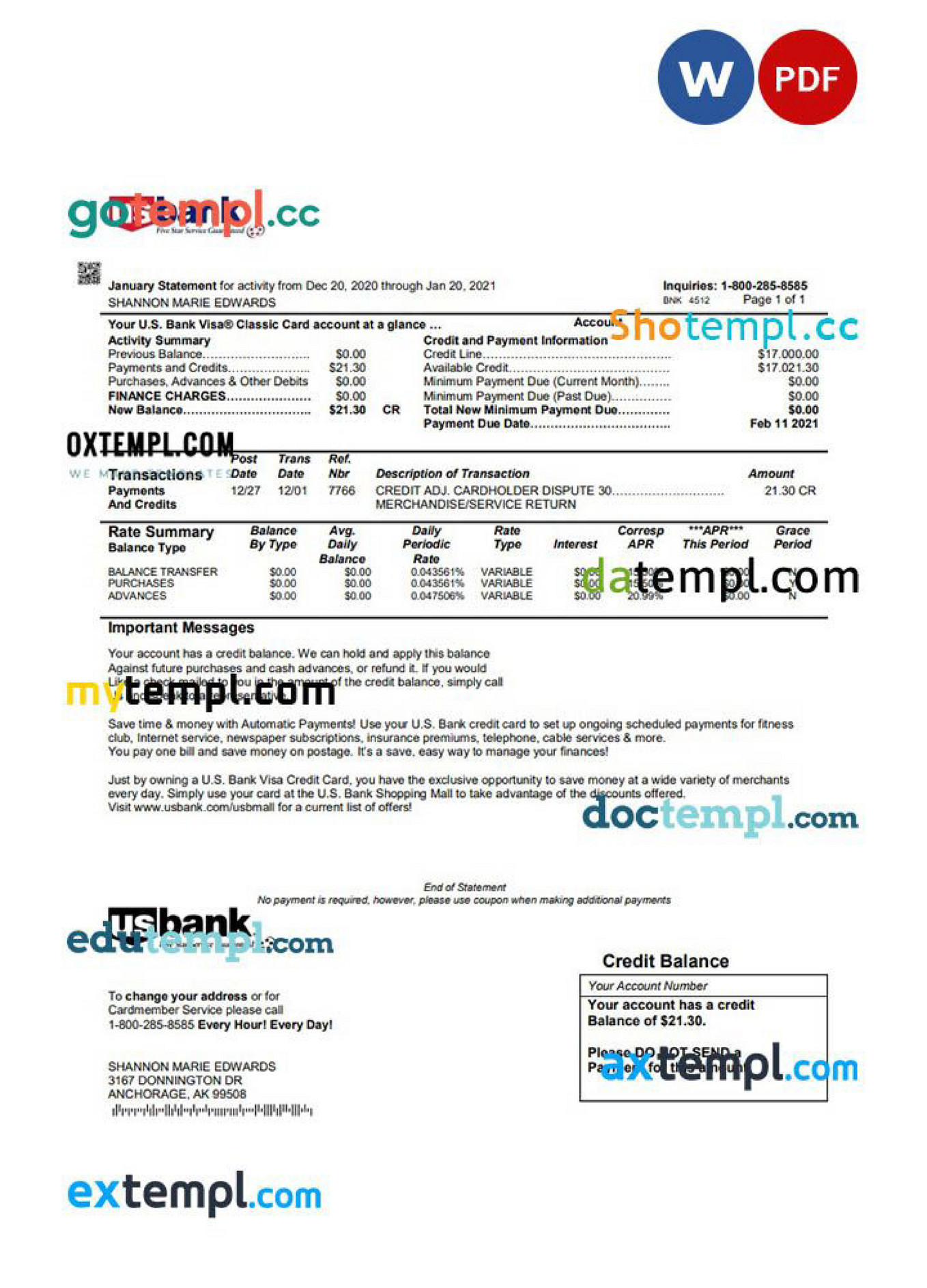

Doctempl USA U.S. bank credit card statement template in Word and PDF

Total (Should Match Statement) * Remember To Attach Receipts * Disclaimer.

1) Summary Of Account Activity.

Understanding What’s On A Credit Card Statement Can Help You Pay Your Bills On Time, Pay The Appropriate Amount, And Use Your Credit Card As A Tool To Manage Your Money.

Compliance With Visa’s Requirements Does Not Imply Compliance With Any Relevant State Laws.

Related Post: