609 Letter Template

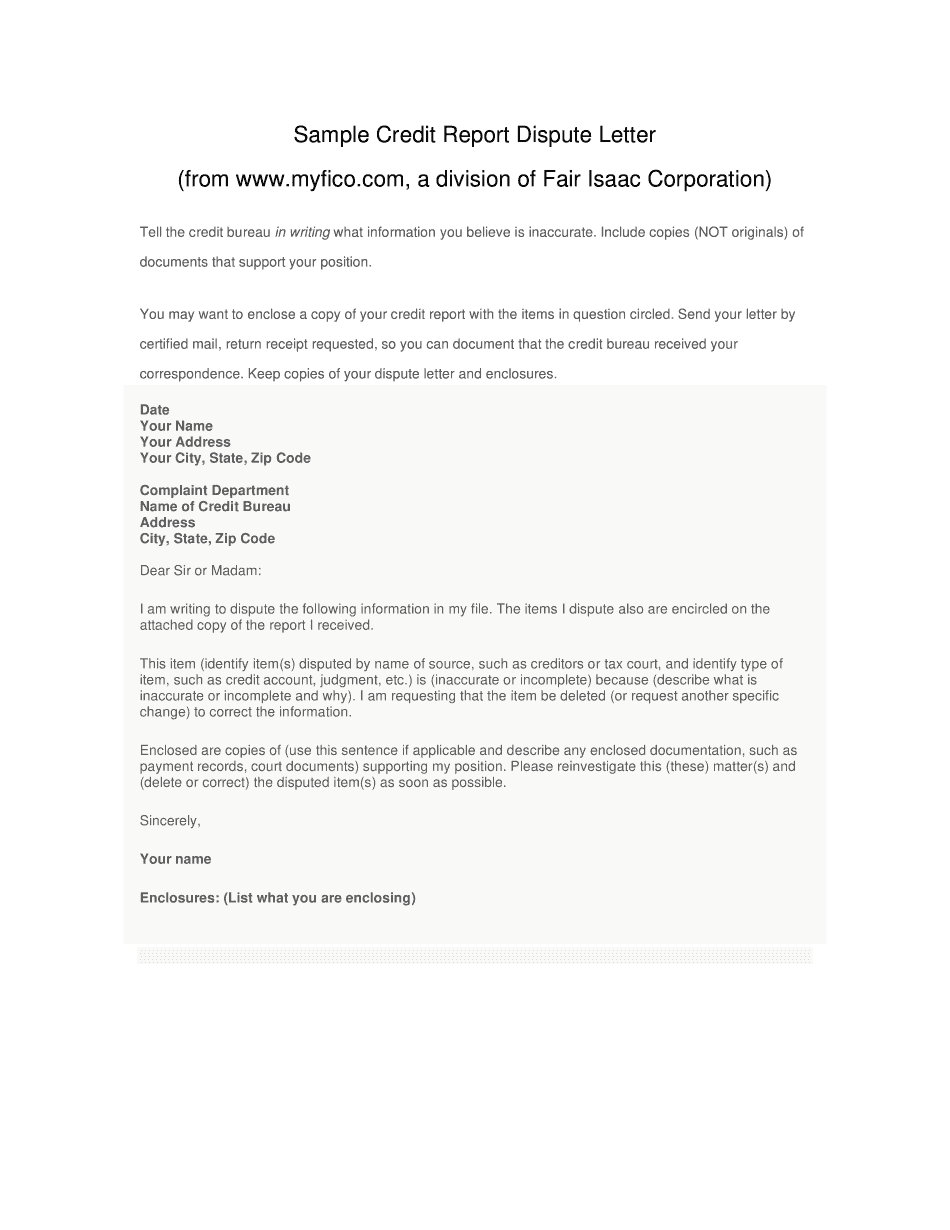

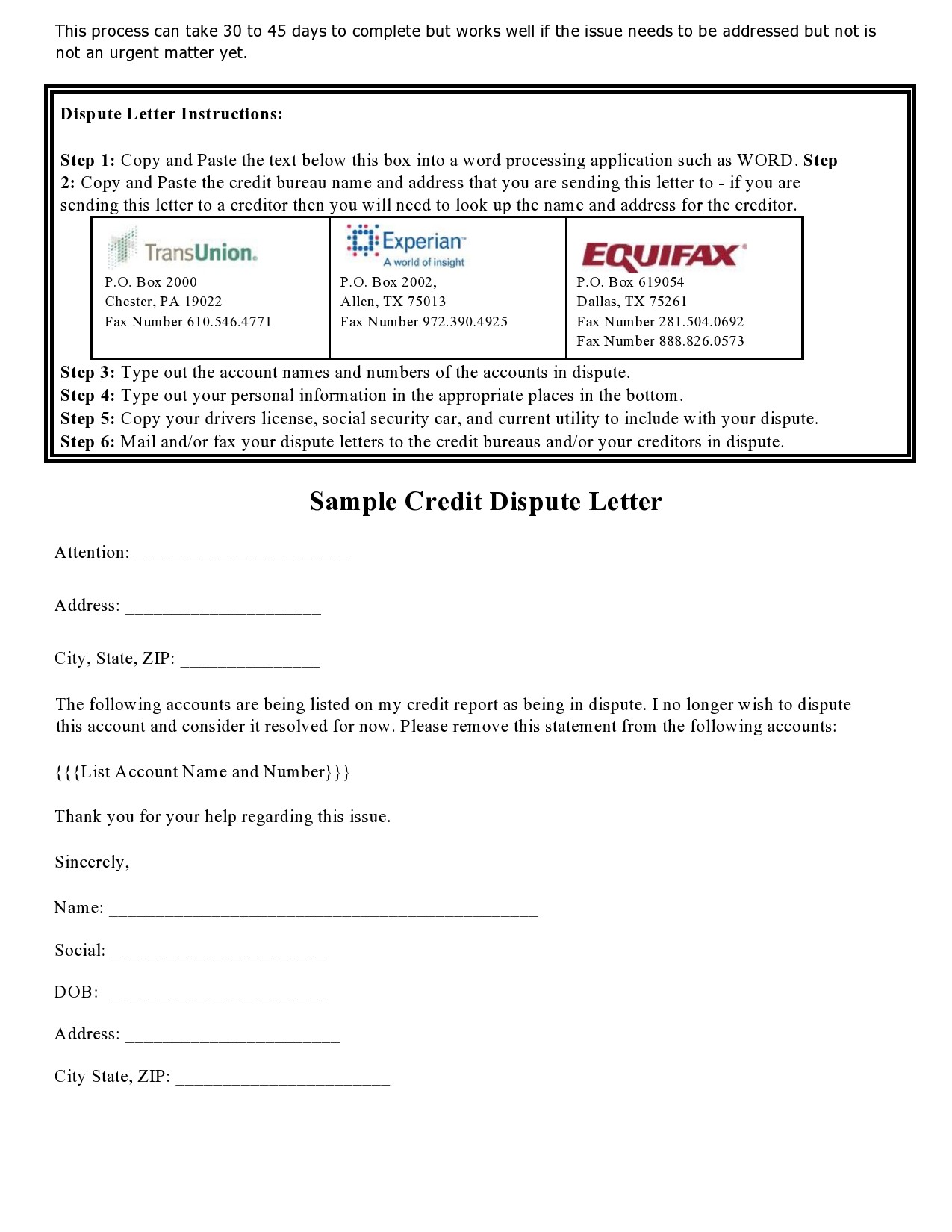

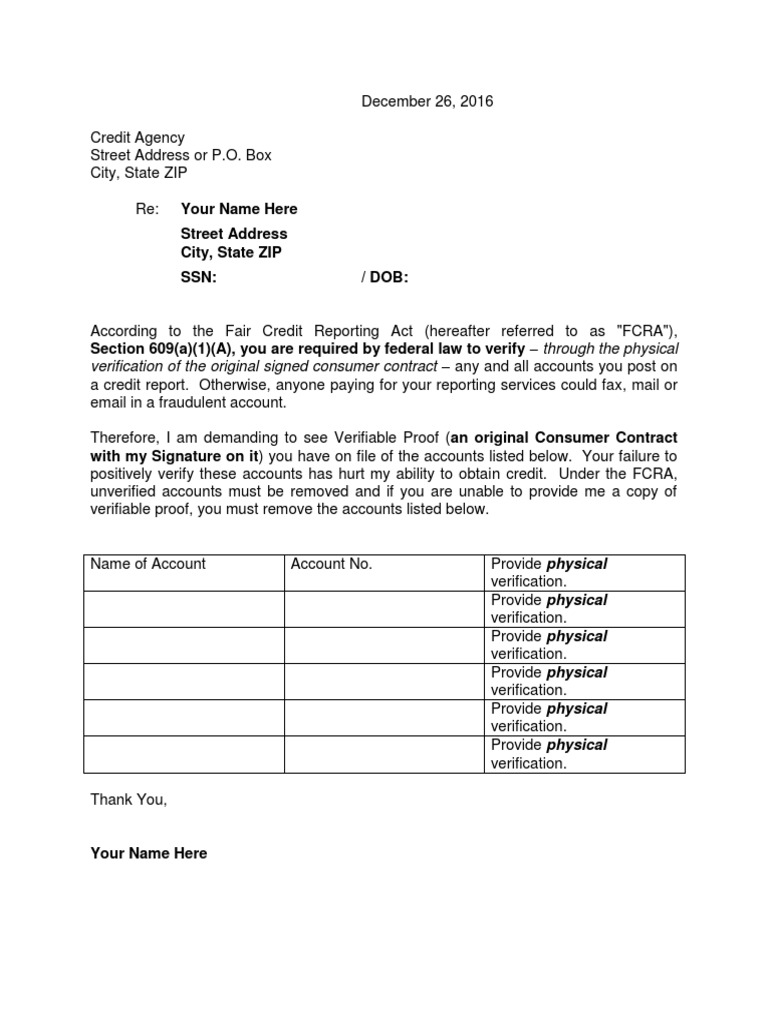

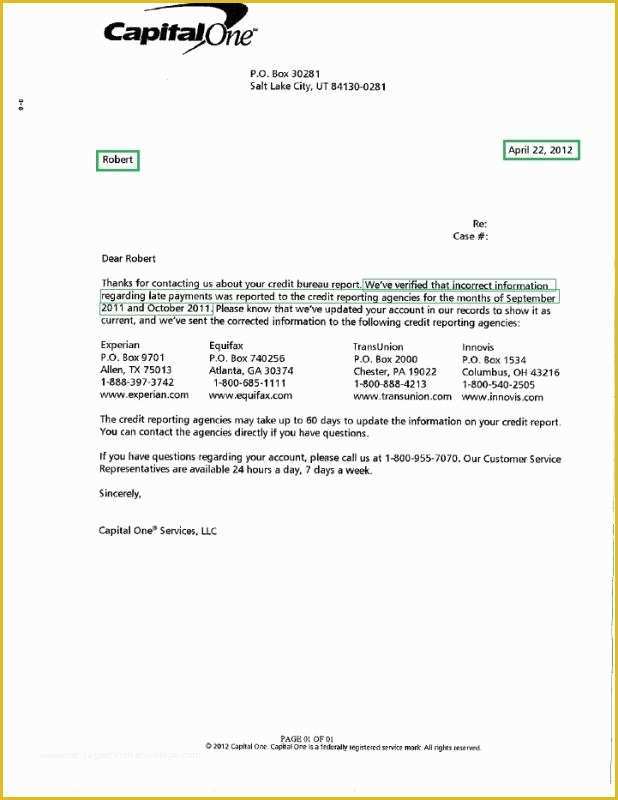

609 Letter Template - It allows consumers to obtain information about the sources of data on their. Use solosuit to respond to debt collectors fast. Per section 609, i am entitled to. Writing an effective dispute letter (or 609 letter) is the key to getting results. As long as you’re in the right, the result will usually be in your favor. This article gives you all the details you need. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. Unfortunately, sometimes it isn’t, and correcting the mistakes can be a lengthy process. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute with bureaus and get rid of negative items. Fortunately, you can challenge inaccurate items with a 609 dispute letter. Writing an effective dispute letter (or 609 letter) is the key to getting results. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Learn how to use a 609 letter — what's also known as a 609 dispute letter — to remove “unverifiable” bad marks and boost your credit score. Done correctly, this letter forces a thorough reinvestigation and can finally provide the breakthrough to repairing. As long as you’re in the right, the result will usually be in your favor. Am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately as afforded to me by the fair credit reporting. Use solosuit to respond to debt collectors fast. Here's how to prepare an effective 609 letter that really works. Per section 609, i am entitled to. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. Fortunately, you can challenge inaccurate items with a 609 dispute letter. As long as you’re in the right, the result will usually be in your favor. Use solosuit to respond to debt collectors fast. Learn how to use a 609 letter — what's also known as a 609 dispute letter — to remove “unverifiable” bad marks and boost your credit. As long as you’re in the right, the result will usually be in your favor. Writing an effective dispute letter (or 609 letter) is the key to getting results. Section 609 of the fcra does not require that consumers submit requests using a specific template or. I am exercising my right under the fair credit reporting act, section 609, to. Writing an effective dispute letter (or 609 letter) is the key to getting results. Here's how to prepare an effective 609 letter that really works. Learn how to use a 609 letter — what's also known as a 609 dispute letter — to remove “unverifiable” bad marks and boost your credit score. Two sections of the fair credit reporting act. This article gives you all the details you need. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. Am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately as afforded to me by the fair. Removing an error from your credit report is generally as simple as completing a credit reporting agency’s dispute form and submitting it online or by mail. Use solosuit to respond to debt collectors fast. Am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately. Per section 609, i am entitled to. Section 609 of fcra directs or allows the consumer to. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Done correctly, this letter forces a thorough reinvestigation and can finally provide the breakthrough to repairing. Writing an effective dispute letter (or 609. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. Section 609 of fcra directs or allows the consumer to. Removing an error from your credit report is generally as simple as completing a credit reporting agency’s dispute form and submitting it online or by mail. Per section 609, i am entitled. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. Per section 609, i am entitled to. Unfortunately, sometimes it isn’t, and correcting the mistakes can be a lengthy process. Section 609 of fcra directs or allows the consumer to. Two sections of the fair credit reporting act build up the. Some companies offer 609 letter templates for sale, but you don’t need to buy a template. It allows consumers to obtain information about the sources of data on their. Section 609 of the fcra does not require that consumers submit requests using a specific template or. Done correctly, this letter forces a thorough reinvestigation and can finally provide the breakthrough. Section 609 of fcra directs or allows the consumer to. Learn how to use a 609 letter — what's also known as a 609 dispute letter — to remove “unverifiable” bad marks and boost your credit score. Two sections of the fair credit reporting act build up the. Removing an error from your credit report is generally as simple as. Section 609 of fcra directs or allows the consumer to. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Writing an effective dispute letter (or 609 letter) is the key to getting results. Fortunately, you can challenge inaccurate items with a 609 dispute letter. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute with bureaus and get rid of negative items. Section 609 of the fcra does not require that consumers submit requests using a specific template or. As long as you’re in the right, the result will usually be in your favor. Removing an error from your credit report is generally as simple as completing a credit reporting agency’s dispute form and submitting it online or by mail. Two sections of the fair credit reporting act build up the. Learn how to use a 609 letter — what's also known as a 609 dispute letter — to remove “unverifiable” bad marks and boost your credit score. Use solosuit to respond to debt collectors fast. Unfortunately, sometimes it isn’t, and correcting the mistakes can be a lengthy process. Per section 609, i am entitled to. Here's how to prepare an effective 609 letter that really works.Example Of A 609 Credit Dispute Letter

Free 609 Letter Template PRINTABLE TEMPLATES

Printable 609 Letter Template Printable Word Searches

609 Letter Template Free Of Free Section 609 Credit Dispute Letter

Example Of A 609 Credit Dispute Letter

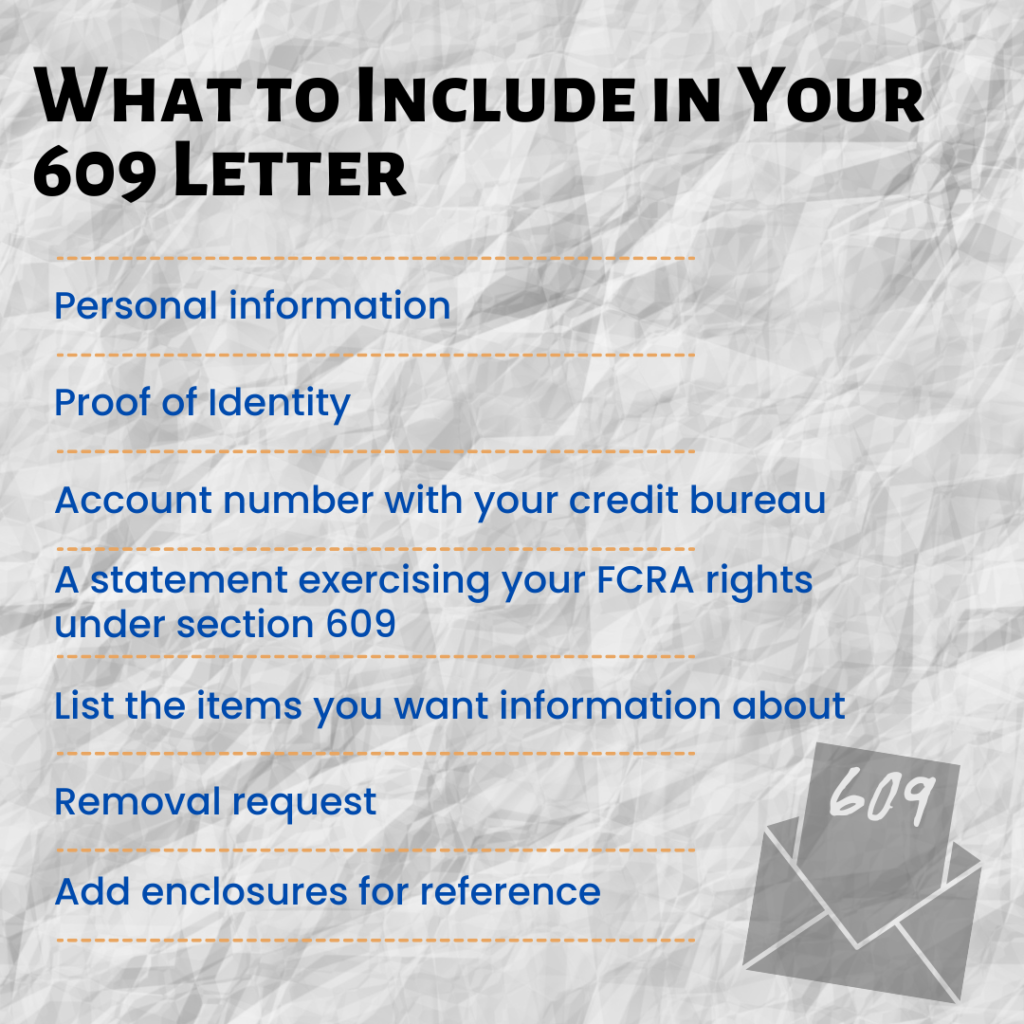

Steps to Writing a 609 Letter Client Dispute Manager Software

609 Template Letter

609 Letter Template

Free 609 Letter Template Free Printable Templates

Free Section 609 Credit Dispute Letter Template Of Section 609 Credit

This Article Gives You All The Details You Need.

Done Correctly, This Letter Forces A Thorough Reinvestigation And Can Finally Provide The Breakthrough To Repairing.

Am Writing To Inform You Of An Error On My Credit Report And Request That You Provide Me With Verifiable Proof Or Delete The Record Immediately As Afforded To Me By The Fair Credit Reporting.

It Allows Consumers To Obtain Information About The Sources Of Data On Their.

Related Post: