Cp2000 Response Letter Template

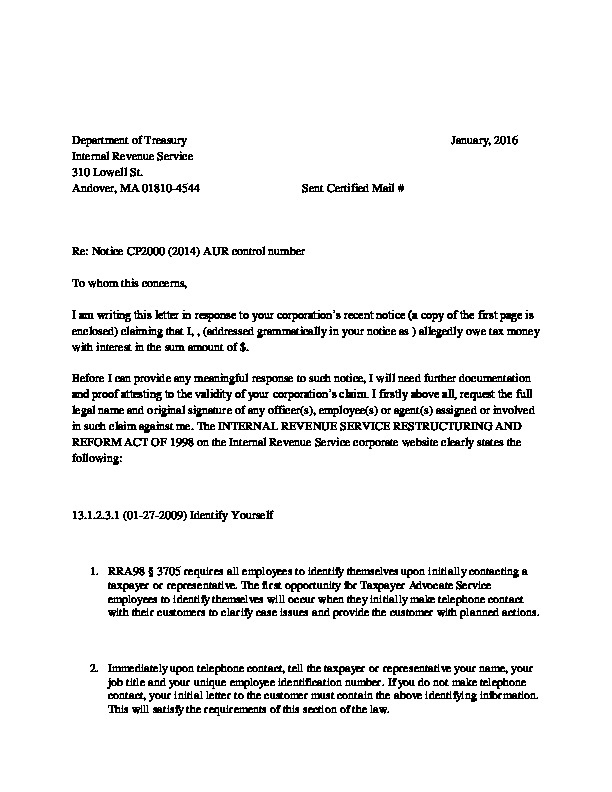

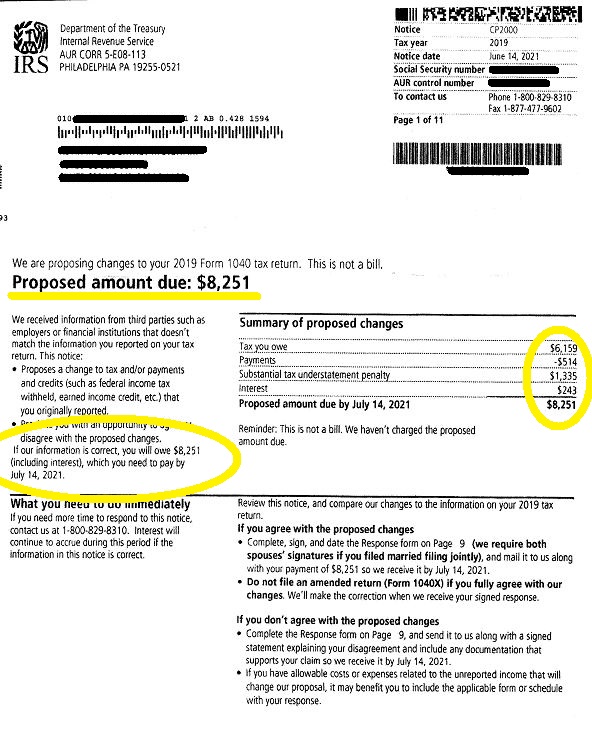

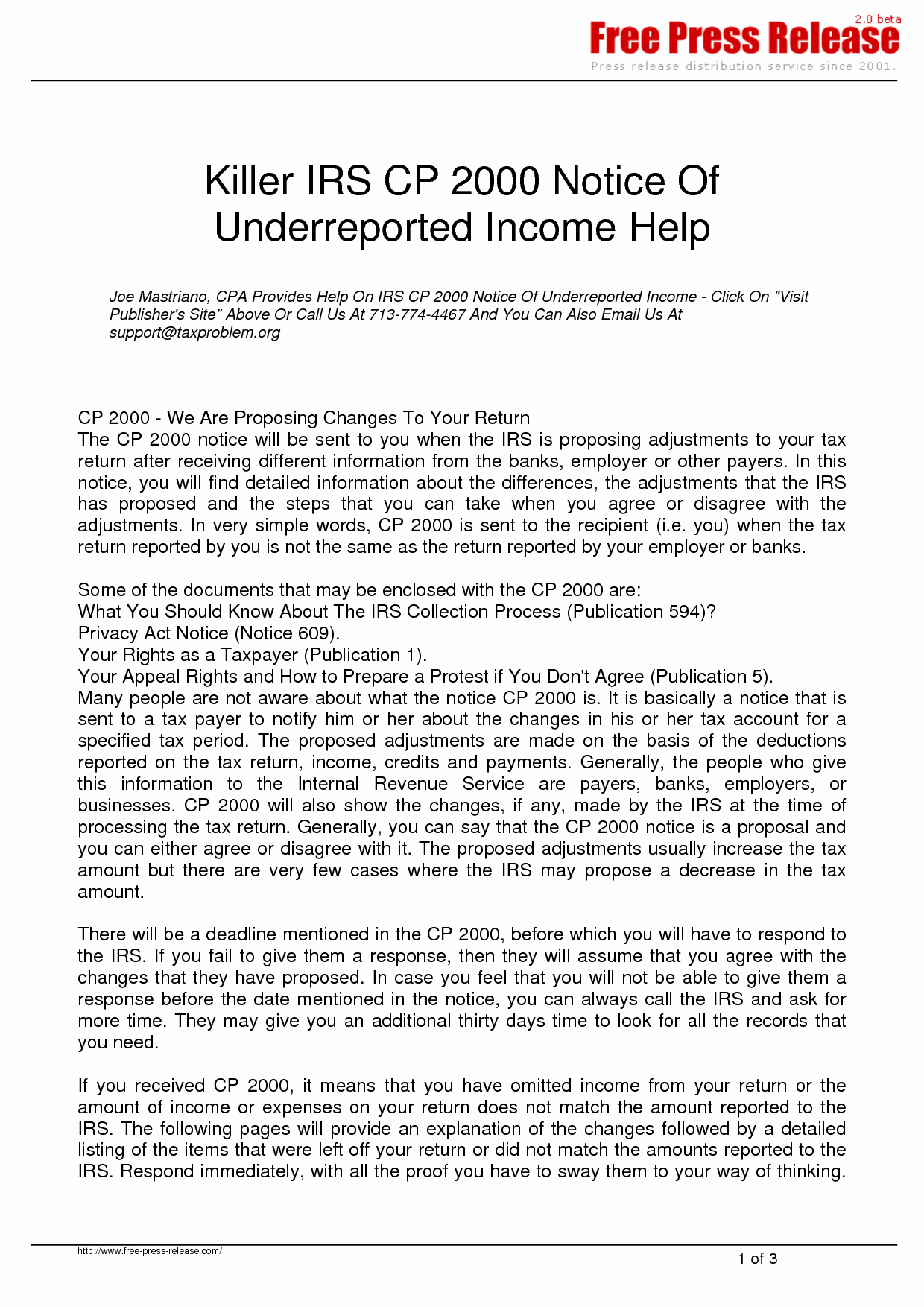

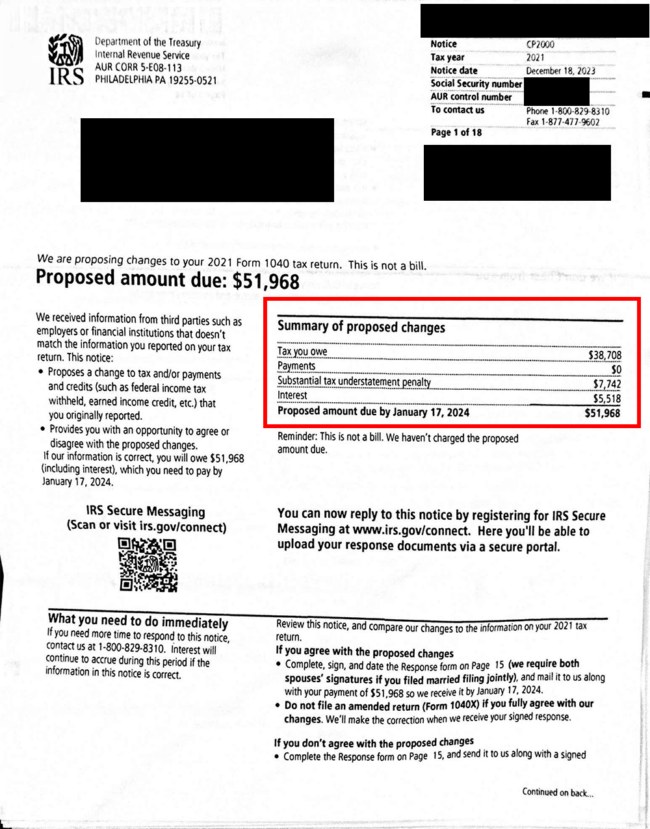

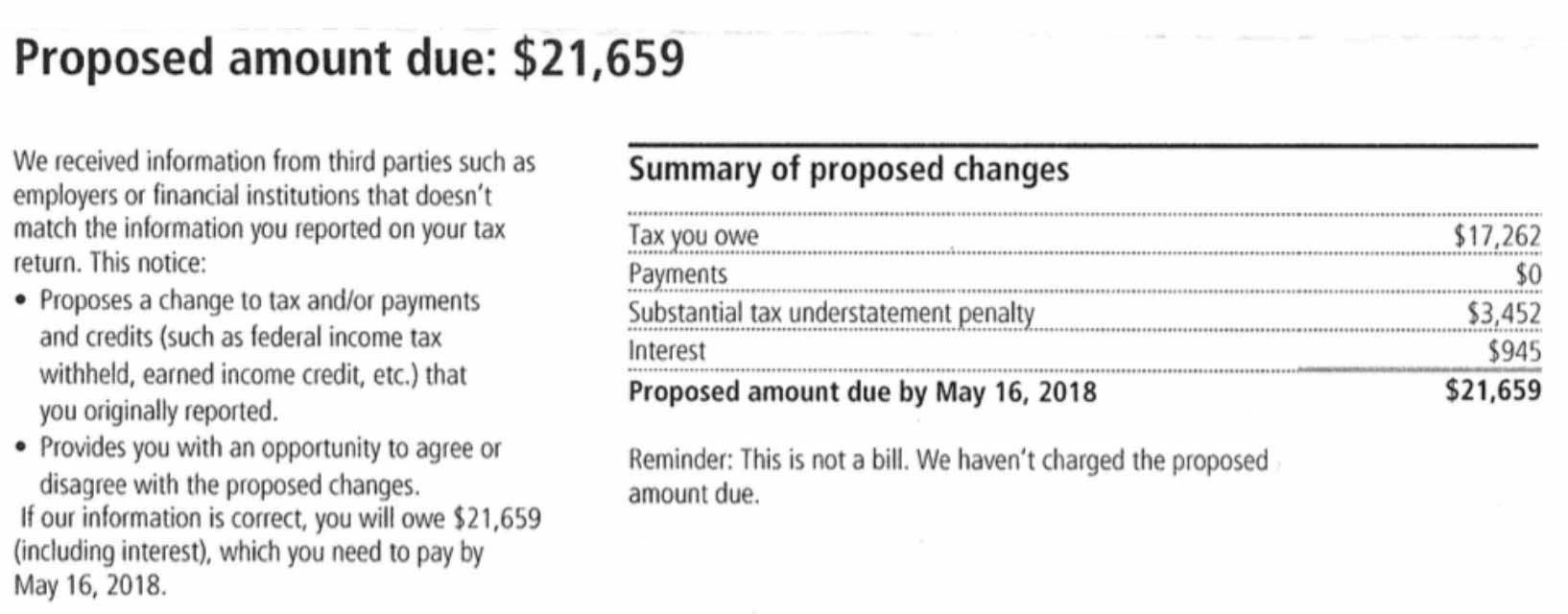

Cp2000 Response Letter Template - What if you agree with the irs? Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. If the cp2000 notice is correct and you have other income, credits or expenses to report: You do this by writing a letter to the irs and faxing it to the number on the cp2000. You have the right to contest penalties and appeal a. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013. However, it does notify the taxpayer that the agency found a discrepancy, and asks if the. See the sample irs cp2000 response letter. The letter is a response to a notice cp2000 claiming tax owed. If you choose to file an amended tax return, write “cp2000” along the top of the 1040x, attach it behind the response form page and send to the address shown on this notice. It is not a formal audit letter notice. This specific letter is irs letter cp 2000. Your response letter to the irs for the cp2000 should describe the items you disagree with, and the irs tax forms used in your calculation. It demonstrates how to reference the notice, explain the issue, provide. Include photocopies of any supporting. If you choose to file an amended tax return, write “cp2000” along the top of the 1040x, attach it behind the response form page and send to the address shown on this notice. You have the right to contest penalties and appeal a. You do this by writing a letter to the irs and faxing it to the number on the cp2000. What if you agree with the irs? This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. It’s important to fully respond by the irs deadline. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries.. This specific letter is irs letter cp 2000. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013. It’s important to fully respond by the irs deadline. Include photocopies of any supporting. Up to 8% cash back cp2000. It’s important to fully respond by the irs deadline. Check out some sample cp2000 response letters here. You do this by writing a letter to the irs and faxing it to the number on the cp2000. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. The first page of the notice provides a summary of. Your response letter to the irs for the cp2000 should describe the items you disagree with, and the irs tax forms used in your calculation. Make a copy of this document so you can edit it → file > “make a copy” .</p> Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address. This specific letter is irs letter cp 2000. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. Check out some sample cp2000 response letters here. If the cp2000 notice is correct and you have other income, credits or expenses to report: Include photocopies of any supporting. Make a copy of this document so you can edit it → file > “make a copy” .</p> It is not a formal audit letter notice. Up to 8% cash back cp2000 notices aren’t audits, but they work the same. Check out some sample cp2000 response letters here. This sample letter guides individuals in responding to irs notice cp2000 regarding. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. It demonstrates how to reference the notice, explain the issue, provide. The letter is a response to a notice cp2000 claiming tax owed. See the sample irs cp2000 response letter. It is not a formal audit letter notice. You do this by writing a letter to the irs and faxing it to the number on the cp2000. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. If the cp2000 notice is correct and you have other income, credits or expenses to report: Make a copy of this document so you can edit it. However, it does notify the taxpayer that the agency found a discrepancy, and asks if the. It’s important to fully respond by the irs deadline. The letter is a response to a notice cp2000 claiming tax owed. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. It is not a formal audit letter notice. Check out some sample cp2000 response letters here. You have the right to contest penalties and. What if you agree with the irs? The first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to respond. Check out some sample cp2000 response letters here. Up to 8% cash back cp2000 notices aren’t audits, but they work the same. This specific letter is irs letter cp 2000. If you choose to file an amended tax return, write “cp2000” along the top of the 1040x, attach it behind the response form page and send to the address shown on this notice. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. You have the right to contest penalties and appeal a. It demonstrates how to reference the notice, explain the issue, provide. However, it does notify the taxpayer that the agency found a discrepancy, and asks if the. You do this by writing a letter to the irs and faxing it to the number on the cp2000. If the cp2000 notice is correct and you have other income, credits or expenses to report: The letter is a response to a notice cp2000 claiming tax owed. See the sample irs cp2000 response letter. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from.Cp2000 Response Letter Template

Response To Cp2000 Letter

Sample Letter To Irs For Correction

Cp2000 Response Letter Template Samples Letter Template Collection

Response To Cp2000 Letter

Response To Cp2000 Letter

CP2000 Crypto Letter How to Respond and Dispute Gordon Law

Response To Cp2000 Letter

What Is a CP2000 IRS Notice? Plus, Response Letter Sample

Cp2000 Response Template

Make A Copy Of This Document So You Can Edit It → File > “Make A Copy” .</P>

This Sample Letter Guides Individuals In Responding To Irs Notice Cp2000 Regarding Income Discrepancies.

Include Photocopies Of Any Supporting.

Your Response Letter To The Irs For The Cp2000 Should Describe The Items You Disagree With, And The Irs Tax Forms Used In Your Calculation.

Related Post: