Credit Card Payment Template Excel

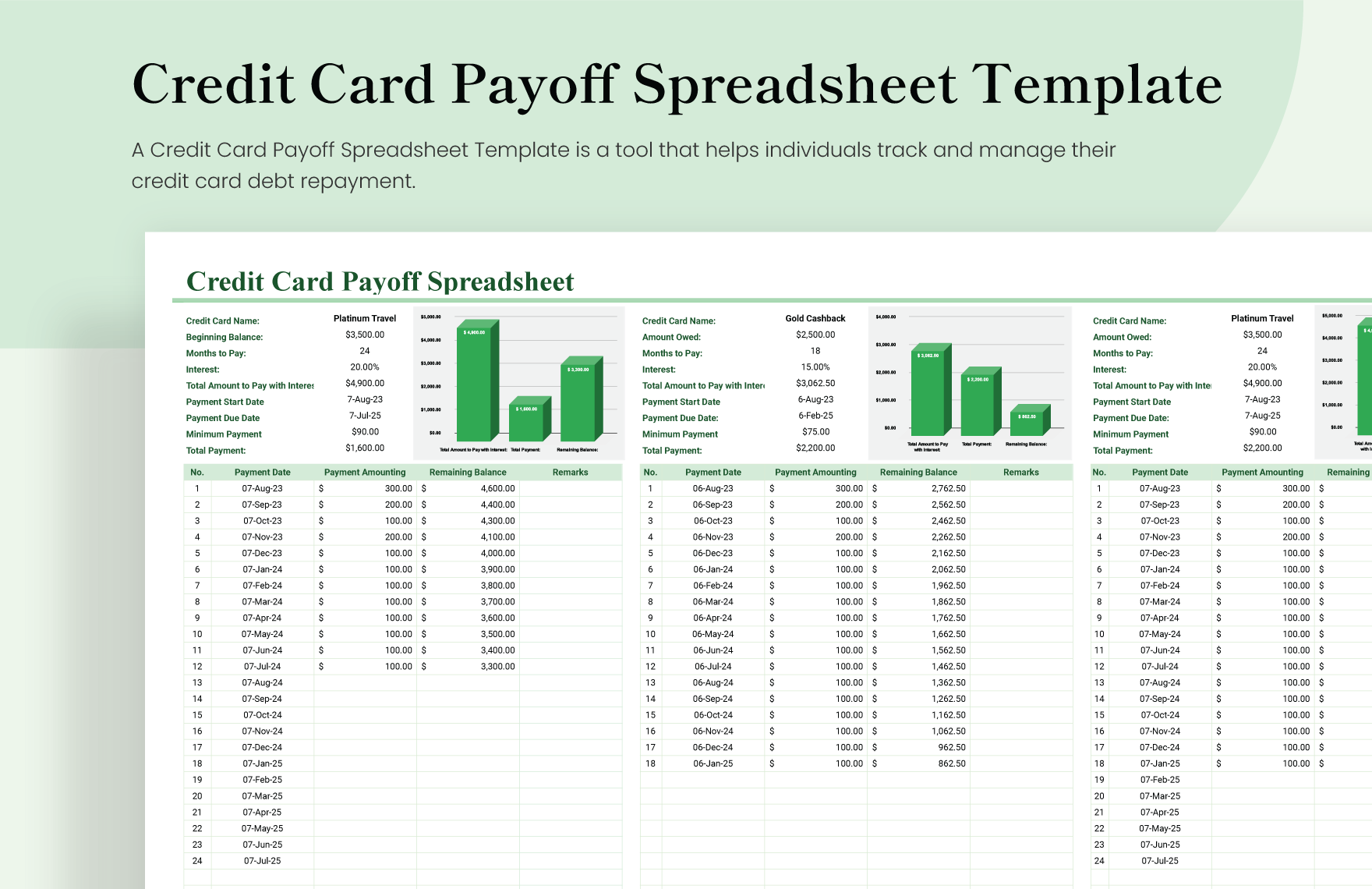

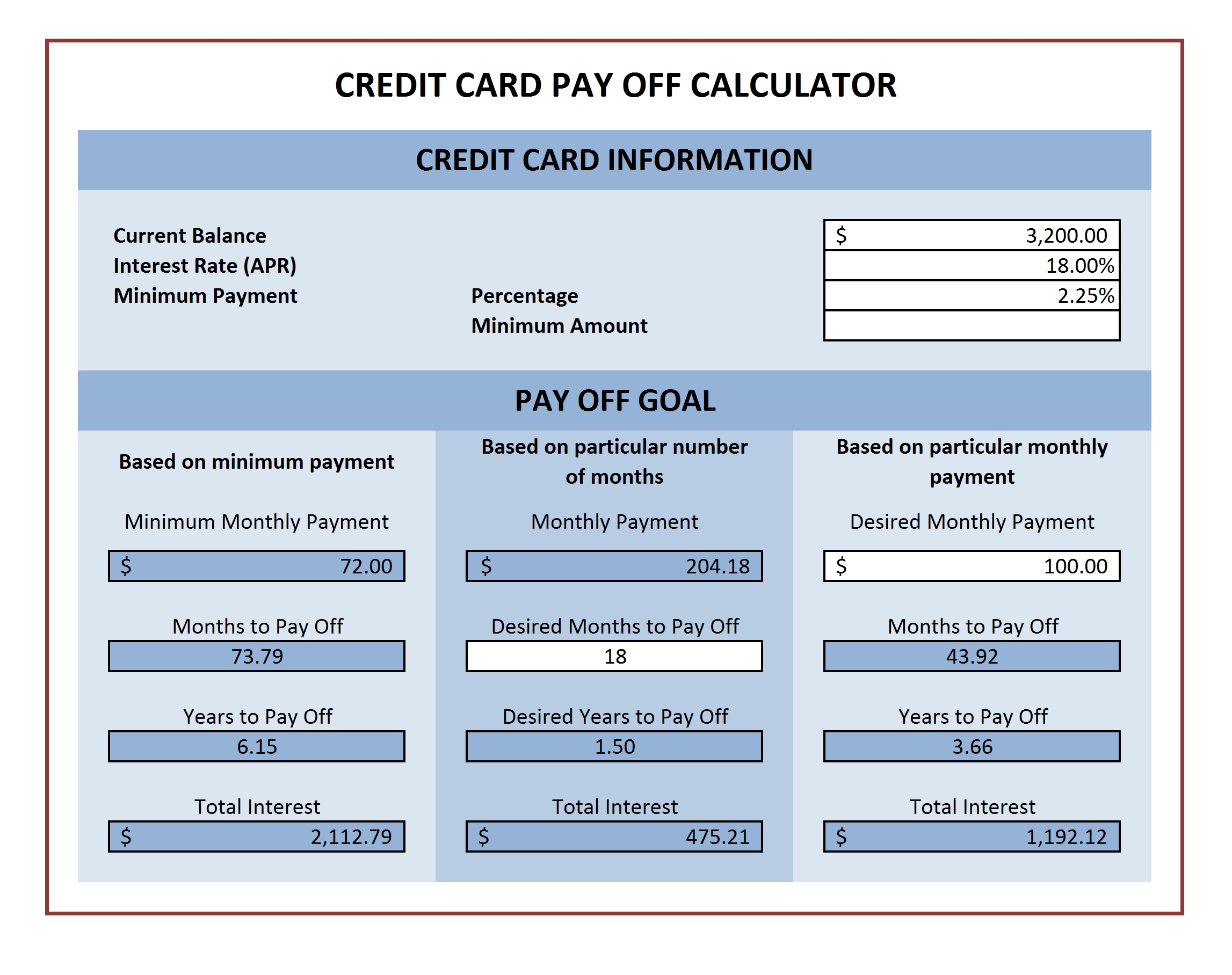

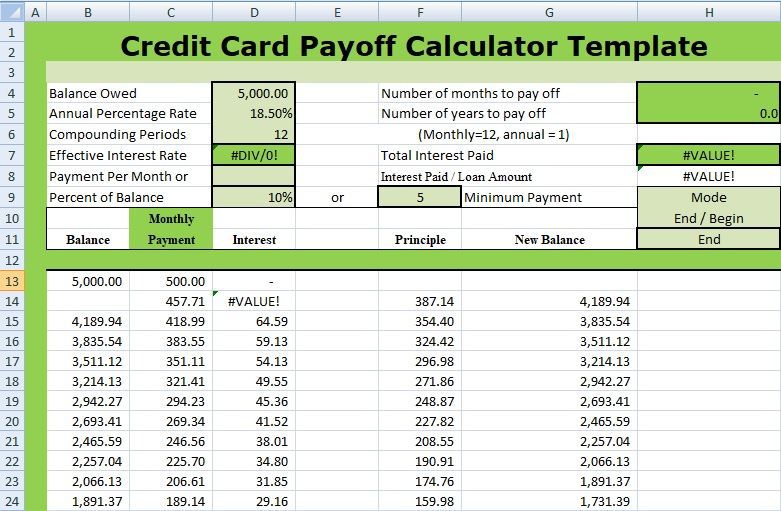

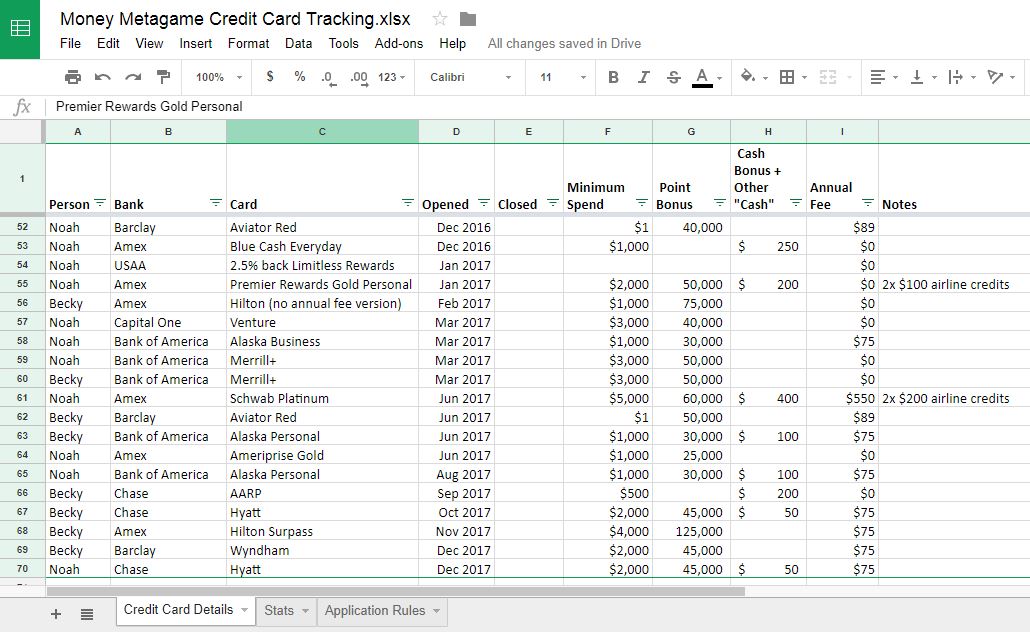

Credit Card Payment Template Excel - It provides a simple way to calculate and compare the cost of different payment plans. We have shown you 2 quick ways to create a credit card payoff spreadsheet in excel using a manual method and an online template from excel. This excel template provides a comprehensive. The credit card payoff spreadsheet 11 excel template provides a way to easily keep track of your credit card payments. Track and map your credit card payments with our credit card payoff calculator excel template. This excel template makes it easy to calculate how long it will take to pay off your credit cards. This credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. This excel template helps you easily track your credit card payments and balances. Track your monthly payments, interest rate, and total balance. We’ll use the dataset below containing 3 debts, and create a. Get out of debt sooner and save money. We’ll use the dataset below containing 3 debts, and create a. Easily track your payments, balance, and interest rate. It reduces errors, improves budgeting and. This excel template helps you keep track of your credit card payments. This credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. This excel template helps you easily track your credit card payments and balances. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. In this article, we will demonstrate how to create a multiple credit card payoff calculator spreadsheet in excel. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. We have shown you 2 quick ways to create a credit card payoff spreadsheet in excel using a manual method and an online template from excel. We’ll use the dataset below containing 3 debts, and create a. Customer payment is vital for any business to remain functioning and provide customers with the services and products they seek. Track your monthly. An excel payment schedule template streamlines the contractor payment process by creating a standardized approach across an organization. It will show you how much you owe, how much you. Get out of debt sooner and save money. This is why a company must monitor. This excel template helps you easily track your credit card payments and balances. This credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. It provides a simple way to calculate and compare the cost of different payment plans. This excel template helps you easily track your credit card payments and balances. This is why a company must monitor. This excel. Track your monthly payments, interest rate, and total balance. Easily track your payments, balance, and interest rate. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Get out of debt sooner and save money. Track and map your credit card payments with our credit card payoff calculator excel template. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. This excel template helps you easily track your credit card payments and balances. In this article, we will demonstrate how to create a multiple credit card payoff calculator spreadsheet in excel. It will show you how much you owe, how much you. This is why a. It will show you how much you owe, how much you. This excel template makes it easy to calculate how long it will take to pay off your credit cards. This excel template provides a comprehensive. This excel template helps you easily track your credit card payments and balances. In this article, we will demonstrate how to create a multiple. This excel template makes it easy to calculate how long it will take to pay off your credit cards. It will show you how much you owe, how much you. We’ll use the dataset below containing 3 debts, and create a. Track and map your credit card payments with our credit card payoff calculator excel template. Track your monthly payments,. Easily track your payments, balance, and interest rate. An excel payment schedule template streamlines the contractor payment process by creating a standardized approach across an organization. It provides a simple way to calculate and compare the cost of different payment plans. This excel template helps you pay off your credit card debt faster. We have shown you 2 quick ways. An excel payment schedule template streamlines the contractor payment process by creating a standardized approach across an organization. Customer payment is vital for any business to remain functioning and provide customers with the services and products they seek. This credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay. This is why a company must monitor. It will show you how much you owe, how much you. This excel template helps you pay off your credit card debt faster. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. This excel template makes it easy to calculate how long it will take to pay off. Track your monthly payments, interest rate, and total balance. Easily calculate your total balance, payment amount, and interest rate with this simple spreadsheet. The credit card payoff spreadsheet 11 excel template provides a way to easily keep track of your credit card payments. Track and map your credit card payments with our credit card payoff calculator excel template. This excel template provides a comprehensive. Customer payment is vital for any business to remain functioning and provide customers with the services and products they seek. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. It reduces errors, improves budgeting and. We’ll use the dataset below containing 3 debts, and create a. This excel template helps you keep track of your credit card payments. With a few simple steps, you can set up a spreadsheet to calculate how long it’ll take to pay off your credit card and how much interest you’ll shell out. Get out of debt sooner and save money. This excel template helps you easily track your credit card payments and balances. This is why a company must monitor. We have shown you 2 quick ways to create a credit card payoff spreadsheet in excel using a manual method and an online template from excel. It provides a simple way to calculate and compare the cost of different payment plans.Credit Card Payment Spreadsheet Template

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

How to Create a Credit Card Payoff Spreadsheet in Excel (2 Ways)

Credit Card Payoff Spreadsheet Template in Excel, Google Sheets

Excel Credit Card Payoff Calculator and Timeline Easy Financial Tracker

Credit Card Payment Calculator for Microsoft Excel Excel Templates

Free Credit Card Payment Google Excel Template A Comprehensive Guide

Credit Card Debt Payoff Spreadsheet Excel Templates

Excel Credit Card Payment Tracker Template

Credit Card Payment Excel Template

Easily Track Your Payments, Balance, And Interest Rate.

In This Article, We Will Demonstrate How To Create A Multiple Credit Card Payoff Calculator Spreadsheet In Excel.

It Will Show You How Much You Owe, How Much You.

This Excel Template Makes It Easy To Calculate How Long It Will Take To Pay Off Your Credit Cards.

Related Post: